Difference Between Renting vs. Owning

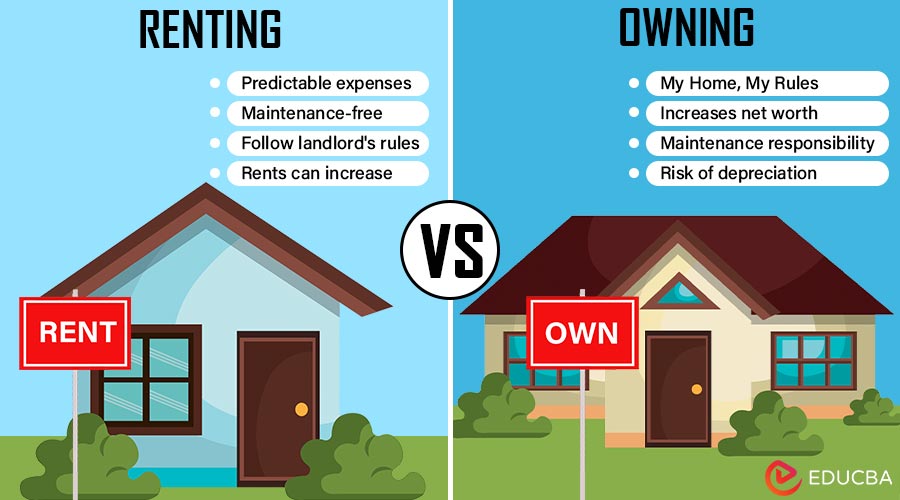

Choosing between renting vs. owning a home is a significant financial decision with long-term implications. Renting offers flexibility and fewer maintenance responsibilities, making it suitable for those seeking mobility or short-term living arrangements. Owning a home, while requiring a more significant initial investment, provides stability, potential property appreciation, and the freedom to customize your living space.

Economic Factors

The factors can significantly influence an individual’s decision and vary based on personal financial situations, market conditions, and long-term goals:

1. Initial Costs

- Renting: Typically, it demands the first month’s rent and a security deposit. As compared to purchasing, these upfront expenses are minimal.

- Owning: Involves a down payment (usually 3-20% of the property price), closing costs, and often the cost of inspections and appraisals. These initial costs are significantly higher than renting.

2. Monthly Expenses

- Renting: Monthly rent payments are usually fixed for the lease term, making budgeting easier. Renters may also have to pay for utilities and renter’s insurance.

- Owning: Monthly mortgage payments can be fixed or variable. Homeowners must also budget for property taxes, homeowner’s insurance, private mortgage insurance (PMI) if the down payment is less than 20%, and utilities. Additionally, maintenance and repair costs are high.

3. Maintenance and Repairs

- Renting: The landlord typically covers the cost of maintenance and repairs.

- Owning: Homeowners are responsible for all maintenance and repair costs, which can be unpredictable and vary significantly.

4. Tax Considerations

- Renting: Renters do not receive tax benefits from their rent payments.

- Owning: Homeowners may save a lot of money on taxes by deducting property taxes and mortgage interest from their federal income taxes.

5. Equity and Investment

- Renting: Rent payments do not build equity; the money spent on rent does not result in ownership.

- Owning: Mortgage payments build equity over time. As the loan balance decreases and property value potentially increases, homeowners build wealth through home equity.

6. Market Conditions

- Renting: Rent prices can increase over time, especially in high-demand areas. However, renters have the flexibility to move if the market becomes unfavorable.

- Owning: Property values can fluctuate based on market conditions. In a rising market, homeowners can gain significant equity. In a declining market, they risk losing equity. Selling a home in a down market can result in financial loss.

7. Flexibility and Mobility

- Renting: Offers greater flexibility and mobility, making it easier to relocate for jobs or other opportunities. Lease terms are typically one year, allowing renters to move without the long-term commitment.

- Owning: Home selling can be lengthy, and moving involves significant costs. Homeownership is typically better suited for those planning to stay at a location for an extended period.

8. Long-Term Financial Benefits

- Renting: Provides no long-term financial benefits as rent payments do not contribute to ownership.

