Updated July 25, 2023

Definition of Return on Average Capital Employed

The term “return on average capital employed” refers to the performance metric that determines how well a company can leverage its capital structure to generate profit.

To put it simply, this metric determines the dollar amount that a company is able to produce in net operating profit for each dollar of the capital (both equity and debt) utilized.

The return on average capital employed is abbreviated as ROACE. This metric is the improved version of ROCE as it takes into account the opening and closing value of the capital employed. ROACE can be used to compare peer performance of a similar scale and with different capital structures as it compares the profitability relative to both equity and debt.

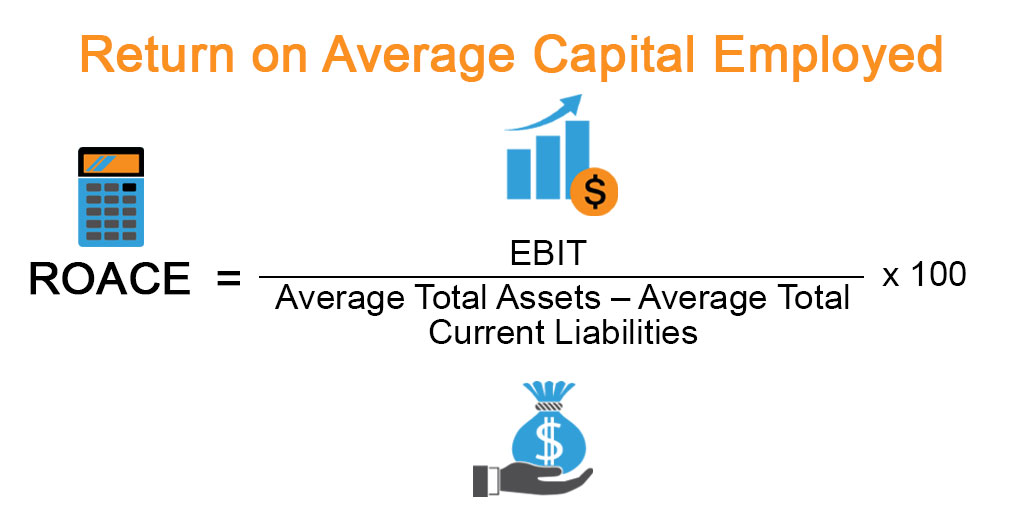

Formula

The formula for ROACE can be derived by diving the operating profit or earnings before interest and taxes (EBIT) by the difference between average total assets and average total current liabilities, which is then expressed in terms of percentage. Mathematically, it is represented as,

The formula for ROACE can also be expressed as operating profit divided by the summation of average shareholder’s equity and average long term liabilities. Mathematically, it is represented as,

Examples of Return on Average Capital Employed (With Excel Template)

Let’s take an example to understand the calculation of Return on Average Capital Employed in a better manner.

Example #1

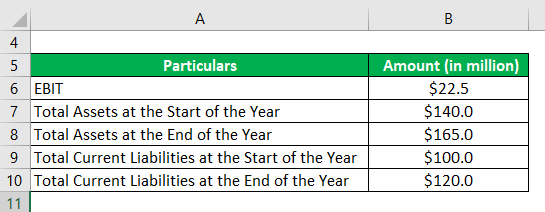

Let us take the example of a company that is engaged in the manufacturing of mobile phone covers. During 2018, the company booked an operating profit of $22.5 million. Its total assets at the start and end of the year were $140 million and $165 million respectively, while its corresponding total current liabilities were $100 million and $120 million respectively. Based on the given information, calculate the ROACE of the company for the year.

