Updated July 7, 2023

What is Public Finance?

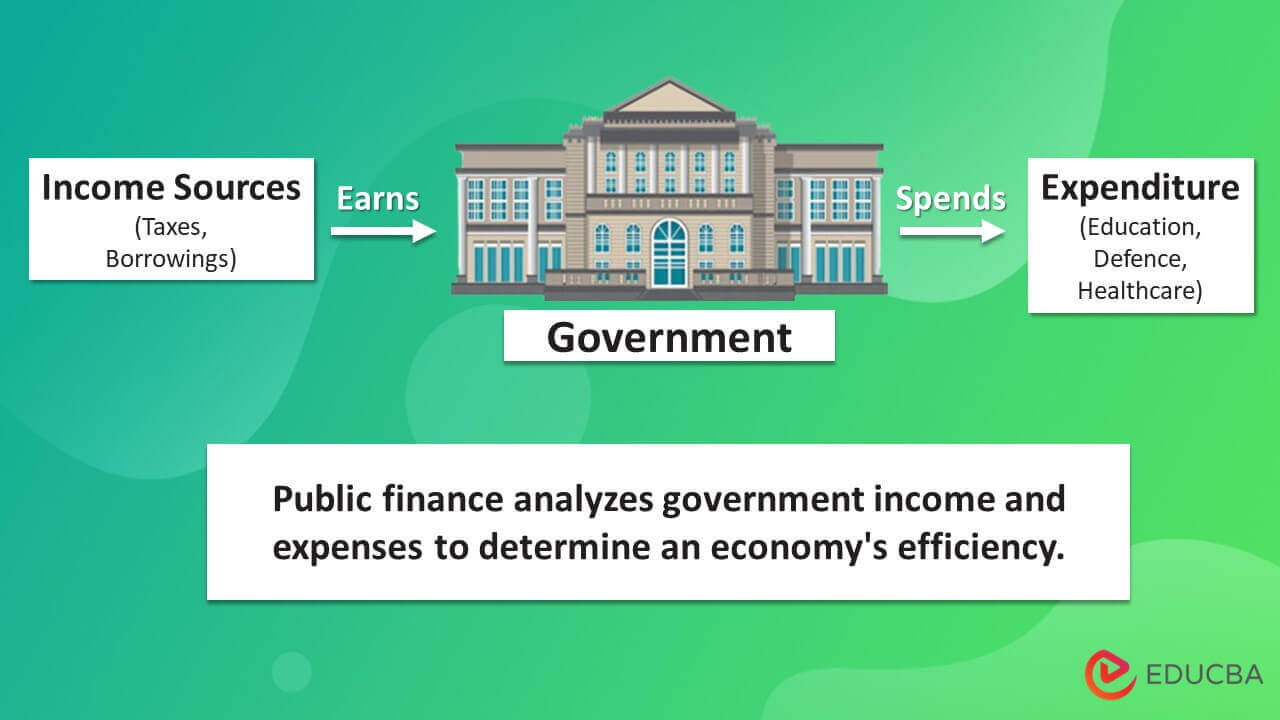

Public finance studies how a government manages its budget and collects taxes to spend on public services for economic growth.

For example, the US federal government announced a third consecutive 0.75% rate hike in the interest rate. The purpose is to deal with inflation and control public spending. Therefore, the US government is handling its expenses to improve the economy.

The main objective is to ensure that all the needs and requirements of the general public are satisfied. It includes taxation, debt, budgetary policy, and spending on food, health, basic infrastructure, education, housing, etc. Contributing towards these essential needs of the general public helps contribute to the nation’s development. In the USA, the Office of Public Finance oversees the function of public financing.

Key Highlights

- Public finance focuses on the government’s financial affairs and their economic impact.

- Its five components are revenue, expenditure, budget, deficit/surplus, and national debt.

- It encompasses all aspects of government spending, revenue, and borrowing, and its scope includes the study of tax systems, government expenditures, and debt management.

- It is associated with government financial management, whereas private finance concerns private businesses and corporations’ financing.

Examples of Public Finance

Example #1

The government of the USA collected a total tax of $4.9 trillion in the fiscal year 2022, whereas its spending was $6.27 trillion. It resulted in a deficit of 1.38 trillion for the year.

