Updated July 5, 2023

Difference Between Public Company vs Private Company

In public company vs. private company, a public company can trade its shares publicly, while a privately owned business cannot. It means a private company cannot issue its stock, whereas a public company can raise funds from the general public by issuing securities.

A company is an association of people who desire to engage in certain business activities while maintaining a legal presence. A company can exist in various ways, including Statutory Companies, Single Person Companies, Companies Limited by shares, a company limited by guarantee, Public Limited Companies, and Private Limited Companies.

Furthermore, company formation type completely depends on the liability of members, the number of members, and the incorporation mode. The most well-known of these types are Private and Public companies. While these two types of businesses operate differently, the fundamental principles of running a successful business apply to both.

What is a Private Company?

For a private company, the shares are privately held and traded among a select group of investors. Privately held businesses do not have stock or owners. The main distinction is that fewer people own and sell fewer shares. Typically, venture capitalists or other investors provide capital to private companies. It is, thus, an excellent investment for those looking for high-risk, high-reward opportunities.

To raise additional funds for growth, private companies can go public through an initial public offering (IPO). The company can decide to go public to gain access to additional capital through public investment, allowing them to expand its market reach and grow its business.

What is a Public Company?

A public company can sell its registered securities to the general public after an initial public offering (IPO). After the IPO, the organization becomes a publicly-traded company, and the general public can trade its shares on public stock exchanges. The U.S. Securities and Exchange Commission (SEC) requires companies with more than $10 million in assets and 500 subscribers to register with them and follow all reporting regulations.

Shareholders, board members, and executives are all part of the shared ownership structure of public organizations. If required, a private equity firm can assist in converting a public company into a privately held company.

Types of Public and Private Companies

The following are examples of public and private companies:

Public Company

1. Listed Public Companies: These companies are publicly traded and have their shares listed on a stock exchange.

Examples: Apple, Microsoft, and Amazon.

2. Unlisted Public Companies: These companies are publicly owned, with shares not traded on a stock exchange.

Examples: Tata Sons in India and Cargill in the United States.

Private Corporations

1. Family-Owned Businesses: Members of the same family own and run these businesses.

Examples: Walmart and Ford Motor Company.

2. Non-profit Organizations: Organizations found to support a social or environmental cause that does not have shareholders.

Examples: The American Red Cross and the World Wildlife Fund.

3. Startups/Unicorns: New businesses typically owned privately and funded by venture capitalists or angel investors.

Examples: SpaceX, Canva, Stripe, and more.

Apart from the basic categorization, small and medium-sized enterprises (SMEs) are businesses with fewer than 500 employees and annual revenue of less than $50 million. They can be either privately or publicly owned.

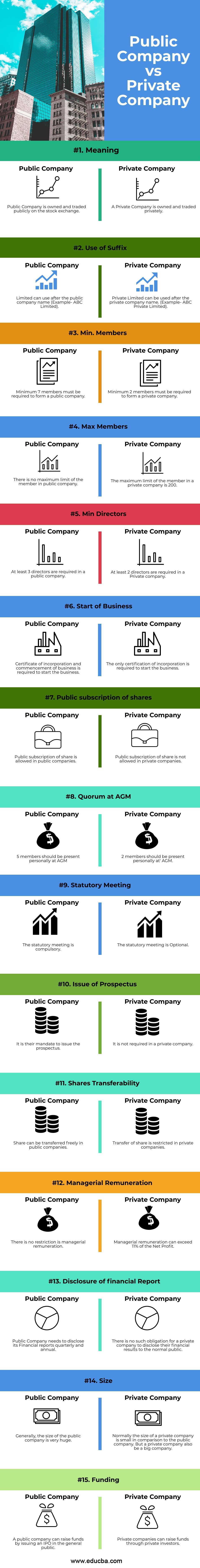

Head-to-Head Comparison: Public Company vs. Private Company (Infographics)

Below are the top 15 differences between Public Company vs Private Company:

Key Differences Between Public Company vs Private Company

Let us discuss some key differences between Public Companies vs. Private Companies.

