Updated July 13, 2023

What is Progressive Tax?

A progressive tax is a logical tax system wherein the tax rates increase as per an increase in the taxable income of the assessee (i.e., taxable person), which leads to a rise in the average rate of tax of a taxable person resulting in shifting the liability of paying heavy taxes from the poor income group to higher income group.

Explanation

- The dictionary meaning of “progressive” is increasing gradually or in stages. So, the term progressive tax refers to an increase in the tax rate as the income slab increases.

- Every government gives some relaxation to persons whose income is very low or below the poverty line. The government usually does not try to recover taxes from the poor income groups of the country.

- Hence, this system of tax is usually famous around the globe.

- This system leads to an increase in the average tax rate as the income slab increases.

- Under this system, the rich person has to pay more tax & poor person has to pay either nil or a small amount of tax.

Example of Progressive Tax

Let us look at the below examples of progressive taxes with calculations:

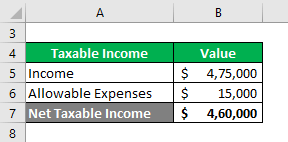

Say an Individual unmarried person earns $475000 during the year. He is curious to know his tax liability. Also, he has maintained his list of expenses totaling around $ 15000.

Solution:

Tax Payable

Explanation

- As you can observe from the above calculation, the average rate of tax the person is paying @ is 30%, which is lower than the marginal rate of tax of 35% (the highest tax rate from above).

- The highest tax amount is applicable on the last income slab of the person.

Progressive Tax Rate

- As said earlier, the tax rate increases as the income slab increases. This leads to a higher tax rate for higher-income & lower tax rate for lower-income.

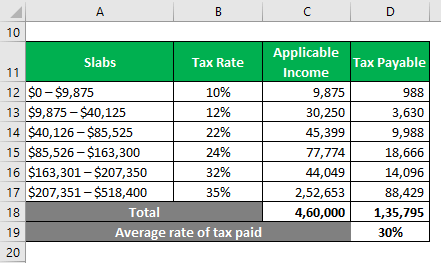

- The tax rates are as follows:

- As you can see, the tax rate is higher for the higher-income groups ($ 518401 in case of Single filers & head of household, $ 622051 in case of married filing jointly & $ 311026 in case of married person filing separately).

- This system is known as the marginal rate of tax. If you earn $ 10,000 annually (single filer), you must tax at 10% for $ 9875 & 12% for a balance income of $ 125.

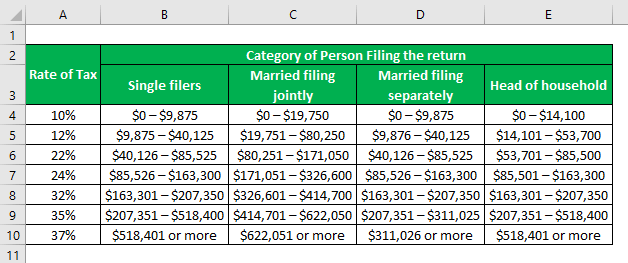

- The category of filers is as follows:

- Single filers: These are unmarried people or individuals legally separated or divorced.

- Married filing Jointly: These are married individuals who aggregate their income & pay tax jointly.

- Married filing separately: These are, again, married individuals who opt to report income separately.

- Head of households: These are unmarried individuals who have managed house expenses for more than half a year & have had a qualifying person with them for over half a year.

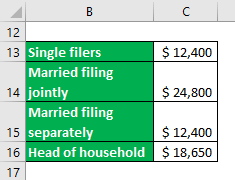

- There is also the concept of the standard deduction. Either specify your list of expenses or opt for the standard deduction. The details are as follows:

Progressive Tax Graph

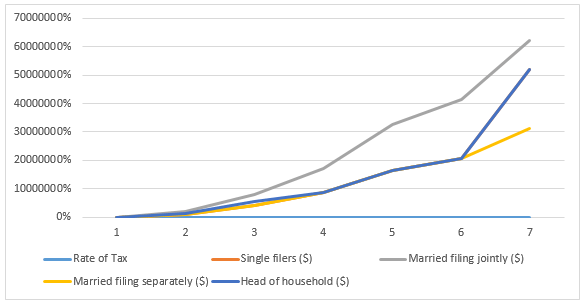

- From the essential tax rates graph, we have the following chart:

Explanation: The above chart has been prepared using the starting amount of income on which the tax rate is applicable.

