Updated September 18, 2023

What is a Phantom Stock?

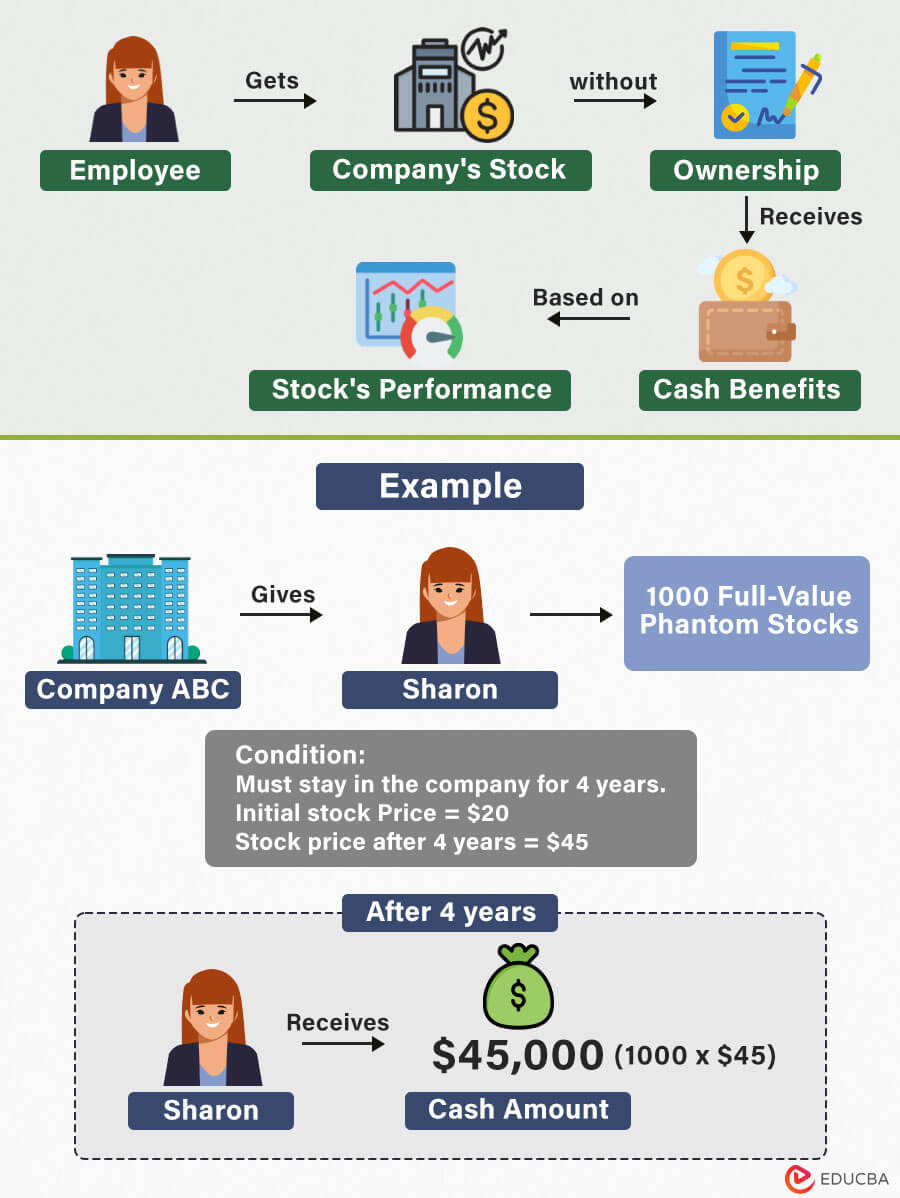

A phantom stock plan, also called a shadow stock plan, is a way for companies to motivate and reward employees without giving them ownership. Instead, employees get virtual shares known as phantom stock units (PSUs).

These PSUs mimic the value of real company shares and go up or down based on how well the company does. When these virtual shares increase over time, employees get cash bonuses matching the PSUs’ worth increase.

This stock plans are also flexible, offering tax benefits, liquidity options, and the ability to customize the plan to suit the company’s unique goals, making them a lucrative opportunity for employees.

Table of Contents

Key Highlights

- In phantom stocks, employees receive cash or cash-equivalent payouts based on the value of virtual shares

- Types of these stocks are appreciation-only, full-value, and performance-based.

- Employees with phantom shares align their goals and interests for the company’s growth and profitability.

How it Works?

The phantom stock plan usually works in the following manner:

Step #1: Allocation of PSU

Companies grant selected employees virtual shares called phantom stock units (PSUs). These PSUs replicate the value and performance of real company shares.

Step #2: Performance tied valuation

The value of these virtual shares goes up and down depending on the company’s financial performance or specific metrics, such as revenue growth or an increase in stock price.

Step #3: Waiting during vesting period

Employees do not receive these virtual shares immediately. They must wait a certain amount of time, known as the “vesting period”, to receive it. The virtual share value may fluctuate during this period depending on the chosen performance criteria.

Step #4: Employees receive payouts

When the vesting period ends, employees will receive cash payments or cash-equivalent payouts based on the value of virtual shares during the vesting period. If the company does well, then employees receive more money.

3. Performance-Based

Some companies incorporate performance metrics in their phantom stock plan. Employees receive payouts based on meeting specific performance goals or milestones mentioned in the plan. It encourages employees to achieve key objectives that benefit the company.

4. Hybrid

This plan combines elements of different types of phantom stock, tailoring compensation to the company’s specific goals and circumstances.

Examples

The following are some examples of the above types.

Example #1: Full-Value

Suppose a company wants to reward a senior manager, John Kelvin, by creating a full-value phantom stock plan. So, they assign 1,000 phantom shares to him at $5 each, so the initial value is $5,000 (1000 x $5).

Over the three years, the company’s stock value or performance increases, and the value of the phantom shares also increases. Now, each phantom share is worth $10. So, John receives a total cash payment of $10,000 (1000 x $10) as a part of the full-value share plan.

Example #2: Appreciation-Only

Emily, who works in an MNC, was granted 400 phantom shares from her company on June 5, 2018, worth $40 each. But, she had to keep working in the company for the next five years to reap the benefits of these shares.

On June 5, 2023, these shares were $52.30 each due to increased company value. The difference between the initial and current share value is $12.30 per share. Since Emily had 500 shares, she got a bonus of $4,920 (400 x 12.30) as a part of an appreciation-only plan.

Example #3: Performance-Based

Michael’s company motivates him to sell more products by giving him 200 phantom stocks at $10 each. These stocks are linked to sales revenue, meaning if he manages to increase the sales revenue by 15% within a year, the value of each stock will increase by 10%.

Michael consistently exceeded the sales target for two years, which raised the stock value to 20%. As a result, each share is now worth $12.10, and he will receive a total cash payment of $2,420 due to his exceptional sales performance.

Calculation:

1st Year : $10 (initial value) + ($10 * 10%) = $10 + $1 = $11

2nd Year: $11 (Year 1 value) + ($11 * 10%) = $11 + $1.10 = $12.10

Agreement

The phantom stock agreement is a formal written agreement that outlines all the terms and conditions of the plan, ensuring clarity and legal enforceability.

The following are some key components typically found in the agreement:

1. Grant of Phantom Shares

Companies mention the number of phantom stock units granted to employees. Here, employees do not own the actual company’s stock or equity.

2. Valuation

It defines the value of phantom shares. The company’s stock price, a predetermined formula, or other performance-based metrics determine the value.

3. Vesting Period

Phantom stock plans often have a vesting schedule, specifying when employees become eligible for the benefits. Vesting may be time-based or performance-based.

4. Payout Terms

The agreement outlines when and how employees can cash out or receive the value of their phantom shares. Payouts can occur upon retirement, termination, or other triggering events.

5. Dividends and Distributions

Employees may receive dividend equivalents or other distributions similar to actual shareholders, depending on the plan’s terms.

6. Tax Considerations

The agreement should address tax implications for the company and its employees.

7. Forfeiture Provisions

It may include provisions for forfeiture of phantom shares if employees leave the company before vesting or other conditions.

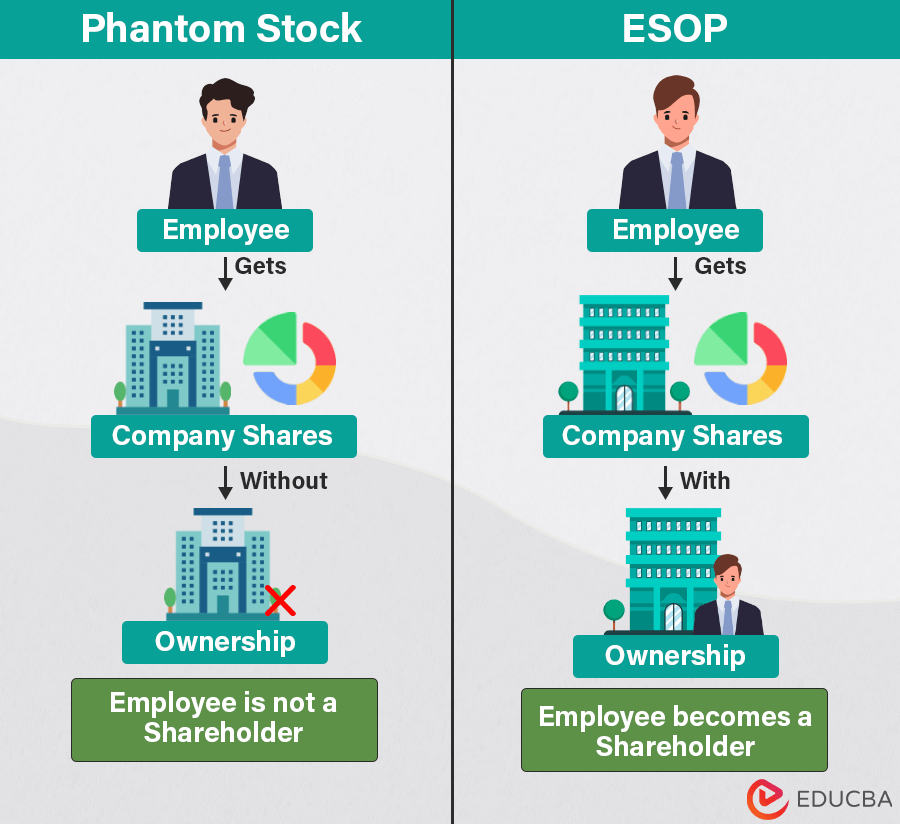

Phantom Stock Vs ESOP

Here are some differences between phantom stock and employee stock ownership plan (ESOP)

| Aspect | Phantom Stock | Employee Stock Ownership Plan (ESOP) |

| Value | Employees receive a cash equivalent of the company’s stock value. | Employees receive a portion of the company’s share. The value is directly tied to the company’s performance and stock value. |

| Ownership | They do not hold actual shares. | They are actual shareholders. |

| Voting Rights | They do not have voting rights in company decisions. | They have voting rights based on their ownership stake. |

| Risk | It involves lower risk, as it doesn’t involve real ownership of shares. | It involves risk tied to the performance of the company’s stock in the stock market. |

| Cashing Out | Shareholders cannot decide when they will receive their payout | Shareholders can choose when to sell their stock. |

| Taxation | Taxed as ordinary outcome on payouts at a higher rate | Tax advantages for both the company and employees and also have the option to defer taxes on gains. |

Benefits

The benefits are as follows:

1. Retention and Motivation

Phantom shares provide a powerful tool for retaining key employees. Since the value of these shares ties to the company’s performance, employees are motivated to work towards the company’s success.

2. Alignment of Interests

Employees with phantom shares align their goals and interests for the company’s growth and profitability. Because if the company does well in the vested period, the employees will also benefit.

3. Cash-Based Rewards

Phantom shares are settled in cash, meaning employees receive monetary rewards without investing their money.

4. Flexible Compensation

Companies can change phantom share plans to suit their objectives and needs. The shares can be given to specific employees or used to motivate them to perform better to avail those benefits.

5. No Equity Dilution

Unlike traditional stock options, phantom shares do not dilute the ownership of existing shareholders.

6. Long-Term Perspective

Phantom shares often come with vesting periods, encouraging employees to stay with the company for the long term.

7. Simplicity

Phantom share plans are typically easier to manage than traditional equity-based compensation plans.

Disadvantages

The disadvantages of Phantom Stock are as follows.

1. Taxation

Phantom stock is generally taxed as ordinary income, and companies also deduct the expense associated with payouts. So, employees will receive the payout amount after all deductions, which can differ from the original amount.

2. Cash Flow Requirements

Implementing and administering can be costly and time-consuming for companies. Employers must have sufficient cash to fund phantom stock benefits when they become payable.

3. Outstanding Liabilities

It may create outstanding liabilities on a company’s balance sheet. These liabilities can affect the company’s perceived value and ability to attract investors or buyers.

4. Lack of Voting Rights

It does not grant employees any voting rights in the company, unlike actual equity ownership.

Taxation

Phantom stock plans are typically taxed when paid to the employee. It’s crucial for employees participating in these plans to understand their specific terms and tax implications.

However, the taxation is similar to regular income tax. The employee needs to report the income from these stocks in the year they receive it. The tax implications vary based on the country’s tax laws, and the payment is typically subject to federal, state, and local income taxes.

Sometimes, companies take some money from phantom stock payouts for taxes, so employees don’t face tax burdens. The company sends this money to the tax authorities on behalf of the employee. The withheld amount is credited against the employee’s tax liability when they file their tax return.

Additionally, tax laws regarding phantom stocks change over time, so staying updated with the latest regulations and seeking professional tax advice is essential.

Frequently Asked Questions(FAQs)

Q1. Are all employees eligible for Phantom Stock?

Answer: No, not all employees are eligible for phantom stock. Companies choose to give to specific employees, like managers, executives, and top-level representatives.

Q2. Is phantom stock a good idea?

Answer: It depends on the goals of the company and its employees. It might be useful for a company to encourage employees to align their interests and performance with its objectives. However, this plan may be complex and have tax consequences.

Q3. What are the risks of phantom stock?

Answer: The risks associated with phantom stock plans include:

- Establishing and managing stock plans for many employees can be complicated.

- The change in market trends affects stock value.

- Employees are not shareholders, which affects their commitment and performance toward the company’s success.

- The payout is subject to high tax liabilities compared to other stocks.

Recommended Articles

This article is a complete guide to phantom stock and how it works. It also explains its types, taxation, agreements, and benefits. You can also refer to the following articles to learn more.