Updated July 15, 2023

Definition of Portfolio Manager

The term “portfolio manager” refers to the profile of financial analysts responsible for managing their investors’ investment portfolios, which can be individuals or companies.

Their primary responsibility is to evaluate various available investment opportunities and recommend the best possible option to the clients while abiding by the relevant laws and regulations. In short, they intend to offer maximum benefit to the client at the minimum risk possible.

How to Become a Portfolio Manager?

Now, let us look at the steps that need to follow to become a portfolio manager:

- Step 1: An aspiring candidate should acquire a bachelor’s degree in finance, business, economics, accounting, statistics, or other disciplines. These subjects help the candidate prepare a strong foundation to start a career as a portfolio manager.

- Step 2: Although not all, some financial institutions strongly favor candidates with a master’s degree. So, students should acquire a master’s degree in business, finance, risk management, or accounting. Some candidates go for the master’s degree straight after the bachelor’s degree, while others gain some experience before going for the degree.

- Step 3: Start the career as an entry level financial analyst and then gradually grow into the role of a portfolio manager, as it requires a significant amount of market knowledge that can only be gained through experience. Typically, candidates join at this level as graduate interns or full-time employees.

- Step 4: A financial analyst must have a valid license from the financial industry regulatory authority (FINRA) to buy and sell securities for portfolio management. Interestingly, some licenses can only acquire after hiring, as the exams require the analysts to have employer sponsorship.

- Step 5: The portfolio managers need to register themselves with their state’s securities agency, while managers handling larger portfolios (> $ 25 million) may need to register themselves with the US Securities and Exchange Commission (SEC).

- Step 6: Some employers prefer candidates with professional finance designations or certifications, such as Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM). Before acquiring these professional credentials, individuals must fulfill certain criteria., like a bachelor’s degree, 3-4 years of professional experience, etc., and clearing the respective exams.

Requirements of a Portfolio Manager

Given that not everybody can become a portfolio manager, certain requirements must be fulfilled before one can wish to become a portfolio manager. They are as follows:

- Should have at least a bachelor’s degree in finance, business, economics, or other related disciplines.

- Should have experience in financial services or investment management, while preference is given to experience in portfolio management.

- Must have a valid FINRA license.

- Although not a must have, it is good to have one or more finance designations or certifications, such as CFA, FRM, etc.

Qualities of a Good Portfolio Manager

Some of the qualities that are typically associates with a good portfolio manager are as follows:

- Must have a competitive spirit and an analytical bent of mind

- Should have strong communication skills

- Should have the ability to anticipate market performance

- Must be calm and patient

- Should possess decision making ability

- Must be capable of generating ideas

- Should be self-sustaining and emotionally balanced

Responsibilities

Some of the major responsibilities of a portfolio manager are as follows:

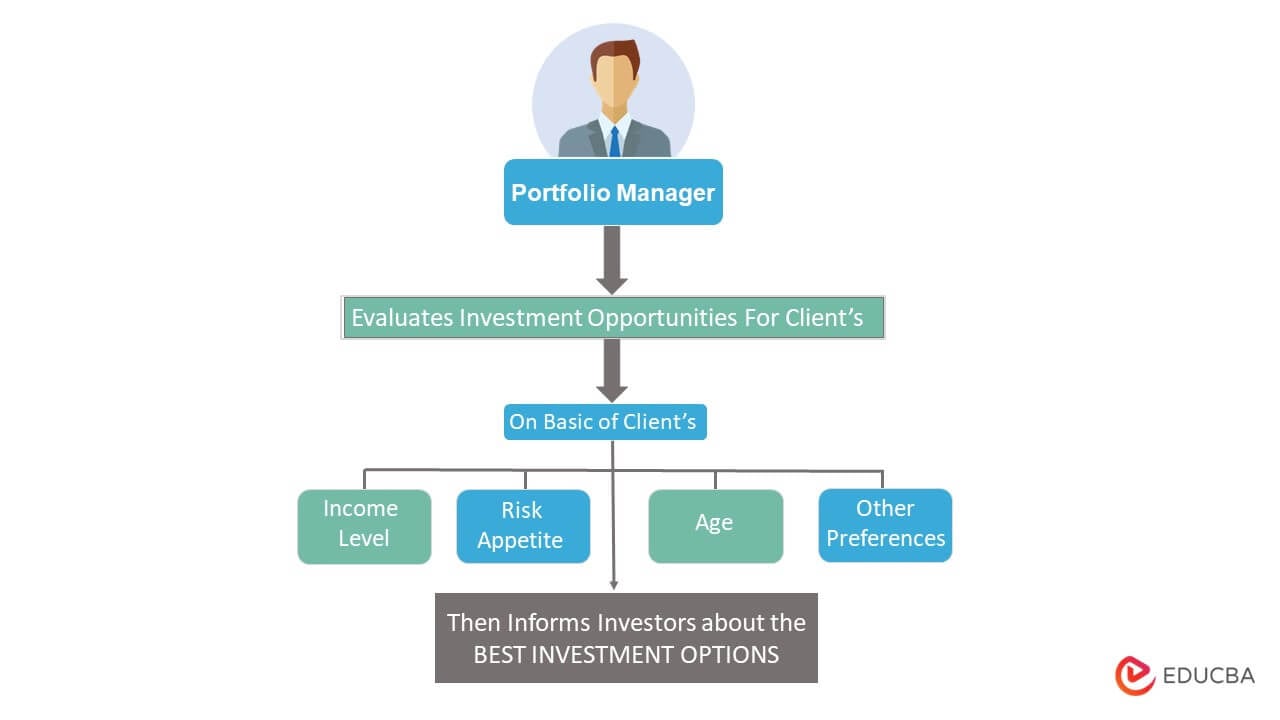

- Select the best investment options for the client on the basis of their income level, risk appetite, age, preferences, etc. They should not influence by higher commissions or bias towards any particular investment.

- Inform the investors about the available investment options, expected returns, and risks involved.

- Regularly update the clients and keep them posted regarding any material change in their portfolio. It is important to maintain transparency and honesty with the clients.

- To be at the right place at the right time(to make the correct investment decision) is one of the most important traits of a portfolio manager. In other words, they should keep track of the market fluctuations occasionally.

- He/she should always be at the top of his game and be updated about all the latest happenings in the financial domain.

- Build customized investment plans for all the clients, as each individual is different, so their preferences may vary significantly.

Salary

Until now, it is quite clear that a portfolio manager requires extensive training, formal higher education, and good designations or certifications, which eventually results in a handsome pay package for this position. According to Payscale, the average salary of a portfolio manager in the US is $86,458, whereas the top 10% draw in excess of $143,000. The compensation is primarily made in the form of assets under management (AUM) fees earned from the clients, which can increase significantly with excellent performance as it helps to grow the client base.

Portfolio Manager Regulations

The portfolio managers come under the purview of the US SEC, which supervises fund management and securities products in the US. The portfolio managers are governed by the US Investment Advisers Act of 1940.

Conclusion

So, it can be seen that the profile of a portfolio manager is both risky and exciting at the same time, as it offers the right balance of risk and reward. It will pose many challenges but offer opportunities to grow, earn, and learn simultaneously. As such, anyone with the ability to conduct in-depth research, anticipate market movement, and be willing to face upcoming challenges can pursue suitable courses to become a portfolio manager.

Recommended Articles

This is a guide to Portfolio Managers. Here we discuss the introduction and how to become a portfolio manager. Along with the qualities and responsibilities of a portfolio manager. You may also have a look at the following articles to learn more –