Updated July 28, 2023

Definition of Percentage of Completion Method

It is one of the revenue recognition methods in accounting to measure and record the revenue from long-term contracts. It is different from the basic revenue recognition principle. This method applies in scenarios where the cost records are proportional and in assured revenue collection.

Also, the record of the revenue and costs of a certain period in the same period to maintain consistency and relevancy. Here we will discuss the percentage of the completion method.

So, revenue and costs are estimated across the project’s length or duration during long-term contracts. The recording of the revenue and costs of the project in the accounting books occurs as the project progresses toward completion on a pro-rata basis. Of course, revenue recognition is subject to the probability of the revenue collection. This type of accounting method is mainly used in construction projects as the length of the project is long, and the costs and revenue need to be tied up together based on the completion of the project.

Components of a Percentage of Completion Method

The following are the components of the percentage of completion method:

- Cost-to-cost method: The revenue recognized for the period is calculated using the raw material and equipment purchase cost. If something is purchased and not utilized in the project, it will not become a part of the calculation.

- Efforts expended method: The cost is calculated as the amount of effort spent instead of the raw material in the project. So the total efforts estimation for the entire project calculates the revenue recognized for that period.

- Units-of-delivery method: In this method, the revenue for the period is recognized to the extent of the units delivered to date to the estimated units delivered for the entire contract length. So the delivery of units to date is a metric for calculating the recognized revenue on a pro-rata basis.

All these variations use different metrics to calculate the revenue for the period, but the underlying logic is still the same.

To simplify, the following are the main inputs for the calculation of the revenue for the period:

- Estimated total cost for the entire duration of the project or contract.

- Estimated total revenue for the entire duration of the project or contract.

- The cumulative cost of the project incurred as of present.

- Cumulative revenue recognized from the project as of present.

Carrying out simple mathematics based on the above components can provide the revenue to be recognized for the current period. Though it may not provide exact, realistic figures, this is a possible way to accurately measure the revenue from long-term contracts in the most probable manner.

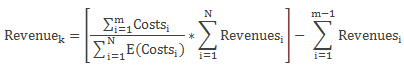

Formula of Percentage of Completion Method

The following formula calculates the revenue to be recognized for the period based on the percentage of completion method:

Where:

- m = the number of periods lapsed since the inception of the contract.

- N = the expected length of the contract

- K = the current period

- E = the total estimated cost of a contract

Example

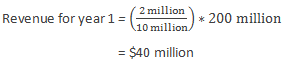

Let us take a simple example of a construction project to recognize the revenue and costs for a particular period after some interval.

Let us assume a corporation got a long-term construction contract. The project will run for 5 years and will cost approx. $10 million (approx. estimate), and the estimation of the total revenue is around 200 million. Suppose, the cost at the end of the first year is $2000.

So the calculation for revenue recognized is as follows:

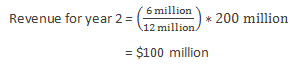

Let’s say, the project’s total cost is $12 million in 2nd year due to some unforeseen circumstances. Also, the cost incurred so far is $6 million.

So the calculation for revenue recognized is as follows:

Advantages

The following are the advantages of the percentage of completion method:

- It allocates the cost and revenue for a particular period on the extent of completion of the contract or project. Hence, there is no need to wait for the completion of the project to recognize the cost and revenues incurred in the duration of the contract or project.

- It does not allocate the proportion of cost incurred not used in the project. Hence it gives a more real-time estimation of the costs and revenues of the project.

Disadvantages

The following are the disadvantages of the percentage of completion method:

- Estimating the costs and revenues is daunting as construction projects take a long time to complete. No proper information is available at the start of the project.

- Suppose the initial estimate of revenue and costs for the project are not accurate. In that case, there may be changes and adjustments quite frequently, showing fluctuating revenue and costs realized in the accounting books. This will not reflect a good picture for the company’s stakeholders.

Limitations

The following are the limitations of the percentage of completion method:

- This method is applicable for contracts that have a duration of more than one year.

- This method may show fluctuation in the estimates given by the management.

Conclusion

There are three types of variations to calculate the percentage of completion method: Cost-to-cost method, Effort expended method, and Units-of-delivery method. This method holds good only in specific circumstances (like long-duration contracts). It is useful only when the estimation of revenue and costs of the project is high to avoid multiple adjustments to the estimates.

Recommended Articles

This article has been a guide to the Percentage Of Completion Method. Here we have discussed the components, formula, example, advantages, and disadvantages of a percentage of completion method. You may also have a look at the following articles to learn more –