- Owning: This can be an excellent long-term investment. Over time, the property can appreciate, providing financial security and potentially profiting you if you sell the home.

9. Inflation Impact

- Renting: Rent prices are subject to inflation and can increase annually based on market conditions.

- Owning: Fixed-rate mortgage payments remain constant, providing a hedge against inflation. As incomes typically rise with inflation, mortgage payments can become more manageable.

10. Opportunity Cost

- Renting: Investing elsewhere can yield higher returns than using money for a down payment and other ownership costs.

- Owning: Funds tied up in home equity might not be as liquid as other investments, limiting immediate access to cash.

Lifestyle Considerations

Lifestyle considerations are crucial when deciding between renting and owning a home:

1. Flexibility and Mobility

- Renting: Renting offers greater flexibility and mobility. It is ideal for those needing to move frequently due to job changes, education, or other personal reasons. Lease agreements typically last for a year or less, making relocating easier.

- Owning: Homeownership ties you to a specific location, which might be better if you anticipate needing to move. To sell a house can be a time-consuming and costly affair.

2. Maintenance and Repairs

- Renting: Renters are generally not responsible for major repairs or maintenance, as the landlord or property management company like Airbnb Management Edinburgh typically handles these. This can save time, effort, and unexpected expenses.

- Owning: Homeowners are responsible for all maintenance and repairs, which can be time-consuming and costly. This includes routine maintenance (like lawn care) and unexpected repairs (like a leaky roof).

3. Customization and Control

- Renting: Renters have limited ability to customize or renovate their living space. Any changes usually require landlord approval and must be reversible when moving out.

- Owning: Homeowners have complete control over their property and can renovate, decorate, and customize their homes to their liking without needing approval.

4. Financial Considerations

- Renting: Renting requires a lower initial financial commitment (typically just the first month’s rent and a security deposit). Monthly rent payments can be more predictable, and property value fluctuations are not risky.

- Owning: Buying a home requires a significant upfront investment, including a down payment, closing costs, and potentially higher monthly mortgage payments than rent. Homeowners can build equity over time but also face the risk of property value fluctuations.

5. Community and Stability

- Renting: Renters may experience less community stability, as neighbors can change frequently. Shorter lease terms may result in a less stable sense of community.

- Owning: Homeownership can provide a sense of stability and permanence, which can foster deeper community ties and long-term relationships with neighbors.

6. Lifestyle Preferences

- Renting: Renting can be preferable for those who prefer a more transient or minimalist lifestyle without the long-term commitment or responsibility of homeownership.

- Owning: Owning a home may be more suitable for those who value stability, long-term investment, and the ability to make a house truly their own.

7. Space and Amenities

- Renting: Rental properties may come with amenities such as pools, gyms, and communal spaces that might be unaffordable for homeowners to install and maintain individually. However, rental units might offer less space than a home you can buy.

- Owning: Homeowners can own larger spaces and private amenities like a backyard or metal garage. However, these come with additional maintenance responsibilities.

8. Long-Term Goals

- Renting: Renting may suit those still determining long-term plans or prioritizing experiences over property investment.

- Owning: Homeownership aligns with long-term goals such as building equity, having a stable living environment, and investing in a property that could appreciate over time.

Financial Stability and Planning

Here’s an overview of how renting versus owning impacts financial stability and planning:

Impact on Credit Score

1. Mortgage Payments and Credit History

- Owning: Making timely mortgage payments can positively impact your credit score, demonstrating responsible debt management.

- Renting: Rent payments typically only appear on credit reports if there are issues like evictions or unpaid rent that go to collections.

2. Rent Payments and Credit Reporting

- Owning: Rent payments generally only directly impact credit scores if you use a service that reports rent payments to credit bureaus.

- Renting: Rent payments are typically only reported to credit bureaus if you’re using a specific rent-reporting service.

Saving for Future Goals

1. Saving Strategies for Down Payment

- Owning: Saving for a down payment is crucial for buying a home, typically requiring a significant upfront cost.

- Renting: This may require less upfront savings, but ongoing rental payments do not contribute to building equity.

