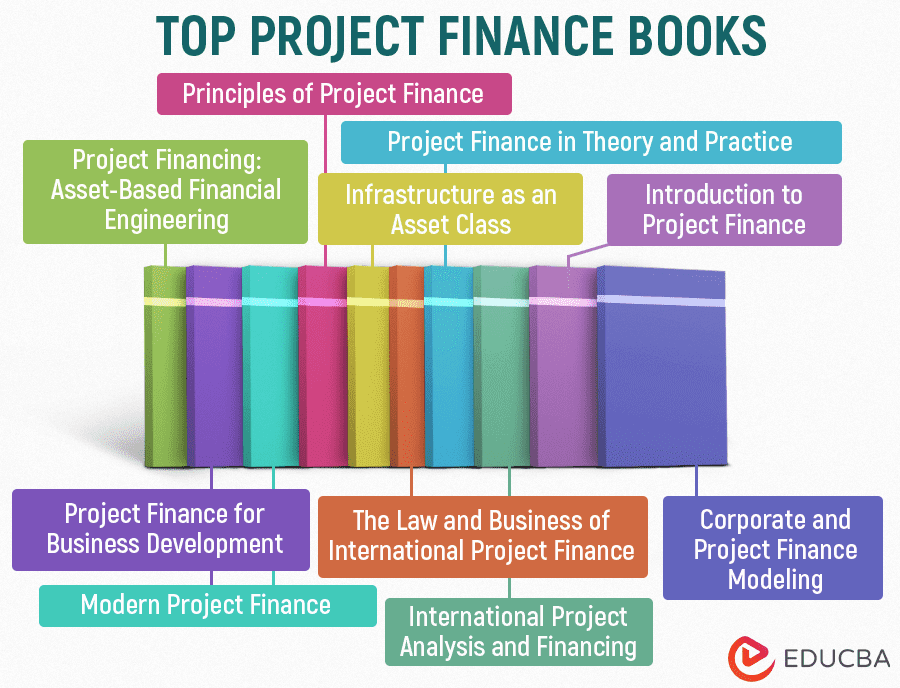

Introduction to Best Project Finance Books

Project finance books make this complex financial topic easy to understand. These books cover risk management, legal frameworks, and long-term investments in areas like real estate, oil, mining, and more. Whether you are new to the field or an industry pro, these books are your guide to mastering project finance.

Below is the list of the top ten project finance books that would be useful to amateurs and professionals to acquire knowledge on Project Finance.

| # | Name of the Book | Author Name | Original Publishing year | Ratings |

| 1. | Project Financing: Asset-Based Financial Engineering | John D. Finnerty | 1996 | Amazon: 4.5 Goodreads: 3.79 |

| 2. | Principles of Project Finance | E. R. Yescombe | 2002 | Amazon: 4.6

Goodreads: 3.95 |

| 3. | Infrastructure as an Asset Class: Investment Strategies, Project Finance, and PPP | Barbara Weber, Miriam Staub Bisang, and Hans Wilhem Alfen | 2010 | Amazon: 4.3

Goodreads: 3.57 |

| 4. | Project Finance in Theory and Practice: Designing, Structuring, and Financing Private and Public Projects | Stefano Gatti | 2007 | Amazon: 4.7

Goodreads: 3.78 |

| 5. | Introduction to Project Finance | Andrew Fight | 2005 | Amazon: 4

Goodreads: 3.91 |

| 6. | Project Finance for Business Development | John E. Triantis | 2018 | Amazon: 4.3

Goodreads: 3 |

| 7. | Modern Project Finance – A Casebook | Benjamin C. Esty | 2004 | Amazon: 3.8

Goodreads: 3.78 |

| 8. | The Law and Business of International Project Finance | Scott L. Hoffman | 1998 | Amazon: 4.1

Goodreads: 4.18 |

| 9. | International Project Analysis and Financing | Dr. Gerald Pollio | 1999 | Amazon: 5

Goodreads: 3 |

| 10. | Corporate and Project Finance Modeling: Theory and Practice | Edward Bodmer | 2014 | Amazon: 4.3

Goodreads: 4.47 |

Let us take you through each of the project finance books and provide you with their key takeaways.

Book #1: Project Financing: Asset-Based Financial Engineering

Author: John D. Finnerty

Get this book here.

Review:

This project finance book is a comprehensive guide to project financing. It provides a detailed overview of the key concepts and techniques used in asset-based financial engineering. It presents complex financial concepts in an easy-to-understand manner, making it an ideal resource for those new to the field.

Key Points:

- The author unfolds the main players in project financing transactions, like lenders, sponsors, and project companies.

- The author guides us to carefully consider legal and regulatory issues, which are the critical components of project financing transactions when structuring and executing deals.

- It demonstrates how financial engineering methods involving financial derivatives, securitization, and special purpose entities can enhance project financing structures and risk management.

Book #2: Principles of Project Finance

Author: E. R. Yescombe

Get this book here.

Review:

This book is a comprehensive guide to the world of project finance. It covers everything from the basics of project finance to the more complex financial structures and legal agreements involved in project finance deals.

Key Points:

- It explains that in project finance, lenders focus on the project’s assets and cash flow for repayment rather than relying on the project sponsor’s financial status.

- The readers also learn about contractual agreements, a crucial component of project finance deals.

- The book teaches how the financial model should include sensitivity analysis and any changes in main variables that impact the project’s Financial performance.

Book #3: Infrastructure as an Asset Class: Investment Strategies, Project Finance, and PPP

Author: Barbara Weber, Miriam Staub Bisang, and Hans Wilhem Alfen

Get this book here.

