Updated July 3, 2023

Definition of Preferred Shares

Preferred shares are shares of an entity’s stock that pay dividends to its shareholders ahead of dividends on regular stock. Preferred shares are a mixture of both equity and debt. Like equity, it has no maturity; like debt, the dividend percentage is fixed.

The payment to preferred shareholders comes before common shareholders, so they have a priority claim on dividends and distribution of assets in case of liquidation.

Key Highlights

- An alternative form of equity is preferred stock, which grants the holder the ability to own a business and generate revenue from its activities.

- Compared to common stockholders, preferred stockholders have a stronger payment entitlement (such as payouts).

- Preferred stock is more appealing to some investors since it combines features of both bonds and common shares.

- The public can contribute money by purchasing preferred shares, and these shareholders often have no or few voting rights in the corporation.

Explanation

- Regarding dividends, preferred shareholders precede common stockholders and can be paid monthly or quarterly. They often yield more than common shares and can be paid in cash. These dividends may be at a fixed interest rate or in relation to an exchange rate benchmark.

- Issuing preferred shares are a way of raising money from the public. The preferred shareholders usually have no voting rights or limited voting rights in the company. The claim on the company’s assets for a preferred shareholder comes below the debt holder’s. It is generally less risky as compared to common shares.

- Preferred stock contains aspects of both equity and debt because it pays set dividends and can increase in value. Investors wanting consistency in anticipated future cash flows will find this compelling.

Example of cost of preferred share

A corporation has a preferred share with a $2 annual dividend. What does a preferred share cost if the current share price is $20?

The formula for Calculating Preferred Stock Cost:

PS = D / P

PS = 2 / 20 = 10%

The management of a firm must evaluate the expenses of all financing options and select the most advantageous one. Management must factor annual dividends into the cost of raising money with preferred shares because preferred shareholders are entitled to them.

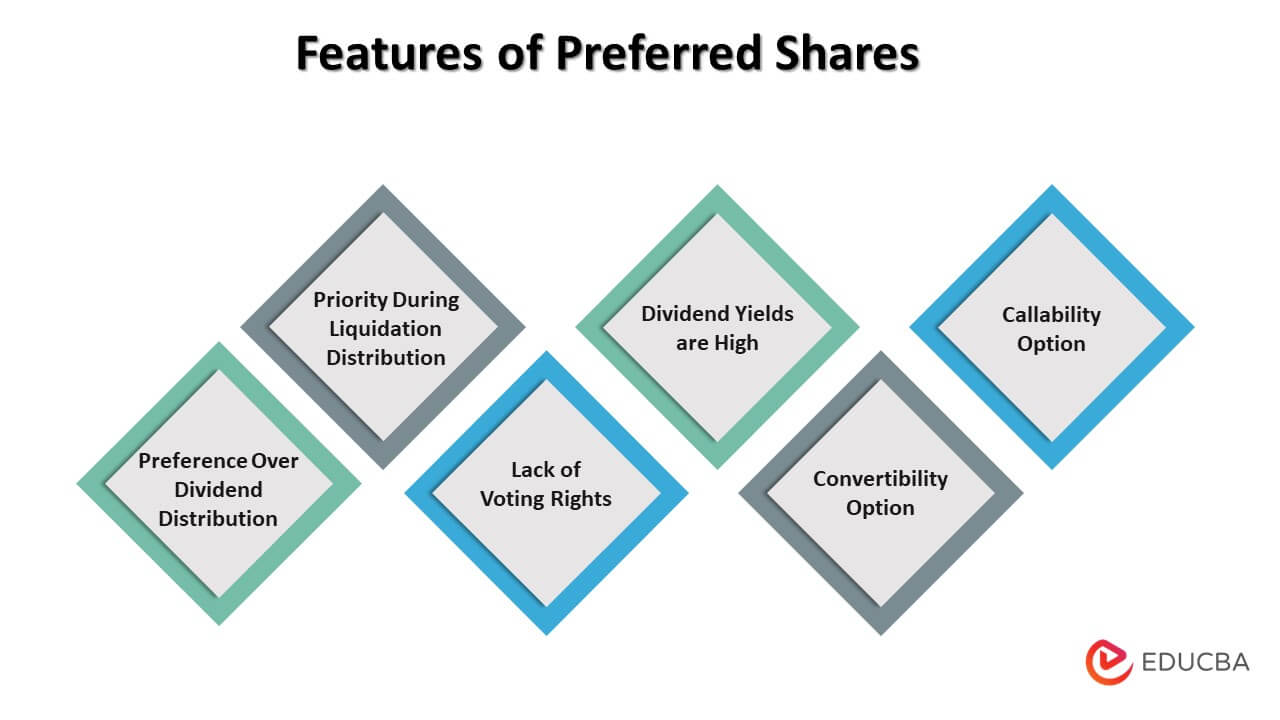

Features

Some of the features are as below:

1. Preference Over Dividend Distribution

Preferred shares are paid dividends before common shareholders. So if the company has not earned enough profit in any year, then it may happen that only preferred shareholders will receive dividends, and common shareholders will not receive anything.

2. Priority During Liquidation Distribution

When the company files for bankruptcy, then the valuation of the company takes place, and assets liquidate. Proceeds from the liquidation go to the preferred shareholders instead of the common shareholders. The proceeds left after payment to preferred shareholders will be distributed among common shareholders.

3. Lack of Voting Rights

Preferred shareholders usually don’t have voting rights, so preferred shareholders can’t participate in the company’s decision-making process.

4. Dividend Yields are High

It is at a higher dividend than an ordinary share. The fixed dividend payment makes it attractive in the market.

5. Convertibility Option

Some preferred shares have the option to convert themselves to common stocks. If the common stock performs well in the market, then preferred shareholders can convert their preferred shares into common shares.

6. Callability Option

Like many callable bonds, many preferred shares also have a callability option. The option lies in the hand of the company. They may call the preferred share whenever they want to.

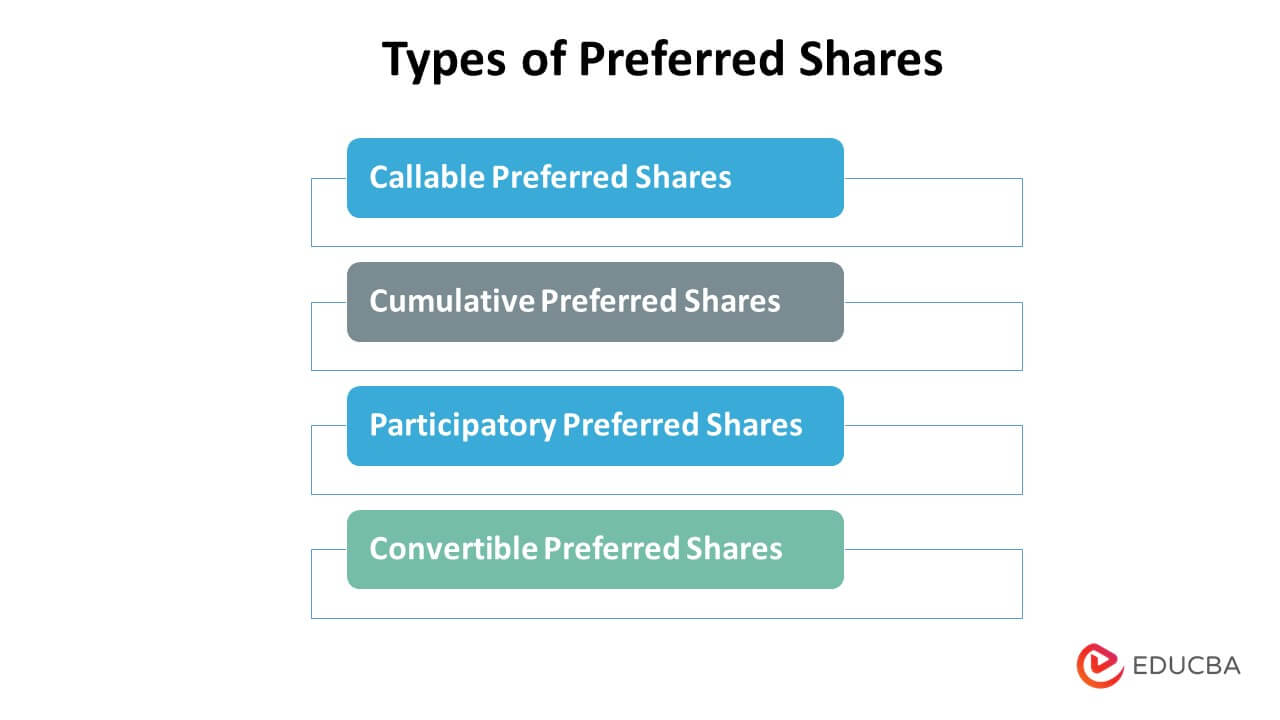

Types

Different Types are below:

1. Callable

The callable feature allows the company to call the preferred share when the price of a preferred share breaches a particular mark in the market. Say the company has issued a callable preferred share, allowing the company to call the preferred shares @$25. So whenever the preferred share price crosses this mark, the company can call it.