2. Budgeting for Rent and Other Expenses

- Owning: Budgeting must account for mortgage payments, property taxes, insurance, maintenance costs, and potentially higher utility bills.

- Renting: Rental costs are often more straightforward, covering rent and utilities, with less responsibility for maintenance and repairs.

Retirement Planning

1. Owning as a Retirement Strategy

- Owning: Paying off a mortgage by retirement can reduce housing costs significantly, providing financial stability in retirement.

- Renting: Renting offers flexibility to move and may have lower housing costs in some situations, but rent payments continue indefinitely.

2. Renting and Flexibility in Retirement

- Owning: Home equity can be tapped into through downsizing or a reverse mortgage, providing additional funds for retirement.

- Renting: Offers flexibility to relocate or downsize without the responsibility of homeownership.

Market and Economic Conditions

Understanding these market and economic conditions helps individuals and policymakers assess the benefits and costs:

- Interest Rates: Mortgage interest rates directly affect homeownership affordability. Lower rates mean lower monthly payments, making buying more appealing by reducing overall borrowing costs. Conversely, higher rates increase monthly payments, potentially making homeownership less accessible and prompting prospective buyers to reconsider or delay purchasing decisions.

- Housing Prices: In a seller’s market, where there is a high demand for homes and a limited supply, home prices increase. This can make buying a home less affordable than renting, as buyers are confronted with inflated prices and potential bidding wars, driving up costs. The rising value of real estate makes renting a more alluring choice for individuals looking for freedom.

- Rental Market Trends: In competitive rental markets, high demand and limited supply increase rental prices. This can make renting less affordable than owning a home, as prospective buyers may find that mortgage payments are more stable or even lower than escalating rental costs in such economic conditions.

- Economic Stability: The state of the economy significantly influences housing decisions. During periods of robust economic growth, higher wages, and job security enhance the appeal of homeownership. Conversely, renting offers flexibility and lower financial risk during uncertain times marked by job losses and wage stagnation, making it a safer choice for those concerned about future income stability.

- Tax Implications: Tax regulations frequently allow deductions for property taxes and mortgage interest, increasing the financial appeal of homeownership. These deductions reduce taxable income, lowering overall tax liability for homeowners. In contrast, renters do not benefit from such deductions, potentially making owning a home more financially advantageous under certain conditions.

- Affordability and Financing: Access to credit and financing greatly influences homeownership. Tighter lending standards, often in response to economic conditions or regulatory changes, can restrict mortgage availability, making qualifying more difficult for prospective buyers. This limitation may steer individuals towards renting instead of owning a home.

Risk Factors

Understanding these risk factors can help individuals decide whether renting or owning is the best choice for their financial and lifestyle needs:

Risk Factors of Renting

- Lack of Equity: Renting needs equity building since monthly payments don’t contribute to ownership. Unlike homeowners, renters don’t gain an asset they can appreciate, resulting in no financial growth from their housing expenses.

- Rent Increases: Rent prices can rise periodically due to landlord decisions or market conditions, causing unpredictable housing costs for renters. This lack of stability can affect financial planning and overall housing affordability, making long-term budgeting more challenging.

- Limited Control: Renters face restrictions on property modifications, such as renovations and decorating, and may have limitations on pet ownership, all dictated by lease agreements, which limit their ability to personalize and fully control their living environment.

- Lease Termination: Lease termination occurs when landlords decide not to renew a tenant’s lease, forcing tenants to find new housing. This situation can be disruptive and stressful, requiring time, effort, and potentially financial resources to secure a new place to live.

- No Tax Benefits: Renters miss out on tax benefits that homeowners are entitled to, like property tax and mortgage interest deductions. These deductions can drastically lower taxable income and total tax burden, making owning a more financially beneficial choice.

- Uncertainty of Stability: The owner may sell rental properties, causing potential eviction or relocation if the new owner has different plans for the property, such as redevelopment or personal use. This creates instability for tenants.

Risk Factors of Owning

- Market Fluctuations: Market fluctuations can decrease home values, resulting in financial loss if you sell the property during a downturn. Homeowners may end up owing more on their mortgage than the home’s market value, a situation known as being “underwater.”

