Profit Percentage Formula (Table of Contents)

What is Profit Percentage Formula?

The extra amount the company receives from the customer over what the company paid to the vendor is called the profit. The net income generated by a company is divided by its sales, and the result is called the profit percentage.

Profit percentage is used for sale and cost management, and thus overall performance assessment, and it is an indicator of pricing power, cost control, and strategic positioning.

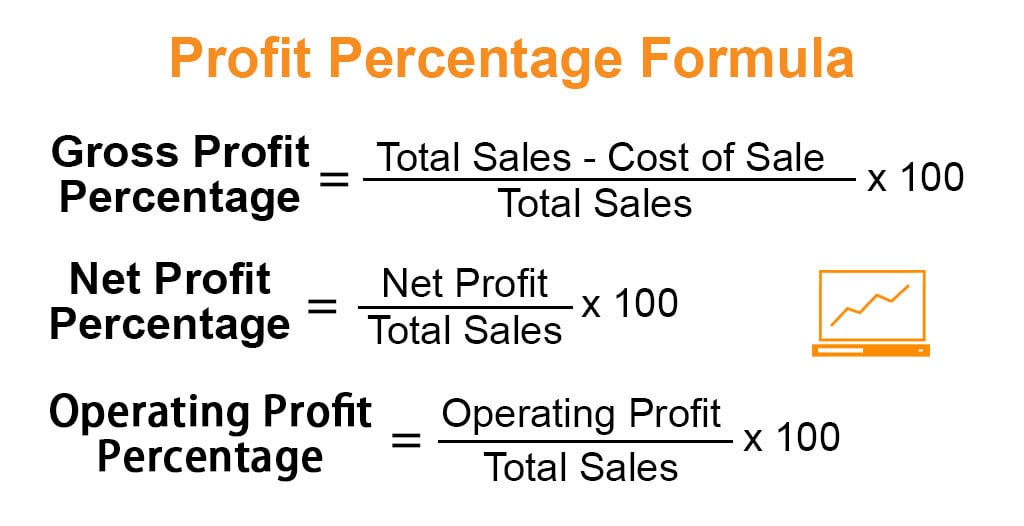

Formula For Profit Percentage is given below

Net Profit Percentage = (Net Profit / Total Sales) * 100

Operating Profit Percentage = (Operating Profit / Total Sales) * 100

Examples of Profit Percentage Formula (With Excel Template)

Let’s take an example to understand the calculation of Profit Percentage calculation better.

Profit Percentage Formula – Example #1

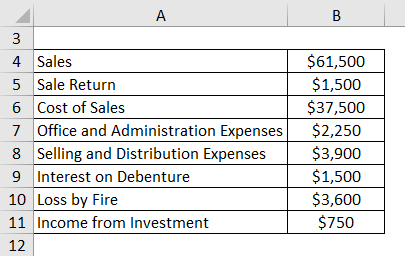

From the given information, calculate a) Gross Profit Percentage b) Net Profit Percentage c) Operating Profit Percentage.

Solutions:

