Updated July 25, 2023

Definition of Return on Sales

Return on Sales (ROS) is an efficiency ratio that measures the amount of profit that a firm earns per unit of sales. It is used to check the efficiency of the operations of the firm. Usually, the firms in the same industry compare their ROS to check their operations. The stakeholders are interested to know about the (ROS) to check the dividend viability, creditworthiness in repayment of the debt, and ability to invest.

Formula

Return on Sales is calculated as follows:

Examples of Return on Sales (With Excel Template)

Let’s take an example to understand the calculation of Return on Sales in a better manner.

Example #1

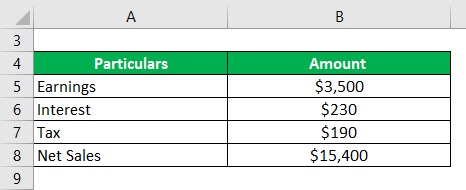

A company has earnings of $3,500 after it pays interest of $230 and a tax of $190. The sales for the period is $15,400. Calculate the return on sales?

Solution:

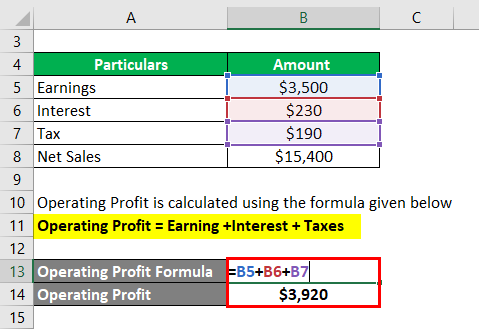

Operating Profit is calculated using the formula given below

Operating Profit = Earning + Interest + Taxes

- Operating Profit = $3,500 + 230 + $190

- Operating Profit = $3,920

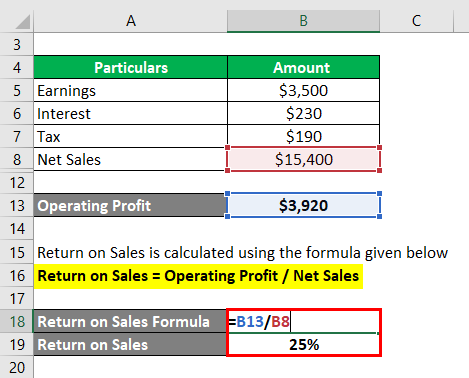

Return on Sales is calculated using the formula given below

Return on Sales = Operating Profit / Net Sales

- Return on Sales =$3,920 / 15,400

- Return on Sales = 25%

Example #2

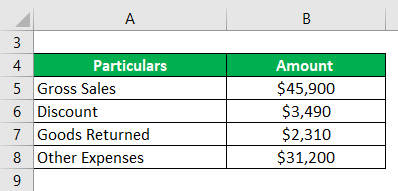

The gross sales of company H are $45,900, the discount given is $3,490 and goods returned by the customer is $2,310. Expenses over the period are $31,200. Calculate the returns on Sales

Solution:

