Updated November 17, 2023

Difference Between Public vs Private Accounting

Public accounting: The easiest way to understand the difference between Public vs Private accounting is to understand who they render their services. A public accounting firm has the expertise and resources to provide accounting, auditing, taxation, consulting & advisory services to the broader client segment, such as Government agencies and Multinational organizations. Private accounting is a relatively narrower concept and is limited in nature and function. In essence, private accounting is a function of the organization and refers to the upkeep of the accounts associated with any specific business. Private accounting is usually considered an ‘internal’ part of the organization, as private accountants are a part of the business and corporate structure.

Public vs Private Accounting – Explanation

Recording day-to-day business transactions systematically and in accordance with international accounting standards enables effective decision-making in accounting. Any business entity involved in monetary transactions must maintain a record of it, as per the accounting standards. An ‘Accountant’ maintains an organization’s accounts by systematically recording accounting transactions, using their education and training in accounting concepts and procedures.

Public Accounting

Public accountants hold professional accounting certifications such as Certified Public Accountants (CPA) and possess the necessary knowledge to carry out their duties effectively. Due to the fact that public accounting firms are not a part of their clients’ corporate or company structures, they are commonly referred to as “External accounting firms.” They usually cater to various clients, ranging from small businesses, large corporations, and Non-government organizations to Government agencies, and charge fees for their services. The Big Four (Deloitte, KPMG, E&Y, and PWC) are the classic examples of public accounting firms, as they are an external yet essential part of their clients.

Private Accounting

Often the work of private accountants is reviewed and audited by public accounting firms—this process leads to establishing the fact that the internal accounting practice of the organization meets the reporting standards. Private accountants typically set up an organization’s accounting systems, maintain day-to-day accounting ledgers, and ensure the accounting process is carried out systematically. Private accountants receive training in processing accounting transactions, such as billings, payments, accounts payable, and accounts receivables. Typically, Private entities, small-large medium-sized businesses, and government agencies hire private accountants on their payroll and designate them to carry out day-to-day accounting work.

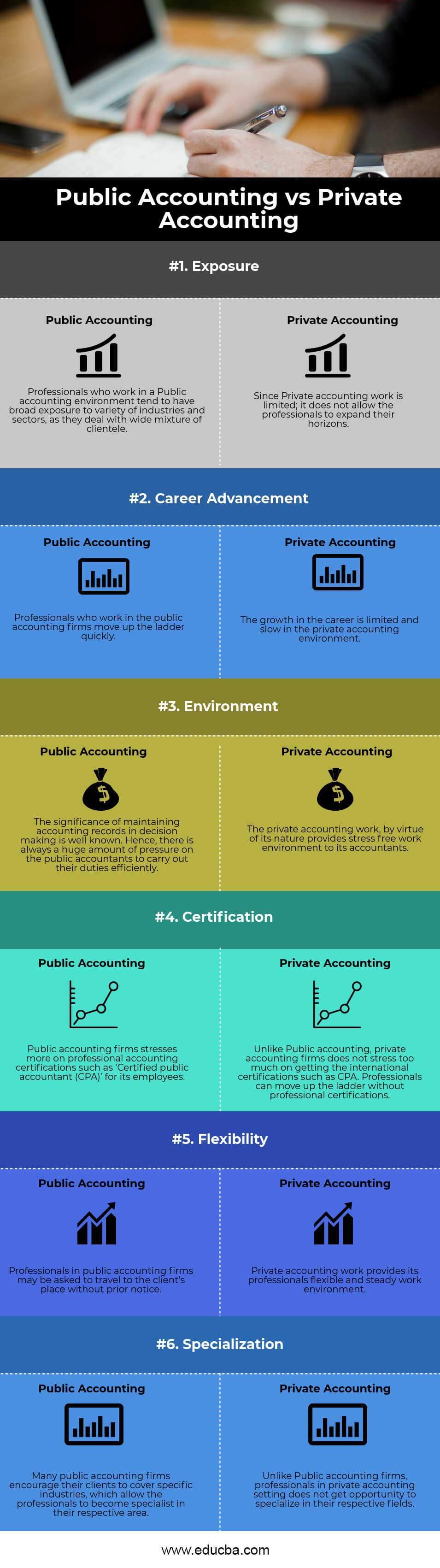

Public Accounting vs Private Accounting (Infographics)

Below is the top 6 difference between Public vs Private Accounting:

Key Differences Between Public vs Private Accounting

Public vs Private Accounting are key components of the Balance of Payments and differ in nature. Let us discuss some key differences :

- Public accounting is an ‘external’ part of any organization. It does not have any place in its corporate structure, whereas private accounting is an ‘internal’ part of the organization and is an integral part of the corporate structure.

- The big four companies (Deloitte, KPMG, PWC & E&Y) are examples of public accounting firms, and private accounting professionals take their place in the private accounting space.

- Public accounting encompasses accounting and advisory work, while private accounting is restricted to internal business transactions.

- Public accounting firms can review & audit the work done by private accounting professionals, whereas private accounting professionals don’t do the same.

- Some examples of the work done by Public accounting firms are 1. Auditing the financial statements and giving an opinion on the same, 2. Providing advisory on the accounting policies & methods of the clients, 3. Helping clients pay their taxes as per the taxation rules. Private accounting work involves 1. Recording daily business transactions in the accounting books, 2. Setting up systems to ensure compliance with the accounting rules, 3.Carrying out internal audit of the records promptly.

Public vs Private Accounting Comparison Table

Below is the topmost Comparison between Public vs Private Accounting:

| The Basis Of Comparison |

Public Accounting |

Private Accounting |

| Exposure | Professionals who work in a Public accounting environment tend to have broad exposure to various industries and sectors as they deal with a wide clientele. | Private accounting work limits professionals from expanding their horizons. |

| Career Advancement | Professionals who work in public accounting firms move up the ladder quickly. | The private accounting environment limits career growth and progression, resulting in slow professional advancement opportunities. |

| Environment | The significance of maintaining accounting records in decision-making is well known. Hence, there is always a huge pressure on public accountants to carry out their duties efficiently. | The private accounting work, by its nature, provides a stress-free work environment to its accountants. |

| Certification | Public accounting firms stress more on professional accounting certifications such as ‘Certified public accountant (CPA)’ for their employees | Unlike Public accounting, private accounting firms do not stress too much about getting international certifications such as CPA. Professionals can move up the ladder without professional certifications. |

| Flexibility | Public accounting professionals may have to travel to client locations without prior notice. | Private accounting work provides its professionals flexible and steady work environment. |

| Specialization | Many public accounting firms encourage their clients to cover specific industries, allowing the professionals to become specialists in their respective areas. | Unlike Public accounting firms, professionals in private accounting settings do not get an opportunity to specialize in their respective fields. |

While both have pros and cons, they are integral to the businesses. No business functions without getting involved in monetary transactions, and to keep track of the transactions for analysis, they maintain a record of it. It won’t be wrong to say that no business can survive without maintaining the accounts.

Conclusion

Public vs Private accounting is the two significant parts of the Accounting framework of the entities, and both require diligence, expertise, and resources to carry out their work efficiently. Public and private accounting both ensure that they maintain accounting transactions per accounting standards and reflect a fair picture of the organization’s financial health, although they differ in scope, functions, and nature.

Recommended Articles

This has guided the top difference between Public Accounting and Private Accounting. We also discuss the Public Accounting vs Private Accounting key differences with infographics and comparison tables. You may also have a look at the following articles to learn more –