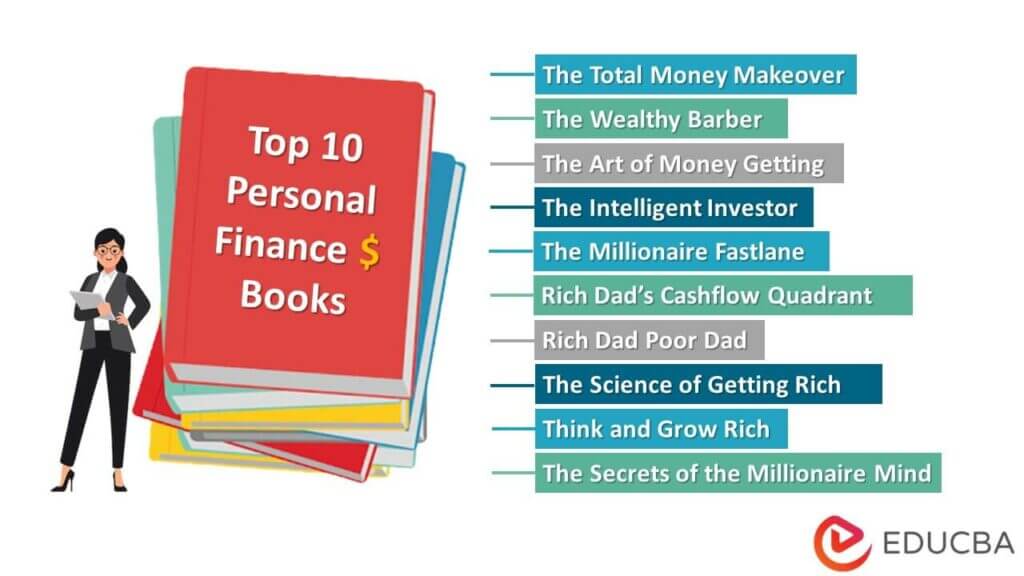

Best Books to Learn Personal Finance

Regarding personal finance, there is no shortage of advice. However, not all advice is created equal. To make smart and informed decisions about your money, it is important to seek high-quality information from reliable sources.

Many great personal finance books exist that can help you make better decisions about your money. We have researched for you and compiled this list of the top personal finance books. This way, you know which books are worth your time and money.

Here are our picks for the best personal finance books:

| # | Book | Author | Published | Rating |

| 1 | The Millionaire Fastlane | MJ DeMarco | 2011 | Amazon: 4.6

Goodreads: 4.31 |

| 2 | The Total Money Makeover | Dave Ramsey | 2013 | Amazon: 4.7

Goodreads: 4.30 |

| 3 | Rich Dad Poor Dad | Robert Kiyosaki | 2022 | Amazon: 4.5

Goodreads: 4.32 |

| 4 | The Intelligent Investor | Benjamin Graham | 2003 | Amazon: 4.5

Goodreads: 4.25 |

| 5 | Rich Dad’s Cashflow Quadrant | Robert Kiyosaki | 2011 | Amazon: 4.6

Goodreads: 4.13 |

| 6 | The Secrets of the Millionaire Mind | T. Harv Eker | 2007 | Amazon: 4.6

Goodreads: 4.20 |

| 7 | Think and Grow Rich | Napoleon Hill | 2020 | Amazon: 4.5

Goodreads: 4.18 |

| 8 | The Science of Getting Rich | Wallace D. Wattles | 2017 | Amazon: 4.3

Goodreads:4.14 |

| 9 | The Art of Money Getting | P.T. Barnum | 1880 | Amazon: 4.2

Goodreads: 3.79 |

| 10 | The Wealthy Barber | David Chilton | 2002 | Amazon: 4.6

Goodreads: 4.03 |

Let us go through the reviews and key points of each book thoroughly below.

Book #1: The Millionaire Fastlane

Author: MJ DeMarco

Buy this book here.

Review:

“This book will teach you how to do everything in your power to survive but also thrive.” – MJ Demarco. The Millionaire Fastlane is a classic self-help book about self-improvement and shows you how to change your life and start living the lifestyle you want. This book teaches readers about various financial principles that young people trying hard not to succumb must follow.

Key Points:

- MJ Demarco aimed to help people achieve their version of the American Dream.

