Updated July 27, 2023

Present Value of Annuity Due Formula (Table of Contents)

What is Present Value of Annuity Due Formula?

An annuity can be defined as an insurance contract under which an insurance company and you enter into a contractual agreement whereby the user receives a lump sum amount upfront in lieu of series of payments to be made at the beginning of the month or the end of the month or at some point in future.

The objective of an annuity is to provide a recurring income to an individual post his or her retirement from services in order for the user to have a stable future when his income will get low. The insurance of the risk company measures the Present Value of an annuity which is due to capturing the risk and how long the payment will come in the coming years.

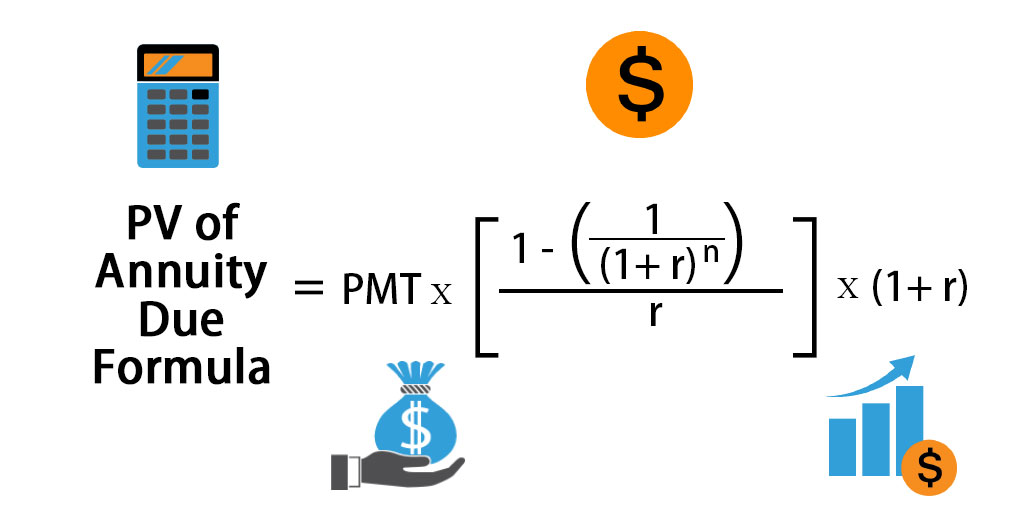

Mathematically the formula of Present Value of Annuity Due is as follows:-

- PV: Stands for Present Value of Annuity

- PMT: Stands for the amount of each annuity payment

- r: Stands for the Interest Rate

- n: Stands for the number of periods in which payments are made

The above formula pertains to the formula for ordinary annuity where the payments are due and made at the end of each month or at the end of each period.

The difference between an ordinary annuity and annuity due is that the annuity amount is paid at the beginning of the month in an annuity due whereas in an ordinary annuity the annuity amount is paid at the end of the month.

Examples of Present Value of Annuity Due Formula (With Excel Template)

Let’s take an example to understand the calculation of Present Value of Annuity Due in a better manner.

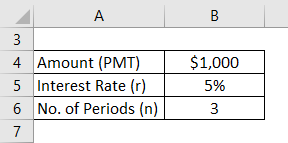

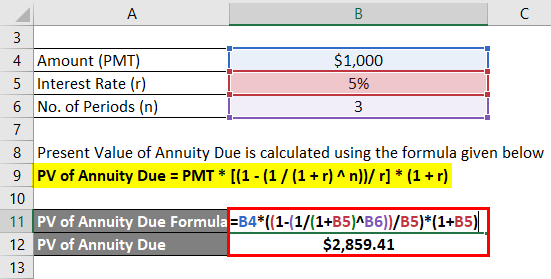

PV of Annuity Due Formula – Example #1

Mr. Anil Kumar deposits $1,000 at the beginning of each year for the period of 3 years and the discount factor of 5%. Calculate the present value of Annuity Due using the following information.

Solution:

The formula to calculate Present Value of Annuity Due is as below:

PV of Annuity Due = PMT * [(1 – (1 / (1 + r) ^ n))/ r] * (1 + r)

- PV of Annuity Due = $1,000 * [(1 – (1 / (1 + 5%)^3)) / 5%] * (1 + 5%)

- PV of Annuity Due = $2,859.41

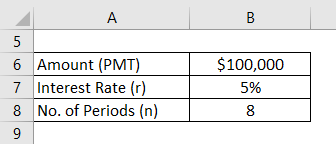

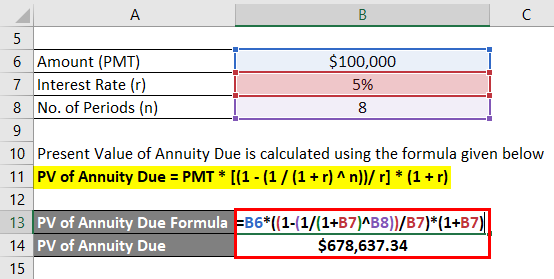

PV of Annuity Due Formula – Example #2

Company ABC Private Limited wants to purchase machinery in the installment purchase system method, and it will the third party an amount of $100,000 at the start of each year for the next 8 years. What will be the amount if the company needs to purchase the machinery upfront, assuming the interest is 5%?