Solution:

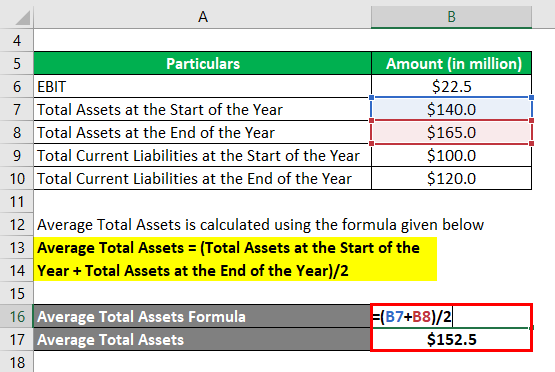

Average Total Assets is calculated using the formula given below

Average Total Assets = (Total Assets at the Start of the Year + Total Assets at the End of the Year)/2

- Average Total Assets = ($140 million + $165 million) / 2

- Average Total Assets = $152.5 million

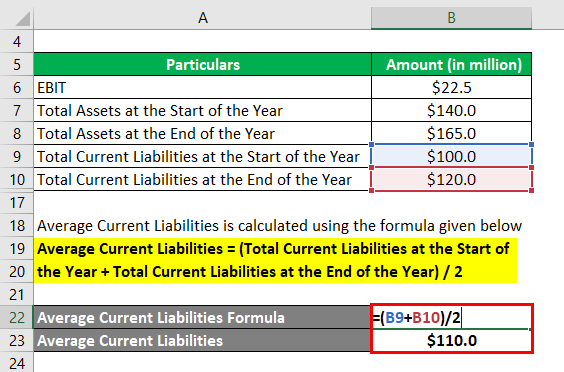

Average Current Liabilities is calculated using the formula given below

Average Current Liabilities = (Total Current Liabilities at the Start of the Year + Total Current Liabilities at the End of the Year) / 2

- Average Current Liabilities = ($100 million + $120 million) / 2

- Average Current Liabilities = $110.0 million

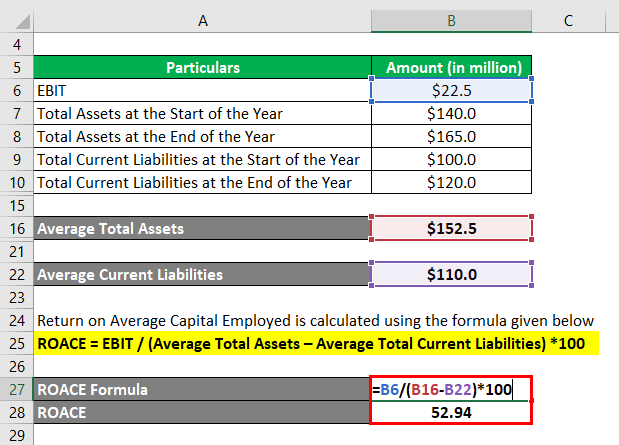

Return on Average Capital Employed is calculated using the formula given below

ROACE = EBIT / (Average Total Assets – Average Total Current Liabilities) * 100

- ROACE = $22.5 million / ($152.5 million – $110.0 million)

- ROACE = 52.94%

Therefore, the company’s ROACE for the year 2018 stood healthy at 52.94%.

Example #2

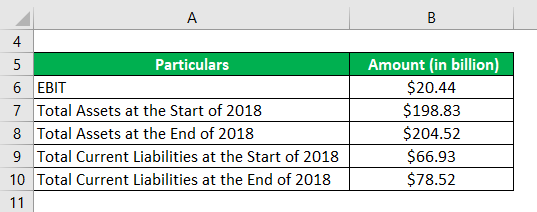

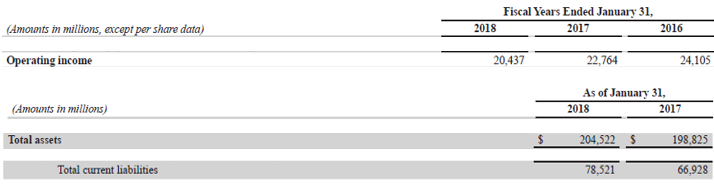

Let us take the example of Walmart Inc.’s annual report for the year 2018 to illustrate the computation of ROACE. During 2018, its operating income was $20.44 billion, its total assets at the start and at the end of the year was $198.83 billion and $204.52 billion respectively and its total current liabilities at the start and at the end of the year was $66.93 billion and $78.52 billion respectively. Calculate Walmart Inc.’s ROACE for the year 2018.

