Updated December 22, 2023

Portfolio Management Books – Introduction

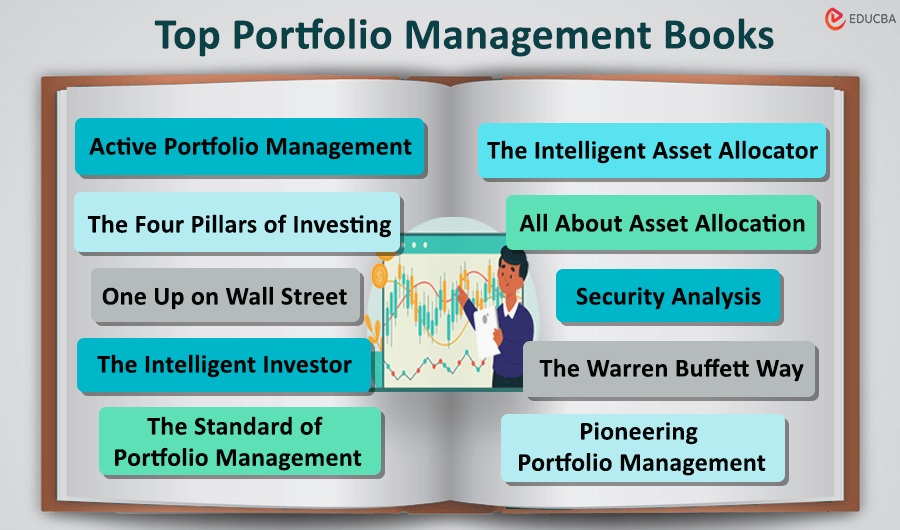

Are you a new investor looking to learn how to manage your portfolio? Or are you an expert wanting to improve your portfolio management skills to increase your profits? These portfolio management books will provide you the needed guidance to manage investment portfolios. These books typically cover a wide range of topics like asset allocation, risk management, portfolio construction, investment analysis, and performance evaluation.

Get these top 10 portfolio management books to learn crucial techniques and strategies that you might find useful.

| # | Portfolio Management Books | Author | Original Publishing Year | Ratings |

| 1 | The Intelligent Investor | Benjamin Graham | 1949 | Amazon: 4.5 Goodreads: 4.25 |

| 2 | Active Portfolio Management | Richard C. Grinold & Ronald N. Kahn | 1994 | Amazon: 4.1 Goodreads: 4.12 |

| 3 | One Up on Wall Street | Peter Lynch & John Rothchild | 1989 | Amazon: 4.5 Goodreads: 4.27 |

| 4 | The Four Pillars of Investing | William J. Bernstein | 2002 | Amazon: 4.6 Goodreads: 4.23 |

| 5 | Security Analysis | Benjamin Graham & David Dodd | 1951 | Amazon: 4.7 Goodreads: 4.29 |

| 6 | All About Asset Allocation | Richard A Ferri | 2010 | Amazon: 4.5 Goodreads: 4.17 |

| 7 | The Intelligent Asset Allocator | William Bernstein | 2000 | Amazon: 4.5 Goodreads: 4.2 |

| 8 | Pioneering Portfolio Management | David Swensen | 2000 | Amazon: 4.5 Goodreads: 4.17 |

| 9 | The Warren Buffett Way | Robert Hagstrom | 1994 | Amazon: 4.4 Goodreads: 4.17 |

| 10 | The Standard of Portfolio Management | Project Management Institute | 2006 | Amazon: 4.6 Goodreads: NIL |

Now, to help you choose which book you can start with, we will review each of the portfolio management books in great detail.

Book #1: The Intelligent Investor: The Definitive Book on Value Investing

Author: Benjamin Graham

Review:

The Intelligent Investor provides a comprehensive guide to value investing and portfolio management. It focuses on minimizing risks and achieving long-term investment success. It also highlights the importance of diversification in an investment portfolio. The book also sheds light on how investing and speculation are very different.

Key Points:

- Graham advocates for investing with a margin of safety, which means buying stocks priced lower than their intrinsic value. This approach helps to minimize the risks associated with investing.

- He introduces the concept of Mr. Market to explain how investors should use Mr. Market’s mood swings to their advantage by buying stocks when prices are low and selling when prices are high.

- The author advises investors to avoid speculation and instead invest in companies with good fundamentals.

Book #2: Active Portfolio Management: A Quantitative Approach for Producing Superior Returns and Controlling Risk

Author: Richard C. Grinold and Ronald N. Kahn

Review:

Active Portfolio Management provides a comprehensive guide to performance measurement, forecasting, risk management, portfolio optimization, and factor models. It is aimed at both professional and individual investors interested in learning more about active portfolio management. The authors provide practical advice on performance measurement, including how to evaluate the performance of an investment strategy using risk-adjusted metrics such as the Sharpe ratio and information ratio.

Key Points:

- The book teaches us how to forecast asset returns and risk using quantitative methods.

- It includes a detailed discussion of risk management, including how to identify and manage different types of risk, such as market risk, credit risk, and liquidity risk.

- The author also provides practical advice on portfolio optimization, including constructing efficient portfolios that balance risk and return.

- The book finally mentions factor models, statistical models that explain the returns of a portfolio based on underlying factors such as value, momentum, and size.

Book #3: One Up on Wall Street: How to Use What You Already Know to Make Money in the Market

Author: Peter Lynch & John Rothchild

Review:

“One Up on the Wall Street” by Peter Lynch is an investment masterpiece that empowers amateur investors to outperform professionals in stock picking. Lynch, a legendary investor, shares insights and wisdom gained during his tenure as the fund manager of Fidelity Magellan Fund. The book is a comprehensive guide divided into three sections. It stands as a timeless resource for anyone interested in stock market investing, offering practical advice and timeless principles for success.

Key Points:

- The author made “Multi-Baggers” famous, urging investors to find stocks that can grow significantly.

- He promotes a simple approach, saying regular investors need only a bit of brainpower and basic math to rival Wall Street experts.

- The book explores the psychology of investing, offering valuable advice on handling emotions in the stock market.

- Lynch details his stock-picking methods, highlighting the need for personal research and guiding investors on spotting opportunities.

Book #4: The Four Pillars of Investing: Lessons for Building a Winning Portfolio

Author: William J. Bernstein

Review:

“The Four Pillars of Investing” by William J. Bernstein is an indispensable guide offering an approach to building and managing a successful investment portfolio. It introduces four fundamental pillars—theory, history, psychology, and business—that form the bedrock of sound investment decisions. While acclaimed for its evidence-based strategies, some critics argue that it might be too technical for novice investors. However, considering individual investment goals is crucial when applying the principles outlined in the book.

Key Points:

- The book, full of real-world examples and historical data, offers practical insights and guidance.

- Bernstein shows how markets have cycles, stressing the value of a long-term approach instead of trying to time the market.

- The book explains market efficiency, suggesting that markets reflect all available information.

- The author explores how human behavior affects investments, tackling emotional biases and offering strategies for disciplined investing.

Book #5: Security Analysis

Author: Benjamin Graham & David Dodd

Review:

“Security Analysis” by Benjamin Graham has timeless investment principles. It is a foundational guide for investors, offering enduring wisdom despite its challenging nature. While some chapters were removed in later editions, the original content remains valuable.

Key Points:

- The book presents four pillars—theory, history, psychology, and business—as essential guides for wise investment choices.

- Graham highlights the link between risk and return, advising investors to carefully evaluate their risk tolerance before deciding.

- Graham and co-author David Dodd emphasize the importance of studying past market trends and historical data.

- Insights from market crashes and economic recessions demonstrate the cyclical nature of markets, promoting a long-term investing mindset.

