Updated June 21, 2023

What is Refinancing?

The term “refinancing” refers to replacing an existing loan agreement with new terms and conditions, usually favoring the borrower. Individuals or businesses refinance their credit obligations to make favorable changes to their interest rates, payment terms, or other terms outlined in the loan contracts. As a result of refinancing, the borrowers benefit in myriad ways, resulting in an improved financial position.

How does refinancing work?

To refinance an existing loan, the borrower must either approach its existing lender or move to a new lender with an application for a new loan. Subsequently, the lender re-evaluates the borrower’s current cash flow and financial position as part of the refinancing process. The borrower will benefit from the refinancing application if the application passes the re-evaluation stage. Some examples of refinanced loans include mortgage loans, vehicle loans, student loans, etc.

Example of Refinancing

Let us look at the following example to understand the concept of refinancing.

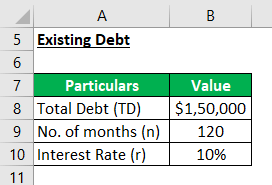

Let us assume John has a loan with outstanding liabilities of $150,000 to be paid over 120 months at an interest rate of 10.0% compounded monthly. First, determine his savings if he can refinance the loan at a favorable interest rate of 7.5%.

Solution:

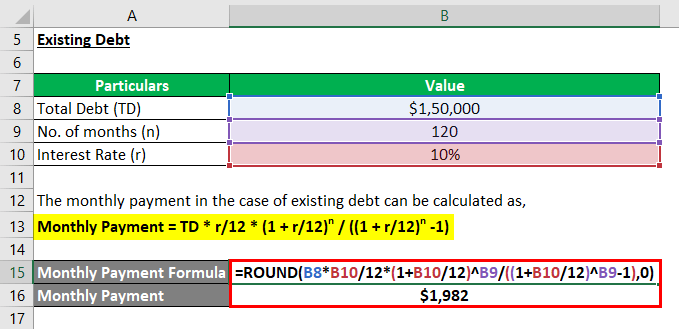

The calculation for monthly payments as below:

Monthly Payment = TD * r/12 * (1 + r/12)n / ((1 + r/12)n -1)

- Monthly Payment = $150,000 * 10%/12 * (1 + 10%/12)120 / ((1 + 10%/12)120 -1)

- Monthly Payment = $1,982

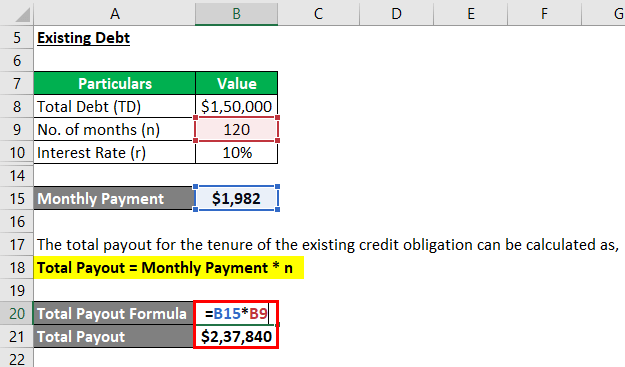

The calculation for the total payout for the tenure of the existing credit obligation is as below

Total Payout = Monthly Payment * n

- Total Payout = $1,982 * 120

- Total Payout = $2,37,840

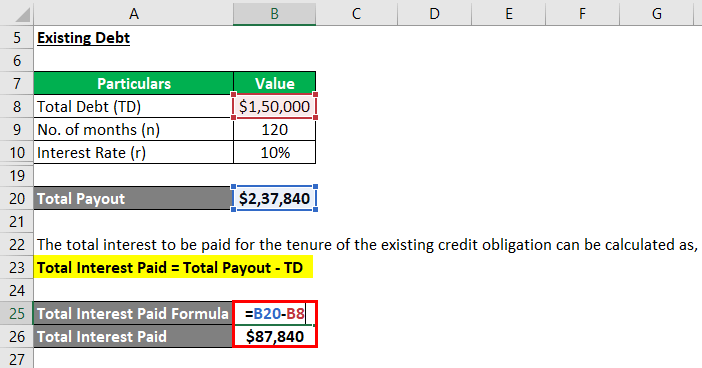

The calculation for the total interest to be paid for the tenure of the existing credit obligation is as below:

Total Interest Paid = Total Payout – TD

- Total Interest Paid = $2,37,840 – $150,000

- Total Interest Paid = $87,840

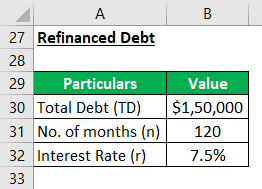

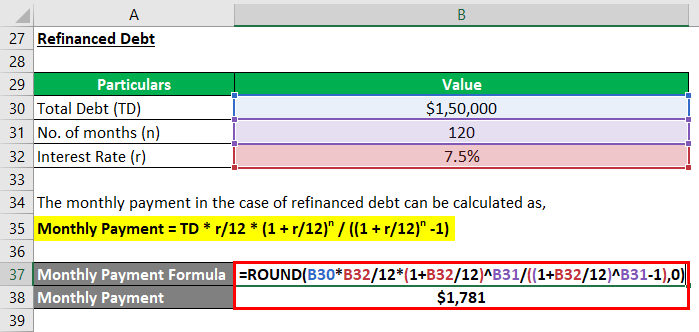

Refinanced Debt

Monthly Payment = TD * r/12 * (1 + r/12)n / ((1 + r/12)n -1)

- Monthly Payment = $150,000 * 7.5%/12 * (1 + 7.5%/12)120 / ((1 + 7.5%/12)120 -1)

- Monthly Payment = $1,781

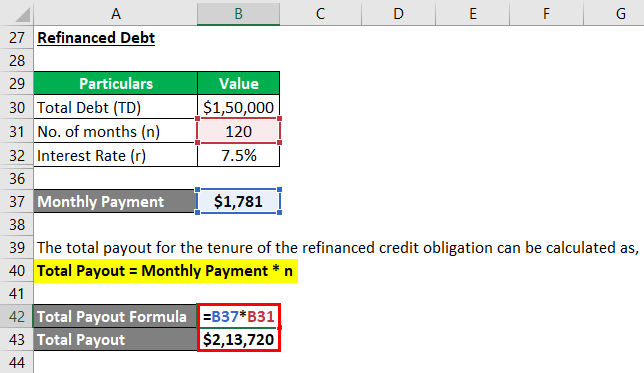

Total Payout = Monthly Payment * n

- Total Payout = $1,781 * 120

- Total Payout = $2,13,720

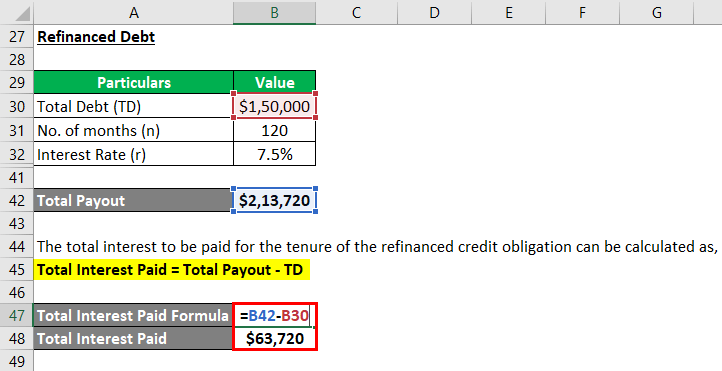

Total Interest Paid = Total Payout – TD

- Total Interest Paid = $213,720 – $150,000

- Total Interest Paid = $63,720

Therefore, if John can refinance his loan, he will save $201 (= $1,982 – $1,781) every month, while the overall savings will be $24,120 (= $87,840 – $63,720) over the lifetime of the loan.

Types of Refinancing

There are many different variants of refinancing, but some of the common types are as follows:

- Rate-and-term Refinance: The most basic form of refinancing wherein the loan’s interest rate, term, or both are changed. It reduces borrowers’ monthly payments, leading to savings on interest payout.

- Cash-out Refinance: In case the market value of the collateral appreciates, the borrower can opt for a cash-out refinance, which effectively increases the debt obligation but provides access to quick cash required for urgent needs.

- Consolidation Refinance: In this case, a borrower can club together multiple credit products into a single loan at a rate lower than the average interest rate of the existing credit products. The borrower gets a single loan at a lower interest rate and then pays off the current multiple loans with the proceeds.

Reasons for Refinancing

Although there are a variety of reasons for refinancing, some of the most common ones are as follows:

- Borrowers usually intend to shorten their loan terms to save on interest payout. However, some borrowers want to extend the loan term to lower monthly payments.

- Most borrowers try to exploit the market situation where interest rates are falling. It can help lower monthly payment obligations and result in huge savings over the life of the loan.

- Many borrowers intend to change their loan type to avoid fluctuating monthly payout, such as adjustable-rate mortgages to fixed-rate loans. Especially during a low-interest-rate environment, it can result in significant savings on interest.

Advantages of Refinancing

Some of the significant advantages of refinancing are as follows:

- First, it lowers the monthly payout if the existing is refinanced at an interest rate lower than the current rate, resulting in significant savings over the life of the loan.

- It makes sense to consolidate multiple loans into a single credit obligation if the borrower can get a lower interest rate than the average of the existing loans.

Disadvantages of Refinancing

Some of the significant disadvantages of refinancing are as follows:

- It may prove expensive. On average, refinancing costs fall from 3% to 6% of the outstanding principal.

- In the case of stretch-out loan payments, the benefit of reduced monthly payments may be offset by the higher cost of borrowing overextended tenure.

Key Takeaways

Some of the key takeaways of the article are:

- Refinancing is taking a new loan at favorable terms to replace an existing one.

- Refinancing usually results in lower monthly payments because of reduced interest rates or extended loan tenure.

- Common refinancing types are – rate-and-term refinance, cash-out refinance, and consolidation refinance.

Conclusion

So, borrowers can use refinancing to lower their credit obligations or save on interest payouts. Either way, it is a winning proposition for them.

Recommended Articles

This is a guide to refinancing. Here we also discuss the definition, working, example, types, and reasons along with advantages and disadvantages. You may also have a look at the following articles to learn more –