Updated July 26, 2023

Portfolio Return Formula (Table of Contents)

What is the Portfolio Return Formula?

The portfolio return is the return obtained from the gain or loss realized by the investment portfolio which is a composite of several types of investments. Portfolios aim is to deliver a return on the basis of prespecified investment strategy to meet the investment objective, as well as the risk tolerance of the type of investors targeted by the portfolio.

Portfolio Expected Return:

Portfolio expected return is the sum of each product of individual asset’s expected return with its associated weight.

Where i = 1,2,3,…….n

- Wi: Defines the associated weight to the asset i

- Ri: It is the asset’s return

The weight attached to an asset = Market Value of an Asset / Market Value of Portfolio

Portfolio Variance:

The variance of a Portfolio’s return is a function of the individual assets and covariance between each of them. If we have two assets, A and B,

Portfolio variance is a measure of risk, more variance, more risk involve in it. Usually, an investor tries to reduce the risk by selecting negative covariance assets such as stocks and bonds.

Portfolio Standards Deviation:

It is simply the square root of the portfolio variance.

And it is a measure of the riskiness of a portfolio.

Examples of Portfolio Return Formula (With Excel Template)

Let’s take an example to understand the calculation of Portfolio Return in a better manner.

Portfolio Return Formula – Example #1

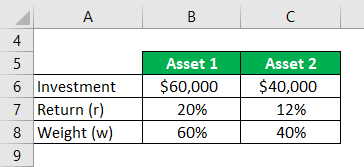

If we take an example, you invest $60,000 in asset 1 that produced 20% returns and $40,000 invest in asset 2 that generate 12% of returns. And their respective weight of distributions are 60% and 40%. Calculate the Portfolio Return.

Solution:

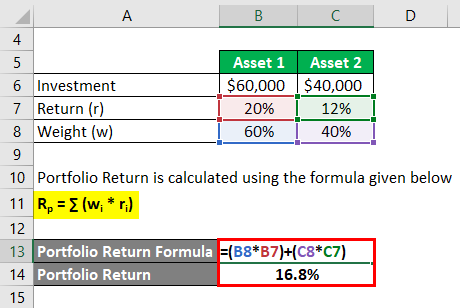

Portfolio Return is calculated using the formula given below

Rp = ∑ (wi * ri)

- Portfolio Return = (60% * 20%) + (40% * 12%)

- Portfolio Return = 16.8%

Portfolio Return Formula – Example #2

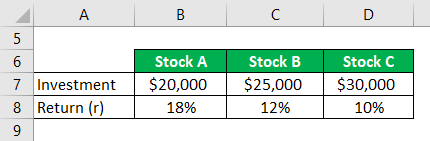

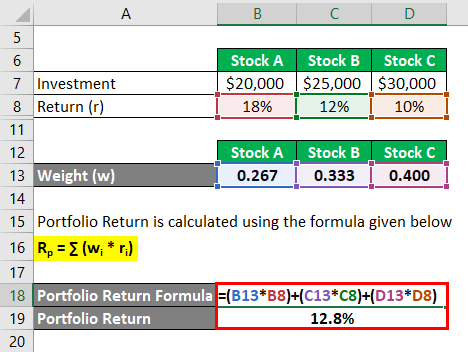

Consider an investor is planning to invest in three stocks which is Stock A and its expected return of 18% and worth of the invested amount is $20,000 and she is also interested into own Stock B $25,000, which has an expected return of 12%. While the expected return of stock C is $30,000 at the rate of 10%. Now, she is interested in to calculate the overall return she would obtain on her portfolio?

Solution:

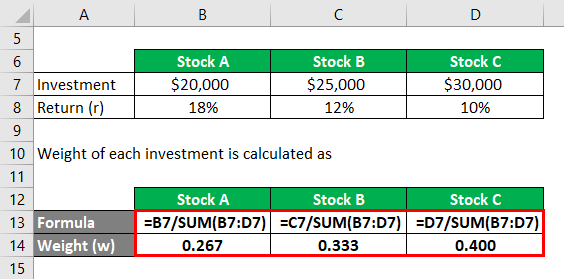

Weight of each investment is calculated as

- WStock A= $20,000 / ($20,000 + $25,000 + $30,000) = 0.267

- WStock B = $25,000 / ($20,000 + $25,000 + $30,000) = 0.333

- WStock C = $30,000 / ($20,000 + $25,000 + $30,000) = 0.400

Portfolio Return is calculated using the formula given below

Rp = ∑ (wi * ri)

