What is Revenue Cycle Optimization?

When you are running a healthcare practice, keeping patients your primary focus is non-negotiable. But let’s be honest for a moment: it’s impossible to sustain that focus without the financial stability of your practice. That’s where revenue cycle optimization becomes critical.

Revenue cycle optimization or revenue cycle management is when healthcare providers manage all financial processes—from patient registration to final payment—to ensure smooth cash flow and reduce delays.

However, it’s important to highlight that revenue cycle optimization isn’t just about boosting profitability (although that’s a big part of it, naturally); it’s also about creating a sustainable practice where you can continue to deliver high-quality care without the constant worry of cash flow interruptions. In short, it’s both about your bottom line and, as an extension of that, about providing the best care to your patients.

Why is Revenue Cycle Optimization Important?

The revenue cycle includes everything from patient registration, charge capture, claim submission, payment posting, and collections. Like any cycle, there are multiple points where inefficiencies can disrupt cash flow.

This is where optimization comes in. While increasing your bottom line is part of this process, it’s also about streamlining operations, reducing errors, and ultimately, freeing up time and resources so you can focus on patient care.

When done right, optimization minimizes the chances of denied claims, speeds up payment collection, and even improves patient satisfaction (because no one likes billing surprises).

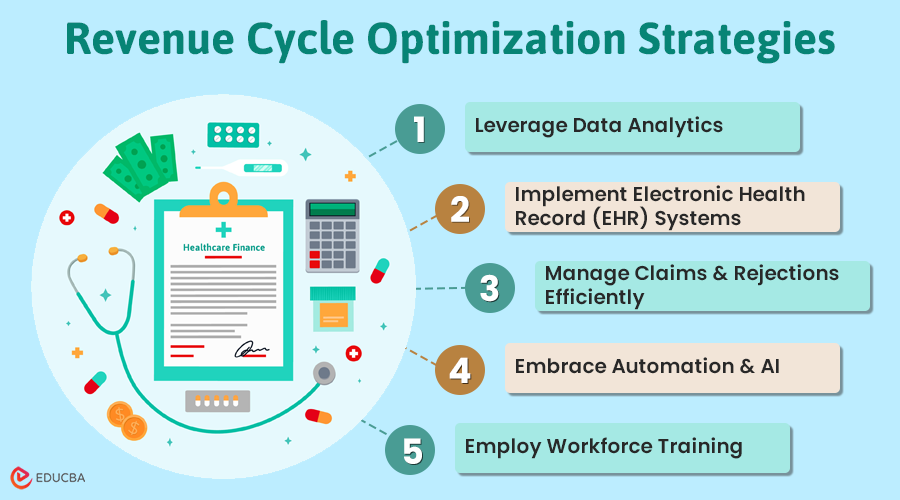

Strategies to Optimize Your Revenue Cycle

So, how can you enhance your revenue cycle management? The truth is, there’s no one-size-fits-all answer. Different practices may need different approaches, but here are a few key strategies that consistently make a difference.

#1. Leverage Data Analytics

Data is your best friend when it comes to optimizing the revenue cycle. By using advanced data analytics, you can gain insights into patterns and trends in your billing processes, identify problem areas (like frequent claim denials), and even predict future cash flows. With the right analytics tools, you can move from reactive problem-solving to proactive management.

For example, if you notice a certain type of claim is denied consistently, you can address the root cause rather than fighting every rejection. Over time, this will reduce revenue leakage and help you make more informed decisions.

#2. Implement Electronic Health Record (EHR) Systems

EHR systems aren’t just about digitizing patient records—they can be pivotal in optimizing your revenue cycle. Integrated EHRs streamline the entire billing process by ensuring that patient information is accurate and accessible in real-time.

It reduces errors during the charge capture and claim submission stages, which in turn lowers the chances of claim denials. Plus, many EHR systems come with built-in features that help automate billing tasks, such as coding, which speeds up the process and ensures compliance with ever-changing regulations.

For instance, DrChrono offers a comprehensive revenue cycle management solution that seamlessly integrates with its EHR platform, allowing you to manage claims, track denials, and handle patient billing all in one place. It’s great for real-time analytics as it offers customized reports that help you keep your revenue cycle on track and your practice financially healthy.

#3. Manage Claims and Rejections Efficiently

One of the most significant pain points in the revenue cycle is claim rejections. Every rejected claim is lost revenue until you correct and resubmit it, which is time-consuming. That’s why managing claims efficiently is critical.

First, focus on submitting clean claims from the get-go by ensuring all documentation is accurate and complete. Also, invest in a claims management system that flags potential issues before submission. If rejections do occur, having a dedicated team or software to handle them quickly can make a huge difference. The quicker you resolve rejections, the faster you get paid.

#4. Embrace Automation and AI

You are probably sick of the word “automation” by this point. Still, the truth is that it’s a practical solution to many revenue cycle challenges. Automating repetitive tasks such as appointment reminders, billing, and even parts of the collections process frees up time to focus on other complex issues.

#5. Employ Workforce Training

Training healthcare staff regarding optimizing your healthcare revenue cycle is crucial. With regular training, they stay updated with the latest strategies to handle financial processes efficiently. It also boosts job satisfaction and enhances productivity, leading to a more stable and effective revenue cycle.

Final Thoughts

On top of this, various AI-driven tools can help predict patient payment behaviors, optimize appointment scheduling to reduce no-shows, and even assist in coding and billing accuracy. The result? Reduced overhead, fewer errors, and faster revenue collection.

Recommended Articles

We hope these tips help you with revenue cycle optimization. Check these other resources for more strategy-based content.