What is a Private Foundation?

A private foundation is a charitable savings account that individuals, families, or companies set up to support specific causes. People with financial means use it to give back to their community or address societal issues. The foundation invests the money and returns funds for charitable activities. In this article, you will see how to set up a private foundation.

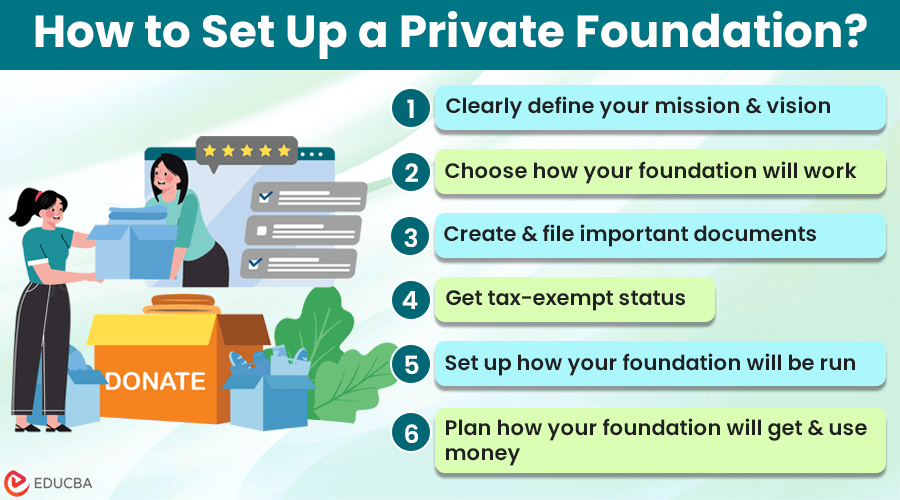

How to Set Up a Private Foundation?

You can follow these steps to set up your private foundation.

Step 1: Clearly Define Your Mission and Vision

Before getting into the legal stuff, make sure you know what your foundation is all about. What causes or areas do you want to support? What goals do you want to achieve? A clear mission and vision will guide what your foundation does. Finally, make sure you are sticking to your values and goals.

Step 2: Choose How Your Foundation Will Work

You can set up a private foundation as a trust or corporation. Trusts are simpler but offer less flexibility, whereas corporations enable more complex operations and have a board of directors. Your choice depends on your vision and how complicated you want things to be. Do seek guidance from legal and financial professionals.

Step 3: Create and File Important Documents

Whether you go with a trust or a corporation, you must create and file important documents. For trusts, it is a trust agreement. Corporations file articles of incorporation and bylaws with the appropriate state agency. These documents will cover the foundation’s name, purpose, structure, procedures, and other important details.

Step 4: Get Tax-Exempt Status

To be a charitable foundation, you must apply for tax-exempt status from the IRS. It shows that your foundation’s activities are exclusively charitable, educational, scientific, or another recognized purpose. Getting tax-exempt status is key to avoiding federal income tax and letting donors claim tax deductions.

Step 5: Set Up How Your Foundation Will Be Run

Good leadership and management are crucial for your foundation’s success and legality. It means appointing a board of directors or trustees to oversee operations, make grant decisions, and ensure legal and ethical compliance. Clear governance, grantmaking, and finance policies will help your foundation run smoothly.

Step 6: Plan How Your Foundation Will Get and Use Money

Your foundation needs an initial funding source, usually from the founder(s). But beyond that, having a smart investment strategy is important for growing the foundation’s assets and supporting charitable activities in the long run. Working with financial advisors who manage nonprofit assets can help your foundation make a bigger impact.

Do You Need a Private Foundation Firm or a Business Attorney?

Setting up a private foundation involves dealing with complex legal, tax, and administrative matters. While you can handle some steps independently, seeking help from professionals who know nonprofit laws and foundation management is usually a good idea. For this, you can either go with private foundation firms or business attorneys. Here is a simple difference between the two.

Private Foundation Firm:

A private foundation firm specializes in creating and managing private foundations. They offer various services, including legal guidance, tax planning, administrative support, and help with grant strategies. These firms can assist you in dealing with the complexities of starting and managing a foundation, ensuring you follow the rules, and making the most positive impact with your foundation.

Business Attorney:

A business attorney, especially one with experience in nonprofits and tax-exempt organizations, can help establish your foundation legally. They can assist in drafting important documents and obtaining tax-exempt status. While they can provide expert legal advice, they might not offer all the services you can get from a private foundation firm.

Final Thoughts

Starting a private foundation is a significant yet rewarding work that allows individuals to support causes they care about and enjoy the benefits of a private foundation. You can make a positive and long-lasting difference in the community. Since setting up and running a foundation can be complex, working with experts like a private foundation firm or a business attorney is wise. These professionals will guide and support you in establishing your foundation correctly, adhering to legal rules, and achieving its charitable goals. This way, you can focus on the fulfilling work of making a positive difference.

Recommended Articles

We hope this article on “Private Foundation” was helpful to you. You can also refer to the articles below to learn more.