Updated July 14, 2023

Introduction of Put-Call Parity

Put-Call Parity is a key concept in options trading and pricing. Options are derivatives that derive their value from the underlying asset, interest rates, dividends, forecasted volatility in asset value, and the period of expiration of the option.

The put-call parity theory demonstrates that the prices of the put option, call option, and the underlying asset must be consistent.

Explanation

Put-call parity is an equation that creates a relationship between the price of the call option and the put option with the same underlying asset. This relationship will work only when the underlying asset, expiration date, and strike price of both the put and call options are the same.

It works only for European options. These options can be exercised only at the expiration date, unlike the American options, which can be exercised on any date until the expiration/maturity date.

How Does it Work?

Put-call parity states that holding both put option and call option with the same underlying asset at the same time with identical strike price and expiration date will yield the same return as a forward contract with the same expiration date that of options, and the forward price will be the same as that of the strike price of the options. If this relationship does not hold well, trading has an arbitrage opportunity, and traders can earn a risk-free profit. If the price of the underlying asset changes, then it affects the price of both the call option and the put option.

The Equation for Put-Call Parity

The equation for put-call parity is given below:

- Call option = Price of the European call option

- Present value of Strike price = It is discounted from the expiration date. The discount rate is the risk-free rate.

- Put option = Price of the European put option.

- Underlying asset = Spot price or Current market price of the underlying asset

Example

Mr. A purchases a European call option for X Corp stock. The strike price is $100, the expiration date is one year from the purchase date, and purchasing the call option costs $10. The Call option gives the right but not an obligation to purchase the X Corp stock at $100 on the expiration date, irrespective of the market price. If, on the expiration date, if stock of X Corp trades at $90, Mr. A will not exercise the option as it is less than the strike price. If the stock is trading is $110, then the option will be exercised, and it is break-even as Mr. A has already paid $10 for the call option initially. If the stock trades above $110, then anything above $110 is pure profit to Mr. A.

In the same way, if Mr. A sells a European put option for the same underlying asset, X Corp stock, and the same strike price, expiration date, and cost of the option. Mr. A will receive $10 for writing the put option, and now Mr. A does not have the right toward that option as he does not own it. The buyer who has purchased the option has the right but not an obligation to sell you the X Corp stock at $100. If the stock is trading more than $100, then the buyer will not sell the stock, and Mr. A’s only gain is $10, and if the stock is trading below $100, then it is a loss to Mr. A.

Solution:

- Present value of strike price = $90

- CMP of X Corp at the exercising date = $110

- $10 + $90 = ($10) + $110

- $100 = $100

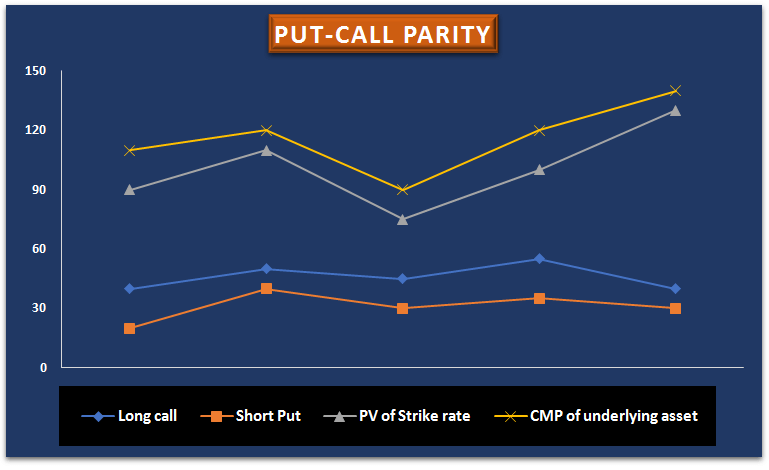

Put-Call Parity Graph

Graph of put-call parity is given below:

Assumptions of Put-Call Parity

The put-call parity principle works on the following assumptions.

- The interest rate does not change with time, and it is constant.

- The dividends to be received from the underlying stock are known and certain.

- The underlying stock is liquid, and there are no transfer barriers.

Implications of Put-Clal Parity

- Put-call parity implies that if there is no dividend payment and in the absence of other carrying costs, the implied volatility of the call and put options must be the same.

Importance of Put-Call Parity

- Put-call parity theory is important because if this relationship is not established, it leaves room for arbitrage opportunity, and traders make profits without risk.

- Put-call parity is an assessment for option spread strategies assuming that a long and short position acts as a hedge against risk.

Conclusion

The put-call parity principle states the relationship between the call option and put option with its underlying asset and strike price. This principle helps traders and investors understand option pricing and how it is impacted by demand and supply in the market. If this equation does not match the forward contract, arbitrage has scope, and traders can make risk-free profits. Successful traders are those who identify the market divergence and the mispricing in the market early.

Recommended Articles

This is a guide to Put-Call Parity. Here we also discuss the introduction and how does put-call parity work? Along with assumptions and importance. You may also have a look at the following articles to learn more –