Book #6: All About Asset Allocation: The Easy Way to Get Started

Author: Richard A Ferri

Review:

Rick Ferri’s “All About Asset Allocation” is a comprehensive guide focusing on asset allocation and portfolio construction. It provides insights into different asset classes, historical correlations, and the impact of combining assets on risk and return. It is a valuable resource for both novice and experienced investors, offering a solid foundation in asset allocation principles and practical portfolio management.

Key Points:

- The book encourages passive investing, elucidating risk, volatility, diversification, and correlation.

- It introduces multi-asset investing, showcasing the impact of various asset classes (U.S. stocks, international stocks, corporate bonds) on risk and return.

- Key concepts in asset allocation are discussed, emphasizing low-correlation assets with unique risks for effective risk diversification.

- The book addresses mutual fund expenses, fees, taxes, and asset location.

- It also provides tips on hiring an investment manager, offering practical guidance for investors.

Book #7: The Intelligent Asset Allocator: How to Build Your Portfolio to Maximize Returns and Minimize Risk

Author: William Bernstein

Review:

William Bernstein delves into the importance of asset allocation in his book “The Intelligent Asset Allocator.” He emphasizes the need for readers to move beyond a simplistic approach to investing and highlights the impact of not understanding asset allocation on financial growth. The book is perfect for both financial and engineering enthusiasts.

Key Points:

- The author emphasizes delving deeper into real investing, moving beyond basic knowledge.

- He suggests creating a portfolio with assets that move independently to achieve a smoothing effect.

- The book recommends owning at least four asset classes for diversity and stability.

- Introducing the concept of rebalancing, the book addresses situations where one asset class may become dominant due to market fluctuations.

Book #8: Pioneering Portfolio Management: An Unconventional Approach to Institutional Investment

Author: David Swensen

Review:

The book “Pioneering Portfolio Management” is an insightful guide for investors at all levels. Swensen’s emphasis on endowments, core investment aspects, and the importance of diversification makes this book a valuable resource. Focusing on institutional and individual strategies, it offers practical advice for achieving financial success in the dynamic world of investments.

Key Points:

- The book emphasizes the significance of endowments for institutional financial success, exploring their benefits and potential challenges.

- Swensen outlines three key aspects for successful investing: asset allocation, market timing, and security selection, offering insights into each.

- Highlighting the power of diversification, the book advocates for well-balanced portfolios, including stocks, bonds, and real estate from various markets.

- Swensen guides investors to adopt a long-term vision, cautioning against impulsive market entry and encouraging strategic allocation of assets.

Book #9: The Warren Buffett Way

Author: Robert Hagstorm

Review:

This book provides valuable insights into the investment philosophy of Warren Buffett, including his practical principles. The book offers financial wisdom and delves into Buffett’s humanity, emphasizing the importance of integrity and human qualities in investment decisions. It is a timeless guide for investors and individuals seeking simplicity in their principles for success.

Key Points:

- The author mentions that Buffett’s success lies in his confidence to act independently, relying on well-researched data and reasoning rather than following the crowd.

- The book distills Buffett’s strategy into nine timeless principles for long-term success.

- His “focus” investing avoids diversification, emphasizing deep knowledge in a few industries.

- The book emphasizes the power of simplicity in investment strategies gleaned from Buffett’s approach.

Book #10: The Standard of Portfolio Management

Author: Project Management Institute

Review:

The Standard for Portfolio Management provides comprehensive guidelines along with a powerful framework. It emphasizes strategic alignment, resource efficiency, and risk management, providing a competitive advantage to readers. It is an excellent guide with easy-to-understand language and concepts.

Key Points:

- The book offers guidelines for effective portfolio management, aligning projects with strategic goals.

- It emphasizes portfolio management, alignment, prioritization, resource optimization, performance monitoring, and value delivery.

- Apart from providing knowledge on the benefits of efficient portfolio management, it also presents its drawbacks like resistance to change, initial investment, reliance on data quality, etc.

Recommended Books

If you found this article on portfolio management books informative and helpful, you can read the following article recommendations,