- Portfolio Return = (0.267 * 18%) + (0.333 * 12%) + (0.400 * 10%)

- Portfolio Return = 12.8%

So, the overall outcome of the expected return is 12.8%

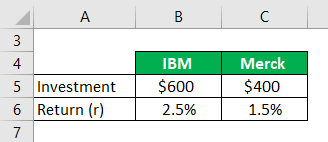

Portfolio Return Formula – Example #3

If you invest $600 in IBM and $400 in Merck for a month. And, If you realized the return is 2.5% on IBM and 1.5% on Merck over the month, Calculate the portfolio return?

Solution:

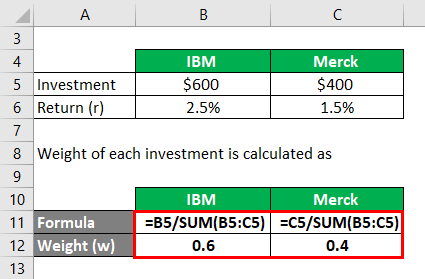

Weight of each investment is calculated as

- WIBM = $600 / ($600 + $400) = 0.6

- WMerck = $400 / ($600 + $400) = 0.4

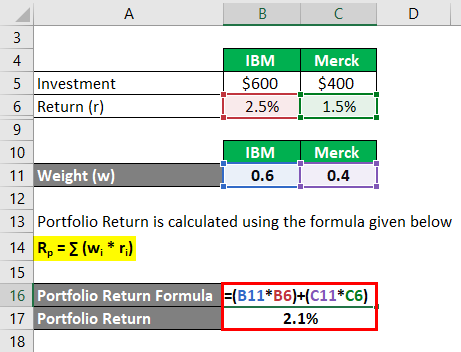

Portfolio Return is calculated using the formula given below

Rp = ∑ (wi * ri)

- Portfolio Return = (0.6 * 2.5%) + (0.4 * 1.5%)

- Portfolio Return = 2.1%

Explanation

The Portfolio return is a measure of returns of its individual assets. However, the return of the portfolio is the weighted average of the returns of its component assets.

Here is a certain predefined set of procedure to calculate the expected return formula for a portfolio.

Step 1: Initially, our intuition is to determine the return obtaining from each of the investment of the portfolio which is denoted as r.

Step 2: Next is to determine the weight of each of the asset in the portfolio on the basis of the current market trading price of it. which is denoted by w.

Step 3: Finally, the expected portfolio return is calculated by the sum of the product of the weight of each investment in the portfolio and the returns are getting from each of the respective investment as follows:

Expected Portfolio Return = ∑ (wi * ri)

Relevance and Uses of Portfolio Return Formula

The concept of the portfolio’s expected return equation is mandatory to understand which helps to anticipate the investor’s profit or loss on an investment. Expected return formula is a formula which an investor can decide whether he can further invest into an asset to obtain the given probable returns.

And an investor needs to consider much more on the weight of an asset in a portfolio and possible tweaking required.

An investor ranks the asset on the basis of the expected return formula, include in the portfolio and perform investment in it. Higher the expected return better will be the asset.

The motive of the formation of a portfolio is to reduce the overall risk and volatility of the investment and continuously striving for attaining the better positive rate of return. Analyst & researcher analysis the historical data and try to predict which stock to include in a portfolio. The negative covariance of included assets reduce the overall volatility of the portfolio and increases the returns. And a positive covariance indicates that two assets are moving sequentially while in a negative covariance two assets move in opposite directions. The diversifiable risk cannot be minimized after adding 25 different stocks in a portfolio. The correlation coefficient is majorly used to determine the relationship between two assets and measure the strength of it.

Portfolio Return Formula Calculator

You can use the following Portfolio Return Calculator

| w1 | |

| r1 | |

| w2 | |

| r2 | |

| Rp | |

| Rp = | (w1 x r1) + (w2 x r2) |

| = | (0 x 0) + (0 x 0) = 0 |

Recommended Articles

This is a guide to Portfolio Return Formula. Here we discuss How to Calculate Portfolio Return along with practical examples. We also provide a Portfolio Return Calculator with downloadable excel template. You may also look at the following articles to learn more –