Updated July 25, 2023

Return on Sales Formula (Table of Contents)

What is the Return on Sales Formula?

The term “return on sales” refers to the financial ratio that helps assess how efficiently a company can convert its revenue to operating profit. In other words, it is used to calculate the amount of profit generated per dollar of sales.

Since the return on sales is a measure of a company’s operational efficiency, it is popularly known as the operating profit. The formula for Return on Sales for a given period can be derived by diving the company’s operating profit or earnings before interest and taxes (EBIT) by its net sales. Mathematically, it is represented as,

Examples of Return on Sales Formula (With Excel Template)

Let’s take an example to better understand the Return on Sales Formula calculation in a better manner.

Return on Sales Formula – Example #1

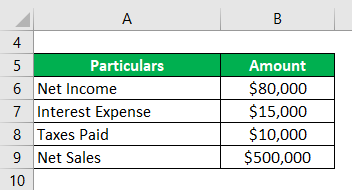

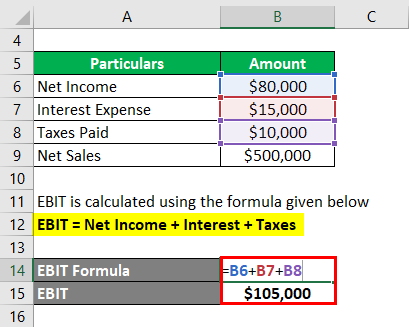

Let us take the example of a company that reported a net income of $80,000 on net sales of $500,000 during the year 2018. Further, during the year, the company incurred an interest expense of $15,000 and paid taxes of $10,000. Calculate the return on sales of the company during 2018.

Solution:

EBIT is calculated using the formula given below

- EBIT = $80,000 + $15,000 + $10,000

- EBIT = $105,000

Return on Sales is calculated using the formula given below

Return on Sales = EBIT / Net sales

- Return on Sales = $105,000 / $500,000

- Return on Sales = 21%

Therefore, the company’s return on sales stood at 21% during the year 2018.

Return on Sales Formula – Example #2

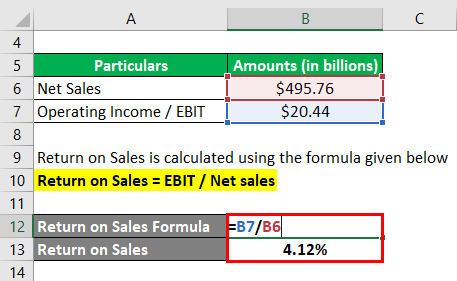

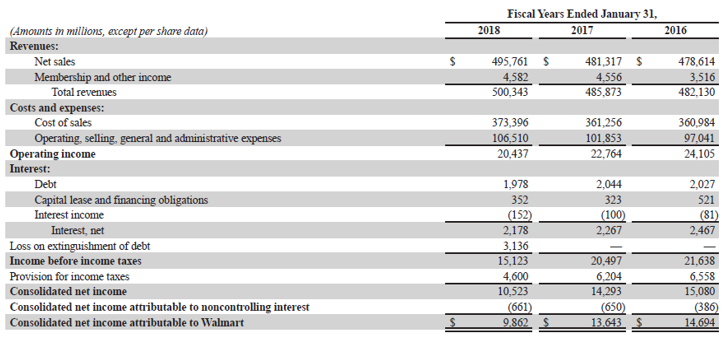

Let us take the example of Walmart Inc. to illustrate the computation of return on sales. As per the annual report for the year 2018, the company generated an operating profit of $20.44 billion on net sales of $495.76 billion. Therefore, calculate the return on sales of Walmart Inc. for the year 2018.

Solution:

Return on Sales is calculated using the formula given below

Return on Sales = EBIT / Net sales

- Return on Sales = $20.44 billion / $495.76 billion

- Return on Sales = 4.12%

Therefore, Walmart Inc. managed to return on sales of 4.12% during the year 2018.

Source: Walmart Annual Reports (Investor Relations)

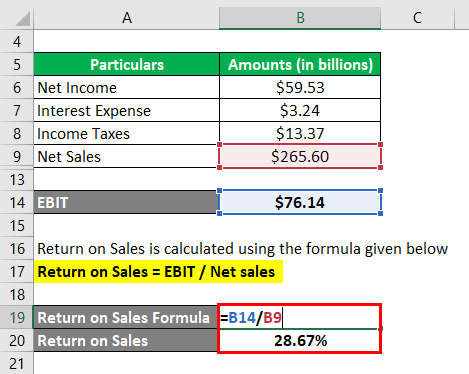

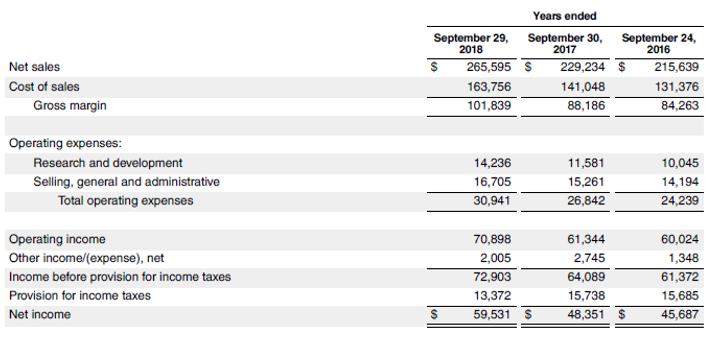

Return on Sales Formula – Example #3

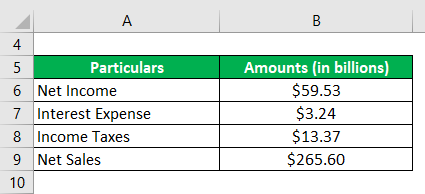

Let us take the example of Apple Inc.’s annual report for the year 2018. As per the income statement, the company reported a net income of $59.53 billion on net sales of $265.60 billion. Further, the Company incurred an interest expense of $3.24 billion and paid income taxes of $13.37 billion during the period. Therefore, calculate the Return on Total Assets for Apple Inc. based on the given information.

Solution:

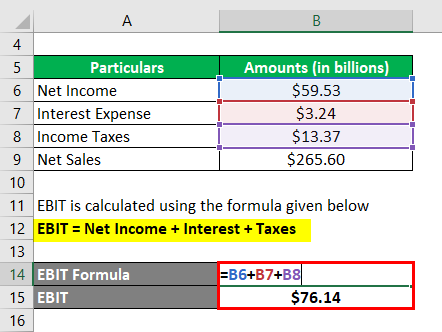

EBIT is calculated using the formula given below

EBIT = Net Income + Interest + Taxes

- EBIT = $59.53 billion + $3.24 billion + $13.37 billion

- EBIT = $76.14 billion

Return on Sales is calculated using the formula given below

Return on Sales = EBIT / Net sales

- Return on Sales = $76.14 billion / $265.60 billion

- Return on Sales = 28.67%

Therefore, Apple Inc.’s return on sales for the year 2018 stood at 28.67%.

Source L:ink: Apple Inc.Balance Sheet

Explanation

The formula for return on sales can be derived by using the following steps:

Step 1: Firstly, determine the operating profit of the company during the given period of time, which is available as a separate line item in the income statement. Otherwise, the operating profit can be computed by adding back interest expense and taxes paid to the net income of the company.

EBIT = Net Income + Interest + Taxes

Step 2: Next, determine the net sales of the company, which is one of the first 2-3 line items of the income statement for most of the companies.

Step 3: Finally, the formula for Return on Sales can be derived by diving the company’s operating profit or EBIT by its net sales as shown below.

Return on Sales = EBIT / Net sales

Relevance and Use of Return on Sales Formula

It is important to understand the concept of return on sales as it is used by various stakeholders of a company (like investors, creditors, and lenders) because this financial metric captures how well a company is able to leverage its operating efficiency to generate higher profit from its net sales. In other words, return on sales can be used to draw insight into the potential earning, reinvestment potential and debt servicing ability of a company. Typically, a higher return on sales indicates that the company is performing well as it is able to retain more money as operating profit.

Further, the return on sales can be used to compare the performance in the current period with that of the past. Such comparison helps in analyzing the trend and evaluate the internal efficiency of the subject over the period of time. In fact, an increasing trend means that the company is growing efficiently, while a decreasing trend can be indicative of a looming financial shortcoming. Return on sales can also be used in peer benchmarking i.e. comparison of the subject company to its peers, which selected on the basis of the scale of operation and operating industry.

Return on Sales Formula Calculator

You can use the following Return on Sales Formula Calculator

| EBIT | |

| Net Sales | |

| Return on Sales | |

| Return on Sales | = |

|

|

Recommended Articles

This is a guide to Return on Sales Formula. Here we discuss how to calculate Return on Sales Formula along with practical examples. We also provide a Return on Sales calculator with a downloadable excel template. You may also look at the following articles to learn more –