Updated July 18, 2023

Definition of Portfolio Optimization

Portfolio optimization is the method of selecting the best portfolio, which gives back the most profitable rate of return for each unit of risk taken by the investors. A portfolio is the asset distribution or, in other words, the pool of investment options of an investor. The best portfolio for an investor depends upon various options like risk appetite, expected rate of return, other cost minimization, etc.

Explanation

An ideal portfolio would be the one that has the highest Sharpe ratio, which William F. Sharpe developed; the ratio calculates the best return that investment can generate for every unit of risk taken by investors. Optimization of a portfolio is based upon the modern portfolio theory (MPT), which confirms that investors want the highest rate of return with the lowest risk.

For achieving this principle of modern portfolio theory, the assets need to be diversified or, in other words, lease co-related to each other. So the impact of the low performance of one asset would not result in the crash of the complete portfolio. The investment or portfolio managers select the optimal portfolio for the client based on this logic only.

How to Optimize a Portfolio

Optimization of portfolio or selection of an optimized portfolio comprises a two-step process that differs according to the needs and requirements of each investor:

- Step 1: Selection of Asset classes: In the first step, portfolio managers choose asset classes for investing the client’s or investor’s funds. This selection depends upon the factors like the expected rate of return needed by the investor and the risk appetite of the investor. If the investor’s need is a high rate of return and is ready to take high risk for that, then the portfolio manager can choose to invest in equities, options, futures, etc, and if the investor does not want to take much of a risk and is ready to accept average rate of return, then portfolio manager can invest the funds in bonds, gold, fixed interest securities, debentures, etc.

- Step 2: Selection of Assets within the class: In the second step, the portfolio manager will choose how much bonds or equity will be included in the portfolio. What kinds of shares will form part of the equities in the portfolio, and how much money will be invested in real estate and fixed-interest securities? This choice is also based on the risk-return relationship chosen by the investor.

Example of Portfolio Optimization

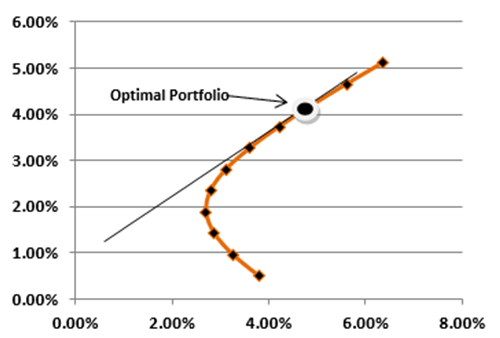

There are two high-risk stocks (A and B) and one risk-free stock with a return of 1%. The efficient frontier is plotted based on the return of these stocks. Please refer to below the efficient frontier.

Efficient Frontier (Stock A and B)

Now the X-axis represents the standard deviation of the stocks, and the y-axis depicts the returns of the stock. The risk-averse investor would move towards the left of the optimal portfolio tangential line, and investors wanting a high rate of return would move to the right towards the high-risk-return trade-off.

Portfolio Optimization Methods

Below is a brief explanation of some of the main portfolio optimization methods:

- Mean-variance model: Through this model, the portfolio manager is able to determine the optimal portfolio, which is the point at which the risk-return trade-off is highest in the graphical representation in the efficient frontier. It is based upon several assumptions relating to the market and investors.

- Mean semi-variance model: Mean semi-variance model helps in measuring the potential downside risk of an optimized portfolio. The average standard deviation of values that falls below the mean is termed semi-variance.

- Conditional Value at Risk model (CVAR): CVAR model helps in measuring the tail risk associated with the investment portfolio. The technique is used for effective risk management in the portfolio optimization process.

- Mean absolute deviation model: Mean absolute deviation model is used while selecting the large-scale optimized portfolio.

Advantages

- Portfolio optimization helps in the maximization of the return on investment. This is done through the efficient frontier graph, which depicts the point where the risk-return trade-off for the portfolio is highest; that point gives back the optimal portfolio.

- Maximized return leads to increased satisfaction on investors’ part.

- Portfolio optimization helps in the diversification of the portfolio. The portfolio manager chooses the diversified portfolio so that one underperforming asset does not impact the complete portfolio.

- For selecting the optimal portfolio, portfolio managers do a lot of market research which helps them in identifying market opportunities before other people, which ultimately benefits their clients or investors.

Disadvantages

- Some assumptions taken by portfolio managers while choosing an optimal portfolio, like a frictionless market, are untrue in reality; there are frictions like transaction cost and other constraints that complicate the process of portfolio optimization.

- The assumptions can throw back incorrect results, which could result in the loss of money.

- There is always a risk of over-diversification of the assets, which would result in a marginal loss of expected return more than the marginal benefit of the reduced risk. This would ultimately result in erosion of the investor’s benefit of the expected rate of return on the investment.

Conclusion

Portfolio optimization is a very good tool for investors wanting to maximize risk-return trade-offs. They can achieve this with the help of a good portfolio manager, who would help in choosing the best combination of high-risk and low-risk asset classes to achieve the trade-off. The selection would always be based on the risk appetite and expected rate of return of the investors. Also, it is worthwhile to say in the last every model or theory has its pros and cons; if used diligently, portfolio managers would be able to draw out the maximum benefits from the portfolio maximization technique.

Recommended Articles

This is a guide to Portfolio Optimization. Here we also discuss the definition and how to optimize a portfolio along with advantages and disadvantages. You may also have a look at the following articles to learn more –