Updated July 15, 2023

What is a Promissory Note?

The term “promissory note” refers to the financial instrument that represents a well-documented promise made by the borrower in favor of the issuer to repay a specific amount of money, either on a particular date in the future or whenever the lender demands repayment.

A typical promissory note should include all information pertaining to the indebtedness, such as the principal amount of the debt, applicable rate of interest, date, place of note issuance, and maturity date of the note.

Explanation

A promissory note can consider a loan agreement or an IOU (informally). It is a legal loan document stating that the borrower has promised to repay the debt to the lender over a specific period. As such, this document is legally enforceable, and the borrower legally obligates to repay the loan per the pre-decided terms and conditions of the document.

Features of Promissory Note

Some of the major features are as follows:

- It should be well-documented in writing, as a verbal agreement/contract has no legal implications. This is a promise the borrower makes to the lender via a written contract.

- It should mention the sum of money that the borrower owes to the lender.

- The name of the borrower and the lender should capture in the note. Basically, it should mention who will pay whom.

- It should also have the date the borrower will repay the debt.

- In cases where the payment has to be done in installments, the number of installments should also capture in the note.

- Lastly, the commitment place should also be in the note.

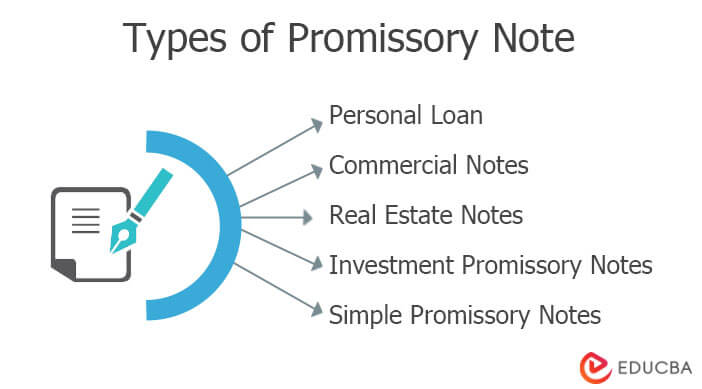

Types of Promissory Note

There can be several types based on the purpose and nature of the transaction. In this section, we will discuss some of the major types:

- Personal Loan: These loans are extended by friends or family members. Although legal writings may seem avoidable when lending to close contact, a promissory note always acts as a safety net for the lender.

- Commercial Notes: These notes are created while dealing with commercial lenders, such as loan agents or banks. In case of a default, these lenders entitle to charge a lien on the collateral until the obligations have been paid in full.

- Real Estate Notes: Similar to commercial notes, the borrower can offer real estate property as collateral in these notes. In case of failure to meet repayment obligations, the lender can rightfully keep the property until the obligations are cleared.

- Investment Promissory Notes: The borrower raises funds for supporting business requirements in these notes. In a default, the lender has the right to take ownership of the borrower’s business until repayment of the debt obligation.

- Simple Promissory Notes: The most basic form of notes is created as a written promise that the borrowed money will be paid back per the agreement. Unlike the above-mentioned notes, the purpose of the loan isn’t captured in detail.

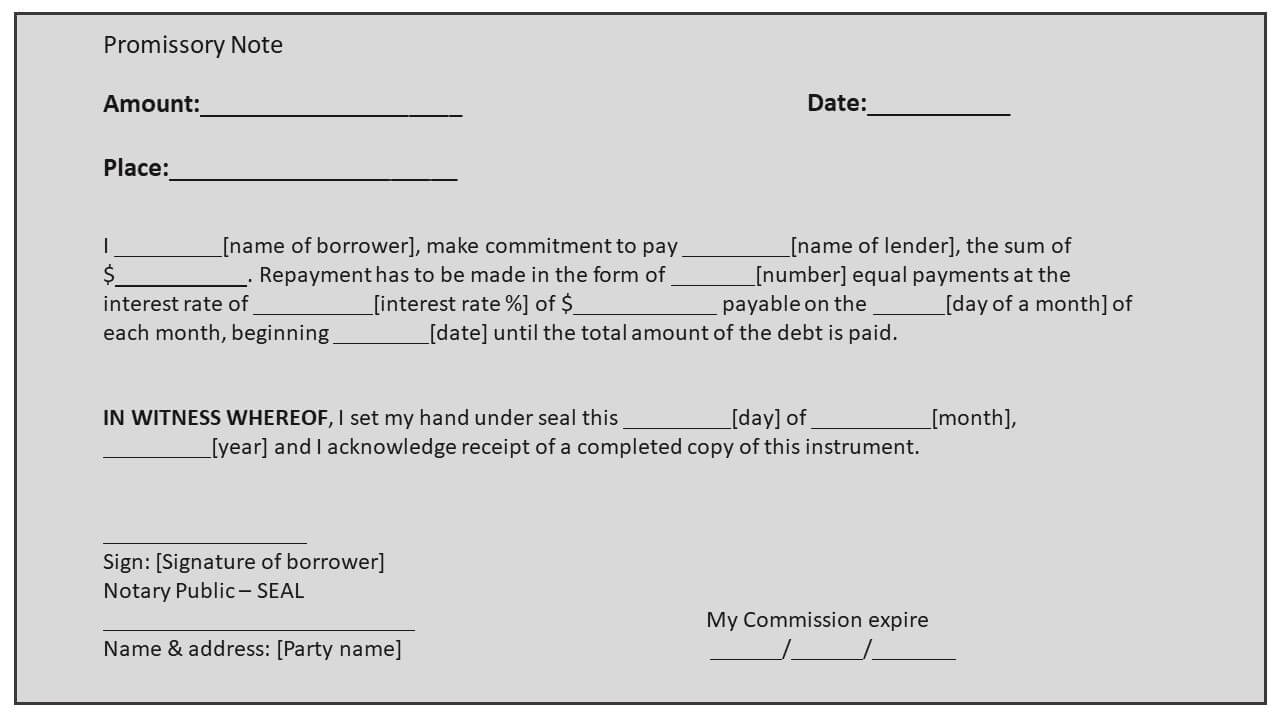

Promissory Note Format

What is Included in Promissory Notes?

A promissory loan note should include the following:

- Name and address of both borrower and lender

- Amount of the borrowed money

- In the case of installments, the frequency and amount of payments

- Details of collateral

- Signatures of both borrower and lender parties

When to Use?

A promissory note usually creates to document personal loans, mortgages, car loans, student loans, business loans, etc. When a lender extends a large sum of money to a person or a business, he/she creates a legal record to mitigate the risk of non-payment or default.

Customization of a Promissory Note

As we have already discussed above, there are different types of notes; Hence, it is necessary to create the right promissory note to fit the purpose of the transaction. It is better not to start from scratch but instead refer to an existing sample note as it helps incorporate the right legal language.

For instance, in the case of a loan with just a lump sum repayment on a specific date, a sample of a simple promissory note can be used. On the other hand, a demand promissory note can use in cases where the obligation arises only when the lender requests the repayment. Similarly, more complicated promissory notes can use for transactions, such as car loans and mortgages, including amortization schedules, interest rates, and other details.

Conclusion

So, it can be seen that different forms of promissory notes change depending on the transaction’s purpose, details to capture, and parties involved. Nevertheless, all these promissory notes have one thing in common – they protect the lender’s money.

Recommended Articles

This is a guide to Promissory Notes. Here we also discuss the introduction and what is included in promissory notes. Along with types and features. You may also have a look at the following articles to learn more –