Difference Between Private Equity vs Venture Capital

Private Equity vs Venture Capital in this, Private equity can be defined as the investment made by a private equity company in another company for the purpose of earning a higher rate of returns. In other words, private equity can be regarded as investment made in private limited companies. In a private equity mechanism, investments are always made in already established or well-performing companies. On the other hand, venture capital can be defined as an investment made by venture capitalists into new ventures or newly set up or start-up companies for the purpose of earning a sizeable profit.

Such kind of an investment takes place when a VC or venture capitalist purchases shares of a newly set up or start-up company and chooses to hold the designation of a financial partner in the same. Unlike private equity, venture capital is a mechanism where the investment is often made into small businesses or start-up companies that show the potential of growth in the nearing time.

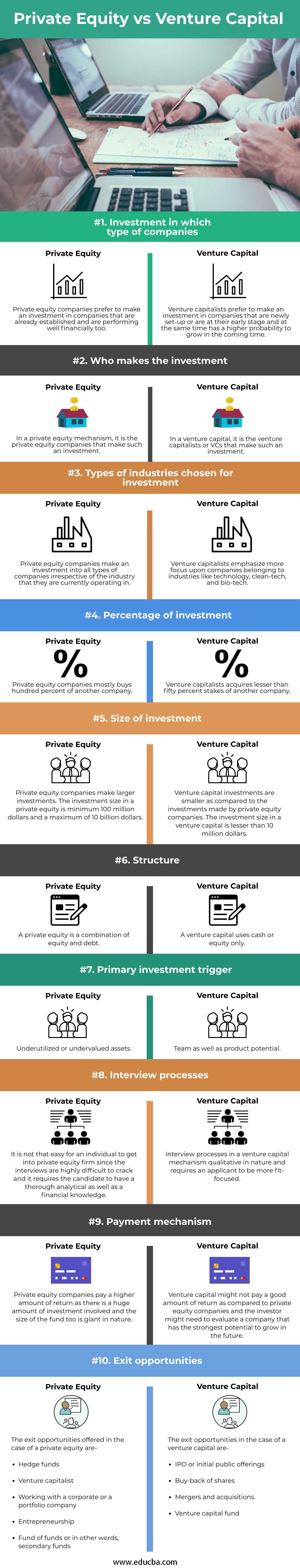

Head To Head Comparison Between Private Equity vs Venture Capital (Infographics)

Below are the Top 10 comparisons between Private Equity vs Venture Capital:

Key Differences Between Private Equity vs Venture Capital

The key differences between private equity and venture capital are as follows-

- Private equity companies purchase the shares of mature companies that have a guaranteed potential to generate higher returns in the future. On the other hand, venture capitals purchase the stakes of mostly start-ups or early stage or newly set-up companies.

- Private equity companies buy stakes of companies belonging to any industry, whereas venture capital only focuses on start-ups operating into industries such as clean-tech, biotech, and technology.

- Private equity entities purchase almost a hundred percent of the stakes of an entity, whereas venture capitalists or VCs acquire only a minority stake that is below fifty percent.

- Private equity firms and venture capitalists rely heavily on efficient deal sourcing to identify opportunities. Tools like the Grata deal sourcing platform help streamline this process, enabling professionals to discover potential investments more effectively while gaining insights across diverse industries.

- Private equity companies use a combination of both debt and equity, whereas venture capital companies use only cash or equity.

- Private equity companies make larger investments, whereas venture capital makes a smaller amount of investments. Private equity companies make an investment of a minimum of 100 million dollars and a maximum of 10 billion dollars. On the other hand, venture capital makes an investment for a maximum of 10 billion dollars for newly set up companies.

- The exit opportunities available in the case of private equity are hedge funds, venture capitalists, entrepreneurship, secondary funds, working with a corporate or a portfolio company. On the other hand, the exit opportunities available in the case of venture capital are IPO or initial public offerings, mergers and acquisitions, buy-back of shares, venture capital funds, etc.

- The level of returns to expect and receive is huge in private equity investment as compared to returns received in venture capital investment.

Private Equity vs Venture Capital Comparison Table

Given below are the Major Difference between Private Equity vs Venture Capital:

| Basis of Comparison |

Private Equity |

Venture Capital |

| Investment in which type of companies | Private equity companies prefer to make an investment in companies that are already established and are performing well financially too. | Venture capitalists prefer to make an investment in companies that are newly set up or are at their early stage and at the same time has a higher probability of growing in the coming time. |

| Who makes the investment? | In a private equity mechanism, it is the private equity companies that make such an investment. | In venture capital, it is the venture capitalists or VCs that make such an investment. |

| Types of industries chosen for investment | Private equity companies make an investment into all types of companies irrespective of the industry that they are currently operating in. | Venture capitalists emphasize more focus upon companies belonging to industries like technology, clean-tech, and bio-tech. |

| Percentage of investment | Private equity companies mostly buy a hundred percent of other companies. | Venture capitalists acquire lesser than fifty percent stakes of another company. |

| Size of investment | Private equity companies make larger investments. The investment size in private equity is a minimum of 100 million dollars and a maximum of 10 billion dollars. | Venture capital investments are smaller as compared to the investments made by private equity companies. The investment size in venture capital is lesser than 10 million dollars. |

| Structure | Private equity is a combination of equity and debt. | Venture capital uses cash or equity only. |

| Primary investment trigger | Underutilized or undervalued assets. | The team as well as product potential. |

| Interview processes | It is not that easy for an individual to get into a private equity firm since the interviews are highly difficult to crack, and it requires the candidate to have a thorough analysis as well as a piece of financial knowledge. | Interview processes in a venture capital mechanism qualitative in nature and requires an applicant to be more fit-focused. |

| Payment mechanism | Private equity companies pay a higher amount of return as there is a huge amount of investment involved, and the size of the fund is giant in nature. | Venture capital might not pay a good amount of return as compared to private equity companies, and the investor might need to evaluate a company that has the strongest potential to grow in the future. |

| Exit opportunities | The exit opportunities offered in the case of private equity are-

|

The exit opportunities in the case of venture capital are-

|

Conclusion

Private equity can be defined as an investment made in such companies that are not publically traded or listed on the stock exchange. Private equity investment is made by a private equity company, and these investors purchase shares of privately owned entities or win control of such entities that were publically traded for the purpose of making them private and delist the same from the stock exchanges. Such an investment is made in mature companies for the purpose of earning a higher rate of returns.

On the other hand, venture capital can be defined as an investment made in companies that are newly set up or are at their early stages but at the same time has a huge potential to outgrow in the nearing time.

Recommended Articles

This is a guide to Private Equity vs Venture Capital. Here we discuss the difference between Private Equity vs Venture Capital, along with key differences, infographics, & a comparison table. You can also go through our other related articles to learn more–