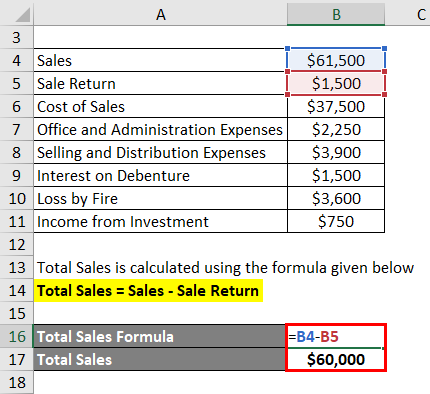

Total Sales are calculated using the formula given below

Total Sales = Sales – Sale Return

- Total Sales = $61,500 – $1,500

- Total Sales = $60,000

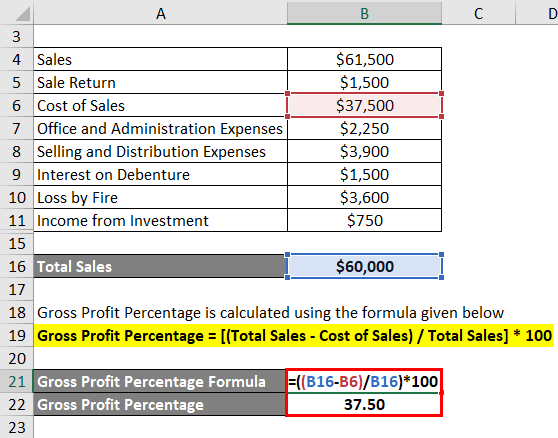

Gross Profit Percentage is calculated using the formula given below

Gross Profit Percentage = [(Total Sales – Cost of Sale) / Total Sales] * 100

- Gross Profit Percentage = [($60,000 – $37,500) / $60,000] * 100

- Gross Profit Percentage = 37.50%

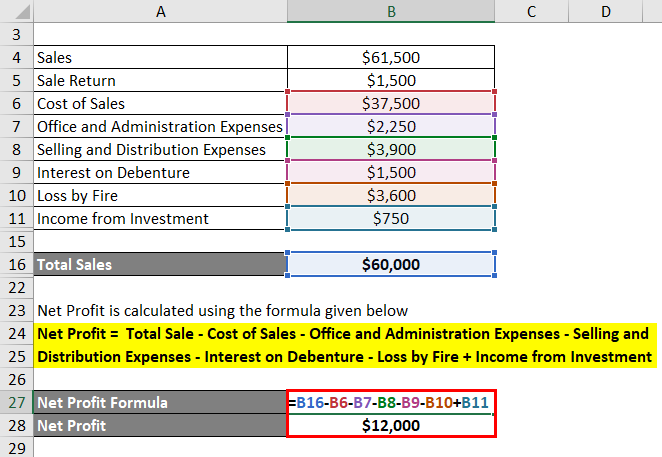

Net Profit is calculated using the formula given below

Net Profit = Total Sale – Cost of Sales – Office and Administration Expenses – Selling and Distribution Expenses – Interest on Debenture – Loss by Fire + Income from Investment

- Net Profit = $60,000 – $37,500 – $2,250 – $3,900 – $1,500 – $3,600 + $750

- Net Profit = $12,000

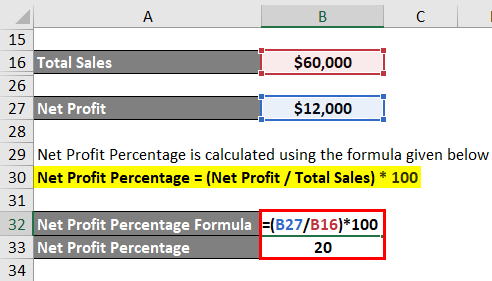

Net Profit Percentage is calculated using the formula given below

Net Profit Percentage = (Net Profit / Total Sales) * 100

- Net Profit Percentage = ($12,000 / $60,000) * 100

- Net Profit Percentage = 20%

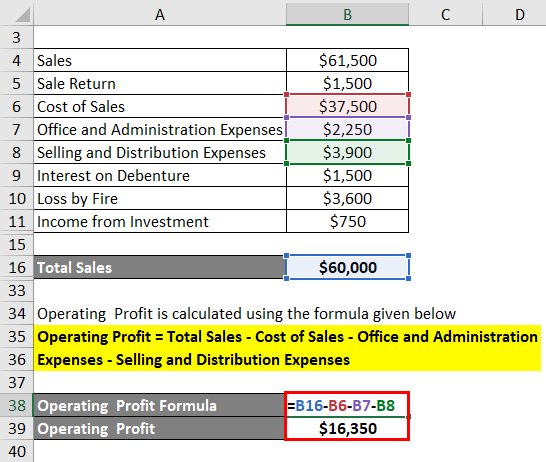

Operating Profit is calculated using the formula given below

Operating Profit = Total Sales – Cost of Sales – Office and Administration Expenses – Selling and Distribution Expenses

- Operating Profit = $60,000 – $37,500 – $2,250 – $3,900

- Operating Profit = $16,350

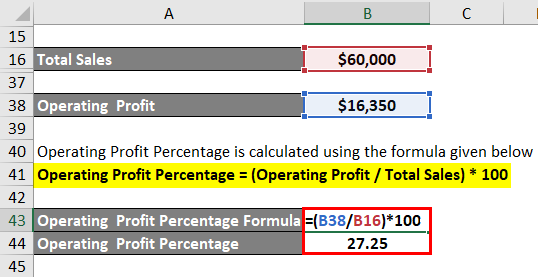

Operating Profit Percentage is calculated using the formula given below

Operating Profit Percentage = (Operating Profit / Total Sales) * 100

- Operating Profit Percentage = ($16,350 / $60,000) * 100

- Operating Profit Percentage = 27.25%

Profit Percentage Formula – Example #2

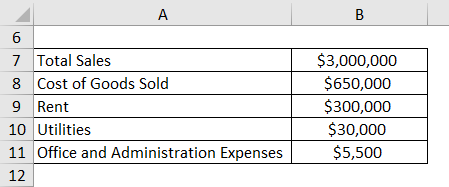

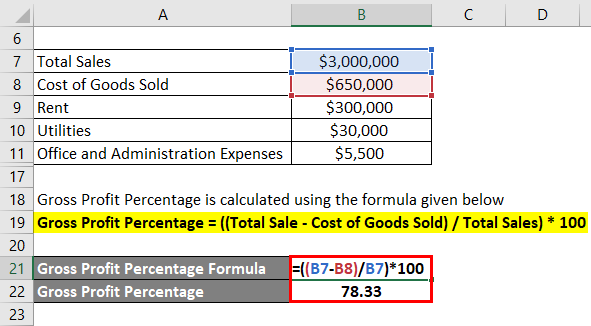

Networking Inc is a Bag manufacturing company that manufactures all types of bags like travel bags, School bags, Laptop bags, and so on. Network Inc established its business in the market successfully. Networking Inc’s management has a forthcoming meeting with its investors, so the management of Networking Inc is looking to find out gross profit and Gross profit percentage from the following Income statement of Networking Inc at the end of the year.

Solutions:

Gross Profit is calculated using the formula given below

Gross Profit = Total Sales – Cost of Goods Sold

- Gross Profit = $3,000,000 – $650,000

- Gross Profit = $2,350,000

So Networking Inc has a Gross profit of $23,50,000, which means that goods that networking Inc Sold for $3,000,000 cost them $650,000 to produce, and the company can utilize $23,50,000 to pay its other expenses.

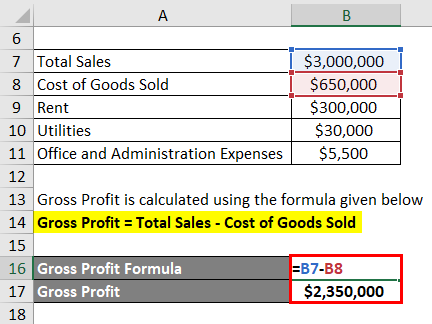

Gross Profit Percentage is calculated using the formula given below.

Finance for Non-Finance Managers Course (7 Courses)Investment Banking Course (123 Courses, 25+ Projects)Financial Modeling Course (7 Courses, 14 Projects)

Gross Profit Percentage = ((Total Sale – Cost of Goods Sold) / Total sales) * 100

- Gross Profit Percentage = (($3,000,000 – $650,000) / $3,000,000) * 100

- Gross Profit Percentage = 78.33%

So Networking Inc is getting 78.33% gross profit on bags, which tells networking Inc that 78.33% of its net sales will become gross profit and for every dollar of sales networking Inc generates, they earn 78.33% in profit before expenses are paid.