2. Cumulative

Here the dividends that must be paid to the preferred shareholders get accumulated. Even though these dividend payments are a promise, they aren’t usually on time. Suppose, in any year, the company doesn’t pay a dividend to the preferred share due to a lack of profit. In that case, the company must record the unpaid dividends and clear the cumulative dividends with the next period’s profit.

3. Participatory

It gives its shareholders the option to receive dividend payments equivalent to the commonly held rate of preferred dividends and an additional payout contingent upon fulfilling certain requirements. Typically, only if the total sum of dividends by ordinary shareholders exceeds a preset per-share number would this additional payment be handed out.

Participatory preferred shares give extra rights to the preferred shareholders. Suppose in any year; the company reaches a desired level of profitability. In that case, the preferred shareholders will participate in the profit sharing and get extra dividends on the fixed dividend they should receive.

4. Convertible

This is an option given to the preferred shareholders. Normally, at the investor’s request, convertible preferred shares are convertible in this manner. Nonetheless, a business may have a clause on certain stocks that enables the issuers or investors to compel the issuance. Preferred shareholders can buy common stocks at a predefined price. So if the stock price increases in the market, preferred shareholders can convert their preferred shares into common shares and enjoy the price rise.

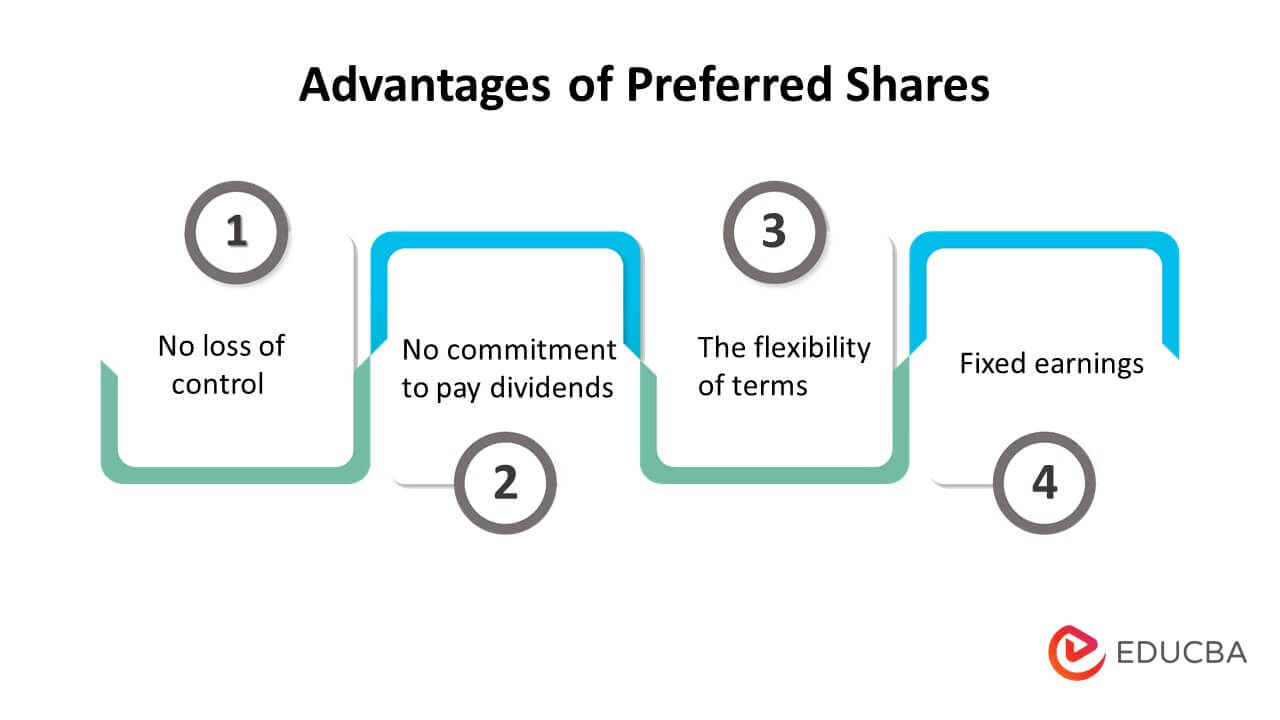

Advantages of Preferred Shares

The following advantages are as below:

- It has a higher claim over dividends as compared to common shareholders. So if the company makes a limited profit, the preferred share will be paid first; anything left will go to the common shareholders.

