What is Pro Forma Income Statement?

Pro Forma Income Statement refers to the Projected Income statement by using assumptions and special Projections by analysts. These Income Statements are not always prepared by following universally accepted accounting principles as the line items can’t be backed by proper documentation. In addition, as most figures are imaginary, proper accounting principles can’t be applied.

Explanation

It is mostly prepared by the management of the company to attract investors. Investors often get motivated by seeing the positive Projections and invest in the company’s share. SEC has made it illegal for companies to circulate these Income statements in public by companies if this Income statement is not prepared using the most conservative approach while calculating Revenue and other line items.

Purpose

- Several stakeholders, investors, analysts, and management try to forecast the revenue for the coming periods. Forecasting is very complicated as the Projections should be based on correct assumptions that are accepted by all and are close to reality. So it helps to predict the revenue of the firm by using accepted and conservative assumptions.

- At times, the firm’s net profit is affected by a sudden, one-time huge expenditure that will not happen in the future. These expenses may make the Income Statement less attractive to the investors as they might think that the firm is losing its Income Producing capability. This situation can be dealt, when management issues Pro forma Income statements for the upcoming periods where the expense is not mentioned.

- The acquiring company uses it to calculate the bidding price based on the target company’s profit generation capability. The acquirer prepares this Income statement of the target and calculates the right takeover price. If the forecasted revenue of the target is high, then the bidding price will also be high.

- An analyst, while doing equity research, prepares this Income statement of the company it is researching. It helps the analyst to accurately predict the share price by the use of financial ratios. The financial ratios will then be compared with peers to generate an overview of the company’s position in the sector.

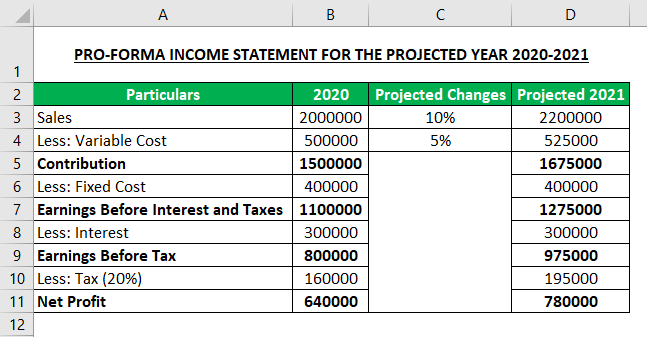

Example of Pro Forma Income Statement

Let us understand with the help of the following example:

Company XYZ is a steel manufacturing company. An equity research analyst is planning to prepare a Pro forma Income statement for the company’s next year. His Projections are based on estimations drawn from the historical trend of the company. Therefore, prepare Pro forma Income Statement for the company.

Solution:

The Projected Net Profit for the year 2021 is $780,000.

Types of Pro Forma Income Statement

It can be of two types:

1. Historical Pro Forma Income Statement

When a company plans to apply some changes in its Income Statements retrospectively, then the Pro forma statement is prepared to adjust line items historically. This Process helps accountants to make certain changes and see how the changes would have affected the company in the past. This analysis is often done to check the performance of management and to find ways of improvement.

2. Projected Pro Forma Income Statement of Future

Projected Pro forma Income statements are Projections. It helps management to form an opinion regarding the future profitability of the company. Several estimations need to be kept in mind while preparing the Projected Pro forma Income statement. Conservative rule should be followed. Only certain revenues and expenditures should be considered.

Advantages

- It helps management to correctly estimate the effect of certain Process changes in operation. It will show the effect of change in Profitability for upcoming years. The Projected figures will help management to understand whether the change is beneficial for the company or not.

- Projections regarding several new ways of sales and cost-cutting can be implemented, and its effect can be monitored on the Net Profit. This will help the management to choose the best way of operation.

- Investors can use these Income statements and decide on the prospects of the company. If the prospects are high and reliable, it will help the stock price rise as more investors will invest in the stock.

Disadvantages

- If the Projections used in making this Income statement are too aggressive, it will mislead investors, and they will buy a stock that may not perform as per Projections in the future.

- Management tends to manipulate data to attract new investors and to please stakeholders. SEC has announced this Income statement disclosure by companies to be illegal if they are based on aggressive Projections.

- If the trend is taken from past data, then the past may not occur in the future. So if the projected data is wrong, then the whole Pro forma Income statement is incorrect.

- As it is not made according to accepted accounting principles, so several entries are managed according to the management. As a result, unfavorable data are ignored, and favorable data are overestimated.

Conclusion

It is extremely important for management to take decisions regarding Process change, Product line, cost-effectiveness, etc. Though the Pro forma statement can be manipulated, still it has several uses in the real world. Investors can have a decent idea about the profitability of the company through a Pro-forma Income statement. It is always advisable to analysts that Proper scrutiny regarding the Projections should be done while reading this Income statement.

Recommended Articles

This has been a guide to Pro forma Income Statement. Here we discuss the two types of pro forma income statements and examples along with their advantages and disadvantage. You can also go through our other suggested articles to learn more –