What are Real Assets?

What are Real Assets?

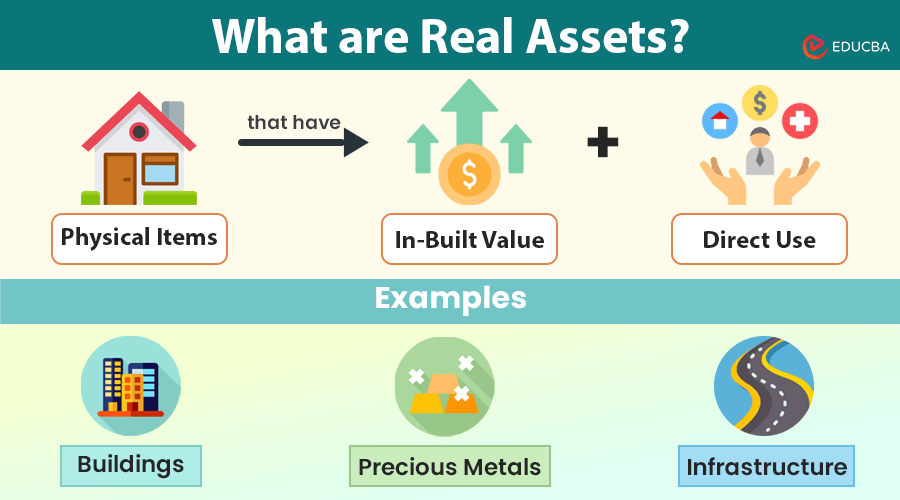

Real assets are physical items like buildings, gold, and bridges that have real, in-built value. This value comes from their physical properties, usefulness, and ability to generate income either through use or just ownership.

They are often stable investments because they are tangible and can hold their value over time. For example, if you own a piece of land, you can use it for farming to generate income or simply hold onto it, and its value may increase over time.

Table of Contents

Types of Real Assets (With Examples)

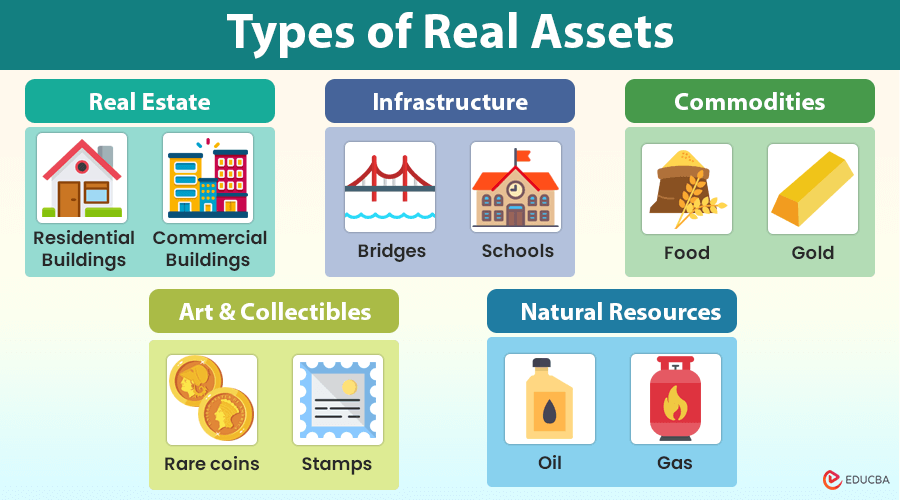

Real assets come in various forms, and the type of real asset an investor chooses will depend on their investment objectives, risk tolerance, and investment horizon.

Real assets come in various forms, and the type of real asset an investor chooses will depend on their investment objectives, risk tolerance, and investment horizon.

Here are some of the main types of it:

1. Real Estate

It includes:

- Residential properties (houses, apartments)

- Commercial properties (office buildings, shopping centers)

- Industrial properties (factories, warehouses)

- Land

Investors in real estate can generate income through rental payments or by selling properties later for profit when their value increases. Factors such as location, demand, and economic conditions can influence the value of real estate. Real estate can be bought directly or through investment options known as real estate investment trusts (REITs).

2. Natural Resources

Natural resources are materials that we naturally find in the environment, such as:

- Oil

- Gas

- Minerals

- Timber

- Water

Investors can profit from natural resources through investing, extraction, and sale. For example, you might buy shares in a company that drills for oil or invest in funds that track the prices of commodities like oil or timber. The value of natural resources fluctuates based on factors like global demand, geopolitical events, and technological advancements in extraction techniques.

3. Commodities

Commodities are basic things we need, like:

- Food

- Metals (Gold, Copper, etc.)

- Energy

For example, farmers grow wheat and soybeans, miners dig up gold and copper, and companies drill for oil and natural gas. Factors like bad weather, political tensions, or changes in supply can affect prices.

4. Infrastructure

Infrastructure assets are physical structures and systems that provide essential services to society, such as:

- Roads, bridges, airports, ports (Transportation)

- Water supply, electricity, gas (Utilities)

- Telecommunications networks, internet infrastructure (Communication)

- Schools, hospitals, prisons (Social infrastructure)

Infrastructure investments often offer stable cash flows and long-term returns, typically through user fees, tolls, government subsidies, public-private partnerships, or regulated monopolies.

5. Art and collectibles

Collectible assets are tangible items valued for their rarity, historical significance, craftsmanship, or aesthetic appeal.

This category includes:

- Art (paintings, sculptures, and fine art prints)

- Antiques

- Rare coins

- Stamps

- Vintage automobiles

- Fine wines

- Jewelry

Collectibles can serve as alternative investments and may profit from buying and selling these items over time.

Characteristics

These assets are physical or tangible assets with intrinsic value due to their importance and properties. Here are some of their key characteristics:

1. Tangibility

They exist in the physical world. You can touch, feel, and see them. For example, real estate properties like houses or buildings are tangible assets because you can physically visit them.

2. Intrinsic value

They have inherent value because of their utility or usefulness. For instance, land can be used for farming, building, or recreational purposes, giving it intrinsic value beyond its monetary worth.

3. Durability

They tend to have long lifespans or durability. Proper maintenance of buildings, infrastructure, and natural resources can last for decades.

4. Scarcity

Many such assets are limited in supply. For example, there’s a finite amount of land available for development, and certain commodities like gold or oil have limited quantities in the earth’s crust. Hence, they are potentially valuable.

5. Illiquid

They are often illiquid and may take time to buy or sell. For example, it may take months to sell a commercial property, whereas you can sell a financial asset such as a stock instantly.

Real Assets Vs. Financial Assets

Real and financial assets are two broad categories of assets people can invest in.

| Aspect | Real Assets | Financial Assets |

| Meaning | Physical or tangible assets with intrinsic value | Claims to future cash flows, usually in the form of securities |

| Examples | Real estate, machinery, commodities, gold | Stocks, bonds, bank deposits, mutual funds |

| Tangible/Intangible | Tangible | Intangible |

| Liquidity | Generally less liquid, harder to convert to cash | Generally more liquid, easier to convert to cash |

| Market Volatility | Often less volatile, but can vary by type and location | Often more volatile due to market fluctuations |

| Income Generation | Can generate rental income or usage fees | Generates interest, dividends, or capital gains |

| Value Depreciation | Subject to physical depreciation and may value over time | Typically, it does not depreciate physically but can lose market value |

| Ownership Evidence | Physical possession or legal documents (deeds, titles) | Ownership certificates or electronic records |

| Inflation Hedge | Often a good hedge against inflation (e.g., real estate) | It can be a hedge against inflation, which depends on the type (e.g., stocks) |

| Risk | Market risk, physical damage, maintenance costs | Market risk, credit risk, interest rate risk |

| Investment Horizon | Often beneficial for long-term investments | Can be short-term or long-term investments |

| Accessibility | Typically requires significant capital to invest | It can be accessible with smaller amounts of capital |

Frequently Asked Questions (FAQs)

Q1. Why are real assets important?

They are important because they have practical uses and help generate income. As these assets are tangible, they provide a sense of security and ownership that is particularly reassuring during uncertain times. Furthermore, as they have intrinsic value, they help protect against inflation and investing in them provides stability and long-term growth.

Q2. Investing in real or financial assets – which is more beneficial?

Real and financial assets are two broad categories of assets people can invest in. Investing in real assets, like property and commodities, provides stability and has a high potential for long-term growth as their values tend to increase over time. On the other hand, financial assets are typically more liquid and easier to trade than real assets. They also provide returns in interest, dividends, and capital gains.

As you can see, each type offers different benefits and opportunities, so investors should consider their goals, risk tolerance, and preferences when choosing investments. Combining both real and financial assets can create a diversified portfolio that reduces risk and enhances returns.

Q3. What are the disadvantages of real assets?

It offers several advantages, like inflation protection, diversification, and potential for income generation. However, they also come with some disadvantages, such as:

- Requires significant initial capital investment, limiting accessibility for some investors.

- High transaction costs include buying, selling, and maintaining assets such as property.

- Illiquidity can make it challenging to sell quickly, especially during economic downturns.

- Vulnerable to market fluctuations, geopolitical risks, and regulatory changes.

Recommended Articles

We hope this article gives you a detailed understanding of the concept. For more asset-based articles, here are some resources: