Updated July 15, 2023

What is Portfolio Investment

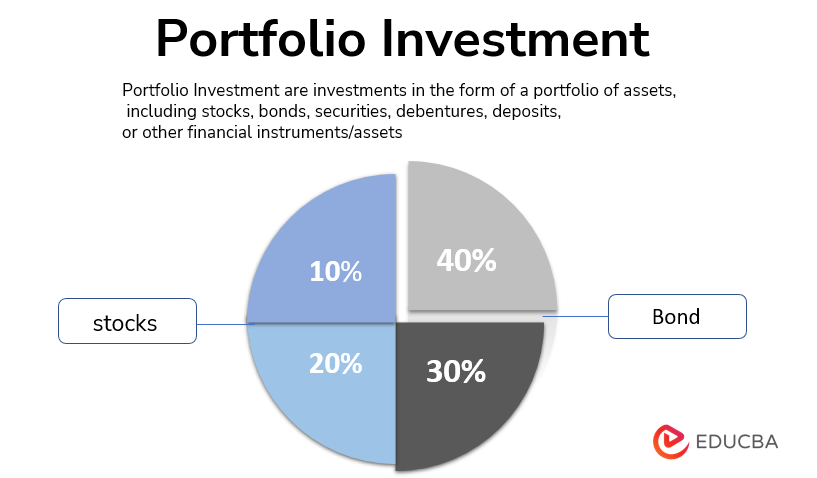

Portfolio investments are investments in a portfolio of assets, including stocks, bonds, securities, debentures, deposits, or other financial instruments/assets. These investments are primarily made with the expectation that they will yield good returns or capital appreciation (i.e.) an increase in the value of investments. Risk and returns are directly proportional (i.e.) the higher the risk, the higher the returns.

Explanation

Portfolio investments are assets acquired with the intention of maximizing wealth or earning income/ profits from the investment. This is a passive investment, as there won’t be any direct ownership or active management of assets. This can be either long-term or short-term; investors choose their investments based on their risk appetite and time period (i.e.) Long term or short-term.

Mutual funds and institutional investors predominantly deal with these investments. In the same way, pension funds and sovereign funds also invest in portfolios with a conservative approach. Risk tolerance is an important factor in choosing portfolio investments.

Features of Portfolio Investment

- Portfolio investments are diversified, which reduces the risk by allocating the investments across various financial instruments, business sectors, and categories.

- It intends to generate better returns by investing in different instruments and industries, so happening of any adverse event will not erode their investments ultimately since each investment would react differently to the same event.

- Investors’ risk tolerance and investment goals matter a lot in portfolio investments.

- Stocks and bonds are predominantly considered portfolio investments but also include investment assets, a strategic investment method.

Example of Portfolio Investment

Mr. A wants to invest in a portfolio with moderate risks and returns. So, Mr. A plans to invest in the below portfolio. US Govt bonds offer a 2% yield of return per annum. This is a risk-free investment as the US Government provides it; at the same time, returns are also low. Blue-chip stocks offer around a 10% yield of return per annum. Dealing with equities always has risks, and the investments are not secured. So, the risk and returns both are high.

To have a moderate risk and returns, it is better to invest 50% in US Govt bonds and 50% in stocks, so the risk is also reduced, and the returns are averaged at 6%. In this case, returns are better than bonds but less than stocks, and at the same time, the risk is also reduced. If Mr. A wants more returns or low risk, it must decide by him, and he can change the proportion of the portfolio according to his risk tolerance and expectations of return.

Types of Portfolio Investment

There are different types of portfolios and different strategies for portfolio investment. It is up to the individual investor or the portfolio managers to choose the portfolio strategy based on the risk appetite and time horizon.

1. Hybrid Portfolio

A Hybrid portfolio is a diversified portfolio with a mix of high-risk and low-risk securities. It means investment in equities where risk and returns are high and in some fixed income securities like bonds, deposits, etc., where the risk and returns are comparatively lower than equities.

This portfolio helps the investors manage the risks and returns. The investor can decide on the proportion of investment into high-risk and low-risk securities based on their risk appetite.

2. Aggressive Portfolio

An Aggressive portfolio invests in high-risk securities that will yield higher returns. The prime aim of this portfolio is to gain more returns from the investments, and their risk tolerance is at the higher end (i.e.) the investor in this portfolio is willing to take more risk in return for better gains.

They choose to invest in companies in the early stages of development with potential growth opportunities. They use the right business strategies where the risk is comparatively higher, and the returns also will be higher.

3. Defensive Portfolio

A Defensive portfolio is an investment in stocks dealing with essential/necessary goods. These stocks do well both in good times and bad times (i.e.) Even if the economy is bad, these stocks will perform as they deal with essential goods like food products, healthcare, household goods, etc., which are necessary for survival. This portfolio has less risk as they focus on essentials and yield better yields.

4. Income Portfolio

An Income portfolio is an investment in fixed income securities and dividend payout stocks that generate a regular source of income. The prime focus is to earn income from the investment. (E.g.) Bonds, deposits, Real estate investment trusts (REIT), etc., generate regular income through interest, rental income distribution, dividends, etc. These are low-risk investments and suitable for risk-averse investors.

5. Speculative Portfolio

A Speculative portfolio is an investment in stocks that generates gain on an investment in a short span of time. This portfolio is suitable for stocks newly entering the market (i.e.) Initial public offerings or stocks in the process of merger or takeover). This portfolio also focuses on stocks working on innovative products that could increase the stock value and performance. Still, it also comes with the risk that the products may not deliver the desired results.

What Amount Should be Invested in Portfolio?

The amount to be invested in the portfolio is at the discretion of the investors and the investment plan offered by the investment managers. There are monthly SIP plans and lump sum investments.

Portfolio Investment Management

Portfolio investment management is the process of selecting the stocks and securities for a portfolio and overseeing their performance, and managing the funds keeping in mind the investment goals, risk tolerance, and time period. It requires analytical and decision-making skills to choose the right stocks for investments. The portfolio manager strategically takes the buy and sell call of stocks and aims to generate maximum returns.

Advantages

Below are some advantages :

- The investor can choose the investment proportion considering the risk tolerance, return expectations, and time horizon.

- Diversification of investments into different financial instruments helps to reduce risk and yield better returns.

- Liquidity and flexibility exist in portfolio investment as the investor can exit from any particular investment at any time, and the remaining investment in the portfolio can be maintained.

- Portfolio investments help to choose both fixed-income securities and capital appreciation investments. An Investor can choose the proportion of investment based on the strategic investment plan.

Disadvantages

Below are some disadvantages :

- It is tough to track investment-related information constantly as the investments are diversified.

- Proper securities and risk profile analysis needs to be carried out before making portfolio investments; otherwise, it may deliver desired returns.

- It is tough for any individual investor to decide on a portfolio as it requires a lot of research and analysis; hence it creates a dependency for investors to rely on portfolio investment managers.

- Financial knowledge is a must for investors to invest in portfolio investments.

Conclusion

Portfolio investments are good for those who want to balance their risk and returns and those who want to diversify their investments. The portfolio offers customization and helps investors to choose investments according to their risk tolerance, time horizon, and yield of returns. These services are offered by investment managers and other financial institutions that research and analyze securities and offer investment plans.

Recommended Articles

This is a guide to Portfolio Investment. Here we discuss the introduction, types of portfolio investment, and advantages and disadvantages. You may also have a look at the following articles to learn more –