- There is no maturity for the preferred share. So unlike debt holders, preferred shareholders will not have to worry about the maturity of their fixed income source.

- Higher claim during liquidation. It will receive the proceeds from liquidation before common shareholders. So once the claim of preferred shareholders goes through a whole settlement, common shareholders will get a chance to settle a claim from the remaining proceeds.

- It has additional features like conversion options, accumulation, etc. All these add to the advantages enjoyed by the preferred share in a company.

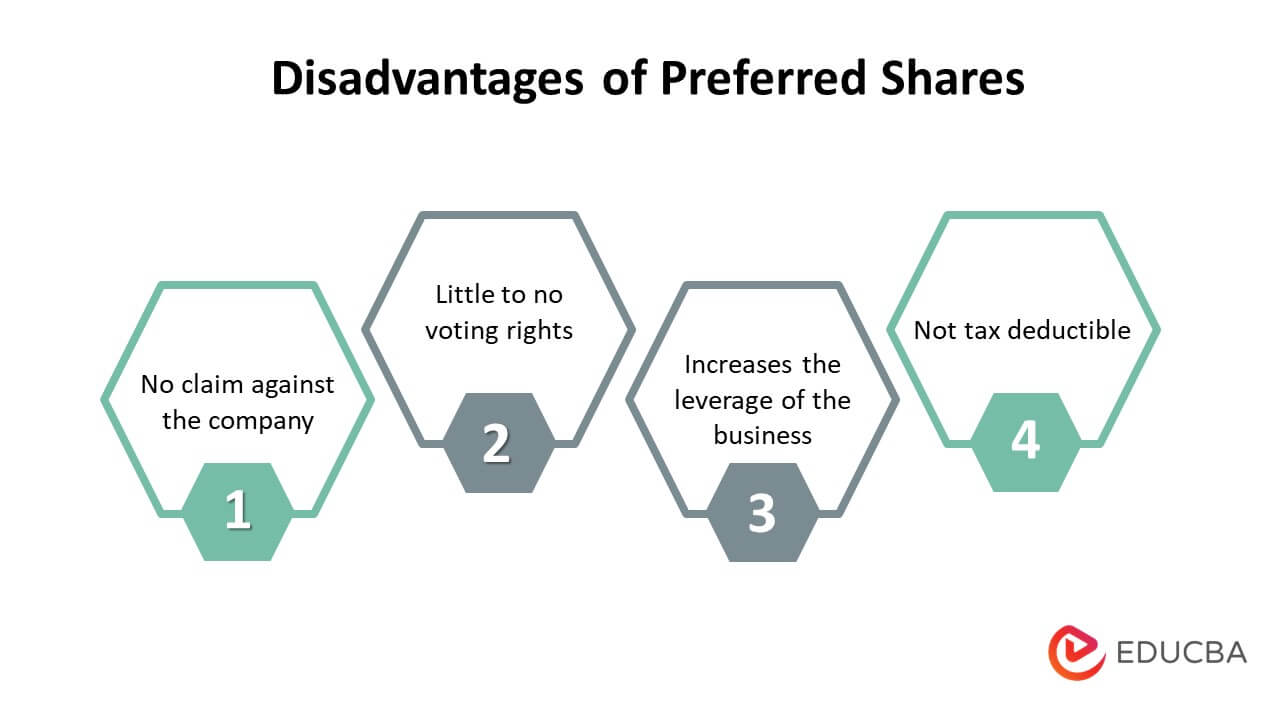

Disadvantages of Preferred Shares

The following disadvantages are as follows:

- It doesn’t enjoy voting rights. So the preferred shareholders can’t participate in a company’s decision-making process.

- As the rate of dividend payment is fixed, if the interest rate in the market increases, the preferred share will be less attractive to investors as the fixed dividend rate is lower than other fixed-income securities offer.

- Dividends on preferred shares are not under any guarantee. If a company runs into financial trouble, preferred dividends may get low or discontinued.

