What is Return on Equity?

Return on Equity Formula or ROE is a metric for calculating a firm’s financial performance by dividing its net income by its shareholder’s equity, expressed as a percentage. Here, shareholder’s equity is equal to a firm’s total assets minus its liabilities.

Thus, it is regarded as the return on net assets. It measures how smartly a company is using its capital for investments to generate earnings growth that will lead to a significant profit. Thus, the higher the ROE the more a company has a chance of turning its equity financing into profits.

For example, a business named Foodie Junction reports an ROE of 25% at the end of the year. It means that the business generated a profit of $25 for every $100 of its share capital.

Return on Equity Formula

The return on equity formula is:

Here,

- Net Income is the total profit generated by a company in a given financial year.

- Shareholder’s Equity is the ownership of assets each shareholder claims after deducing total liabilities from total assets.

In the Return on Equity formula, net income is taken from the company’s income statement, which is the total sum of financial activities for that particular period. Whereas shareholders’ equity is calculated from a company’s balance sheet. Shareholder’s equity is also called shareholder’s fund. Shareholder fund comprises reserves the company generated from its operation in the past.

What Does High ROE Mean?

- A firm with sustainable and growing ROE over time indicates that it can generate shareholder value because it understands how to reinvest its earnings sensibly to boost productivity and profits.

- Moreover, the return on equity is different for different sectors; the textile sector will have a different return on equity than the information technology sector.

- So it is the investor’s choice to make an investment into the particular sector to benefit.

What Does Low ROE Mean?

- A firm with a low Return on equity means that the firm has not used the amount invested by shareholders efficiently.

- It reflects that the company’s management is not in a state to provide investors with substantial returns on their investments.

- Equity analysts or investors feel if a firm’s return on equity is less than 13-14 percent, it is not a good firm to invest in. Firms with a return on equity of 20 percent or above are considered good investment opportunities.

Examples of Return on Equity Formula (With Excel Template)

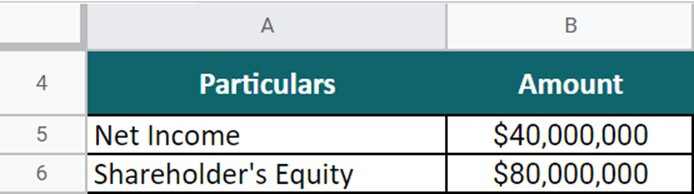

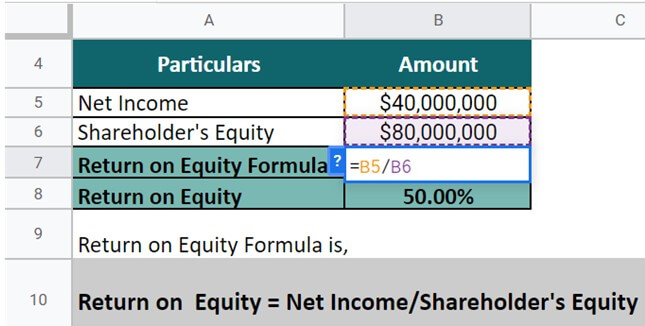

Example #1

Hop on Food, a business based in Dallas, generated $40,000,000 as a net income in the year 2022. If the company’s shareholders’ equity equaled $80,000,000 in the same year. Find the Return on Equity for the Hop on Food business.

Given,

Solution:

Let’s find the ROE for the company by evaluating the particulars and applying the formula:

From the above calculation, we can conclude that Hop on Food generated a profit of $0.50 for every $1 of shareholders’ equity in the year 2022 with a return on equity of 50%.

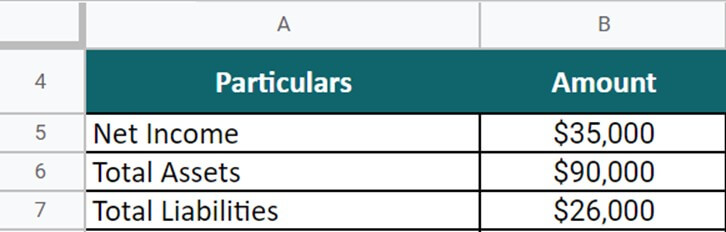

Example #2

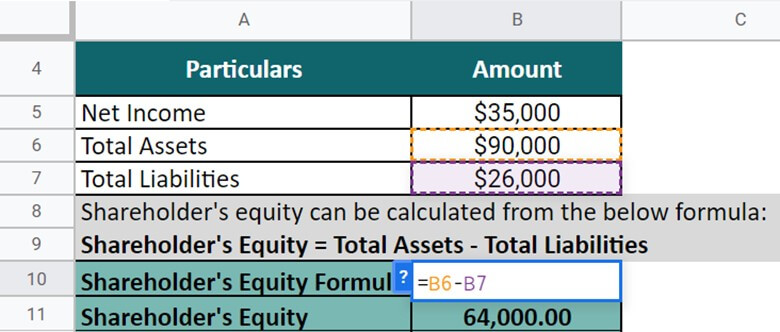

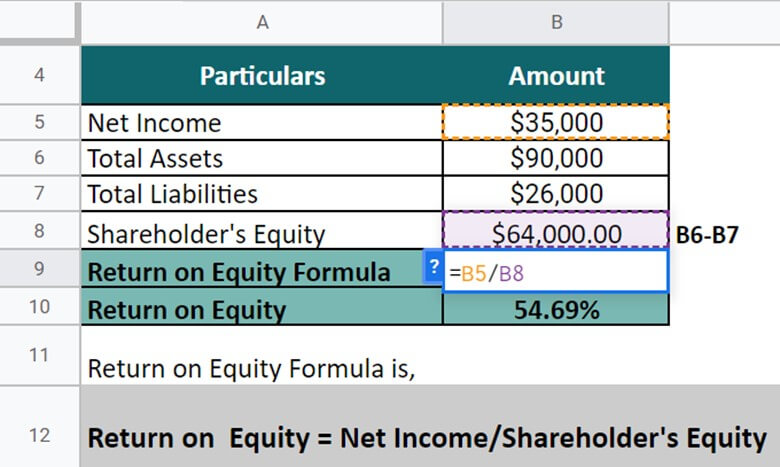

Marks & Logistics Pvt. Ltd. generated a net income of $35,000 for the financial year 2022. The company mentioned on its balance sheet that its total assets are worth $90,000, and its total liabilities are worth $26,000. Find their return on equity for the company.

Given,

Let’s first find the shareholder’s equity for the company. Shareholder’s equity is calculated using the formula given below:

So, the shareholder’s equity of the company is $64,000. Now, let’s find out the ROE of the company by implementing the formula:

From the above calculation, we can conclude that Marks & Logistics generated a profit of $0.54 for every $1 of shareholders’ equity in 2022, with a return on equity of 54.69%.