Solution:

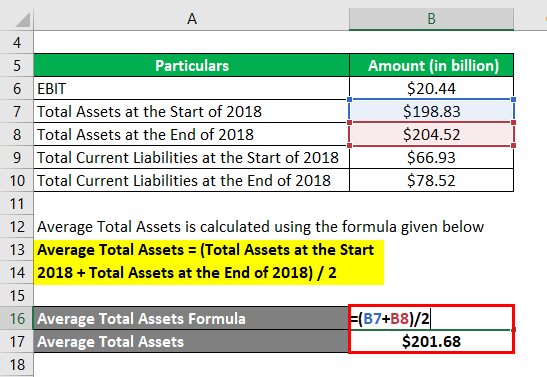

Average Total Assets is calculated using the formula given below

Average Total Assets = (Total Assets at the Start 2018 + Total Assets at the End of 2018) / 2

- Average Total Assets = ($198.83 billion + $204.52 billion) / 2

- Average Total Assets = $201.68 billion

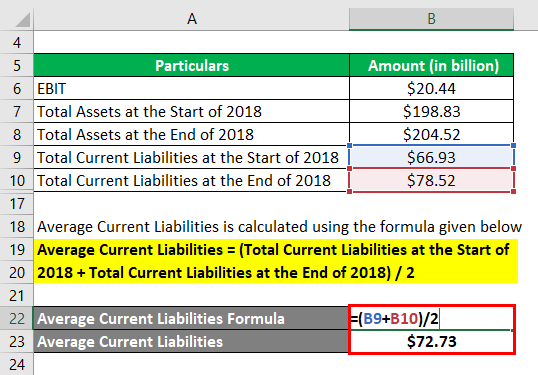

Average Current Liabilities is calculated using the formula given below

Average Current Liabilities = (Total Current Liabilities at the Start of 2018 + Total Current Liabilities at the End of 2018) / 2

- Average Current Liabilities = ($66.93 billion + $78.52 billion) / 2

- Average Current Liabilities = $72.73 billion

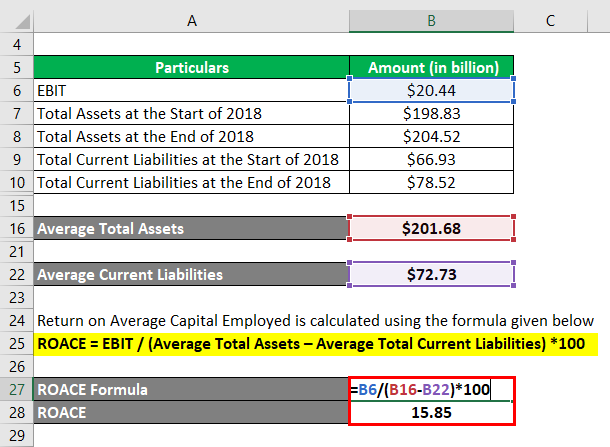

Return on Average Capital Employed is calculated using the formula given below

ROACE = EBIT / (Average Total Assets – Average Total Current Liabilities) *100

- ROACE = $20.44 billion / ($201.68 billion – $72.73 billion)

- ROACE = 15.85%

Therefore, Walmart Inc.’s ROACE stood at 15.85% during the year 2018.

Source: Walmart Annual Reports (Investor Relations)

Advantages of Return on Average Capital Employed

Some of the advantages of return on average capital employed are:

- It measures the return on both equity and debt.

- It is used to compare the profitability of companies with different capital structures.

Limitations of Return on Average Capital Employed

One of the limitations of return on average capital employed is that it can be manipulated through accounting forgery, such as the classification of long-term liabilities as current liabilities.

Conclusion

So, ROACE is an important financial metric that helps in the evaluation of the overall profitability of a company. However, it is also risks of accounting manipulations and so it is essential that you are cautious while analyzing companies based on ROACE.

Recommended Articles

This is a guide to Return on Average Capital Employed. Here we discuss how to calculate Return on Average Capital Employed along with practical examples. We also provide a downloadable excel template. You may also look at the following articles to learn more –