- He chose an evolutionary philosophy as a foundation for his straightforward yet detailed modeling of how to live financially free and wealthy.

- The book provides time frames, steps, and strategies necessary for wealth-building.

- Millionaire Fastlane is one of the best financial resources that motivate people to leave their homes, communities, and places where they are comfortable to build that future they visualize.

Book #2: The Total Money Makeover

Author: Dave Ramsey

Buy this book here.

Review:

The Total Money Makeover is a New York Times bestseller that promises to teach everyone to manage money efficiently. With simple steps that are easy to embrace, the book guides anyone who wants to learn how to manage their money efficiently and save for a better financial future. Over three million people endorse this book. It is an easy read for everyone without struggling with excessive financial jargon.

Key Points:

- This book is a comprehensive guide divided into four sections. It shows the readers how to pay off debt, achieve financial freedom, and radically change the kind of future they will have.

- The book breaks down the various ways to save money, invest better, and secure one’s future into easy-to-consume chapters.

- It Is an effective 7-step program allowing readers to control their financial futures.

- It recommends small and realistic changes people can make to improve their finances for the long term. For example, taking full advantage of 401k matching at work or buying low-cost shares in one’s company.

Book #3: Rich Dad Poor Dad

Author: Robert Kiyosaki

Buy this book here.

Review:

Rich Dad Poor Dad started a personal finance revolution that inspired millions worldwide to find financial freedom. It has since become one of the top personal finance books and has seen numerous translations worldwide, with millions of copies selling in every language. One cannot adequately convey the extent to which Rich Dad Poor Dad has transformed how people think about money and wealth.

Key Points:

- This book chronicles two fathers and their different strategies for a successful and fulfilling life.

- The book focuses on teaching people how to make their money work for them through the right investments.

- It teaches how making a lot of money is not important. It also shows how one manages their money.

- At the end of the book, one would know how to reduce one’s financial struggle while enhancing their investments.

Book #4: The Intelligent Investor

Author: Benjamin Graham

Buy this book here.

Review:

The Intelligent Investor by Benjamin Graham is one of the most well-known and influential books on personal finance. Published in 1949, the book is still relevant today and is considered required reading for anyone looking to invest their money. Graham lays out his investment philosophy based on value investing in the book. The book has four parts- general observations on investing, investor, and stock market fluctuations, and the survey of common stocks and bonds versus stocks. The author also provides case studies and real-world examples to illustrate his points.

Key Points:

- The Intelligent Investor is one of the most important investment books.

- This comprehensive and informative book is essential for anyone interested in personal finance.

- The book’s author, Benjamin Graham, is widely considered the father of value investing.

- The Intelligent Investor is not a get-rich-quick book. It is a book that every serious investor should read and re-read. The book has wise counsel and advice that will stand the test of time.

Book #5: Rich Dad’s Cashflow Quadrant

Author: Robert Kiyosaki

Buy this book here.

Review:

Regarding personal finance, The Cashflow Quadrant by Robert Kiyosaki is a must-read book. The Cashflow Quadrant is a great book for those looking to improve their personal finances. The book is a quadrant, each stage represented by a different color. The stages are green, blue, yellow, and red. Green symbolizes the phase of financial stability where you can live comfortably without worry. Blue means the phase of financial security, where you have a good income and debt. Yellow talks about the financial independence phase, where you can live without debt and have a good income. Finally, red is the phase of financial freedom, where you can live without debt and have a high income.

Key Points:

- The Cashflow Quadrant is a book by Robert Kiyosaki that explains the different stages of financial success.

- If you want personal finance books to teach you how to become wealthy, this book is for you.

- This book mentions how to change your mindset regarding money and start thinking like the rich.

- It is handy for those in the blue and yellow stages, providing a roadmap for achieving financial independence.

Book #6: The Secrets of the Millionaire Mind

Author: T. Harv Eker

Buy this book here.

Review:

The Millionaire Mind is a book by T. Harv Eker that reveals the secrets of the wealthy. Eker takes the reader on a journey through the mindset of the wealthy, uncovering the myths that keep us trapped in financial mediocrity. The book’s premise is that our beliefs about money shape our financial reality. To be wealthy, we need to change our money beliefs. The Millionaire Mind is an eye-opening book that provides valuable insights into the psychology of money. He provides concrete steps that we can take to change our money beliefs and achieve financial freedom. If you are serious about creating wealth, this book is a must-read.

Key Points:

- In The Secrets of the Millionaire Mind, T. Harv Eker argues that the key to financial success is not intelligence or education but your mindset.

- He breaks down the mindset of the wealthy into 17 “wealth files”. These include things like “Wealthy people think big,” “Wealthy people are generous,” and “Wealthy people are risk takers.”

- Eker’s book has many stories and examples of how changing your mindset can lead to financial success. He also provides exercises and action items to help readers change their mindsets.

- If you’re looking for personal finance books on changing your relationship with money, The Secret of the Millionaire Mind is a great place to start.

Book #7: Think and Grow Rich

Author: Napoleon Hill

Buy this book here.

Review:

This review will look closely at what the book offers and whether it lives up to the hype. This is a highly popular book on the subject, and for a good reason. In this book, Hill draws on his own experiences and the experiences of other successful people to explain how one can use the mind to achieve success. In this book, he discusses the importance of positive thinking and taking action. If you require a book that will inspire you to achieve your financial goals, look no further than Think and Grow Rich by Napoleon Hill.

Key Points:

- The book supports the idea that you must think like a millionaire to succeed.

- Hill provides step-by-step instructions on setting and achieving goals.

- It contains Hill’s 13 principles for success, which he derived from interviews with some of the most successful people of his time.

- Look no further than Think and Grow Rich if you want personal finance books to motivate you to achieve your financial goals.

Book #8: The Science of Getting Rich

Author: Wallace D. Wattles

Buy this book here.

Review:

Are you looking for a book to help change your financial situation? If so, you may be interested in reading The Science of Getting Rich. This book has helped many people achieve their financial goals and may help you. You may be amazed at what you learn! In this book, Wattles lays out his philosophy on how to become rich. He believes the key to wealth is not to make more money but to learn how to use money properly. He also believes that everyone has the potential to be wealthy and that poverty is not inevitable.

Key Points:

- If you want to learn more about becoming rich, check out The Science of Getting Rich by Wallace D. Wattles.

- The book is divided into 17 chapters, each dealing with a different aspect of getting rich.

- Wattles begins by explaining the nature of thought and how it helps create wealth.

- He then goes on to show how to put this knowledge into practice in your own life. The Science of Getting Rich is a must-read if you are serious about creating wealth.

Book #9: The Art of Money Getting

Author: P.T. Barnum

Buy this book here.

Review:

You can’t go wrong with The Art of Money Getting if you’re searching for good personal finance books. This book is a timeless classic that offers sound advice on how to make, save, and invest money. Barnum was one of the most successful businessmen of his time. His advice is equally relevant today as it was during its first publication in the 19th century. In addition to offering advice on financial matters, Barnum dispels some common myths about money.

Key Points:

- The Art of Money Getting is a classic book on personal finance.

- The book has advice on how to earn and save money. Barnum was a successful businessman and showman, and he used his experience to write a book that is still relevant today.

- The book is divided into three sections- “Getting Money,” “Keeping Money,” and “Using Money.”

- Barnum discusses earning money through hard work and perseverance in the first section. The second section offers advice on saving money. The third section provides tips on using money wisely.

Book #10: The Wealthy Barber

Author: David Chilton

Buy this book here.

Review:

David Chilton’s The Wealthy Barber is among the most iconic and bestselling personal finance books. The book was first published in 1989 and has sold over two million copies. The book follows the story of Roy, a small-town barber who gives financial advice to his clients. Through Roy’s conversations with his clients, Chilton covers various topics, including savings, debt, investing, and retirement planning. While the book is now more than 30 years old, its lessons are just as relevant today as they were when it was first published.

Key Points:

- If you are searching for personal finance books to help you learn about personal finance, then The Wealthy Barber is a great choice.

- The book is about the fictional character “Tom,” a barber. Tom is advised by his friend and financial planner, “The Wealthy Barber,” on how to save and invest his money.

- Chilton’s ability to present complex financial concepts in a relatable and humorous way has made this a must-read for anyone who wants to improve their financial literacy.

- Overall, the book is an easy and entertaining read that provides valuable insights into personal finance.

Recommended Books

This article reviews the top 10 personal finance books for growing your wealth. To know more, read the following books,