Updated September 29, 2023

What is Responsibility Accounting?

Responsibility accounting is a management accounting concept where the company assigns the financial responsibility of certain tasks to a department or a part of an organization. Companies use this practice to assess the performance of each department and assign direct accountability. This accounting system ensures that every department works in line with the organization’s overall goals.

Although the concept of responsibility accounting dates back to the 1920s, it gained popularity in the 1950s and 60s when businesses started becoming more complex. Today, responsibility accounting has evolved into a system that helps organizations set goals, allocate resources, and monitor performance at departmental and individual levels.

Table of Contents

Key Highlights

- Responsibility accounting assigns clear responsibilities to each area/department of the organization.

- The process involves identifying different responsibility centers, setting targets, monitoring and evaluating performance, and taking corrective actions.

- Cost, investment, revenue, and profit are the four types of responsibility centers.

- Its top advantages are an increase in transparency and accountability.

- The main disadvantage is that it can be challenging to identify responsibility centers.

Features

Some features of responsibility accounting are:

1. Responsibility Centers

It divides the organization into input centers (profits and revenues) and output centers (costs and investments), and each center receives a specific responsibility. The performance of these centers is evaluated based on the responsibilities assigned to them.

2. Budget Preparation

Companies practicing responsibility accounting prepare the budget for each responsibility center. This budget outlines the expected performance and serves as a benchmark for evaluating actual performance.

3. Performance Evaluation

The actual performance of responsibility centers is regularly compared with the expected performance. Companies take corrective action if they identify any differences.

4. Decentralization

Companies delegate the decision-making powers to different departments/responsibility centers. Each responsibility center operates independently and is accountable for its performance.

5. Motivation

By holding managers and units responsible for their performance, responsibility accounting can lead to improved motivation and better decision-making.

6. Forward-looking

It focuses on planning and forecasting rather than just reviewing past performance.

Process

The main steps involved in responsible accounting are:

Step 1 – Identify Responsibility Centers:

Determine which parts of the organization are accountable for costs, revenues, profits, and investments.

Step 2 – Set Performance Targets:

Define goals for each section based on the company’s overall objectives.

Step 3 – Gather Data:

Collect financial and non-financial data related to each section’s activities.

Step 4 – Compare Results:

Analyze the difference between the actual performance and the set targets.

Step 5 – Find Reasons:

If there is a discrepancy between the targeted and actual results, find out the reasons for such deviations.

Step 6 – Take Action:

Take corrective actions by communicating with the individual in charge of that part.

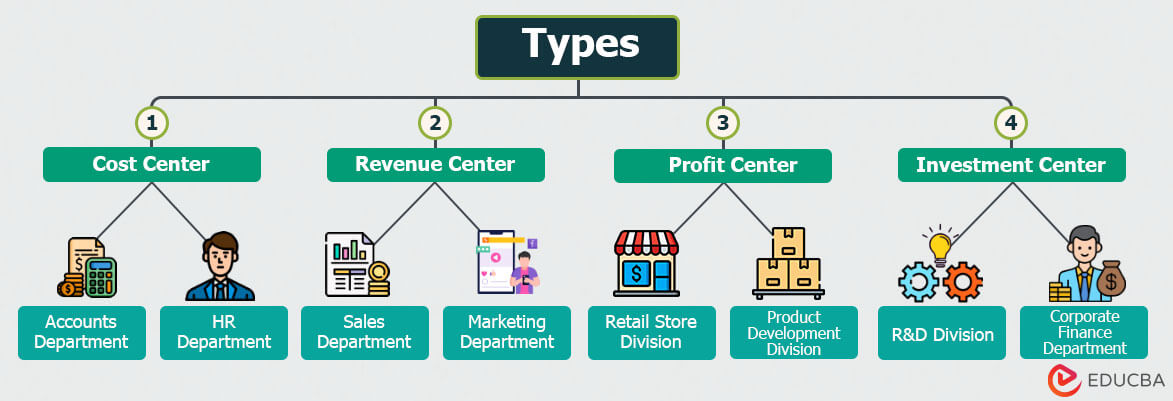

Types

Following are the four types of responsibility centers used in responsibility accounting.

1. Cost Center

It consists of all the departments and individuals responsible for cost control. Revenue generation is not the responsibility of cost centers. They are only supposed to monitor and manage controlled costs. The company evaluates the performance of each cost center by comparing estimated costs to actual costs. A company’s HR, maintenance, accounting, and customer service departments are all examples of cost centers.

2. Revenue Center

A revenue center consists of the people who are responsible for generating revenue for the company. Cost control is not their primary responsibility. It is usually the sales team that’s responsible for revenue generation. The sales department is the primary example of a revenue center.

3. Profit Center

A profit center is a department or section of an organization where the performance is measured in terms of both cost and revenue. The primary responsibility of this center is to generate profit by increasing revenue and decreasing costs. A manufacturing company’s factory is an example of a profit center.

4. Investment Center

The primary responsibility of an investment center is to ensure a good return on the capital invested.

Examples

Here are a few examples of responsibility accounting in all four types of responsibility centers.