Example #3

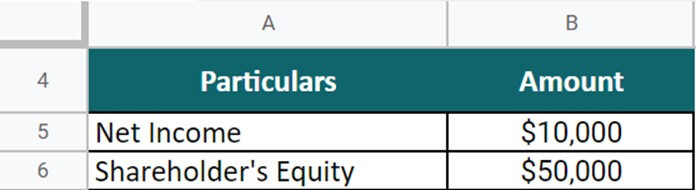

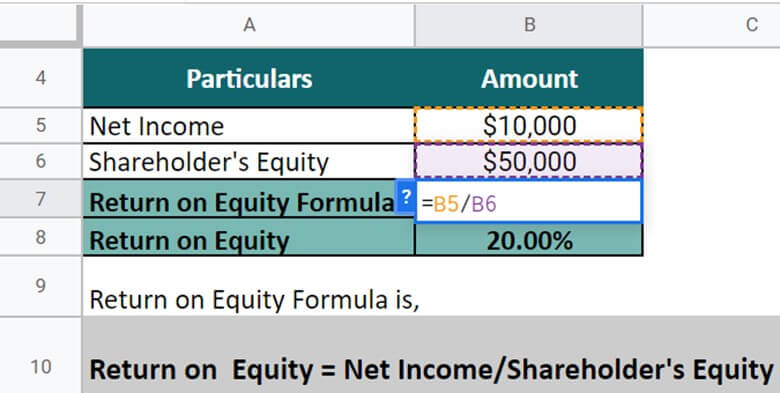

Leather Bags Pvt. Ltd. manufactures pure leather products such as bags, belts, clothes, etc. The business generated a net income of $10,000 for the financial year 2022. If the company’s shareholders’ equity is $50,000 in the same year. Find the Return on Equity for Leather Bags Pvt. Ltd.

Given,

Solution:

Let’s find the ROE for the company by evaluating the particulars and applying the formula:

From the above calculation, we can conclude that Leather Bags Pvt. Ltd. generated a profit of $0.02 for every $1 of shareholders’ equity in 2022 with a return on equity of 20%.

Return on Equity Formula Real-World Excel Examples

#1 PayPal Holdings Inc.