- Maintenance and Repairs: Homeowners bear the entire burden of maintenance and repair expenses, which can arise unexpectedly and be expensive. These costs, including regular upkeep and emergency fixes, add to the overall financial responsibilities of owning a home.

- High Initial Costs: Purchasing a home requires substantial upfront expenses: a down payment, a percentage of the home’s price; closing costs for processing the transaction; and moving expenses, all of which can add up significantly before ownership begins.

- Property Taxes and Insurance: Homeowners must cover property taxes and insurance, which can rise over time. These costs add to the overall expense of owning a home, impacting homeownership’s long-term affordability and financial planning.

- Liquidity Risk: Real estate liquidity risk makes it difficult and time-consuming to sell a property fast, making it difficult to lock the cash in the asset at times of dire need.

- Interest Rate Risk: It involves potential increases in mortgage payments when rates rise, especially for adjustable-rate mortgages (ARMs). If interest rates increase, this can lead to higher monthly costs, affecting the homeowner’s budget and financial stability.

Social and Psychological Aspects

The choice between renting and owning involves weighing various social and psychological factors that can impact one’s lifestyle:

Social Aspects

1. Community Ties and Stability

- Owning: Homeownership often leads to more excellent community stability. Owners are likelier to put down roots and invest in their neighborhoods, strengthening community ties. This can foster a sense of belonging and long-term relationships with neighbors.

- Renting: Renters might move more frequently, which can lead to less community engagement and weaker ties with neighbors. However, renting can also allow people to live in different neighborhoods, providing exposure to diverse communities.

2. Social Status and Perception

- Owning: Homeownership is often associated with success and stability. It can enhance one’s social status and serve as a milestone of financial success. Owning a home may also be linked to social expectations and norms.

- Renting: While renting might be viewed by some as a less stable or less prestigious option compared to owning, it’s important to note that perceptions are changing. Renting is increasingly seen as a choice that offers flexibility and financial prudence, making it a viable and respectable housing option.

3. Family and Lifestyle Considerations

- Owning: Families may prefer owning a home for the sense of permanence and the ability to customize the living space. It can offer a stable environment for raising children and hosting extended family.

- Renting: Renting can benefit those with a mobile or transient lifestyle. It’s an excellent option for those with jobs that require frequent relocation or those who prefer to avoid the responsibilities of home maintenance, offering them the flexibility they need to live their preferred lifestyle.

Psychological Aspects

1. Sense of Security and Control

- Owning: Homeowners often experience a strong sense of security and control over their living environment. They can make changes and improvements, contributing to a sense of personal satisfaction and ownership.

- Renting: Renters may feel less secure due to the possibility of lease termination and lack of control over the property. This can lead to stress about potential relocations and less ability to personalize the space.

2. Financial Stress and Stability

- Owning: Homeownership typically involves significant financial commitments, including mortgages, property taxes, and maintenance costs. While this can build long-term equity, it can also lead to financial stress, especially if unexpected expenses arise.

- Renting: Renters might experience less financial stress related to property maintenance and repairs, as these are typically the landlord’s responsibility. However, they might face financial instability if rent prices increase or if they need to move frequently.

3. Long-term Planning and Investment

- Owning: Buying a home is frequently seen as a long-term financial commitment and a means of gradually accumulating wealth. It can provide psychological comfort through the accumulation of equity and the potential for property value appreciation, instilling a sense of optimism about future financial growth.

- Renting: Renters may focus on other forms of investment and saving, potentially feeling less burdened by property-related financial commitments. They might experience less pressure to stay in one place and more freedom to pursue other economic opportunities, fostering a sense of ease with the potential for change.

Environmental Considerations

Environmental considerations play an important role in individuals making informed choices about renting or owning:

1. Energy Efficiency

- Renting: Energy-efficient improvements, such as new windows or insulation, may be difficult for tenants to implement, which could have an impact on the environment and overall energy use.

- Owning: Homeowners can invest in energy-efficient improvements (e.g., solar panels and high-efficiency appliances), potentially reducing their carbon footprint.

