Updated July 24, 2023

Difference Between Private Equity vs Hedge Fund

Private Equity vs Hedge Fund in this, Private equity funds can be defined as the investment mechanism of private equity companies in a privately held company to gain ownership in the equity capital of a company or earn a higher rate of returns. Private equity firms might even choose to invest in a public limited company solely for the purpose of delisting the same from the stock exchange or, in other words vesting the public listed company with the status of a private limited company.

The investment capital in private equity is taken into use to enhance the working capital (WC) of an entity, strengthen the balance sheet, or introduce and install newer technology in an entity solely to leverage the output and so on. Private equity requires a larger amount of funds, and it is why the majority of the investors who participate in the same are institutional and accredited investors.

On the other hand, hedge funds can be defined as an alternative investment mechanism where funds from various sources are assembled through various strategies to maximize the earnings of the investors. Hedge funds are also regarded as investment partnerships.

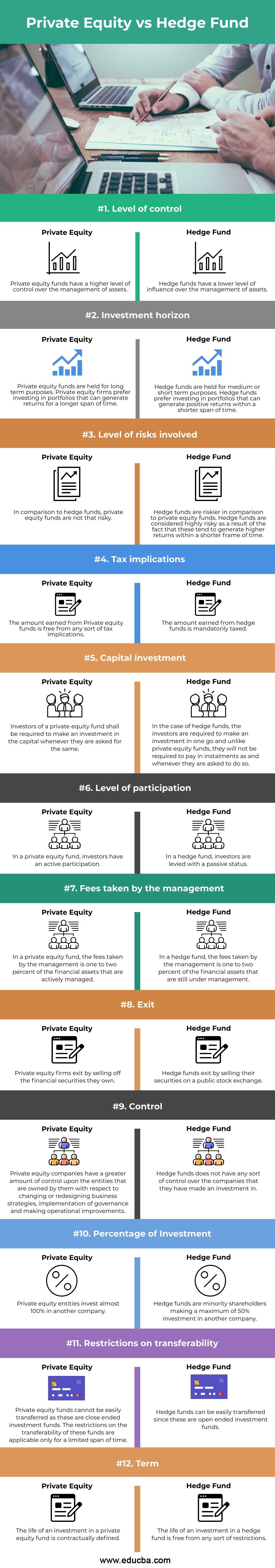

Head To Head Comparison Between Private Equity vs Hedge Fund (Infographics)

Below are the Top 12 comparisons between Private Equity vs Hedge Fund :

Key Differences Between Private Equity vs Hedge Fund

The key differences between private equity and hedge funds are provided and enumerated as follows:

- Hedge funds are closed-ended investment funds, while private equity funds are closed-ended investment funds.

- Hedge funds are riskier when compared with private equity funds.

- Private equity funds are invested with a motive to earn rewards within a longer period of time. Hedge funds are invested with a motive to earn rewards returns within a shorter span of time.

- The returns earned in private equity funds are free from the implications of tax, whereas the returns earned in hedge funds are subjected to be tax implications.

- Private equity funds will require the investors to invest the capital whenever required or asked for, whereas, in the case of hedge funds, investors will need to make a single-time investment only.

- Private equity funds have a higher level of control over asset management, whereas hedge funds have a lower level of control over asset management.

- The investors in a private equity fund are actively involved as compared to the investors in a hedge fund that enjoy passive status.

- In private equity, the life of a fund is defined contractually, i.e. pre-stated in the contract, whereas, in a hedge fund, the life of a fund has minimal or no limitation at all.

Private Equity vs Hedge Fund Comparison Table

Given are the Major differences between Private Equity vs Hedge Fund:

| Basis of Comparison |

Private Equity |

Hedge Funds |

| Level of Control | Private equity funds have a higher level of control over the management of assets. | Hedge funds have a lower level of influence over the management of assets. |

| Investment Horizon | Private equity funds are held for long-term purposes. Private equity firms prefer investing in portfolios that can generate returns for a longer span of time. | Hedge funds are held for medium or short-term purposes. Hedge funds prefer investing in portfolios that can generate positive returns within a shorter span of time. |

| Level of Risks Involved | In comparison to hedge funds, private equity funds are not that risky. | Hedge funds are riskier in comparison to private equity funds. Hedge funds are considered highly risky as a result of the fact that these tend to generate higher returns within a shorter frame of time. |

| Tax Implications | The amount earned from Private equity funds is free from any sort of tax implications. | The amount earned from hedge funds is mandatorily taxed. |

| Capital Investment | Investors of a private equity fund shall be required to make an investment in the capital whenever they are asked for the same. | In the case of hedge funds, the investors are required to make an investment in one go, and unlike private equity funds, they will not be required to pay in installments as and whenever they are asked to do so. |

| Level of Participation | In a private equity fund, investors have active participation. | In a hedge fund, investors are levied with a passive status. |

| Fees are taken by the Management. | In a private equity fund, the fees taken by the management is one to two percent of the financial assets that are actively managed. | In a hedge fund, the fees taken by the management is one to two percent of the financial assets that are still under management. |

| Exit | Private equity firms exit by selling off the financial securities they own. | Hedge funds exit by selling their securities on a public stock exchange. |

| Control | Private equity companies have a greater amount of control upon the entities that are owned by them with respect to changing or redesigning business strategies, implementation of governance, and making operational improvements. | Hedge funds do not have any sort of control over the companies that they have made an investment in. |

| Percentage of Investment | Private equity entities invest almost 100% in another company. | Hedge funds are minority shareholders making a maximum of 50% investment in another company. |

| Restrictions on transferability | Private equity funds cannot be easily transferred as these are close-ended investment funds. The restrictions on the transferability of these funds are applicable only for a limited span of time. | Hedge funds can be easily transferred since these are open-ended investment funds. |

| Term | The life of an investment in a private equity fund is contractually defined. | The life of an investment in a hedge fund is free from any sort of restrictions. |

Conclusion

Private equity funds are the funds taken into use to acquire the stakes of public limited companies and convert them into private limited companies or make an investment in private companies to gain control over their asset management. The purpose of a private equity fund can be the acquisition of an organization, expansion, strengthening the balance sheet of an organization, etc. Hedge funds are privately-owned companies that choose to raise funds from their investors and then reinvest them into risk-bearing portfolios.

Recommended Articles

This is a guide to the Private Equity vs Hedge Fund. Here we discuss the difference between Private Equity vs Hedge Fund, along with key differences, infographics, & a comparison table. You can also go through our other related articles to learn more–