Review:

This book covers everything from the basics of infrastructure investment to the more complex financial structures and legal agreements involved in infrastructure projects. The author guides readers in choosing the correct investments in the infrastructure market. The book provides proper insight and awareness to make informed investment decisions.

Key Points:

- The book shows how PPPs have become increasingly popular in recent years due to the perceived benefits of increased efficiency and improved risk allocation.

- The author discusses Infrastructure investments in depth involving risks, including construction risks, operational risks, and market risks.

- The readers learn about all the legal and financial agreements tied to project finance deals, including the project agreement, construction contract, operation and maintenance agreement, and finance documents.

Book #4: Project Finance in Theory and Practice: Designing, Structuring, and Financing Private and Public Projects

Author: Stefano Gatti

Get this Book here.

Review:

The book is a comprehensive guide that covers everything from the basics of project finance to the more complex concepts. The expert author provides an in-depth exploration of project finance, offering both theoretical foundations and practical insights in the book. Its simple language makes it suitable for anyone interested in learning about project finance, including students, professionals, and investors.

Key Points:

- The author uses a clear and organized method to simplify complex ideas, making the book suitable for readers of all levels, whether they are new or experienced.

- The book emphasizes the importance of including a sensitivity analysis in the financial model.

- Another notable aspect of the book is its frequent use of real-world examples, giving readers valuable insights into how to use project finance principles in actual situations.

Book #5: Introduction to Project Finance

Author: Andrew Fight

Get this Book here.

Review:

The book is an informative and practical guide to project finance and offers a comprehensive understanding of the subject. The author shows how project finance aids infrastructure and private or public venture capital needs. The book discusses how it is applicable in underdeveloped and developed countries. The author uses real-world examples to illustrate the concepts.

Key Points:

- The author explains the different types of risks and the methods to mitigate them, including construction, operational, and market risks.

- The book covers the different methods used to evaluate a project, such as discounted cash flow analysis and sensitivity analysis, and how to use them effectively.

- It also discusses financing methods structured to use the project’s cash flows to repay the debt, and the lenders have limited recourse to the project sponsor’s assets.

Book #6: Project Finance for Business Development

Author: John E. Triantis

Get this Book here.

Review:

The book covers the basics of project finance, including the various players involved, risk assessment, and project evaluation. It is an excellent resource for students and professionals who want to understand project finance and its application to business development.

Key Points:

- This book adopts a business-focused perspective, making it particularly valuable for entrepreneurs, managers, and decision-makers involved in project development.

- The book shows how project evaluation is essential in project finance, as lenders need to ensure that the project is viable and can generate sufficient cash flows to repay the debt.

- The author explains the different methods investors can use to evaluate a project.

Book #7: Modern Project Finance – A Casebook

Author: Benjamin C. Esty

Get this book here.

Review:

An author from Harvard Business School takes you behind the scenes of the most important project financing of the past five years. This book is a practical shortcut to understanding project finance, giving readers the knowledge they need to compete with seasoned professionals. It includes solid real-world data explaining why companies opt for project finance and why banks back it.

Key Points:

- The case studies offer important lessons about making good decisions in project finance, helping readers make better choices in their projects.

- The book strongly emphasizes understanding and managing risks in project finance, giving readers the tools to handle the challenges that come with it.

- This casebook is a current and valuable resource because it focuses on modern project finance practices, reflecting the changing nature of this dynamic field.

Book #8: The Law and Business of International Project Finance

Author: Scott L. Hoffman

Get this book here.

Review:

The author draws upon his extensive experience in the field to provide practical insights and guidance for project participants. Having represented Fortune 500 countries, banks, and utilities for over 22 years, the author, Scott L. Hoffman, is a renowned authority in Project finance. He has also presented testimony on energy policy-making before the US Congress. The book provides comprehensive coverage of legal and financial aspects of project finance, including project financing structures, risk allocation, contract negotiation, and dispute resolution.

Key Points:

- It is an excellent resource for governments, sponsors, lawyers, and project participants who need a comprehensive understanding of project finance.

- Readers get exposure to international project finance across industries and governance.

- The author provides practical guidance and insights based on his extensive experience in the field.

Book #9: International Project Analysis and Financing

Author: Dr Gerald Pollio

Get this book here.

Review:

The book emphasizes the importance of understanding different aspects of a country, like the local economic, political, and social context, when undertaking international projects. The author provides guidance on examining the legal and regulatory environment of different countries, which can be a significant challenge for project managers and finance professionals.

Key Points:

- Readers will thoroughly understand the financial structuring intricacies specific to international projects, empowering them to create robust financing plans.

- The book is a valuable resource for professionals in the field of international development, including project managers, finance professionals, and policymakers.

- It provides practical advice and case studies illustrating key concepts and best practices in foreign project analysis and financing.

Book #10: Corporate and Project Finance Modeling: Theory and Practice

Author: Edward Bodmer

Get this book here.

Review:

This book aims to assist readers in achieving a thorough understanding of financial modeling and valuation principles by guiding them to create precise and adaptable valuation analyses. It covers important aspects like cash flow patterns, asset depreciation, updates for recent data, and dynamic ways to present different scenarios and sensitivity analyses.

Key Points:

- This book covers the full spectrum of financial modeling, encompassing both corporate and project finance scenarios.

- It includes numerous case studies and exercises illustrating critical concepts so the learner gets hands-on experience building financial models.

- Readers gain insights into advanced modeling techniques, including scenario analysis and sensitivity testing, which are crucial for informed decision-making.

Recommended Books

We believe this EDUCBA guide on the best 10 Project Finance books has been informative. To dive deeper into finance-related books, EDUCBA suggests exploring these specialized articles.