Profit Percentage Formula – Example #3

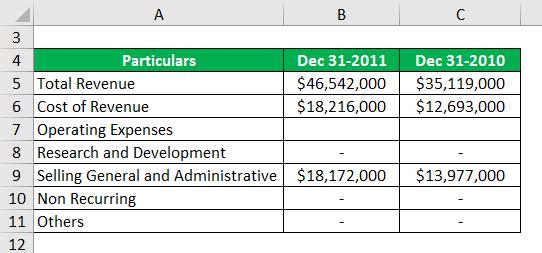

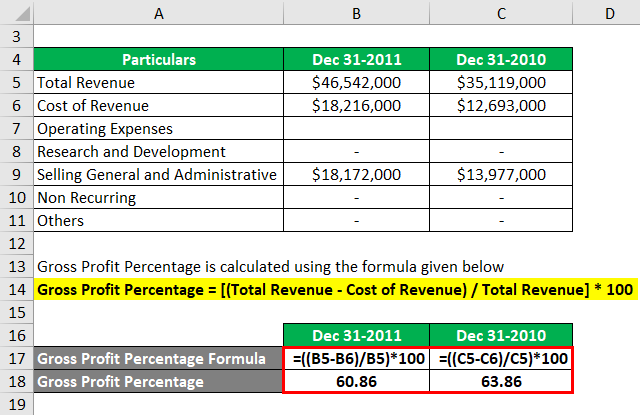

From the following income statement of Coca-Cola Company for the year ended Dec 2011 and Dec 2010, calculate the Gross Profit Percentage and Operating Profit Percentage for both the years.

Solution:

Gross Profit Percentage is calculated using the formula given below

Gross Profit Percentage = [(Total Revenue – Cost of Revenue) / Total Revenue] * 100

For Dec 31-2011

- Gross Profit Percentage = (($46,542,000 – $18,216,000) / $46,542,000) * 100

- Gross Profit Percentage= 60.86%

For Dec 31-2010

- Gross Profit Percentage = (($35,119,000 – $12,693,000) / $35,119,000) * 100

- Gross Profit Percentage = 63.86%

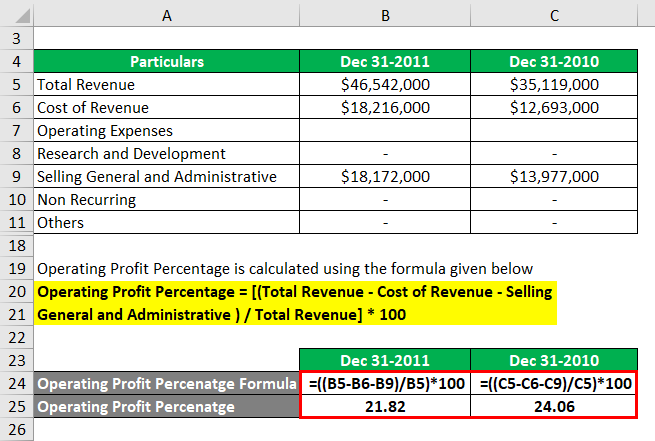

Operating Profit Percentage is calculated using the formula given below

Operating Profit Percentage = [(Total Revenue – Cost of Revenue – Selling General and Administrative ) / Total Revenue] * 100

For Dec 31-2011

- Operating Profit Percentage = (($46,542,000 – $18,216,000 – $18,172,000) / $46,542,000)) * 100

- Operating Profit Percentage = 21.82%

For Dec 31-2011

- Operating Profit Percentage = (($35,119,000 – $12,693,000 – $13,977,000) / $35,119,000) * 100

- Operating Profit Percentage= 24.06%

Explanation

The formula is nothing but the company’s Total revenues (Total Sales) minus its cost of revenues (Cost of Goods sold or Cost of Sales) Divided by the Total revenues (Total Sales). The formula can tell us a lot about the company’s economical nature, which we cannot get to know from gross profit. The formula is the percentage of sales available to cover expenses and provide a profit. Operating profit percentage is the difference between sales revenues, cost of goods sold, and other operating expenses divided by total sales. An Increase in operating margin might reflect a higher gross profit margin and/or better control of operating costs. Calculating profits Percentage formula can be complicated in determining them and considering what is accurate for the business.

Relevance and Uses of Profit Percentage Formula

Companies followed profit percentage numbers closely, one of the most followed numbers in finance. Before investing in any stock, shareholders or investors look at the net profit percentage closely because it shows how superior the company performs and how much profit investors will get from total revenue. The Net profit percentage numbers are not fixed, and a percentage of sales is used to compare the net profit percentage with other competitors. Profit Percentage is nothing but the business evaluation formula.

Potential investors closely watch gross profit percentage for any small increases or decreases. The formula tells us how effectively a business turns its sales into profit and how efficiently a business is run, whether a business can add value during the production process or not.

Recommended Articles

This is a guide to the Profit Percentage Formula. Here we have discussed How to Calculate Profit Percentages along with practical examples and a downloadable Excel template. You may also look at the following articles to learn more –