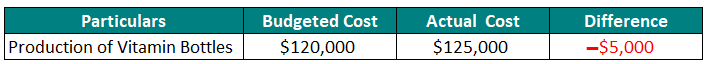

Example #1 – Cost Center

XYZ Healthcare Ltd. manufactures health supplements. They aimed to manufacture 20,000 vitamin bottles in 2022. They allocated a budget of $120,000 for this at the beginning of the year. But, by the year-end, the actual production cost amounted to $125,000. This results in an additional expenditure of $5,000 above the estimated budget. The production manager is thus answerable for this difference in cost.

Some of the reasons for the difference could be:

- The manager might have selected premium ingredients to enhance supplement efficacy, causing the raw material costs to rise.

- An increase in utility charges led to more overhead costs.

- Less manual labor requirements led to a decrease in labor costs while increasing the production process.

Example #2 – Revenue Center

Delta Electronics Ltd. set a revenue goal of $110,000 from their gadgets division for 2022. However, by the year-end, they made $108,000 in revenue, marking a deficit of $2,000 in their expected revenue. The manager of the gadgets division is required to explain the gap between the expected and actual revenue. He prepared the following report to explain the gap.

Report Analysis:

- Their laptop and tablet sections met the projected figures.

- Their headphones and smartwatch actions surpassed expectations.

- The speaker and smart TV sections underperformed and missed the target by $2,000.

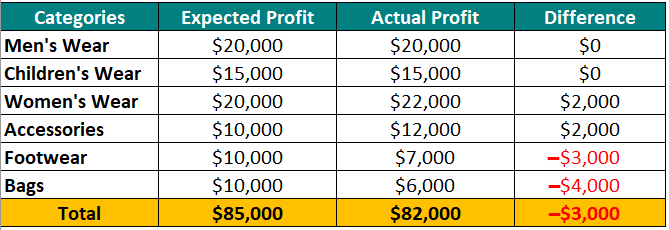

Example #3 – Profit Center

Omega Fashion Inc. had a profit target of $85,000 for its apparel division. They, however, earned an actual profit of $82,000, showing a $3,000 decrease.

Following is the breakdown of the profit earned by each division:

Report Analysis:

- Their men’s wear and children’s sections aligned with the projections.

- Women’s wear and accessories surpassed profit expectations.

- Yet, the footwear and bags category didn’t reach the expected profits, leading to an overall shortage in the apparel division.

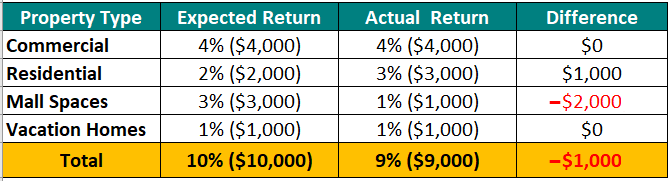

Example #4 – Investment Center

Beta Investments predicted a return of 10% on a $10,000 investment in real estate for 2022. However, the actual return amounted to 9%, equating to $9,000.

Report Analysis:

- Investments in commercial property and vacation homes gave expected returns.

- Residential properties provided higher returns than expected.

- On the contrary, returns from mall spaces fell below expectations.

Advantages and Disadvantages

The following are the main advantages and disadvantages of responsibility accounting:

| Advantages | Disadvantages |

| Responsibility accounting provides a clear framework for evaluating performance. | Identifying responsibility centers can be difficult for complex organizations. |

| It helps maintain transparency in the organization. | It only applies to controllable costs and doesn’t consider uncontrollable costs. |

| This system facilitates better decision-making. | It can lead to inter-departmental conflicts and blame culture. |

| It increases accountability among managers as each person/department is assigned clear responsibilities. | Generating reports for each responsibility center requires a lot of time and resources. |

| It helps align individual and departmental goals with the organization’s goals. | There is a potential for results manipulation by managers. |

Frequently Asked Questions (FAQs)

Q1: What are the main principles of responsibility accounting?

Answer: Managers are required to align with company goals by ensuring the following principles of responsibility accounting:

- Assigning Clear Roles: Every manager knows their specific duties.

- Setting Budgets: Managers get financial guidelines for their tasks.

- Performance Checks: The company compares the managers’ actual work with the set expectations.

- Holding Accountable: Managers are held responsible only for the assigned tasks under their control.

- Timely Feedback: Quick updates help managers adjust their actions.

- Giving Decision Power: Lower-level managers can make quick decisions without waiting for continuous approval requirements from higher authorities.

- Uniform Measurements: The same criteria is used to judge every manager.

Q2: What is the importance of responsibility accounting?

Answer: Responsibility accounting is an approach where different sections of an organization are held accountable for their performance. Its importance includes:

- Accountability: Promotes responsibility among managers for their department’s results.

- Budgeting: Helps in creating and monitoring specific departmental budgets.

- Performance Evaluation: Allows for better assessment of each department’s efficiency or shortcomings.

- Decision-making: Clarifies decision-making by focusing on areas of excellence or underperformance.

- Motivation: Encourages better performance by making managers and teams aware of their responsibilities.

Q3: What are the prerequisites of responsibility accounting?

Answer: For responsibility accounting to work, a business needs:

- A well-defined organizational structure that makes it easier to identify responsibility centers

- Allocating a realistic budget for each responsibility center.

- Clear targets and metrics to evaluate the performance of each center.

- Unbiased management and complete involvement of all levels of the organization.

- A strong flow of communication between departments.

Recommended Articles

If you found this EDUCBA article about responsibility accounting helpful, you might also like to check out the following articles: