Updated July 27, 2023

Profit Formula (Table of Contents)

What is Profit Formula?

The term “profit” refers to the financial benefit made when the amount of sales achieved from business exceeds the cost incurred in the process of the business activity.

The formula for profit is very simple and it is expressed as the difference between the total sales or revenue and the total expenses. Mathematically, it is represented as,

Further, the formula for profit can also be expressed in terms of each unit of production by deducting the cost price of production from the selling price of each unit. Mathematically, it is represented as,

Examples of Profit Formula (With Excel Template)

Let’s take an example to understand the calculation of Profit in a better manner.

Profit Formula– Example #1

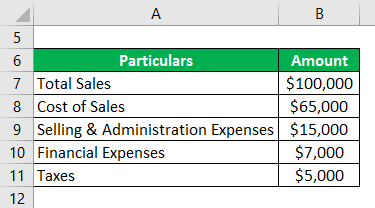

Let us take the example of a Retail Food & Beverage Shop that has clocked total sales of $100,000 during the year ended on December 31, 2018. As per the income statement, the cost of sales, selling & administrative expenses, financial expenses, and taxes stood at $65,000, $15,000, $7,000 and $5,000 respectively during the period. Calculate the profit of the shop for the year.

Solution:

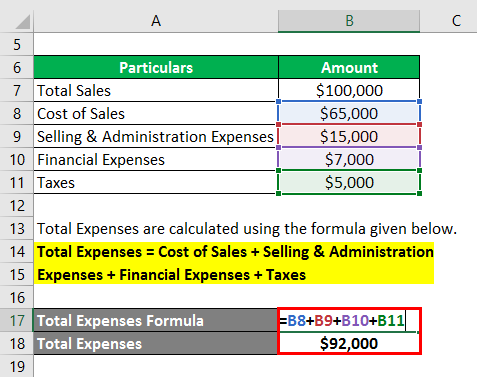

Total Expenses are calculated using the formula given below.

Total Expenses = Cost of Sales + Selling & Administration Expenses + Financial Expenses + Taxes

- Total Expenses = $65,000 + $15,000 + $7,000 + $5,000

- Total Expenses = $92,000

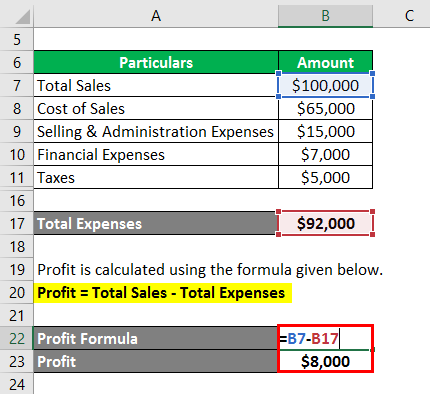

Profit is calculated using the formula given below.

Profit = Total Sales – Total Expenses

- Profit = $100,000 – $92,000

- Profit = $8,000

Therefore, the Retail Food & Beverage Shop recorded a Profit of $8,000 during the year ended on December 31, 2018.

Profit Formula– Example #2

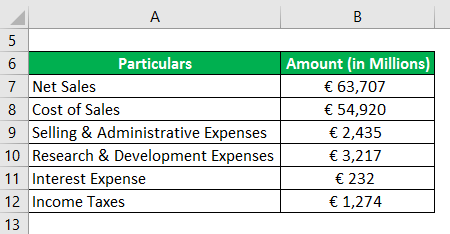

Let us take a real-life example of Airbus SE to calculate the profit for the year ended on December 31, 2018. As per the annual reports, the information (non-operating incomes and expenses have been excluded) is available. Calculate the profit of Airbus SE for the year 2018 based on the given information.

Solution:

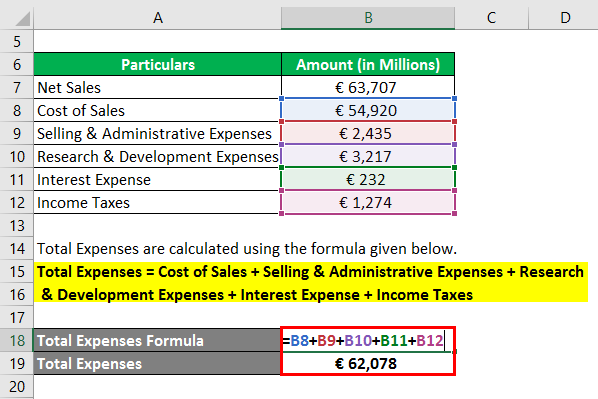

Total Expenses are calculated using the formula given below.

Total Expenses = Cost of Sales + Selling & Administrative Expenses + Research & Development Expenses + Interest Expense + Income Taxes

- Total Expenses = € 54,920 + € 2,435 + € 3,217 + € 232 + € 1,274

- Total Expenses = € 62,078 million

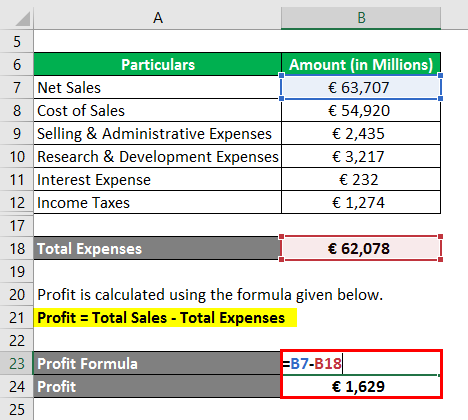

Profit is calculated using the formula given below.

Profit = Total Sales – Total Expenses

- Profit = € 63,707 – € 62,078

- Profit = € 1,629 million

Therefore, Airbus SE secured a profit of €1,629 million from the business during the year ended on December 31, 2018.

Profit Formula– Example #3

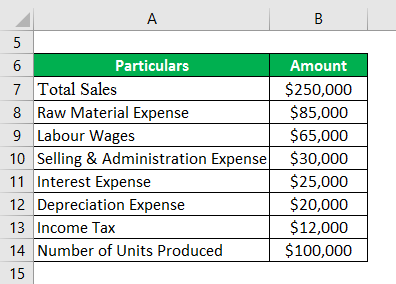

Let us take the example of a manufacturing company ABC Ltd. The company has achieved total revenue of $250,000 during the year ended on December 31, 2018. As per its income statement, the information is available for the period. Calculate the profit per unit of ABC Ltd for the year ended on December 31, 2018, if the number of units produced is 100,000.

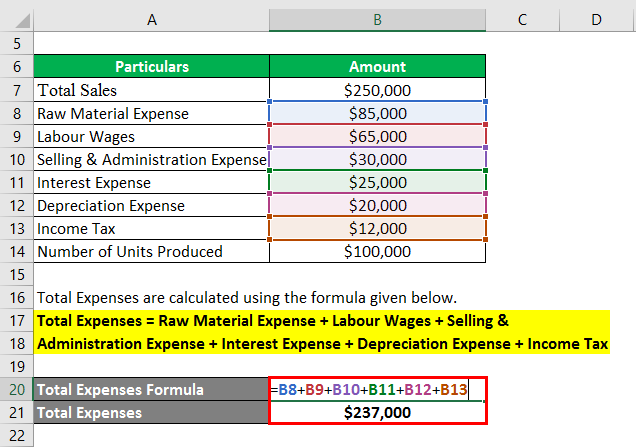

Total Expenses are calculated using the formula given below.

Total Expenses = Raw Material Expense + Labour Wages + Selling & Administration Expense + Interest Expense + Depreciation Expense + Income Tax

- Total Expenses = $85,000 + $65,000 + $30,000 + $25,000 + $20,000 + $12,000

- Total Expenses = $237,000

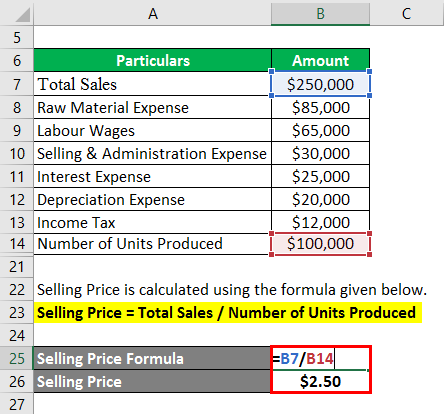

Selling Price is calculated using the formula given below.

Selling Price = Total Sales / Number of Units Produced

- Selling Price = $250,000 / 100,000

- Selling Price = $2.50

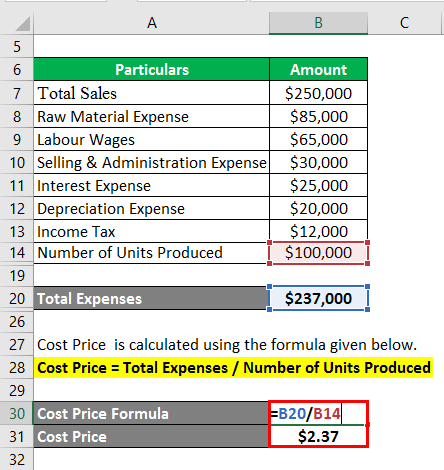

Cost Price is calculated using the formula given below.

Cost Price = Total Expenses / Number of Units Produced

- Cost Price = $237,000 / 100,000

- Cost Price = $2.37

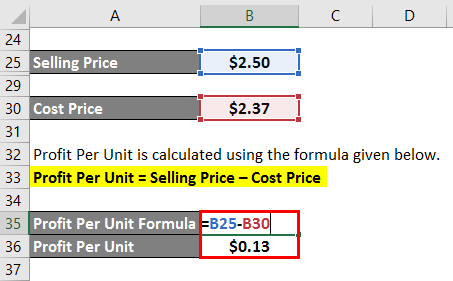

Profit Per Unit is calculated using the formula given below.

Profit Per Unit = Selling Price – Cost Price

- Profit Per Unit = $2.50 – $2.37

- Profit Per Unit = $0.13 or 13 cents

Therefore, ABC Ltd made a profit of 13 cents per unit during the year ended on December 31, 2018.

Explanation

The formula for profit can be derived by using the following steps:

Step 1: Firstly, determine the revenue or sales of the company and it is easily available as a line item in the income statement of the company. In the case of profit per unit, the selling price can be computed by dividing the total sales by the number of units produced.

Step 2: Next, determine the total expenses of production which are the summation of the cost of sales, selling & administration expense, financial expense, etc. In the case of profit per unit, the cost price can be computed by dividing the total expenses by the number of units produced.

Step 3: Finally, the formula for profit can be derived by subtracting the total expenses (step 2) from the total revenue (step 1) as shown below.

Profit = Total Sales – Total Expense

Again, the formula for profit per unit can be derived by deducting the cost price of production from the selling price of each unit as shown below.

Profit per unit = Selling Price – Cost Price

Relevance and Uses of Profit Formula

From the perspective of any business, profit is considered to one of the most important metrics as it is predominantly used to determine the financial health of the business and measure its success. Nevertheless, while analyzing a company, profit should not be the sole criteria of assessment and it should be used in conjunction with other business factors. Typically, an increasing trend in profit indicates a successful business while the decline in profit can be seen as a signal of some business issues.

Profit Formula Calculator

You can use the following Profit Formula Calculator

| Total Sales | |

| Total Expenses | |

| Profit | |

| Profit = | Total Sales – Total Expenses |

| = | 0 – 0 |

| = | 0 |

Recommended Articles

This is a guide to Profit Formula. Here we discuss how to calculate Profit along with practical examples. We also provide a Profit calculator with a downloadable excel template. You may also look at the following articles to learn more –