Example #2

On March 31, 2022, Peru borrowed $500 million from the world bank. This loan was to strengthen the foundations for a green, resilient economy. This amount is known as deficit spending.

Components of Public Finance

1. Revenue

- Revenue refers to the money that the government collects from different sources, like income tax, corporate tax, penalties, etc.

- The government uses this money to finance its operations and public services.

2. Expenditure

- It is the money that the government spends on different things, including salaries, benefits, and other costs

- The government must carefully manage its expenses to ensure it only consumes what it can afford.

3. Budget

- The budget is a plan that outlines how the government collects and spends public funds

- The government needs to stick to its budget to avoid overspending and going into debt.

4. Deficit/Surplus

- If the government spends more money than it collects, it has a deficit. Similarly, if it collects more than it spends, it has a surplus

- The government must avoid a deficit; otherwise, it can lead to debt problems.

5. National Debt

- The national debt refers to the amount of money that the government owes to citizens or other counties

- The government should reduce its debt levels to avoid future financial problems.

Scope of Public Finance

- It contributes to financial stabilization by promoting savings and investments through various government policies.

- It ensures economic stability by controlling resource allocation and equal wealth distribution.

- It also assists in enhancing national exports and developing public infrastructure.

Public Finance Functions

- Macroeconomic stabilization: Utilization of fiscal policy to stabilize aggregate demand in an economy by adjusting government spending and taxation

- Resource allocation: It is the use of policies to influence the allocation of resources in an economy

- Distributive justice: Distributing resources equally in an economy among all citizens of the nation.

Public Finance vs. Private Finance

| Public Finance | Private Finance |

| It is a macroeconomic concept that refers to the government’s role in effectively growing a nation’s economy while being responsible for managing the finances. | A microeconomic concept refers to an individual’s financial dealings, i.e., how they use financial resources to fulfill personal goals. |

| The legislative branch is responsible for examining and approving the budget. | A person’s/company’s budget is not subject to surveillance, nor does it need to be authorized by the government. |

| It contributes to the economic and social growth of the country, both on a domestic and an international scale. | Individuals/businesses use financial management to increase personal profits and growth. |

| All economic and financial transactions must be transparent to the country’s citizens. | Private transactions do not need to be published publicly. They might only be necessary for personal requirements, like a loan or mortgage. |

Importance of Public Finance

- It is a critical area of economics that helps policy-makers make informed decisions about raising funds and allocating resources.

- It ensures that the government has the resources to function effectively and provide services to citizens.

- It also plays a critical role in stabilizing the economy by managing fiscal policy, which regulates funds utilization to influence economic activity.

- It can be helpful to stabilize the economy in times of crisis, such as during a recession. And it also plays a vital role in promoting economic growth.

Final Thoughts

Public finance is a critical component of any government and plays a vital role in ensuring the stability and prosperity of a nation. A robust finance system can help fund essential services, reduce poverty and inequality, and promote economic growth. While there are many challenges to implementing effective fiscal policies, the benefits can be substantial.

Frequently Asked Questions(FAQs)

Q1. What is the main objective of public finance?

Answer: Government financial decisions directly impact citizens’ incomes, living, and the economy’s overall health. Thus, it analyzes how the government adjusts economic factors to achieve desirable effects. It also evaluates these decisions to ensure the government avoids any undesirable situation.

Q2. What are the primary sources of public finance?

Answer: The three primary sources of this finance are taxation, borrowing, and government spending. Taxation is the primary source of finance, providing the government with revenue to fund its operations. The most common types of taxes are income, sales, and property. Borrowing is another crucial source of finance. The government may borrow money from individuals, businesses, or financial institutions to finance its operations.

Q3. How can the public benefit from public finance?

Answer: One way the public can benefit from it is through lower taxes. The government can do so without raising taxes when it finances public projects, such as infrastructure or education. It frees up money for households and businesses, which they can use to purchase other goods and services, stimulating economic activity.

Recommended Articles

This article provides details regarding Public Finance. It explains its scope, functions, and components. You can get more information by reading the following articles,