Updated July 17, 2023

Definition of Put Options

A put option is a derivative contract that gives the option holder the right to sell the underlying securities or exercise the option held at a predetermined date and an agreed price.

The option holder has the right to exercise the option but is not obligated to do so. The agreed price on which the option holder may exercise the option is called a strike price. Different kinds of underlying assets put options are traded, like stocks, currencies, bonds, commodities, etc.

Explanation

Like other stock options, a put option with underlying assets as stocks are traded on the stock exchanges over the counter “OTC” market. The price of the underlying asset impacts the price of the put option. So, suppose the underlying asset’s price falls. In that case, the option holder will sell off the option by exercising the right to sell and make a profit due to the difference between the strike price and the market value of the underlying asset.

In other words, we can say that the value of the put option is conversely related to the market price of the underlying asset, i.e., when the price of the underlying asset falls, the value of the put option increases, and when the price of the underlying asset rises the value of put option goes down.

How Does Put Options Work?

Put options allow option holders to speculate over the downward movement of the underlying asset price. A small dip in the underlying asset price can lead to a huge profit for the put option holder. We can understand the working of the out option through the following points:

- Options traders expect a decline in the underlying stock price and wish to make money.

- Investors use the put option as a risk-management str, also called a protective put. Under this strategy, the put buyer ensures that the loss attached to the underlying asset does not go beyond the strike price, i.e., the price at which the put buyer would exercise the option.

- The option’s value also decreases when it reaches the expiration date due to the impact of time decay. When the put option loses time value, intrinsic value is left, which is the difference between the strike price and the market value of the underlying asset.

Example of Put Option

A bearish trader purchased a put option at the strike price of $70 per share or contract, which will expire in three months. The investor expects the price to go below $70 in the three months. The current price of the stock is $90 per contract. Now, if the price goes below $70 during the contract, the trader can sell the option at $70 per share and profit from the difference between the strike price and market value.

Types of Put Options

The types of put options can categorize in different ways:

- Put option as per the situation: The put option holder can experience the below three situations while exercising the option.

- In-the-money: In this situation, the strike price is more than the underlying asset’s price.

- At-the-money: In this situation, the strike price is equivalent to the underlying asset’s price.

- Out of the money: In this situation, the underlying asset’s price is above the option’s strike price.

- American Style put option: This type of put option gives its holder more flexibility because the option holder can exercise the option anytime between the purchase and expiration date.

- European style put option: The flexibility of exercising the option is nonexistent in this type of put option. Traders can only exercise the put option on the expiration date.

- Exchange-traded put option: These options are traded at the stock exchanges and are easily accessible to the general public.

- Over-the-counter put option: These options are traded on the OTC market and are not easily accessible to the general public.

Put Options Profit/Loss Chart

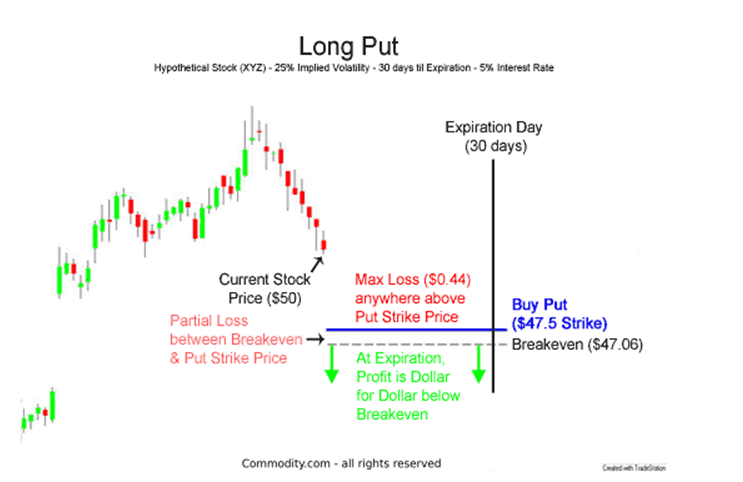

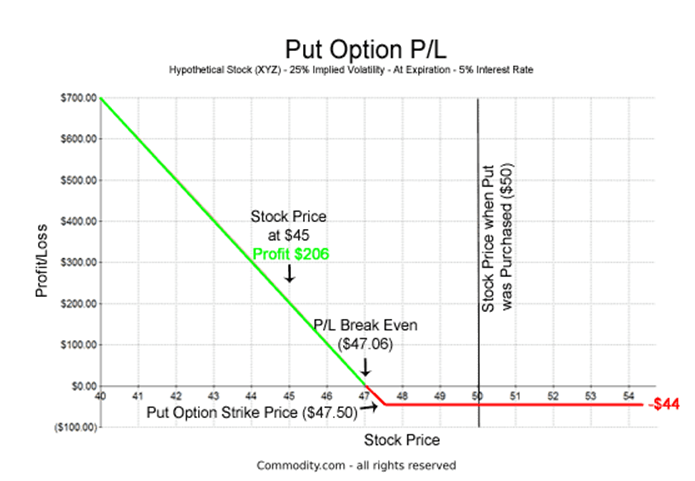

A trader expects that the price of the underlying asset of a put option he holds will go down to as low as $47.06 per contract in the next month. Currently, the stock is trading at $50. Considering the abovementioned expectations, the trader has selected the strike price as $47.50, trading for $0.44, i.e. ($47.50 -$0.44 =$47.06). The total cost of a contract bought by the trader would be (100 x $0.44) = $44.

From the above graph, we can clearly understand that if the stock price does not fall below $47.5, i.e., the strike price. A put option will be worthless, and the trader must bear the loss. There will be a partial loss if the price falls between $47.5 and $47.06. At $47.06, there will be no profit, no loss. And if the price falls below $47.06 at expiration, the trader will reap profit due to the difference between the strike price and the stock’s current market value.

Source: https://commodity.com/technical-analysis/options/put/

The above chart depicts the profit and loss for this particular put option for the strike price of $47.50 and the current price of $50.

How would Put Option Make Money?

A put option gives the trader the right to exercise or sell the option at an agreed price and date. The option holder can reap the benefit while speculating the downward movement of the pricing of the underlying stock.

In a put option, the trader makes a profit when the underlying asset’s price falls below the strike price before the expiration date. Therefore, if a trader is expecting a fall in the price of a certain underlying stock below a certain level, they can purchase the put option and make a profit from the difference between the strike price and the underlying stock’s market value.

Benefits

Following are the benefits as given below:

- A put option carries a limited level of risk when compared to short selling of stock.

- A put option must be paid only when exercised and requires less initial capital than common stock.

- They generally offer a higher percentage of return.

- They have a variety of underlying assets traded under their umbrella, like stocks, currencies, commodities, bonds, etc.

Conclusion

Put option helps investors with limited risk appetite reap the benefit of trading in various financial instruments under one umbrella. If used diligently, it can reap a great return for its owner. To trade in options, one must understand the options market well.

Recommended Articles

This is a guide to Put Options. Here we discuss the definition and how put options work. Along with benefits and types. You may also have a look at the following articles to learn more –