- A public company is listed on a well-known stock exchange, while private limited companies are not.

- In a private company, calling a statutory meeting of members is not mandatory. In contrast, it is compulsory to have a statutory meeting in the case of a public limited company.

- Public companies need at least seven members to start, while private companies only need a minimum of two members.

- There is no capping for the maximum number of members in a public limited company. But a private company can have up to 200 members, subject to some conditions.

- There should be at least three directors to start a public company, and the minimum number of directors in a privately held company should be 2.

- In a public company, at least five members must be present personally at the Annual general meeting (AGM) to form the requisite quorum. At least two members should present at the AGM in a private limited company.

- The company can invite the General Public to a public limited company shares subscription. On the other hand, there is no such thing as a private limited company inviting the general public the subscription to share

- The issuance of the prospectus is compulsory in the public limited company; however, there is no such instance for the private limited company.

- In a private limited company, there is a restriction on the transferability of shares. In contrast, the shareholders of a public limited company can easily and freely transfer their shares.

- A Private Limited Company requires only a certificate of incorporation to start the business. Conversely, a public company requires a certificate of incorporation and a commencement certificate to start a business.

Public Company vs Private Company Comparison Table

Let’s discuss the top comparison between Public Company vs. Private Company:

|

Basis for Comparison |

Public Company |

Private Company |

| Meaning | It is public to the world, and any individual can trade their share and be an investor. | It has private individual owners and investors. |

| Use of Suffix | Can use “Limited” after their name (e.g., ABC Limited). | Can use “Private Limited” after their name. (e.g., ABC Private Limited.) |

| Min. Members | Requires seven members minimum to form a public company. | Requires two members minimum to form a private company. |

| Max Members | No maximum limit to members. | The maximum limit of members is 200. |

| Min Directors | Requires 3 directors minimum | Requires 2 directors minimum |

| Start of Business | A public company requires a certificate of incorporation and commencement to start the business. | A private company requires only a certificate of incorporation to create the company. |

| Public Subscription of Shares | Facilitates public subscription of shares. | Public subscription of shares is not allowed. |

| Quorum at AGM | Five members should be personally present at the AGM. | Two members should be personally present at the AGM. |

| Statutory Meeting | Compulsory | Optional |

| Issue of Prospectus | Mandatory to issue the prospectus. | Not mandatory to issue the prospectus. |

| Shares Transferability | Can freely transfer shares. | Restricted transfer of shares. |

| Managerial Remuneration | Managerial remuneration ranges from 5% to 11% of the net profit. | There is no restriction on managerial remuneration. |

| Disclosure of Financial Report | A public company needs to disclose its financial reports quarterly and annually. | A private company does not need to disclose its financial reports. |

| Size | Very large generally | Smaller than a public company, but it can be a big one as well. |

| Funding | Can raise funds by issuing an IPO to the general public. | Can raise funds through private investors. |

Famous Examples of Public Company vs. Private Company

Top 10 public companies based on their market capitalization:

|

Public Company |

Market Capitalization |

| Apple Inc. | $2.5 Trillion |

| Microsoft Corporation | $2.05 Trillion |

| Alphabet Inc. (Google) | $1.31 Trillion |

| Amazon Inc. | $1 Trillion |

| Tesla Inc. | $606.9 Billion |

| Meta | $525.89 Billion |

| Johnson & Johnson | $478.27 Billion |

| Exxon Mobil | $430.7 Billion |

| Walmart | $388.63 Billion |

| JPMorgan Chase | $378.19 Billion |

(Source: Companies Market Cap)

Top 10 private companies based on their revenue generation:

|

Private Company |

Revenue |

| Vitol | $505 Billion |

| Cargill Inc. | $165 Billion |

| Schwarz Group | $158 Billion |

| TATA Group | $128 Billion |

| Robert Bosch | $95.13 Billion |

| Huawei | $92.56 Billion |

| State Farm | $89.3 Billion |

| Nippon Life Insurance | $77 Billion |

| Deloitte | $59.3 Billion |

| IKEA | $48.21 Billion |

How Does a Company Go Public?

When a company decides to go public, it typically takes the following steps:

1. Hire an investment bank: A company’s first step is to hire an investment bank to assist with the IPO process. The investment bank will help determine the IPO price, the number of shares offered, and the timeline for the IPO process.

2. File a registration statement: The company then files a registration statement with the Securities and Exchange Commission (SEC), which includes financial, operational, and management information. The company does this to ensure SEC compliance and to make information available to potential investors.

3. Conduct Roadshows: The investment bank and the company hold roadshows to market the IPO to potential investors. Meeting with investors, presenting the company’s story and financials, and answering questions are all part of the job.

4. Set the offering price: The investment bank and the company determine the offering price for the IPO based on investor feedback. It is the price at which the company will offer its shares to the general public.

5. Allocate Shares: The investment bank then allocates the shares to institutional and retail investors as well as company insiders.

6. List on a stock exchange: Following the allocation of shares by the investment bank, the company lists its shares on a stock exchange, and trading begins. The company is now public, i.e., anyone can buy and sell its stock on the open market.

Regulations and Disclosure Requirements

Due to the higher interest in public companies’ operations and financial performance, they are typically subject to stricter regulations and disclosure requirements than private companies. However, both businesses must abide by several laws and rules to function legally and avoid disciplinary action and monetary fines. The following are the essential rules and disclosure requirements for public company and private companies:

Public Companies

Securities laws: Several securities laws and regulations, such as the Securities Act of 1933 and the Securities Exchange Act of 1934, apply to public businesses. These laws regulate the issuing and trading of securities and mandate that public companies provide investors with specific information.

Financial reporting: Public businesses must submit periodic financial reports, such as annual reports (Form 10-K), quarterly reports (Form 10-Q), current reports, Form 8-K, etc., to the Securities and Exchange Commission (SEC). These reports must include comprehensive financial data on the business’s operations and success.

Corporate governance: Public businesses must abide by several rules and laws that address this topic, including those that address the make-up and duties of the board of directors, executive pay, and shareholder rights.

Private Businesses

State and federal regulations: Private businesses must abide by laws that the state and federal government sets. It may include employment laws, taxation rules, sustainable environment maintenance, etc.

Disclosure obligations: Investors or lenders may require private businesses to reveal specific information, depending on the conditions of any financing or investment agreements. It is regardless of the fact that private companies do not require filing regular financial reports with the SEC.

Corporate governance: Private companies may adopt specific governance practices to encourage accountability and openness even though they are not subject to the same rules as public companies.

Common Misconceptions

Some common misconceptions about public company vs. private company are as follows:

- Public companies are more significant: While some public companies are large and well-known, several of them are small-scale and unknown as well. Similarly, many private companies are also large and well-established (e.g., Dell Technologies, Bloomberg L.P, Ernst & Young).

- Private companies are less regulated: Private companies are subject to different regulations than public companies. However, government agencies still regulate them, and the company must comply with various laws and regulations.

- Public companies are more profitable: While some public companies are highly profitable, private companies have good profitability too. A company’s profitability depends on many factors, including the industry it operates in and its strategies.

- Public companies are more transparent: Public companies must disclose certain information to the public, such as financial statements and annual reports. However, they are not necessarily more transparent than private companies. Private companies may reveal more information to their stakeholders, such as investors and employees, than they are legally required.

- Private companies have more control over their operations: Private companies have more control over their functions but are still subject to various constraints, such as the need to generate profits and comply with multiple laws and regulations.

Trends and Future Outlook

Various variables are likely to impact the future of both public and private companies, including technological advancement, shifting stakeholder expectations, and greater regulatory scrutiny. The following trends are influencing the future of both public company vs. private companies:

Increased emphasis on ESG (Environmental, Social, and Governance) issues:

- In the present world, stakeholders focus more on ESG issues in the business world and call on businesses to address them more actively.

- Companies that emphasize ESG problems will likely be more successful in the long run.

Increased adoption of technology:

- Both public and private companies are adopting technology at an accelerated rate, opening up new business possibilities using innovations like artificial intelligence, blockchain, and the Internet of Things.

- Businesses that can use technology in the future will likely be more successful and competitive.

More emphasis on stakeholder capitalism:

- It is becoming more prominent as businesses increasingly understand to serve the interests of all stakeholders, not just the shareholders.

- Companies must emphasize the needs of their customers, workers, and other stakeholders.

The continued growth of private equity:

- Private equity firms are becoming increasingly significant in business, lending money and advising private companies on their strategy.

- Private equity firms play a substantial part in the development and success of private companies.

Greater regulatory, investor, and public scrutiny of publicly traded companies:

- Regulators, investors, and the general public increasingly prioritize transparency, responsibility, and ethical conduct.

- Business success is more likely for companies that can meet these demands.

Conclusion

We have seen both types of companies, which have their own share of advantages and disadvantages. A private company cannot issue its share, and a public company can raise capital from the general public by issuing securities. Majorly, the public company size is relatively higher than private companies. A public can transform into a private company, or a private company can be transformed into a public company by offering an IPO.

Frequently Asked Questions (FAQs)

Q1. Is it Better to Have a Public Company or a Private Company?

Answer: Whether it is better to have a private or public company depends on factors like the company’s goals, growth potential, funding requirements, level of transparency, and more.

Private companies generally have more control over their operations and can avoid regulatory and reporting requirements. They also have decision-making flexibility and can focus on long-term goals rather than satisfying short-term investor demands. However, they may find it challenging to raise capital as they can’t use the public markets.

On the other hand, public companies can access a larger pool of capital through public offerings and gain market credibility and visibility. They are, however, subject to regulatory compliance, shareholder scrutiny, and quarterly financial reporting obligations.

Q2. What is a Public Company vs. Private Company Example?

Answer: Here is an example of a private and public company:

Public Business Example:

Meta, also famously known as Facebook, went public in February 2012. From its initial public offering (IPO) of 421.23 million shares at $38 each, Meta raised $16 billion.

Private Business Example:

Discord, an online chat startup launched in 2015, is a private business owned by Jason Citron and Stan Vishnevskiy. With more than 350 million users, it generated a revenue of $200 million in 2021.

Q3. What are the Top five Public Companies?

Answer: As of March 2023, the top five public companies by market capitalization are Apple, Microsoft, Alphabet (the parent company of Google), Amazon, and Facebook.

Q4. Is Apple a Private Company and Google a Public Company?

Answer: Apple and Google are public companies listed on the NASDAQ stock exchange under the AAPL and GOOGL, respectively. Google (now Alphabet) went public in 2004 and raised $1.9 billion, while Apple went public through an IPO in December 1980 and raised approximately $100 million.

Q5. What are the Benefits of a Public Company vs. Private Company?

Answer: Public companies can raise significant capital by selling shares to the general public. Furthermore, being publicly traded can boost its visibility and credibility, making attracting customers, suppliers, and employees easier.

In contrast, private companies possess extra control over decision-making and strategy because of a lack of shareholder pressure. Furthermore, they do not have to adhere to strict regulations and reporting requirements.

Q6. What are the Drawbacks of a Public Company vs. Private Company?

Answer: The disadvantage of being a public company is the increased regulatory and reporting requirements. They also face increased scrutiny and pressure from investors, impacting decision-making and strategy.

On the other hand, being a private company limits its ability to raise capital. Moreover, attracting customers, suppliers, and employees becomes challenging due to having a lower profile.