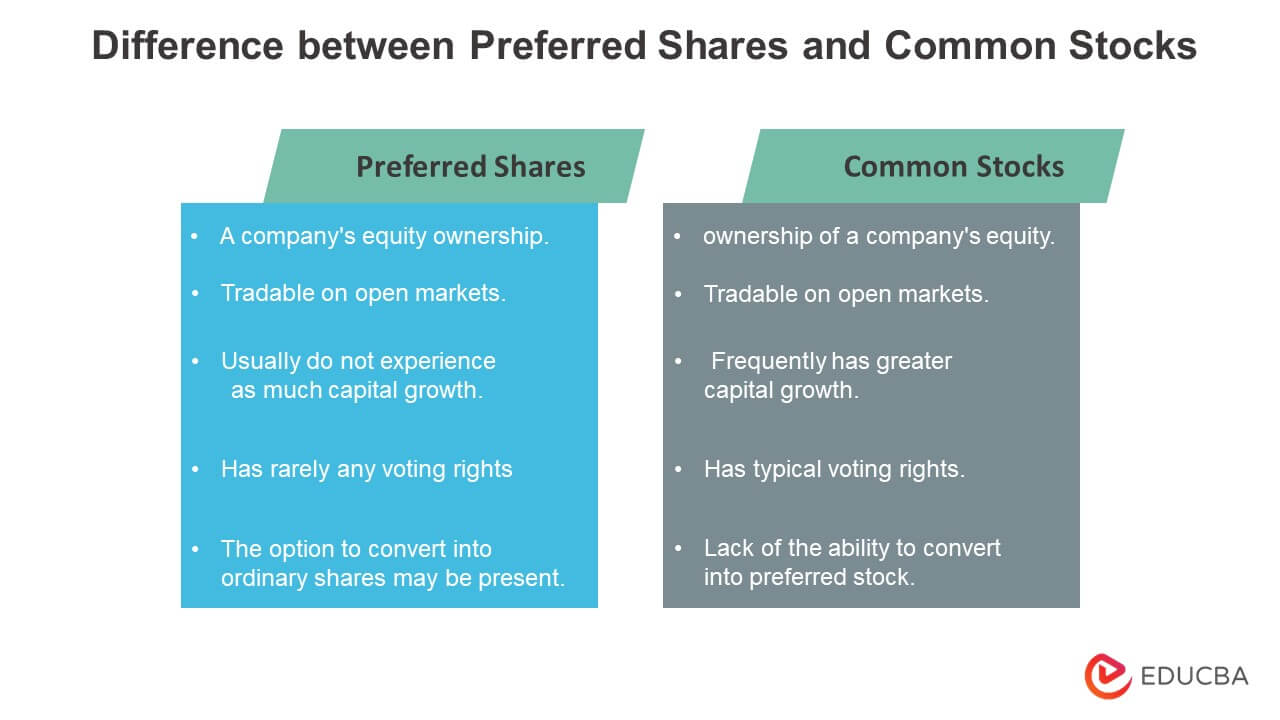

Preferred Shares vs. Common Stocks

- Preferred shares and common shares are both issued by companies to raise capital. In the case of common shares, there are voting rights. So common shareholders will take part in the decision-making process of the company. These voting rights are lacking in the preferred share of the company.

- There is a fixed percentage of dividend payment for preferred shares. In the case of common shares, the dividend payment is optional.

- Common stock often participates in capital appreciation (or depreciation) more than preferred stock. The continuous cash dividends that owners receive make up a preferred stock’s intrinsic value. On the other side, it is more challenging to evaluate a common stock.

