Why is Restaurant Finance Management Needed?

Every business needs proper financial management, and restaurants are no exception. Restaurant finance management includes overseeing the financial aspects of a restaurant, such as budgeting, tracking expenses, managing cash flow, and more.

Restaurants need to manage expenses, track revenue, and handle payroll, among other financial tasks, to keep the business running smoothly. Proper financial management can help restaurateurs make informed decisions, optimize costs, and ensure profitability.

For example, let’s say a restaurant owner notices that the cost of ingredients for one of their signature dishes has increased significantly. Without proper financial management, they may continue to order the same amount of ingredients, resulting in a higher cost per dish and lower profits. However, with financial planning and management, the owner can adjust the recipe or negotiate better prices with suppliers to maintain profitability.

In this article, we will look at some financial strategies specifically tailored for restaurant finance management.

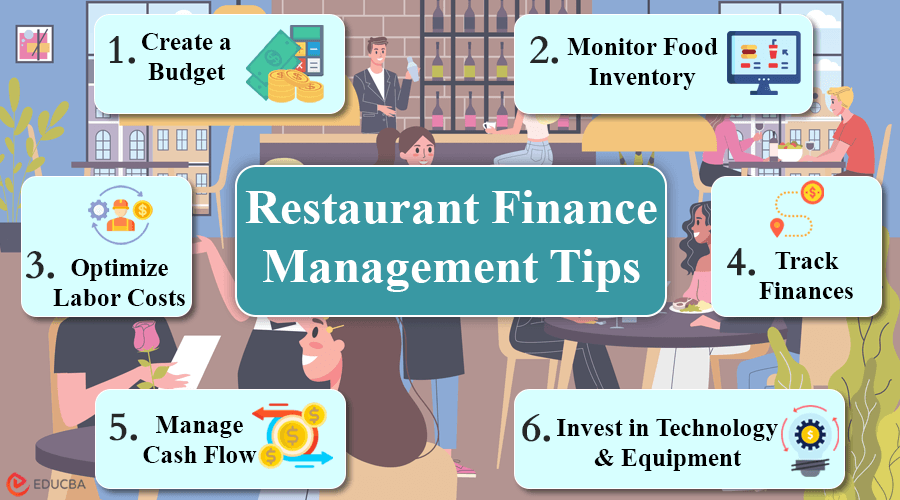

Tips on How to Manage Restaurant Finances

1. Create a Budget

Start by creating a detailed financial plan for your restaurant that outlines all the expenses, like rent, utilities, ingredients, etc. Set realistic revenue goals and allocate funds accordingly. Once done, make sure to review your financial budget regularly and adjust it if needed.

2. Monitor Food Inventory

Monitor your food inventory closely to minimize waste and control costs. Optimize your menu by regularly reviewing sales data and eliminating low-performing or high-cost items. Moreover, negotiate bulk discounts with suppliers and utilize seasonal or local ingredients to reduce expenses while maintaining quality.

3. Optimize Labor Costs

Effectively manage your labor costs by scheduling staff based on predicted customer traffic. This way, you can optimize staffing levels during peak hours. You can also consider investing in restaurant coaching programs and staff training to improve your restaurant’s efficiency.. This will improve your turnover (revenue from sales). Furthermore, you can implement incentive programs to motivate employees and reward performance.

4. Track Finances

Use accounting software or Excel to track detailed records of daily sales, expenses, and cash flow. This way, you can check your business’s financial performance and identify any areas of concern or potential overspending.

5. Manage Cash Flow

Managing cash flow includes monitoring financial records to ensure you have enough cash to cover daily operational costs. To improve cash flow, you can negotiate favorable terms with suppliers and implement strategies to quicken customer payment collection.

6. Invest in Technology & Equipment

Technology offers restaurants with tools to streamline operations, improve accuracy, and provide insightful data for better decision-making. Embracing technology can reduce costs in the long run. Digital signage is a valuable tool in modern restaurants, providing a dynamic way to display menus and promotional content. This not only enhances the customer experience but also reduces costs associated with printing traditional materials. For instance, consider implementing a POS system with inventory tracking capabilities and upgrading kitchen equipment to improve productivity. Moreover, you can use a paystubs generator for efficient payroll management as they provide accurate calculations of wages, taxes, and deductions, ensuring compliance and transparency.

Benefits Of Restaurant Finance Management

1. Leads to Better Experiences for Customers

Effective restaurant finance management ensures smooth operations and timely service. This enhances the dining experience for customers. Additionally, with streamlined processes and attentive staff, customers are more likely to enjoy their visit, leading to positive reviews and repeat business.

2. Optimizing Financial Operations Improves Profitability

Maximizing revenue while minimizing costs results in higher profit margins and improved financial performance. Therefore, closely monitoring expenses, optimizing menu offerings, and managing inventory can increase profitability.

3. Helps Minimize Operating Costs

Implementing measures such as inventory control, labor optimization, and energy efficiency initiatives can significantly reduce restaurant operating expenses. Furthermore, by identifying and eliminating unnecessary expenditures, restaurants can minimize waste and improve overall cost-effectiveness.

4. Provides a Sense of Financial Security

Well-managed finances provide restaurant owners and stakeholders financial stability. By having adequate reserves, restaurants can weather unexpected challenges, such as economic downturns, without jeopardizing their operations.

5. Contributes to Efficient Business Management

Proper restaurant finance management leads to efficient decision-making and resource allocation within the restaurant. With accurate financial data and reporting systems in place, managers can make informed choices regarding menu pricing, staffing levels, marketing strategies, and investments in equipment or technology. This leads to more effective management practices and better overall performance.

Final Thoughts

Restaurant finance management extends beyond mere number-crunching; it’s about crafting a sustainable path for growth, innovation, and stability. By embracing efficient payroll practices and integrating tools like paystub generators, restaurant owners can overcome financial hurdles and focus on what they do best—delivering exceptional dining experiences! With the right strategies and technology, the journey from managing finances to thriving in the culinary world becomes a rewarding adventure.

Frequently Asked Questions (FAQs)

Q1. How can paystub generators benefit my restaurant finance management?

Answer: Paystub generators streamline payroll processing, ensuring accuracy and compliance and saving time, which can be redirected towards improving your restaurant’s offerings. By leveraging pay stub generators, restaurateurs can save time, reduce errors, and improve operational efficiency, allowing them to focus more on enhancing their culinary offerings and customer experience.

Q2. What other technologies can aid in restaurant finance management?

Answer: In addition to pay stub generators, financial management software, inventory management systems, and digital payment solutions can significantly enhance a restaurant’s financial operations. By adhering to the principles of effective financial management and leveraging modern tools, restaurateurs can navigate the industry’s complexities and steer their establishments toward success and longevity.

Recommended Articles

We hope you found this article on restaurant finance management helpful. For similar content, visit the following articles.