Updated July 24, 2023

Put Call Parity Formula (Table of Contents)

What is the Put Call Parity Formula?

Put call parity concept establishes a relationship between the prices of European put options and calls options having the same strike prices, expiry and underlying security. Parity will be obtained when the differences between the price of call and the put option will be equal to the difference between the stock’s current price and the current value of the strike price. This will result in a zero profit or loss situation.

In this section, we are going to discuss a very interesting concept of the stock market, know as put-call parity. This concept applies only in the case of European options and not American options.

In order to understand the put-call parity concept, we need to understand the following terms-

- Put Option: The put option gives the holder of the option a right to sell the underlying security at a pre-agreed price, on a specified future date, irrespective of the prices prevailing in the market of the underlying security on such future date.

- Call Option: Call option gives the holder of the option a right to buy the underlying security at a pre-agreed price, on a specified future date, irrespective of the prices prevailing in the market of the underlying security on such future date.

- Strike Price: It means the price agreed by the holders of the options contract at which the underlying security will be sold (in case of a put) or purchased (in case of a call) in case the option is exercised.

- Spot Price: Spot price means the price prevailing in the market of the underlying security. In our words, it is the current price of the underlying security.

Formula

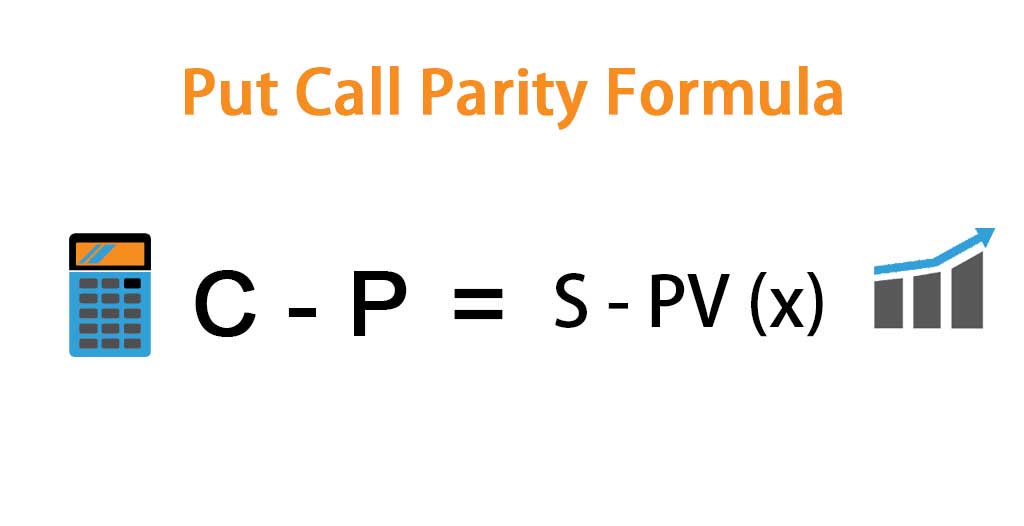

The formula for put call parity is as follows-

Where,

- C = Price of the Call Option

- P = Price of the Put Option

- S = Spot Price

- PV (x) = Present Value of the Strike Price, being “x.”

This equation suggests there shall be an equilibrium between the call option and the put option when they have the same strike price, underlying security and maturity date. The reason is that an investor goes for a call option for security when he expects the price will rise in the future by a certain amount, and he goes for a put option for the same security when he expects that the price will decrease in the future. Now, we shall move on to some examples so as to have a better understanding of the put call parity formula.

Examples of Put Call Parity Formula (With Excel Template)

Let’s take an example to understand the calculation of Put Call Parity in a better manner.

