Updated July 24, 2023

Definition of Quick Ratio Interpretation

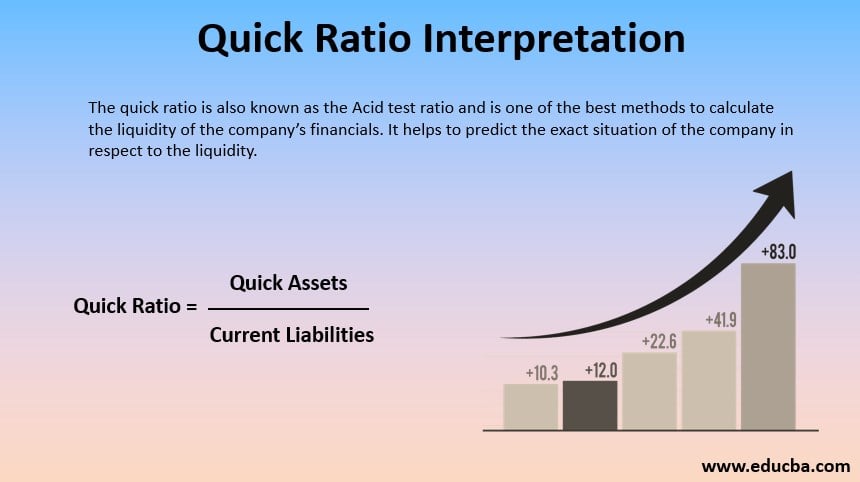

The quick ratio also is known as the Acid test ratio and is one of the best methods to calculate the liquidity of the company’s financials. It helps to predict the exact situation of the company with respect to the liquidity.

The quick ratio will tell the company that in case they don’t consider their sales revenue and only focuses on the current obligation, then will that company is able to cope with it or not?

The quick ratio is an indicator that will help the company’s management to understand its liquidity status. The company should always make an attempt to meet its current ongoing obligation with the funds available on its hands and therefore in that case, if the company is able to do that, then it is considered an ideal situation. The company should always consider the liquidity factor since this may help to pay off the short-term liabilities of the company with the assets mostly cash in hand within a short period of time. The assets which are considered as quick are always readily available to easily convert them into cash and make the best use of it.

Formula

The formula to calculate the quick ratio is

Here the Quick assets mean the Current assets minus all the inventories and minus all the prepaid expenses because only cash or near to cash assets are considered.

Current asset here includes sundry debtors, cash and bank balances, loans and advances, receivables, etc.

Current liabilities here include Bank O/D, outstanding expenses, provision for taxation, unclaimed and proposed dividend, short term loans from any financial institution, etc.

Example of Quick Ratio Interpretation (With Excel Template)

Let’s take an example to understand the calculation of Quick Ratio Interpretation in a better manner.

Example #1

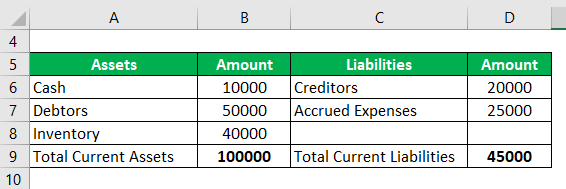

A company ABC has:

Cash- $10000, Debtors-$50000, Inventory-$40000, Creditors-$20000, Accrued Expenses-$25000. What will the Quick ratio of the company be?

Solution:

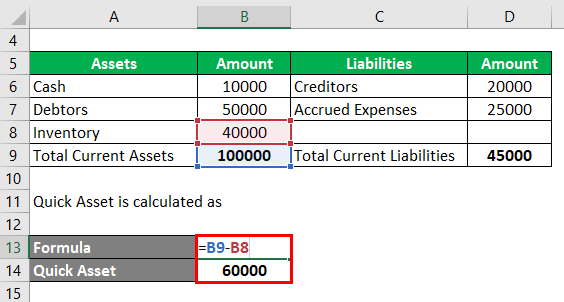

Quick Asset is calculated as

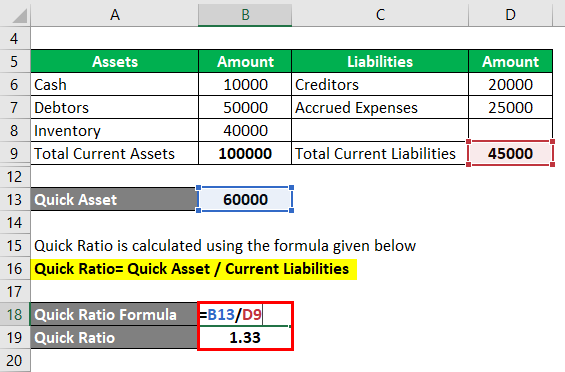

Quick Ratio is calculated using the formula given below

Quick Ratio= Quick Asset / Current Liabilities

The Quick Ratio of this company is good because it is more than 1:1.

How to Improve Quick Ratio?

The ratio 1:1 is considered as an ideal situation for the company if we are considering the quick ratio. The assets are sufficient to pay off the ongoing current liabilities. The improvement in the quick ratio is considered when the quick assets are more than the current liabilities. This is possible only if the company starts to increase its current assets except for the inventories and the prepaid expenses because these are not the cash assets.

To improve the quick ratio the company should consider making the assets more liquid the assets which are cash equivalents should be able to get converted into cash within 90 days of time. All the unwanted assets should be removed from the company so that the ratio calculation will be done in a correct and logical manner also it helps to improve the liquidity of the company. The company should also make some arrangement to clear all their bills or dues on time to improvise the quick ratio of the company.

Difference Between Quick Ratio vs Current Ratio

- The quick ratio is calculated by dividing the quick assets with the current liabilities whereas in the calculation of the current ratio the current assets are divided with the current liabilities to get the ratio.

- In quick ratio calculation, the inventories and the prepaid expenses are not considered whereas as in the current ratio all the current assets and current liabilities are considered.

- The quick ratio is more conservative than the current ratio since the quick ratio excludes a few items.

- Only the liquid assets or liquid able assets that can be easily converted into cash within 90 days of time are considered in this quick asset calculation while in case of current ratio all the current assets are considered.

Importance of Quick Ratio

- The quick ratio is very conservative and helps to find the exact liquidity of the company.

- It helps the management to understand that it’s time to pay off their liabilities.

- It is a better technique of decision making the then-current ratio of the company.

- The quick ratio doesn’t take inventory to its calculation and therefore the liquid cash and cash equivalent is considered and it is also very appropriate to do so.

- The quick ratio also helps the management to dispose of the unwanted assets and the liabilities to get an exact quick ratio.

- Quick ratio calculation can be very technical for big companies but once it is done it will help in a number of ways.

- The quick ratio helps to make the management realize the assets which can be used to quickly pay off the liabilities.

- The quick ratio is very significant in decision making for the investors also.

- Prepaid expenses are also not a part of this quick ratio calculation since it is not a liquid asset that can be used.

Conclusion

The quick ratio is calculated by dividing the quick assets with the current liabilities. In a quick ratio, the quick assets are used because they are easily converted into cash. The company should make arrangements to clear the dues of the company with immediate effect so that the quick ratio of the company is maintained. An ideal quick ratio is 1:1 that means assets are sufficient to pay off the liabilities. This means if the income from the sales is not considered then also the company should have enough money to pay off all its ongoing liabilities with the liquid funds available with them in the company.

Recommended Articles

This is a guide to Quick Ratio Interpretation. Here we discuss how to calculate quick ratio interpretation along with a practical example. we also provide a downloadable excel template. You may also look at the following articles to learn more –