2. Resource Utilization

- Renting: Rental properties may only sometimes prioritize sustainable resource management, like water-saving fixtures or eco-friendly landscaping. Tenants might have limited influence on these aspects.

- Owning: Homeowners can implement resource-saving measures, such as rainwater harvesting systems or sustainable landscaping practices, contributing to better environmental stewardship.

3. Waste Management

- Renting: Waste management practices can vary by rental property, and tenants may need more control over recycling programs and waste reduction initiatives.

- Owning: Homeowners can establish personal waste management systems, including composting and extensive recycling practices, to minimize waste production.

4. Construction and Renovation

- Renting: Tenants generally do not have control over construction materials or renovation processes, which may not prioritize sustainable practices or eco-friendly materials.

- Owning: Homeowners can choose sustainable building materials and methods during renovations or construction, aligning with green building standards.

5. Building Lifecycle

- Renting: Rental properties might have shorter lifecycles with frequent turnover, which can lead to increased waste and resource consumption if not managed sustainably.

- Owning: Homeownership often involves a longer-term commitment to a property, allowing for ongoing maintenance and upgrades to improve the building’s sustainability over time.

6. Location and Transportation

- Renting: Rental properties may be located in areas with varying access to public transportation, affecting the environmental impact of commuting and travel.

- Owning: Homeowners can choose locations with better access to public transportation or closer proximity to work and amenities, potentially reducing reliance on personal vehicles.

7. Community Impact

- Renting: Tenants may have less influence on community-wide environmental initiatives or sustainability programs.

- Owning: Homeowners can contribute to and advocate for community-based environmental efforts, such as local green spaces or neighborhood sustainability projects.

8. Land Use

- Renting: Rental properties may be part of larger rental complexes or urban developments that only sometimes prioritize land conservation.

- Owning: Homeowners have the potential to manage their land more sustainably, with opportunities to implement conservation practices or support local biodiversity.

Future Trends

Future trends highlight the evolving nature of housing preferences and the factors driving future decisions about renting and owning:

- Shift Towards Flexible Living Arrangements: The rise of short-term rentals via platforms like Airbnb and the growth of co-living spaces, which offer shared common areas and private rooms, reflect a shift towards flexible, community-oriented living arrangements, appealing to those seeking mobility and shared experiences.

- Technological Advancements: Smart home technology will become more common in rentals and owned properties, enhancing convenience and efficiency. Virtual tours and online transactions will streamline rental and purchasing processes, making property searches and deals faster and more accessible.

- Economic and Demographic Shifts: Millennials and Gen Z may prefer renting due to financial pressures, student debt, and a desire for flexibility. Urbanization boosts demand for city rentals, while suburban and rural ownership of Cougar Homes for sale offers more prominent spaces and lower costs, appealing to those seeking affordability.

- Sustainability and Eco-Friendly Housing: Future housing trends will emphasize energy-efficient buildings and eco-friendly materials, driven by increasing sustainability awareness. Regulations and incentives for reducing carbon footprints will impact rental and ownership markets, promoting green building practices and sustainable property management.

- Housing Market Dynamics: The housing affordability crisis may lead to innovative models like shared ownership and rent-to-own programs. Market volatility influences decisions; downturns make renting more appealing, while upswings may encourage ownership due to potential value gains and stability.

- Regulatory Changes: Changes like stricter rent control and enhanced tenant protections may make renting more appealing. Conversely, modifications in property taxes, mortgage rates, and homeownership incentives could affect the desirability and affordability of owning a home.

- Lifestyle Changes: Remote work may lead people to seek more significant rental properties or homes in unconventional locations for flexibility and space. A greater emphasis on health and wellbeing may increase demand for homes with gyms, outdoor areas, and other features that encourage a healthier way of living.

Conclusion

Choosing between renting and owning involves weighing flexibility against investment. Renting offers mobility and lower financial risk, while owning builds equity and long-term stability. Making an informed decision that fits one’s unique goals and circumstances requires considering one’s aspirations, financial condition, and lifestyle preferences.