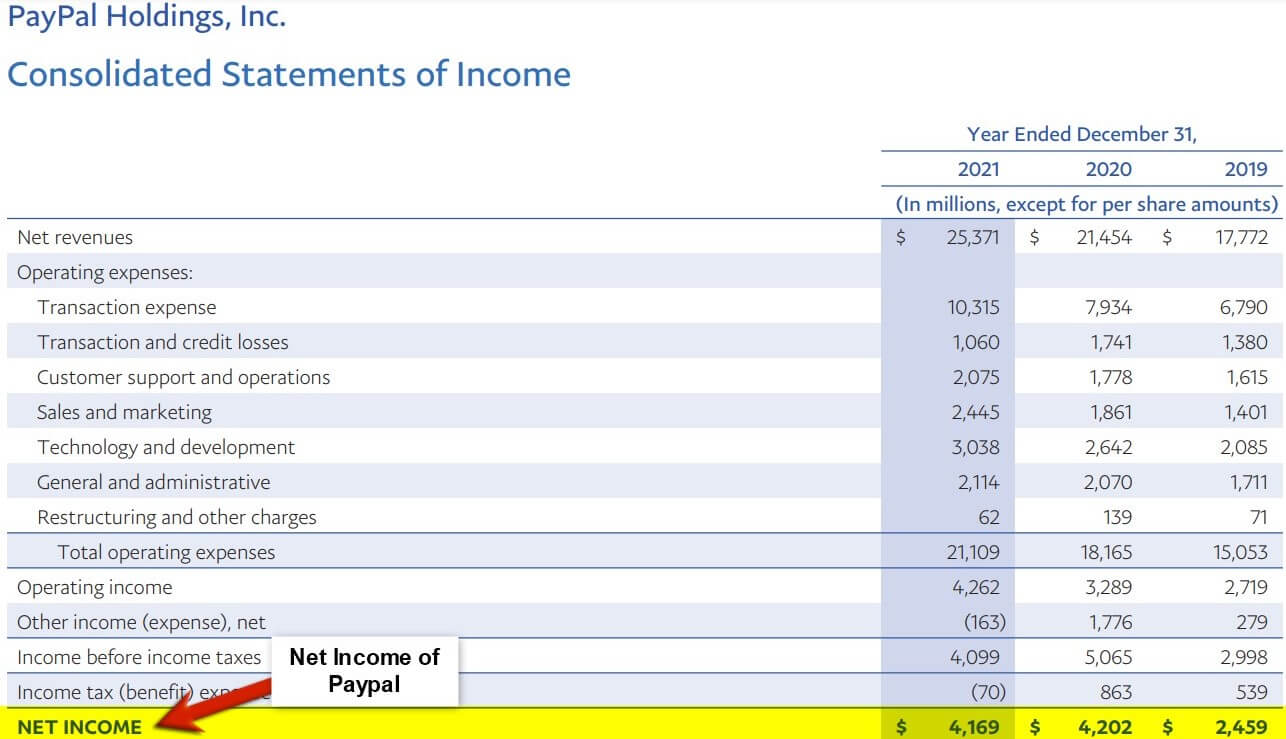

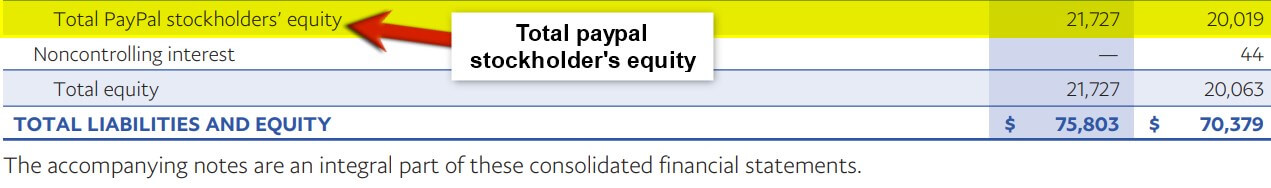

Let us take the example of PayPal Holdings Inc. to calculate the return on equity for a real-world company.

(Image Source: PayPal’s Annual Report, 2021)

As per the latest annual report, PayPal reported the following:

- Net Income = $4,169

- Shareholder’s equity = $21,727

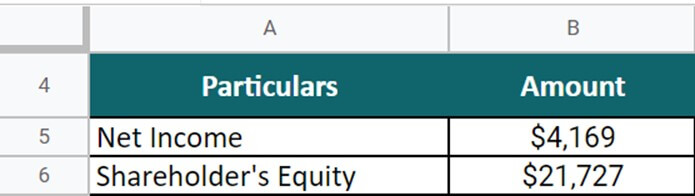

Calculate the ROE for PayPal for FY21.

Given,

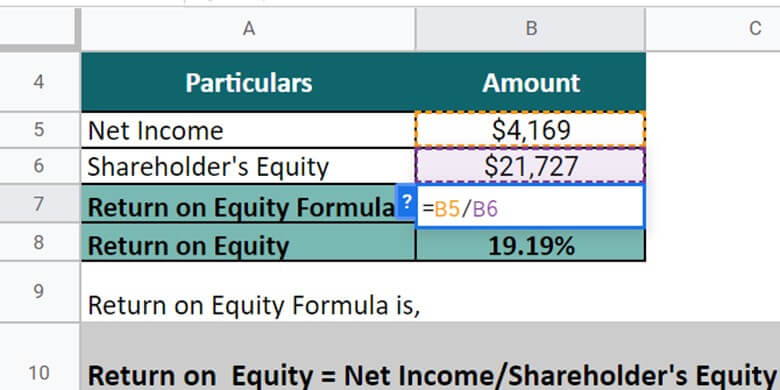

Solution:

Let’s find the ROE for the company by evaluating the particulars and applying the formula:

From the above calculation, we can conclude that PayPal Holdings Inc. generated a profit of $0.19 for every $1 of shareholders’ equity in 2021, with a Return on equity of 19.19%.

#2 Berkshire Hathaway

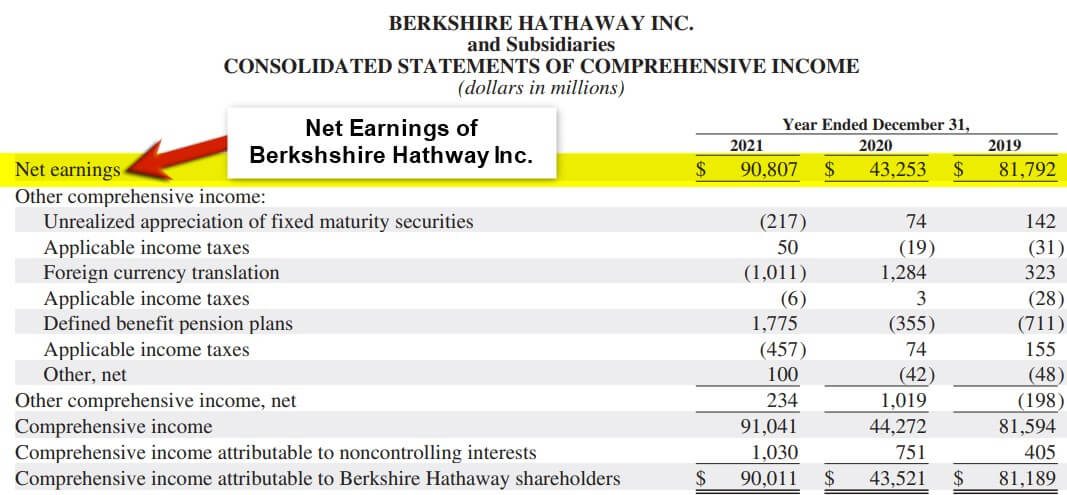

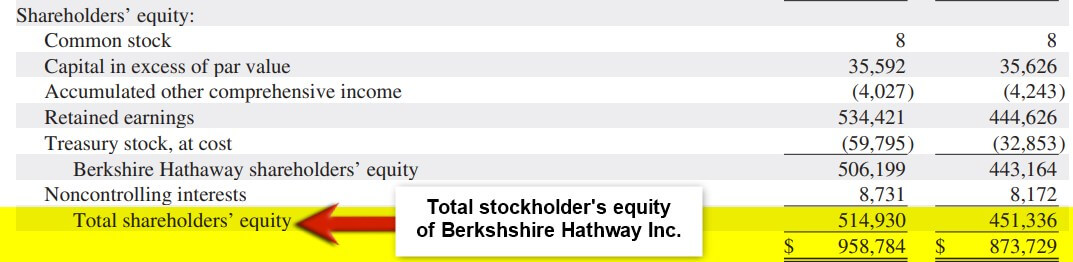

Let us take the example of Berkshire Hathaway to calculate the return on equity for a real-world company.

(Image Source: Berkshire’s Annual Report, 2021)

As per the latest annual report, Berkshire Hathaway reported the following:

- Net Income = $90,807

- Shareholder’s equity = $514,930

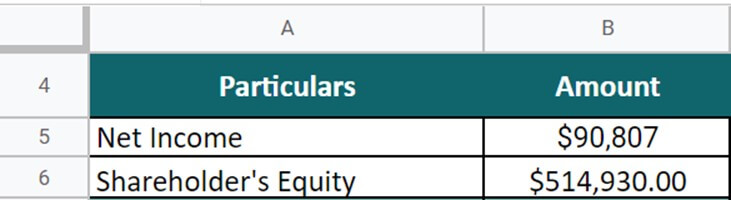

Calculate the ROE for Berkshire Hathaway for FY21.

Given,

Solution:

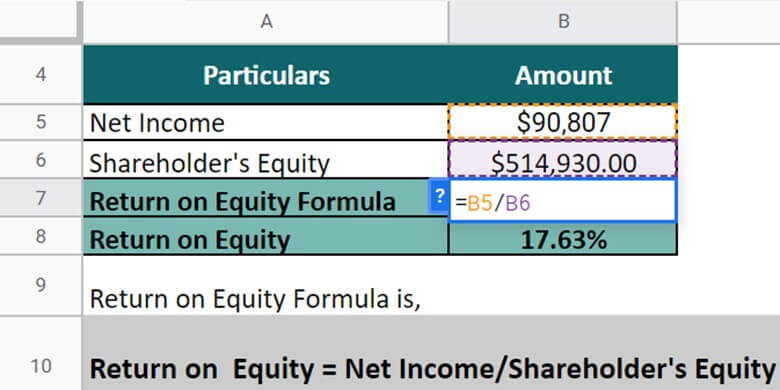

Let’s find the ROE for the company by evaluating the particulars and applying the formula:

From the above calculation, we can conclude that Berkshire Hathaway generated a profit of $0.17 for every $1 of shareholders’ equity in the year 2021 with a Return on equity of 17.63%.

