Updated July 25, 2023

Product Cost Formula (Table of Contents)

What is the Product Cost Formula?

In managerial accounting, the term “product cost” refers to the overall production cost that is incurred to manufacture products or provide services. The precise knowledge of the cost of production helps the management to decide the price of the product in order to earn the desired profitability.

The formula for product cost can be derived by adding direct material cost, direct labor cost and manufacturing overhead cost. Mathematically, it is represented as,

Manufacturing overheads include all the indirect costs of production that are necessary to manufacture a finished good or create a service.

Examples of Product Cost Formula (With Excel Template)

Let’s take an example to understand the calculation of Product Cost in a better manner.

Product Cost Formula – Example #1

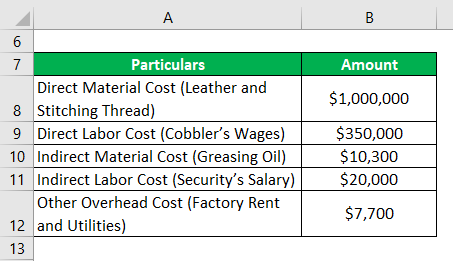

Let us take the example of a company that is engaged in manufacturing shoes in the Canadian province of Alberta. Recently the company collected information pertaining to production cost. The following information has been confirmed by the company’s accounts department:

- $1,000,000 expensed on leather and stitching thread

- $350,000 paid for cobbler’s wage and $20,000 for security’s salary

- $10,300 worth of greasing oils used for machine maintenance

- $7,700 incurred as factory rent and utilities

Calculate the product cost of the company based on the given information.

Solution:

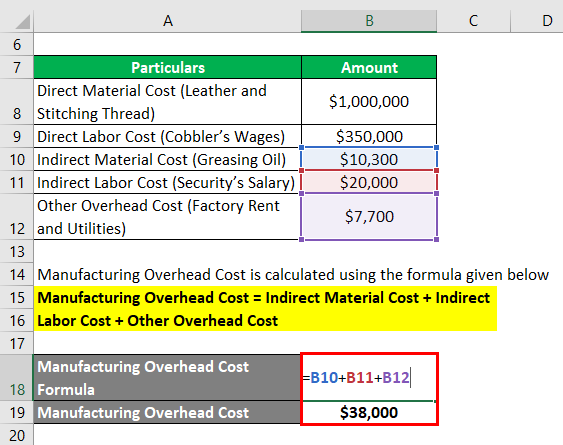

Manufacturing Overhead Cost is calculated using the formula given below

Manufacturing Overhead Cost = Indirect Material Cost + Indirect Labor Cost + Other Overhead Cost

- Manufacturing Overhead Cost = $10,300 + $20,000 + $7,700

- Manufacturing Overhead Cost = $38,000

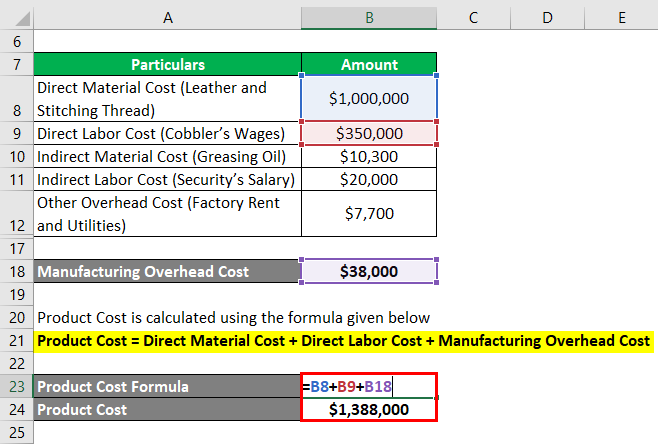

Product Cost is calculated using the formula given below

Product Cost = Direct Material Cost + Direct Labor Cost + Manufacturing Overhead Cost

- Product Cost = $1,000,000 + $350,000 + $38,000

- Product Cost = $1,388,000

Therefore, the production cost of the company add up to $1.39 million for the period.

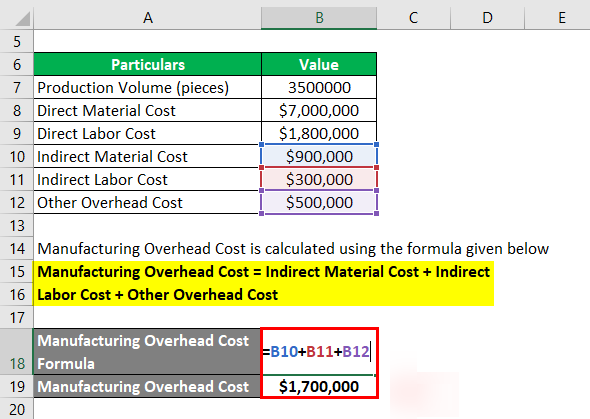

Product Cost Formula – Example #2

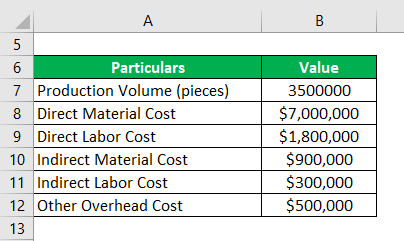

Let us take the example of a company that is associated with the manufacturing of mobile phone covers. The company is planning to bid for a large volume (1,000,000) 6-monthly contract at the rate of $4.00 per piece. So, the management decided to determine the per-unit production cost incurred during last year. As per the account’s department, the following information is available,

Based on the given information, Calculate whether the company should go ahead with the bidding process.