Solution:

The formula to calculate Present Value of Annuity Due is as below:

PV of Annuity Due = PMT * [(1 – (1 / (1 + r) ^ n))/ r] * (1 + r)

- PV of Annuity Due = $100,000 * [(1 – (1 / (1 + 5%)^8)) / 5%] * (1 + 5%)

- PV of Annuity Due = $678,637.34

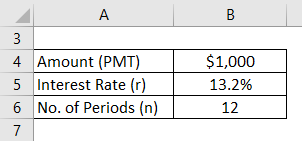

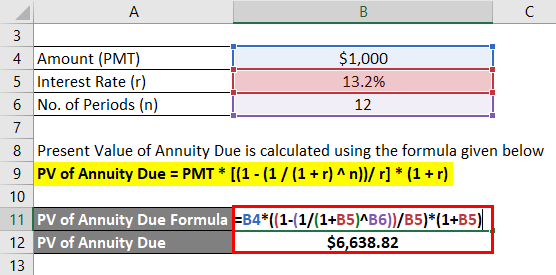

PV of Annuity Due Formula – Example #3

Calculate the present value of an annuity due of 1,000 at the beginning of a month. The interest rate is 13.2%

Solution:

The formula to calculate Present Value of Annuity Due is as below:

PV of Annuity Due = PMT * [(1 – (1 / (1 + r) ^ n))/ r] * (1 + r)

- PV of Annuity Due = $1,000 * [(1 – (1 / (1 + 13.2%)^12)) / 13.2%] * (1 + 13.2%)

- PV of Annuity Due = $6,638.82

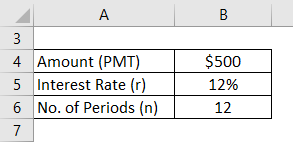

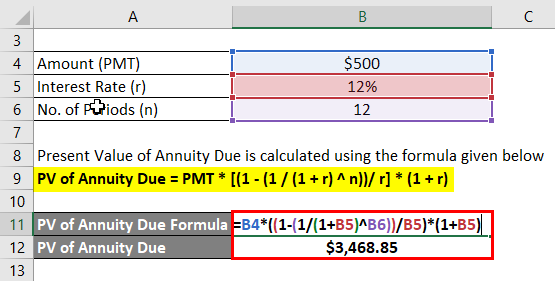

PV of Annuity Due Formula – Example #4

Calculate the present value of an annuity due of 500 paid at the end of each month. The interest rate is 12%. The tenure of the annuity is 12 months.

Solution:

The formula to calculate Present Value of Annuity Due is as below:

PV of Annuity Due = PMT * [(1 – (1 / (1 + r) ^ n))/ r] * (1 + r)

- PV of Annuity Due = $500 * [(1 – (1 / (1 + 12%)^12)) / 12%] * (1 + 12%)

- PV of Annuity Due = $3,468.85

Explanation

Calculating the present value of an annuity due is discounting future cash flows to the present date to calculate the lump sum amount of today.

Relevance and Uses of Present Value of Annuity Due Formula

- Annuity ensures a lifetime stream of income. It is a financial product that ensures regular income regularly without any risk. It is just that the individual needs to make an initial investment in the bucket to reap future benefits and returns.

- The annuity also is income tax exempted as per some tax laws and regulations, and it is a good choice for retirees to invest and who want to make their investment income last.

Apart from this, annuities are a difficult financial product as they are complex in nature, and it is not easy to measure risk beforehand. Every company requires a team of actuaries to examine the annuity liability. Although, there are various options of annuities to choose from.

Present Value of Annuity Due Formula Calculator

You can use the following Present Value of Annuity Due Calculator

| PMT | |

| r | |

| n | |

| PV of Annuity Due Formula | |

| PV of Annuity Due Formula = | PMT X [1 - (1 / (1 +r)n) / r] X (1 + r) | |

| 0 X [1 - (1 / (1 +0)0) / 0] X (1 + 0) = | 0 |

Recommended Articles

This has guided the Present Value of the Annuity Due Formula. Here we discuss calculating the Present Value of Annuity Due and practical examples. We also provide a Present Value of Annuity Due calculator with a downloadable Excel template. You may also look at the following articles to learn more –