#3 Tesla

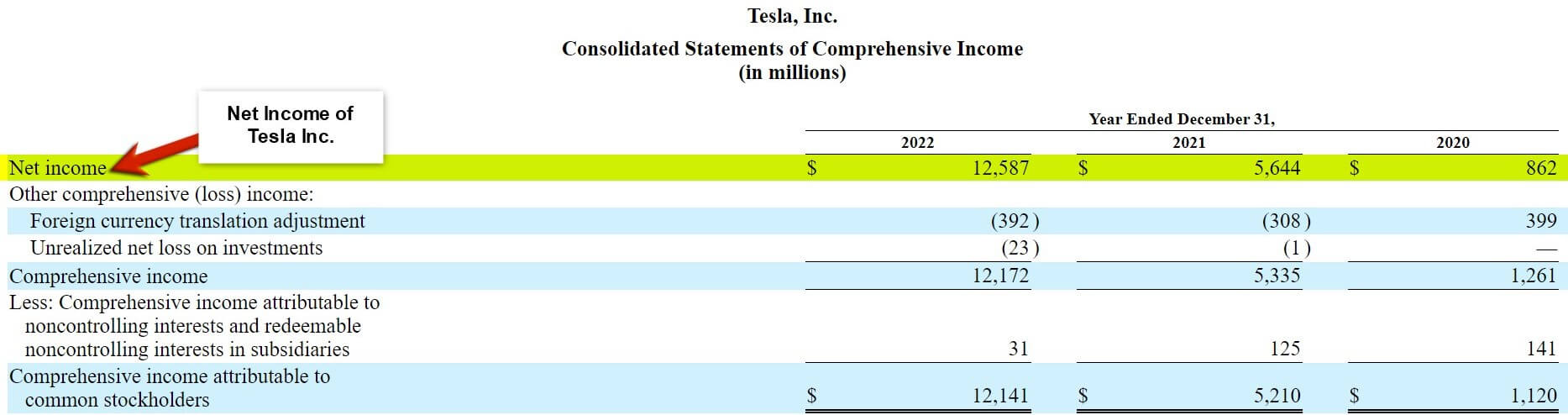

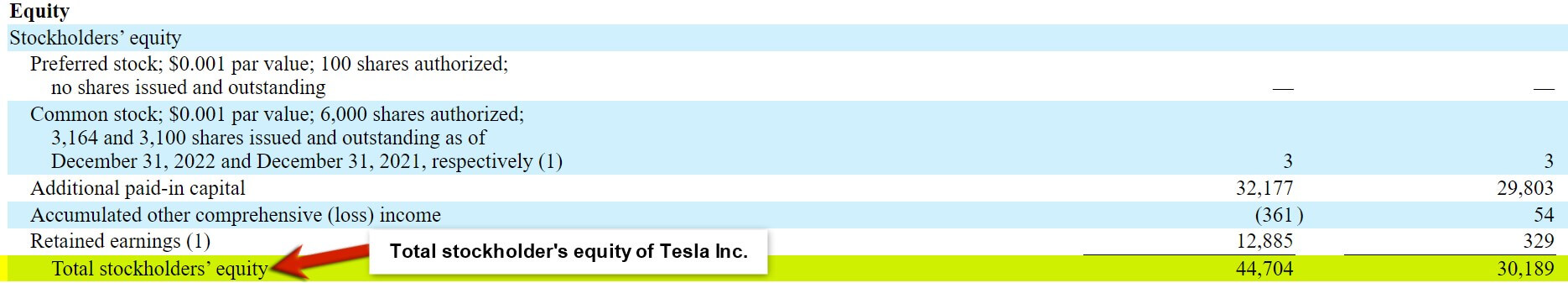

Let us take the example of Tesla Inc. to calculate the return on equity for a real-world company.

(Image Source: Tesla’s Annual Report, 2022)

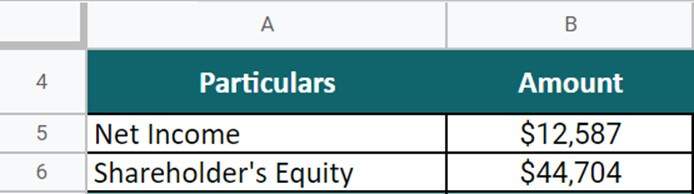

As per the latest annual report, Tesla Inc. reported the following:

- Net Income = $12,587

- Shareholder’s equity = $44,704

Calculate the ROE for Berkshire Hathaway for FY21.

Given,

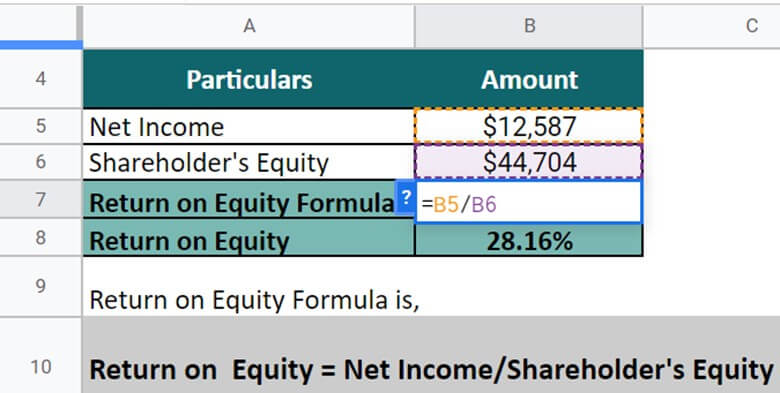

Solution:

Let’s find the ROE for the company by evaluating the particulars and applying the formula:

From the above calculation, we can conclude that Berkshire Hathaway generated a profit of $0.28 for every $1 of shareholders’ equity in the year 2021 with a Return on equity of 28.16%.

Return on Equity Formula Calculator

Use the following calculator for Return on Equity calculations.

| Net Profit | |

| Shareholder’s Equity | |

| Return on Equity = | |

| Return on Equity = | (Net Profit / Shareholder’s Equity) |

| = | (0 / 0 ) = 0 |

Final Thoughts

While debt financing can be utilized to raise ROE, it’s critical to remember that overleveraging has drawbacks, including high-interest costs and a higher chance of default. Additionally, the businesses must know that ROE is a ratio and that the company can adopt measures like asset write-downs and share repurchases to artificially enhance ROE by lowering total shareholders’ equity.

Frequently Asked Questions (FAQs)

Q1. What is the return on equity investment formula?

Answer: The return on equity formula measures the amount of money the common stakeholders will receive in return as compared to the amount they have invested in any business. In simple words, you can it usually tracks the performance of any business over time, and the formula for calculating this is as follows:

Return in Equity = Net income /Shareholder’s equity

Q2. What does 20% return on equity mean?

Answer: A 20% return on equity means that for every $1 spent from the stakeholder’s equity, the company will generate $0.20 as profit. The meaning of return on equity varies from sector to sector. However, the 15 – 20% equity ratio is usually considered good.

Q3. Is High ROE good?

Answer: Return on equity (ROE) measures any company’s net income divided by its shareholders’ equity, which shows the company’s overall performance in terms of its profit. So higher the ROR, the better the company is performing and the better they are converting its finances into profits.

Q4. Why is ROE important?

Answer: Return on equity is important because it provides insights into the profitability of any company for its investors and owners. In other words, it helps the investors understand whether or not they will get a good return on their invested money. ROE is an accurate measure of the profitability of any company because it works on the company’s net income.

Q5. How is the return on equity calculated?

Answer: ROE is calculated by dividing a company’s net income by its average stockholder’s equity. ROE is the financial ratio that shows how well a company manages the capital invested by its stakeholders.

Recommended Articles

This has been a guide to a Return on Equity formula. Here, we discuss its uses along with practical examples. We also provide a Return on Equity Calculator with a downloadable Excel template. You may also look at the following articles to learn more –