Reimbursement Meaning

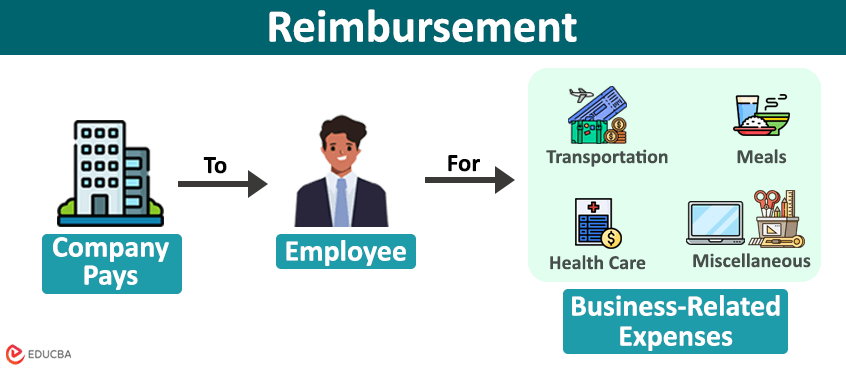

Reimbursement is a process where a company pays or returns the amount spent by an employee for business-related activities upon submission and verification of receipts or proof of expenditure.

The company also compensates employees for out-of-pocket expenses such as client meetings, conferences, lodging, training, travel expenses, etc. Apart from organizations, Governments also reimburse or compensate citizens through tax refunds. Organizations outline the policy, mentioning prerequisites, reasons for expenditure, types of expenses eligible for refunds, documentation, and other terms to quality and claim for remuneration. Employees must submit the required documents, and after a thorough investigation, the company will pay them according to its terms.

Tables of Contents

How Does it Work?

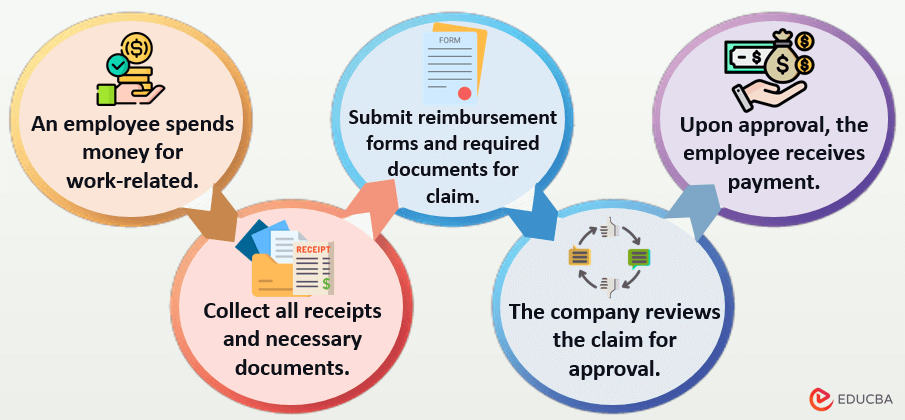

The process of repayment works by claiming it. A reimbursement claim is an employee’s formal request to the company for expenses they have incurred. This process varies depending on the organization’s policies, the nature of costs, and the specific procedures in place.

Let’s understand how it works or how to claim it with the help of the following steps.

1. Employees must Incur Expenses

Employees must pay or spend money related to a company’s activities, services, or other requirements. These expenses can include travel, medical, or purchases made on behalf of an organization.

2. Documenting all Expenses

Employees should collect receipts, invoices, or any valid documents that serve as proof of incurred expenses. This documentation is crucial for supporting the reimbursement claim, and it should mention the exact amount spent, at which place, and at what time.

3. Submitting Documents to Claim

After gathering all required documents, employees submit a formal reimbursement form to the organization’s appropriate department (HR) or authority. This form usually includes a request for refund along with the supporting documents. Employees must submit or claim within 30 or 60 days after incurring expenses, or depending on company policies.

4. Company Reviews and Approves

After submitting the documents, the department will review them to ensure they align with company policies and guidelines. They will also verify the authenticity of the documentation provided and assess if the proofs given for expenses are valid. They may even deny any documents found invalid.

5. Employees Receive Payment

Once the authorized personnel approve a requested claim, the repayment amount is calculated and processed. Then, the company pays through direct deposit, a check, or an agreed-upon payment method.

Types of Employee Expense Reimbursement

Employee expense reimbursement is commonly known as employee or expense reimbursement. These are expenses incurred by employees during business-related activities.

The following are the types of employee expense reimbursement.

1. Travel

Travel expenses are those that employees spend on on-site services, like during client visits, conference meetings, or any professional gatherings. It includes transportation costs such as taxis, buses, trains, parking, tools, and airplane tickets.

2. Mileage

Mileage includes those expenses when an employee uses their vehicle for work-related meetings, site visits, or services, they get reimbursed for their mileage. It is calculated by multiplying the fuel rate and the kilometer of business travel.

3. Meals & Accommodation

It includes expenses when an employee stays in hotels or pays for their meals during accommodation or traveling. It also includes dinner or lunch during client meetings.

4. Business Expense

It includes miscellaneous or other expenses such as stationery, laptops, office supplies, uniforms, internet usage, phone bills (business calls), etc.

5. Healthcare Expenses

The company covers employees’ medical expenditures and health insurance through the reimbursement of medical expenses. Sometimes, employees have to pay from their pocket for medical expenses, which the company or insurance company later reimburses.

Disbursement vs. Reimbursement

The following is the difference between disbursement and reimbursement.

| Particulars | Disbursement | Reimbursement |

| Definition | The release or distribution of funds for specific purposes or expenses. | It is an act of repaying an already spent amount. |

| Includes | Loans, employee salaries, business operations, etc. | Travel, accommodation, meals, etc. |

| GST | Not subject to GST. | May or may not attract GST. |

| Example | ABC Corporation disburses funds for employee salaries monthly | John attends a conference for ABC Corporation and the company reimburses all his travel expenses. |

Final Thoughts

The reimbursement term commonly applies to businesses, insurance providers, or government offices. Although it benefits individuals, some can misuse and submit incorrect documents to fetch more money. Thus, any entity should carefully review submitted applications before releasing the amount.

Frequently Asked Questions (FAQs)

Q1. How long does it take for the reimbursement process to take place?

Answer: The duration of the reimbursement process depends on the company policies and regulations and the refund amount. Ideally, it takes 2 to 4 weeks after submitting the required documents and approvals. After processing, it also depends on the bank services.

Q2. Is reimbursement taxable?

Answer: Reimbursements are generally non-taxable if an employee spends for business expenses eligible under company policies. In addition, expenses made under the accountable plan policy are not taxed. However, if the expenses come under a nonaccountable plan policy, they are taxed as income.

Q3. What is a legal reimbursement?

Answer: Legal reimbursement refers to a process in which one person pays for their former partner’s education or career growth. A judge legally orders it during a divorce settlement. For example, if one partner paid for the other’s education during marriage, and now that the other partner is working, then the first person might get money back under reimbursement alimony.

Recommended Articles

We hope this article on “Reimbursement” was helpful to you. For more related topics, refer to our articles below.