Solution:

Manufacturing Overhead Cost is calculated using the formula given below

Manufacturing Overhead Cost = Indirect Material Cost + Indirect Labor Cost + Other Overhead Cost

- Manufacturing Overhead Cost = $0.9 million + $0.3 million + $0.5 million

- Manufacturing Overhead Cost = $1.7 million

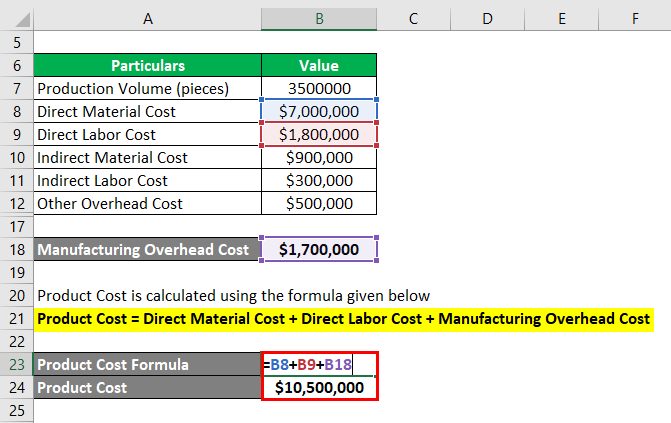

Product Cost is calculated using the formula given below

Product Cost = Direct Material Cost + Direct Labor Cost + Manufacturing Overhead Cost

- Product Cost = $7.0 million + $1.8 million + $1.7 million

- Product Cost = $10.5 million

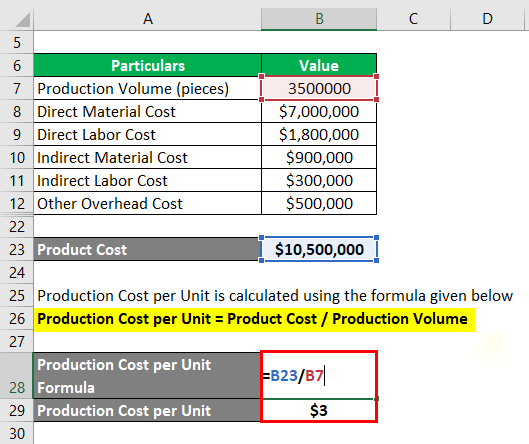

Production Cost per Unit is calculated using the formula given below

Production Cost per Unit = Product Cost / Production Volume

- Production Cost per Unit = $10.5 million / 3.50 million

- Production Cost per Unit = $3 per piece

$3.00 per piece, which is less than the bidding price

Therefore, the company should go ahead with the bidding process.

Explanation

The formula for product cost can be computed by using the following steps:

Step 1: Firstly, determine the direct material cost, which includes the cost of the raw material that gets transformed into the finished goods. It refers to the raw material that can be easily attributed to the process of manufacturing.

Step 2: Next, determine the direct labor cost, which includes the expenses incurred on manpower and labor force that are directly engaged in the production process. that can be directly apportioned to the production level. Direct labor cost is the aggregate of salaries, wages, and benefits paid to the labor force for their services.

Step 3: Next, determine the manufacturing overhead cost, which includes costs that are needed for the production process but can’t de directly allocated to any product. It can be broadly classified into indirect material cost, indirect labor cost and other overhead costs.

Manufacturing Overhead Cost = Indirect Material Cost + Indirect Labor Cost + Other Overhead Cost

Step 4: Finally, the formula for product cost can be derived by adding direct material cost (step 1), direct labor cost (step 2) and manufacturing overhead cost (step 3) as shown below.

Product Cost = Direct Material Cost + Direct Labor Cost + Manufacturing Overhead Cost

Relevance and Uses of Product Cost Formula

It is important to understand the concept of production cost because it is usually used by the companies to determine the overall production cost of the business and then eventually the product costs per unit based on the production volume and actual costs incurred. On the basis of the production cost per unit, the pricing of the final finished product can be determined.

As far as accounting is concerned, the product costs of the sold products are captured in the income statement, while that of the unsold product is reflected in the inventory of finished goods.

Product Cost Formula Calculator

You can use the following Product Cost Formula Calculator

| Direct Material Cost | |

| Direct Labor Cost | |

| Manufacturing Overhead Cost | |

| Product Cost | |

| Product Cost = | Direct Material Cost + Direct Labor Cost + Manufacturing Overhead Cost | |

| 0 + 0 + 0 = | 0 |

Recommended Articles

This is a guide to Product Cost Formula. Here we discuss how to calculate Product Cost along with practical examples. We also provide a Product Cost calculator with a downloadable excel template. You may also look at the following articles to learn more –