Payment Gateway Definition

When you buy things online, you need a way to pay for them, right? Well, that’s where a “payment gateway” comes in. It’s like a virtual cashier for the internet. Now, some websites use ready-made gateways from other companies, but here’s the thing – using those can cost money. So, some online shops create their own gateways.

A payment gateway is software that provides a payment method on a website & automatically transfers the buyer’s payment information to the seller.

Unlike banks or money apps, these gateways don’t deal with money directly. They ensure your payment info gets safely from you to the company. It all happens quickly and automatically.

How Does a Payment Gateway Work?

These gateways make online shopping smooth and secure by handling the behind-the-scenes work of moving payment info around.

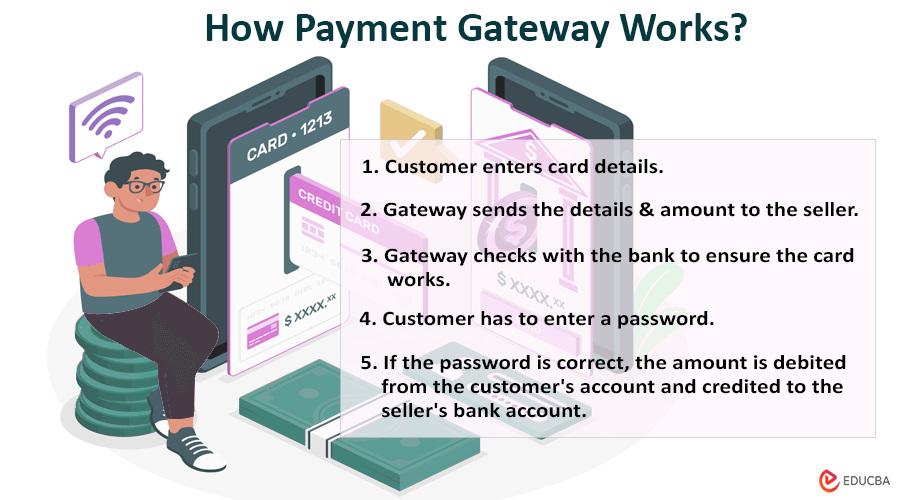

Here is how they work:

- You order online and want to pay for it with a bank card. When you click the online payment button, a page opens with a form for entering card details.

- The payment gateway sends your payment details and the amount you must pay to the company. At the same time, it checks with your bank or credit card company to ensure the card works and that the transaction is not fraudulent.

- If the card has 3D Secure protection, the customer is taken to a page with a field for entering a password. If the password is entered correctly, the issuing bank sends a notification to the payment system.

- In case of a successful transaction, the target amount is debited from the customer’s account and credited to the seller’s bank account.

Development Requirements

When developing a payment gateway, you should consider the following:

1. Make it Secure

- Use modern data protection methods to keep transactions safe.

- Make sure it follows SSL encryption rules and can digitally sign things.

- Stick to PCI DSS standards (a security standard for handling cardholder info).

- Check IP addresses and confirm transactions through SMS, calls, or other ways.

2. Ensures Legal Compliance

- Make sure your gateway can work in different countries. (if you operate in different countries).

- Offer payment options that people in different places can use.

- Support various currencies in your payment portal.

3. Geographical Location Verification

- Make sure the person paying matches the address on their card.

4. User-Friendly

- Make it easy for your employees to use, especially those handling money and websites.

- Check transaction processing speed so customers don’t get impatient waiting for payment confirmation.

Final Thoughts

The future of payment gateway development is focused on enhancing security, adaptability across countries, and user-friendly features. Developers should prioritize robust security measures, flexibility for global transactions, efficient data tools, and fast transaction processing. The key is to keep up with evolving technology, making gateways safe, adaptable, and easy-to-use payment gateways for high-risk businesses too.

Frequently Asked Questions (FAQs)

Q1. How much does it cost to create a payment gateway?

Answer: Creating a payment gateway comes with different costs depending on the platform, complexity, and types of payments you want to handle. Typically, the investment for developing a gateway varies, averaging between $20,000 to $50,000. This range covers the custom features needed to match your specific business requirements.

Q2. Can I create my own payment gateway?

Answer: Creating your own payment gateway is a big task requiring serious tech know-how. A skilled team of software developers who know the ins and outs of handling payments is needed. It involves working with different banking systems and smoothly connecting with online stores. Success in this venture boils down to smart coding and a good understanding of the complex world of digital transactions.

Q3. How many types of payment gateway are there?

Answer: There are four types of payment gateways: Hosted, API-hosted, self-hosted, and local bank integration gateway.

Q4. What are the benefits of payment gateway development?

Answer: Payment gateway development offers benefits such as secure transactions, global reach, user-friendly interfaces, adaptability to various payment methods, and fast processing for speedy payment confirmations.

Recommended Articles

We hope you found this EDUCBA guide on payment gateway easy and helpful. Check the following recommendations for similar articles.