Put Call Parity Formula – Example #1

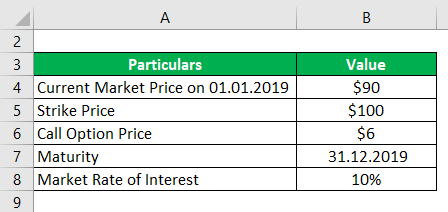

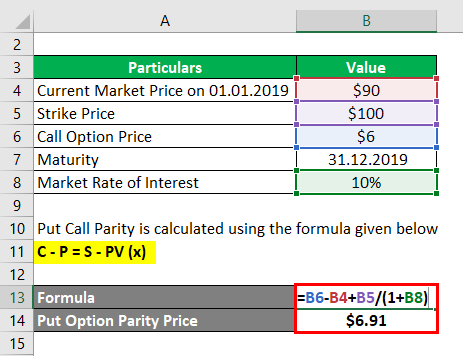

The following details are given with respect to stock.

Now let us calculate the price of the put option so that put call parity is maintained.

Solution:

Put Call Parity is calculated using the formula given below

C – P = S – PV (x)

- P = 6 – 90 +100 /(1+0.10)

- P = $ 6.91

If the put option is trading for $ 6.91, then the put and call option can be said to be at parity.

Put Call Parity Formula – Example #2

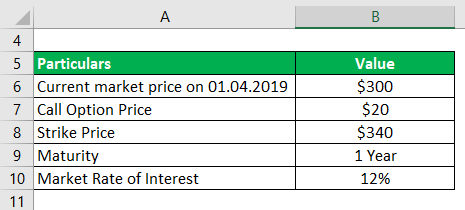

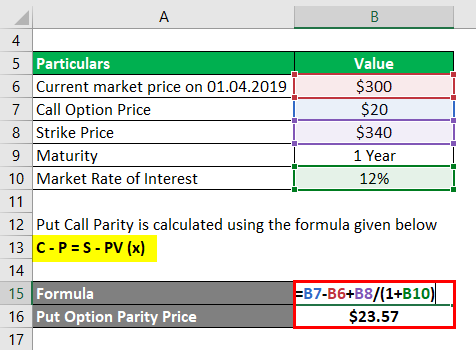

The stock of a company XYZ Ltd is trading in the stock market for $ 300 as of 01.04.2019. The call option is trading for $ 20 for the strike price of $ 340. The maturity of the contract is for one year. The risk-free return rate that is prevailing in the market is 12%. Now let us calculate the current price of the put option to maintain parity between the put and call option.

Solution:

Put Call Parity is calculated using the formula given below

C – P = S – PV (x)

- P = 20 – 300 +340 / (1+0.12)

- P = $ 23.57

Put Call Parity Formula – Example #3

Continuing with the previous example, let us understand what will happen if the put and call options are not at parity. So, let us say the put option is trading for $ 25, and the call option is trading for $ 23.57, and other conditions remain the, then an investor will buy the call option and invest the present value of Rs. 340, i.e. the exercise price for one year (This concept is known as a fiduciary call), sells the put option and sells the stock at the entice (This concept is known as protective put). The result is explained as follows with the help of the solution of cash flows that will arise-

- Selling Protective Put: Investors will receive $ 25 as a premium and $ 300 from the sale of the stock in the market at the current price. The total cash inflow will be $ 325.

- Buying Fiduciary Call: The investor will pay $ 20 as a premium and invest $ 303.57 (present value of strike price). Here, the total cash outflow will be $ 323.57

- Effective cash inflow = $ 1.43

Relevance and Use of Put Call Parity Formula

As explained in this article, the put-call parity concept establishes a relationship between the prices of European put options and call options having the same strike prices, expiry and underlying security and creates a position of no gain or loss. If the prices of put and call options do not follow this parity formula, then chances will arise for arbitration which an investor can utilize to obtain risk-free profits, as seen in our last example.

Recommended Articles

This is a guide to Put Call Parity Formula. Here we discuss how to calculate Put Call Parity Formula along with practical examples. We also provide a downloadable excel template. You may also look at the following articles to learn more –