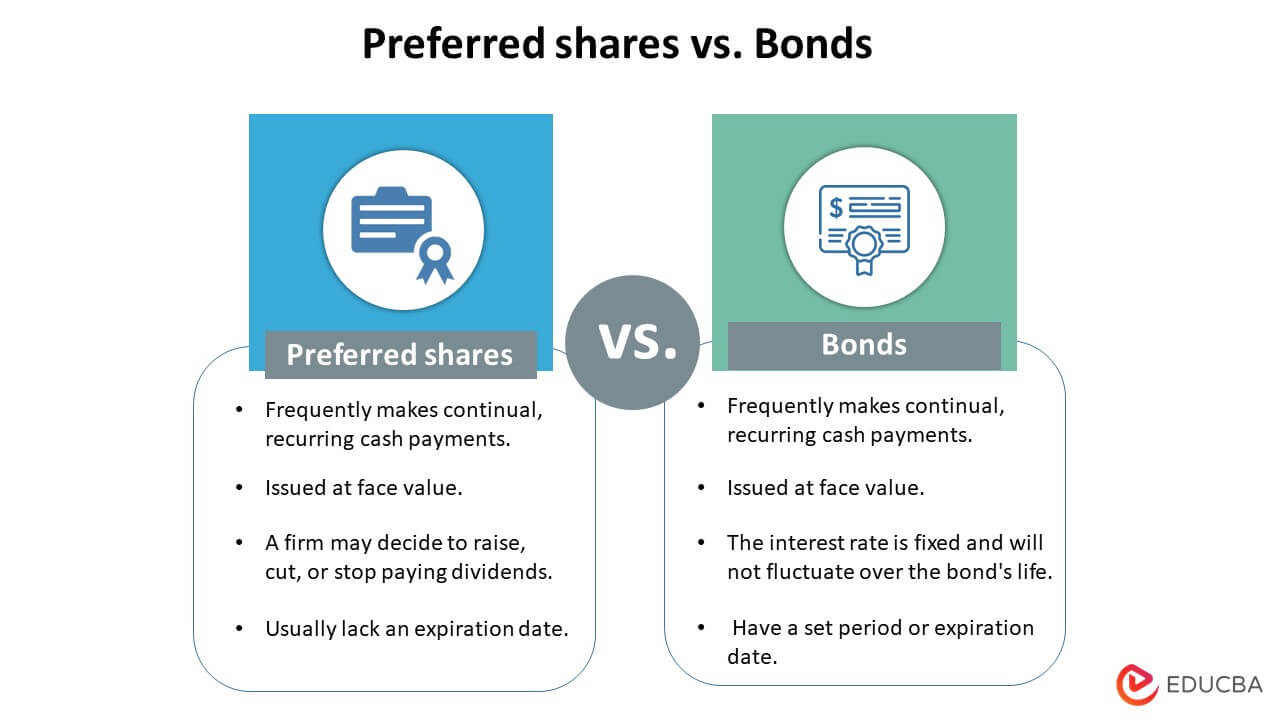

Difference between Preferred shares vs. Bonds

Due to the possibility of recurrent cash payments, preferred stock is frequently linked to bonds.

- Dividend payouts on preferred shares are arbitrary and subject to change. These payouts, however, frequently have lower tax rates than bond interest.

- Bonds frequently have a term that expires after a specific period of time. Theoretically, preferred stock has no “expiration date.”

- Bondholders often receive the revenues from the sale of liquidated assets, whereas debtholders typically enjoy special consideration. If any assets are left over, payouts then go to preferred stockholders. The last in line, common investors, sometimes receive little to no insolvency assets.

Similarities include the fact that both assets are frequently at full price or par value. This value, which has nothing to do with the security’s market rate, is useful for predicting new cash dividends. Then, firms might pay dividends, much like bonds do with coupon payments. The ultimate effect is recurring income from an investment, despite the fact that the process is distinct.

Conclusion

Companies need to raise capital. It doesn’t have voting rights, so ownership dilution will not happen. In the case of debt, the company needs to give back the principal due, but in the case of preferred shares, there is no need for principal repayment as there is no maturity for preferred shares. An investor should judge the prevailing interest rate in the market and decide the correct preferred share to be purchased.

FAQs

1. What are the Preferred Stock’s Drawbacks?

Answer: Even while preferred stock frequently has more benefits and entitlements to dividends, its value frequently does not rise as quickly as common stock’s. Additionally, because preferred stockholders frequently forsake voting rights, they have minimal to no influence over how the firm is run.

2. Is the preferred stock a smart investment?

Answer: Preferred stock typically pays better-fixed payments than bonds, requiring a smaller share investment. In addition, preferred stockholders are entitled to dividends and liquidated proceeds before common stockholders. As opposed to common stock, its price is typically more steady. All these factors make it an appealing option for investors.

3. What distinguishes equity shares from preference shares?

Answer: Equity shares signify a firm’s shareholding. In contrast, preferred shares have priority access to the business’s assets and income. The main distinction between equity and preference shares is also in regard to voting rights and ownership of the firm’s profits and assets.

Recommended Articles

This is a guide to Preferred Shares. Here we also discuss the definition and features along with advantages and disadvantages. You may also have a look at the following articles to learn more.