Updated July 29, 2023

Definition of Real Interest Rate

It is an indicator of the purchasing power of money in an economy. It takes into account the effects of inflation on the nominal interest rates.

For example, a bank might offer a 4% interest rate on its savings account, but if the inflation rate is 5%, then an investor is actually losing his money by 1% per annum. Here 4% is the nominal interest rate, and -1% is the real interest rate. This implies the importance of real interest rates, which helps in analyzing the real return on investments compared to the nominal interest rates, which are misleading as, most of the time, they provide an incomplete picture. Simply put, it measures by calculating and deducting the current inflation rate from risk-free investments like treasury bonds.

Real Interest Rate Formula

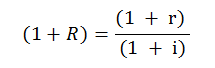

In mathematical form, the formula is as follows:

Where,

- R = Real interest rate

- r = Nominal interest rate

- i = Rate of inflation

This is the formula of real interest rate used in almost all financial calculations and analysis, and it is more simple and approx. The formula is used more often, illustrated as follows:

This formula gives a direct and better picture of the two interest rates and their relationship.

Example of Real Interest Rate

Below is an example of Real Interest which is as follows:

Example #1

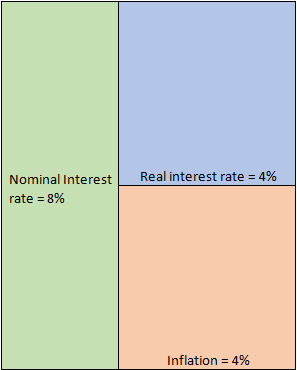

Let’s assume that you invest $1 million in a corporate deposit for 10 years which promises an 8% interest rate per year. In ideal circumstances, this is the rate at which you can expect your money to grow. However, this is just a hypothetical scenario, as one has to consider the pertaining inflation rate. For the sake of simplicity, let’s assume that for 10 years, there was a constant inflation rate of 4%. This inflation is effectively eating your money as you might have been promised an 8% return, but year on year, the purchasing power of that money is decreasing by 4%. Hence the real interest that you are getting on your investment is only 4%, as derived from the below equation.

- Real Interest Rate = Nominal Interest Rate – Rate of Inflation

- = 8% – 4%

- = 4%

Diagrammatically, it can be illustrated as:

Implications

Under normal circumstances, in a growing economy, Real Interest Rate (RIR) is positive. This means that the economy is growing steadily and effectively countering the effects of inflation. In our example, even though the inflation was 4%, it was still manageable as we got an 8% return on investment. Central banks are more interested in RIR than nominal interest rates simply because it is effectively a better measure of the purchasing power of people.

A high RIR is cheered by debt investors. This is because, in such a scenario, they are assured of a better return on their investments without taking any additional risk. However, the scenario is completely different for equity investors because higher interest rates increase the cost of borrowing for corporates. This disturbs the leverage equilibrium, which puts pressure on profits, earnings per share, and, eventually, stock price. Also, because of the higher rates, more people are inclined to take their money from equity markets and park it in less risky debt instruments, eventually decreasing the number of buyers and increasing the number of sellers. This also adds more pressure on the stock prices. This is where central banks have to act and maintain a balance else the growth rate of the economy takes a hit.

Unlike these scenarios, there might be a case when RIR is negative. This is quite scary as it suggests that economic growth cannot counter inflation, and money’s purchasing power decreases yearly. This might have a catastrophic effect as people will refrain from deposits, and banks will not have any money to lend. This will lead to liquidity and credit crunch, and the cost of borrowing will increase for the corporates, affecting the growth momentum. Additionally, the negative real interest rates will affect not only shun away foreign investors but also domestic investors, who will now look for investment opportunities elsewhere. All these factors will eventually further affect the economy’s growth, leading to a vicious circle.

It becomes imperative for an investor to understand the difference between the real interest rate and the nominal rate. It helps in understanding if an investment is worth investing in or not. At the macroscopic level, it helps determine if the GDP growth numbers are as good as they look on paper. For example, consider a developing economy having a GDP growth rate of 8%. This looks promising compared to developed economies where the growth has stagnated and the GDP is growing at a flat rate of 1- 2%. Global and domestic investors would like to infuse their money into the growing economy in anticipation of a better investment return. However, there is a catch to it. What if the inflation rates are also too high, say 7%? When this high growth rate is combined with the high inflation rate, the effective interest rate is only 1%.

This completely changes the picture as an effective return on investment is meager. Though this might not affect global investors in the short run, surely domestic investors will shun away. They would take out their money and look for opportunities elsewhere. In the long term, this will affect the flow of money in the economy as people will refrain from bank deposits leading to a liquidity crunch which will impact the growth momentum and start reflecting in the corporate balance sheets, eventually impacting the economic growth cycle.

Conclusion

As explained earlier, it is clear how nominal interest rates can be misleading. On the other hand, RIR provides a better picture, thereby helping incomplete financial analysis and calculation of the internal rate of return. An investor should always look at a real interest to understand if any financial instrument is attractive and satisfies their investing goals. A nominal interest rate is more about taking investments at their face value, while real interest rates are more about reading between the lines.

Recommended Articles

This has been a guide to what is Real Interest Rate. Here we discuss how to calculate RIR Using the formula and a practical example. You may also look at the following articles to learn more –