What is the Profit and Loss Statement Template?

The Profit and Loss Statement Template presents the financial summary of the income generated and expenses incurred by a company during a particular period. Once the P&L statement template exists, one can enter the revenue and costs data to calculate the company’s monthly or year profit. This statement can also calculate the percentage change from a prior period.

Explanation

The profit and loss statement is one of a company’s most critical financial statements because it shows how it generates revenue and incurs expenses. It systematically specifies how the company can transform revenue into net income. Thus, creating a template for the profit and loss statement is essential to implement a standardized approach. The template shows the best way to calculate the net earnings for a given period based on the provided information. Furthermore, these templates are user-friendly and can be customized for any business in minutes, and one doesn’t need an accounting degree to use them.

Example of Profit and Loss Statement Template

Here are some examples of the monthly and annual P&L statement templates:

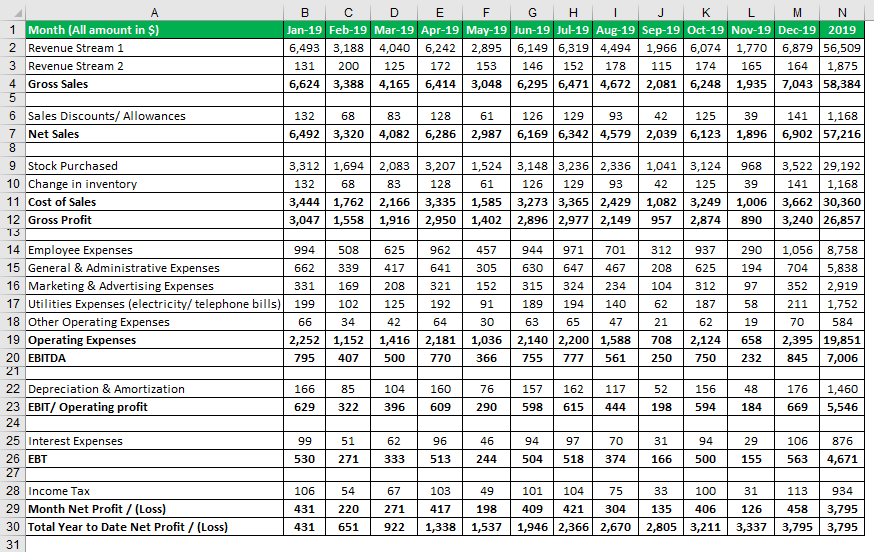

Monthly Profit and Loss Statement Template

The monthly P&L statement template is particularly useful for companies that require regular reporting for continuous and detailed monitoring. It is suitable for businesses of all sizes since the template can be easily customized by adding or eliminating line items per the requirements. Below is an example of a monthly P&L statement template.

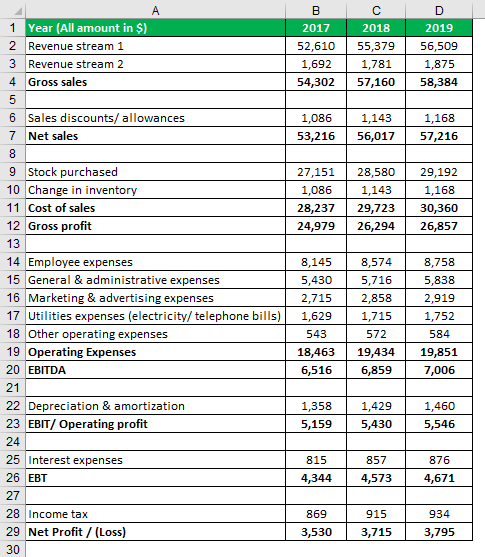

Annual Profit and Loss Statement Template

The annual P&L statement template is commonly used by companies that have been in operation for multiple years. The format and structure for the yearly P&L statement template are similar to the monthly version. However, it does not include the last column for the entire year or the previous row for year-to-date net profit. Below is an example of an annual P&L statement template.

Components of P&L Statement Template

Although the profit and loss statement is unique for every company, several line items are common across all the statements. Some of the major line items and their subcategories are as follows:

- Revenue/Sales/Turnover

- Various Revenue Streams

- Returns/Refunds/Discounts

- Cost of Sales

- Gross Profit

- Operating Expenses

- Lease Rental

- Salaries & Wages

- Utilities

- Selling, General & Administrative (SG&A)

- Earnings Before Interest, Taxes, Depreciation & Amortization (EBITDA)

- Depreciation & Amortization

- Earnings Before Interest & Taxes (EBIT)

- Interest Expense

- Income Taxes

- Net Income

Conclusion

As a result, the Profit and Loss Statement Template makes it easier for accountants to monitor a company’s income and expenses for any given period. It systematically represents how the company can transform revenue into net income. Furthermore, one can customize the templates to meet the company’s reporting requirements, which are available in annual and monthly formats.

Recommended Articles

Here are some further related articles for expanding understanding: