Updated July 12, 2023

Definition of Par Value of Share

Par Value, also known as the Face Value of a share, is the original value of a share shown in the Share certificate at the time of issuance of the shares by the company. It is the minimum value of a share below that the company cannot sell to the public.

Explanation

The value of a share is fixed and does not change with time. It has no relationship with the market value of shares. The value of a share is usually minimal. A company can issue shares above the value but not below the same.

For example, a company’s equity share with a value of $10 is set for sale in the market at $25. So, in this case, $10 will be shown under the Common Stock of the company, and $15 will be conducted under the Additional Paid-up capital/Premium account under the company’s balance.

The total value of the company’s stock is called Equity capital. This is a legal capital that a company has to maintain in any situation.

How Does It Work?

It is essential to understand the value of a share while investing in the share market. Par value is a fixed value assigned to a share, which is entirely different from its Market value. The value has no impact on the market value of a share.

How to Determine the Par Value of Share?

The company decides the value of a share at the time of the stock issue. It is usually a small amount per share.

In the Balance sheet, the value of a share is mentioned in the Shareholder’s Equity section under the head Common Stock. The value of a company is calculated by multiplying the value per share by the number of shares issued. Any amount received in addition to the value is shown under the additional paid-up capital head.

The value of a share is calculated by dividing the Total stock value by the total outstanding shares.

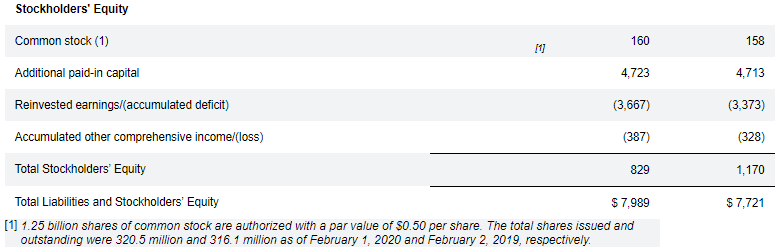

Below is the screenshot of a company’s Balance sheet showing the value of a share and the shares issued and outstanding.

The above balance sheet shows total shareholder’s equity as of 2020 and 2019, which comprises Common stock, additional paid-up capital, Retained earnings, and accumulated losses.

Example of Par Value of Share

Company Fellow Ltd issues 5000 shares with a value of $10 per share. Since shares can be sold in the market at a price higher than the value of a share, the company offers to sell the share at $15 per share.

Here, the company’s common stock will be 5000 shares * $10, which is $50,000.

$5 received over and above the value will be shown as Additional paid-up capital calculated as 5000 shares * $5 = $25,000

So, the Journal entry will be done as below:

| Cash Account | Debit | $75,000 |

| Common Stock | Credit | $50,000 |

| Additional Paid Up Capital | Credit | $25,000 |

Importance of Par Value of Share

- The value of a share was of greater importance when the stock market was not well established. A minimum amount of shares is set so the company cannot sell its shares at different prices to different investors.

- The value of a share has more legal and accounting importance. Since the value of a share is mentioned on its share certificate, the investor is assured about a minimum capital invested.

- Also, the dividend is calculated and paid on the par value of the shares and not the market value of the share. Hence, it is essential to understand the par value of the share.

Benefits of Par Value of Share

Following are the benefits of the value of shares:

- It is easier to understand the value of a share and the company’s common stock by a layman with little accounting knowledge.

- It provides a minimum guaranteed amount to the investors. A share price cannot go below the par value of a share.

- A company cannot issue shares below value. Hence, it assures the investors that shares are sold at the same amount.

Conclusion

The value of a share is a nominal value assigned by the company at the time of stock issue. Nowadays, the company doesn’t need to issue shares at Par. There can be shared at No par value. So, it is essential to understand the value of a share, but it has no impact on its equity value or market value.

Recommended Articles

This is a guide to Par Value of Share. Here we also discuss the definition and how to determine the par value of a share, along with examples and benefits. You may also have a look at the following articles to learn more –