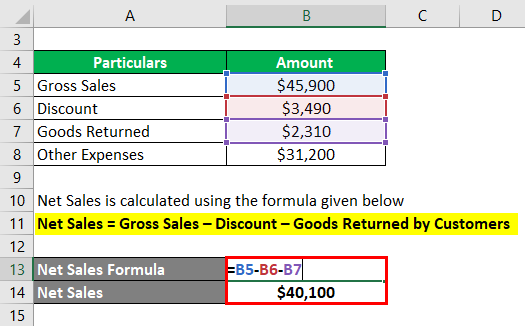

Net Sales is calculated using the formula given below

Net Sales = Gross Sales – Discount – Goods Returned by Customers

- Net Sales = $45,900 – $3,490 – $2310

- Net Sales = $40,100

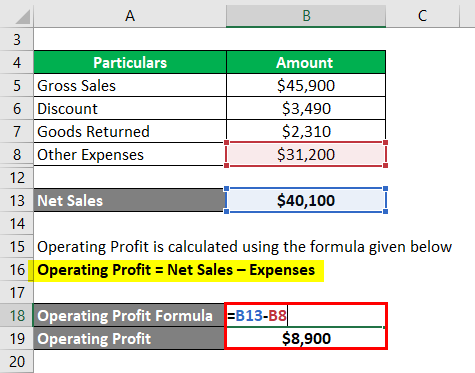

Operating Profit is calculated using the formula given below

Operating Profit = Net Sales – Expenses

- Operating Profit =$40,100 – $31,200

- Operating Profit = $8,900

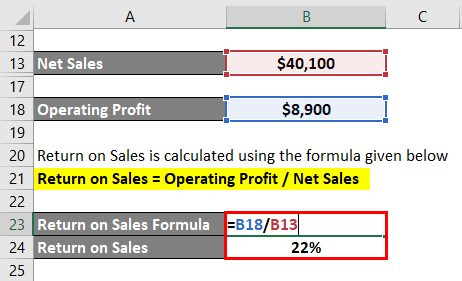

Return on Sales is calculated using the formula given below

Return on Sales = Operating Profit / Net Sales

- Return on Sales = $8,900 / $40,100

- Return on Sales = 22%

Advantages and Disadvantages of Return on Sales

Below are the advantages and disadvantages mentioned :

Advantages of Return on Sales

A higher ROS augurs well for the business. Below are some of the advantages associated

- The ROS is good proof of whether the revenue operations of the entity are yielding a profit or not. If the returns are lagging, probably there needs to be a cut in expenses or an increase in profit margin in the way the business is being run.

- The ROS is an important measure for the stakeholders to make decisions about their future with the entity. In terms of the creditors, whether the firm will be able to repay the dues to them, to the investors if they should continue investing, and in general to the people associated with the entity on how the immediate future looks like.

- Comparison with the entities in the same industry also tells about the changes that are needed or the things in which the entity has an advantage and which it should continue aggressively ahead in the future. Sometimes, when the returns are not on the healthier side, it forces the management to look out for reasons, analyze the functioning of the competitors, and checks the impediments in the way. Like all efficiency ratios, it is a good tool for introspection.

- Also, when the entity compares the ratio with those of the prior periods, there is a sense of what is going well and the things that can be worked upon. A trend analysis gives a good measure of where the firm is heading and the opportunities and challenges in its way.

- Finally, the ratio is a good measure of the efficiency of the management and whether changes are needed in its long-term approach. It also helps to understand if the current assets are being utilized to the best of their abilities or whether a change is required to ensure that it happens.

Disadvantages of Return on Sales

- Inputting too much emphasis on returns on sales, the management sometimes loses track of how the business cycle and market conditions are holding up. On many occasions, the conditions are beyond the control of the management alone. The paltry returns might invite criticism, induce demotivation and lead to change in management. However, all the changes in the world might still not help in recovering the ratio given that so many variables are not changeable.

- One more criticism that has been levied against returns on sales is that the returns on any concern should be compared with the capital that it has and not on the sales that it makes. A given entity might have too much or too little sales based on the nature of its products and that would lead to an incorrect comparison. However, the capital or the assets of the firm are constant in nature and any returns, if compared against them, would ensure a better measurement of how the concern is operating.

- The return on sales is also not a good measure for assessing the conduct of newly incorporated businesses. At the start, the business has a lot of expenditure on promotions and ensuring that the right sales channel is found i.e commission to external salespeople. In such scenarios, the (ROS) is bound to be short. If this ratio is then considered as the final measure of how the business is operating then it would be incorrect and not the best decision-making tool.

Important Points

Some of the Important points are:

- Consideration should be given to the period which is being covered by the conversion cycle. Whether, it is weekly, monthly, or yearly. Given the variation, the standards of the industry might change.

- Even though the ratio should be compared with the competitors in the same industry, however, there could be challenges that are unique only to the firm in operation and those should be taken into account while making the final decision.

Conclusion

ROS is one of the important efficiency ratios and if combined well with other analytical tools can lay the groundwork for the management to utilize their assets well and make relevant changes for ensuring a healthier business.

Recommended Articles

This is a guide to Return on Sales. Here we discuss the advantages and disadvantages and how to calculate Return on Sales along with practical examples. We also provide a downloadable excel template. You may also look at the following articles to learn more –