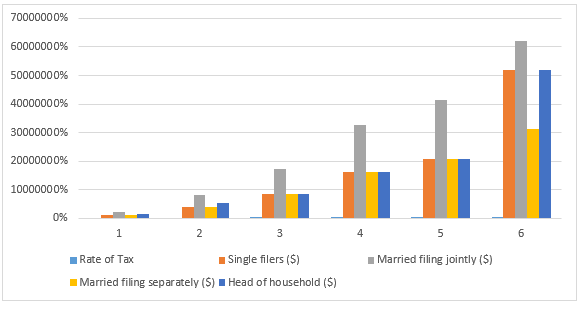

- For the maximum income under each slab, we have the following chart:

Explanation: The above chart uses the ending amount of taxable payable for each income slab.

Criticisms of Progressive Tax

- The lower-income group should be exempted from the tax system at all.

- Even if income is lower, some persons are still asked to file a return of income.

- The tax system is not easy to understand for anybody due to the slab system. Moreover, the calculation is difficult compared to the system’s flat rate.

- Standard deduction rates are lower & do not consider the type of expenses one has to incur.

- The average tax rate the rich income groups pay is still near to middle-class income.

How do They Impact the Economy?

- The progressive tax system is also called redistribution of income. The reason is the government collects more taxes from rich people. Using the said higher tax. The government improves the quality of public utilities.

- The poor should get complete services free of cost & the rich should pay for luxurious services.

- A progressive tax system allows the government to keep the money for the health care system. As a result, the poor can afford health care services for severe diseases.

- It further enables increasing the demand for products due to higher disposable income. Higher disposable income is due to a lower average rate of tax.

- The progressive tax system aims to ensure a minimum standard of living for everyone in the country.

Advantages of Progressive Tax

- Higher disposable income leads to higher savings.

- Higher savings leads to proper fund management for the future.

- It also helps the citizens to face recession scenarios in the future. Like in the COVID-19 scenario, higher disposable income has led to lower dependence on the government.

- The tax system has focused on the earning capacity & is not blind like the flat rate of the system.

- This system creates confidence in equality in the country.

- A progressive tax system reduces the gap of unequal distribution of income.

- Each individual is assured of minimum standards of living.

- The rich are taxed higher & the poor are taxed lower.

Disadvantages of Progressive Tax

- The tax payable amount is difficult due to different slabs.

- Low clarity about the category of person.

- The rich can quickly reduce their income slab using tax planning tools, leading to lower tax rates.

- The progressive tax system is based on diminishing the marginal utility of money. However, the utility of money does not decline as income increases. So, the assumption is not appropriate here.

- The rate of taxes levied is higher. If you see, 10% -15% is not a lower tax rate. If a person earns $ 100, he is $ 10 of his hard-earned money & left with only $ 90 in his hand.

- The system lacks essential exemption criteria. That means that part of the total income should not be taxed.

Conclusion

Taxes are the primary source of revenue for any Government. Each government has to decide on the system they want to implement. Besides the progressive tax rate system, the world also has a “Flat rate” system wherein the tax rate is flat irrespective of the income slab. Another system is the regressive tax system, wherein a person is taxed higher for the lower-income slab & lower for the highest-income slab. A regressive tax system is used by governments of underdeveloped countries that need funds for revamping the economy. Major countries around the globe have progressive tax systems with some modifications per the country-specific scenarios.

Recommended Articles

This is a guide to Progressive Tax. Here we also discuss the definition, examples, and their impact on the economy, along with the advantages and disadvantages of Progressive Tax. You may also have a look at the following articles to learn more –