Project Budgeting Definition

One of the key challenges project managers face is making sure that the project stays within the budget. Budget overruns can impact a project’s success and affect the company’s financial health. Therefore, project budgeting requires strategic planning for effective budget management.

Project budgeting is how companies calculate the approximate total cost of completing a project within a defined timeframe.

It includes all aspects of project finance, from resource allocation to labor costs, and requires meticulous planning and revision. Understanding project budgeting is foundational to effective project management, as it sets the financial blueprint that guides the project’s execution. In this article, we will look into strategies and tools for effective budget management in project management.

Table of Contents

Key Highlights

- Effective project budgeting is necessary for successfully completing projects, as it helps companies determine total costs required for a project.

- Defining clear budget boundaries, implementing a contingency plan, and regular financial reviews are essential for keeping projects on track.

- Tools like project management software, budgeting applications, and paystubs generators significantly track and manage expenses.

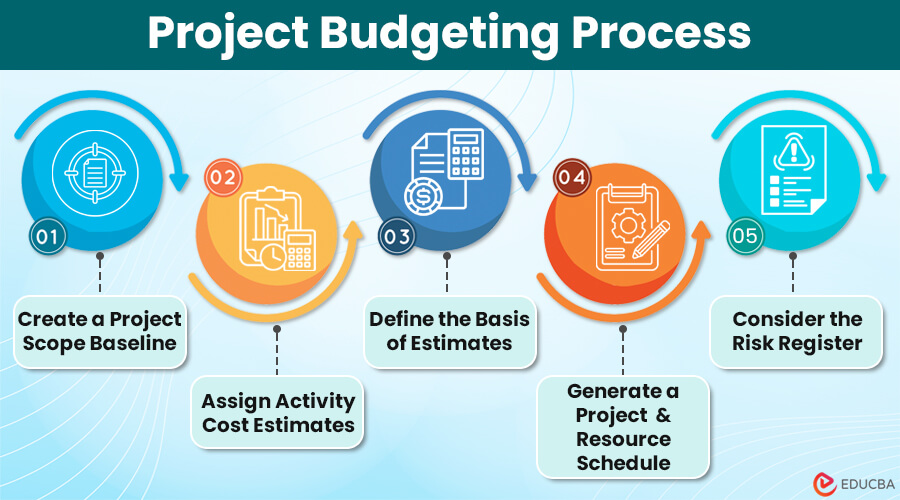

Project Budgeting Process

The steps to the project budgeting process are as follows:

#1: Create a Project Scope Baseline: A project scope baseline simply outlines the detailed scope of the project. It includes information about the deliverables, timelines, and any assumptions or constraints. This baseline is a foundation for budgeting. By having a clear understanding of what the goal is, project managers can accurately estimate the resources and costs they require to fulfill the objectives.

#2: Assign Activity Cost Estimates: This includes dividing project objectives into smaller tasks or activities and assigning costs to each. To do this, firms must collect historical data, connect with subject matter experts, and examine external sources to determine the resources (such as labor, materials, equipment, etc.) needed and their associated costs. These estimates are crucial for developing an overall budget for the project.

#3: Define the Basis of Estimates: This basis of estimates provides the rationale and assumptions behind the cost estimates. It documents the methodologies, data sources, and any constraints or uncertainties considered during the estimation process. Having a clear basis for the estimates helps stakeholders understand the reliability of the budget and allows for adjustments as the project progresses.

#4: Generate a Project & Resource Schedule: The project and resource schedule outlines the sequence of activities, their durations, and resource requirements over the project timeline. Integrating the schedule with the budget ensures managers can allocate resources efficiently and accurately account for corresponding costs.

#5: Consider the Risk Register: The risk register identifies potential threats and opportunities that could affect the project’s cost objectives. Risks may include unexpected changes in market conditions, delays in deliverables, resource shortages, or technical challenges. By analyzing the effect of each risk, project managers can develop contingency plans and budget reserves to mitigate their effects on the project budget.

Strategies for Effective Budgeting in Project Management

- Defined Budget Scope: Define the scope and limitations of your project budget. Establish clear cost estimates for each phase or component of the project.

- Regular Financial Reviews: Conduct periodic reviews of your project’s financial performance and accordingly adjust the budget and make required adjustments to prevent overspending.

- Contingency Planning: Keep aside a small percentage of the budget for emergency or unexpected expenses. A well-planned contingency fund can mitigate risks associated with budget overruns.

- Proper Stakeholder Communication: Maintain open lines of communication with stakeholders. Regular updates on budget status can help manage expectations and foster trust.

Project Budgeting Tools

Utilizing technological solutions can significantly improve budget management efficiency. These tools provide project managers with real-time data and analytical insights, enabling more informed decision-making and better financial control.

Several tools can enhance budget management in project management, including:

1. Project Management Software

Project management softwares, like Microsoft Project, Zoho Projects, ProofHub, etc., provides an integrated platform for budget planning, tracking, and reporting. Project managers can use these tools to create budget estimates, allocate funds to specific tasks or resources, and track expenses as the project progresses. Additionally, project management software often includes features for generating budget reports, which firms can share with stakeholders to ensure transparency and accountability.

2. Budgeting Applications

Budgeting applications are specialized tools designed to create detailed budget forecasts and track expenses against budget allocations. Some examples include QuickBooks, FreshBooks, or Oracle NetSuite. These tools allow project managers to input cost estimates and monitor actual expenses in real time. Budgeting applications often include features for automating expense tracking and analyzing budget variances, enabling project managers to make informed decisions about project budgets.

3. Paystubs Generators

Paystub generators are useful for managing and tracking personnel expenses. They offer a straightforward solution for generating accurate paystubs for employees and contractors, which is critical for maintaining precise records of labor costs. These tools facilitate easy monitoring of wages, taxes, and other deductions, providing a clear view of personnel expenses that contribute to the overall project budget.

Final Thoughts

Effective project budgeting is crucial for successful project management. By employing strategic planning, leveraging appropriate tools, and utilizing pay stub generators, project managers can deliver projects on time and within budget. Moreover, embracing technological advancements streamlines budget management processes and enhances overall project efficiency and accountability.

Frequently Asked Questions (FAQs)

Q1. How often should firms conduct financial reviews in project management?

Answer: Businesses should conduct financial reviews at regular intervals. It is ideal to review project finances after completing a major project milestone to ensure that the project remains on budget.

Q2. What percentage of the budget should businesses allocate for contingencies?

Answer: A contingency fund should typically represent 5-10% of the total project budget, depending on the project’s complexity and associated risks.

Q3. How can paystub generators aid in budget management?

Answer: Paystub generators help accurately track personnel expenses, which are a significant part of project costs. This ensures that labor costs are transparent and manageable.

Q4. Can technology replace traditional budget management techniques?

Answer: While technology greatly enhances efficiency and accuracy, it should complement rather than replace traditional budget management techniques. A blend of technology and traditional methods ensures comprehensive budget oversight.

Recommended Articles

If you found this article on project budgeting informative, learn about similar concepts below.