Updated July 20, 2023

What is Revenue Reserve?

The revenue reserve is defined as the reserve that the organization establishes from the profits that the business earns through the course of business for a given period.

The revenue reserves are utilized for meeting contingencies and for the purpose of small projects that helps in business expansion. Whenever an organization makes good level of profits or earns substantially well, as a conservative policy, then tend to establish a reserve that holds a portion of the profit and could be used for reinvestment to meet the business requirements. The retained earnings can be illustrated as the best example of a revenue reserve. Normally, a business can distribute revenues reserves in the form of bonus stock issues.

It helps the business to become fundamentally strong and stable. This feature, in turn, becomes beneficial for the stockholders. Therefore, whenever a business makes surplus profits in a given financial year, it distributes some portion as dividends and it retains some portion in the form of revenue reserves that could be invested in the form of reinvestment. Maintenance of revenue reserves also helps in comparing the operational efficiency of the business. The revenue reserves are regarded as the indirect measure of operational efficiency. The revenue reserves are never reflected in the book of accounts as they are made up and prepared from the actual profits derived by the business.

In order to check for the revenue reserves, access the liabilities section under stock holder’s equity of the balance sheet. Higher the amount, more it is beneficial for the stakeholders. Therefore, it could be stated that this amount is set aside and is generally not distributed as dividends to the end stakeholder.

Examples of Revenue Reserve

Retained earnings can be classified as an example of revenue reserves. Suppose the business earned a net income of $12,000. The business distributed $2,000 as dividends. However, the business decided to retain $10,000 in the retained earnings after the distributions are made.

Therefore, by doing so business, the business creates a revenue reserve of $10,000. This can be then utilized for meeting out any potential financial emergency as it is self-created internal finance.

Types of Revenue Reserve

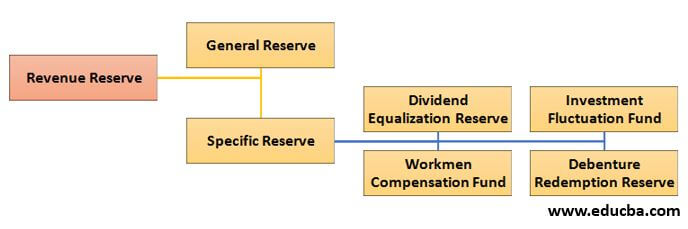

This can be classified into two broad categories namely, specific reserve and general reserve.

- General Reserve: The general reserves can be broadly described as the reserves that is formed for the purpose that is not yet finalized or the intended use is unknown at the moment.

- Specific Reserve: The specific reserve can further be categorized as dividend equalization reserve, workmen compensation fund, debenture redemption reserve, and investment fluctuation fund. The specific reserves, on the other hand, is the revenue reserve fund that is established to meet specific business objectives. The proceeds can be used for redeeming debt and hence a reserve may form that would be termed as debenture redemption fund. The reserves may be created to meet intermittent fluctuations observed in the market value of the investments. Similarly, dividend reserves are created to distribute dividends for the time period when the business earns below expected results.

Revenue Reserve Journal Entry

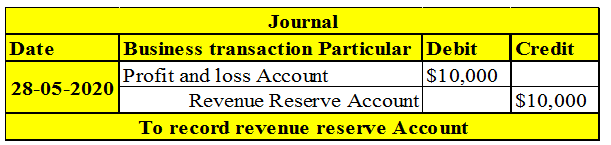

Normally, to create a journal entry for revenue reserve, an entry is created in a revenue account as a debit to retained earnings account and credit to the revenue account. Suppose for the given financial year earnings were $20,000 out of which $10,000 is passed into a reserve account.

The following would be journal entry for the stated transaction:

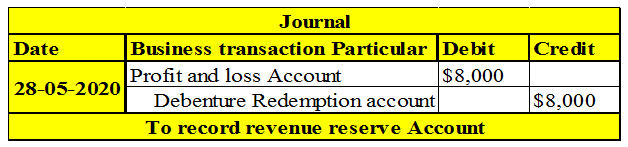

As it could be seen that from the above journal entry, $10,000 was debited from the profit and loss account. Now the ending balance of the profit and loss statement is $10,000. The management further decides that $8,000 be captured for debenture redemption fund and remaining to be distributed as dividends. To capture the transaction, the following would be the journal entry as shown below:

Difference Between Revenue Reserve and Capital Reserve

- The revenue reserve is made to make up for the unforeseen events that may happen in business organizations.

- The capital reserve is developed to fund any projects of the business that have a period of a long time period.

- The revenue reserves are developed from the earnings earned by the business through many business lifecycles.

- The capital reserves are generally created by selling off capital assets or from the capital gains earned from the sales of the marketable securities.

- These are established with the end goal of meeting reinvestment needs.

- The capital reserves are formed with the intent of complying with the accounting principles.

- They are employed for short-term projects whereas capital reserves are employed for long-term projects.

- The revenue reserves as a utilization could be employed for dividend distribution whereas capital reserves cannot be applied for dividend distribution.

- Retained Earnings are an example of revenue reserves whereas Sale of capital assets and marketable securities are an example of capital reserves.

Advantages of Revenue Reserve

Some of the advantages are given below:

- The revenue reserves create a potential source of internal finance. This can be utilized for meeting small business requirements.

- It can be distributed to the shareholders as well in the most testing times of the business.

- It is recognized as the monetary value in real terms and simultaneously can exist in the book of accounts.

- Some portion of proceeds may be utilized to finance asset replacement requirements.

- It is also utilized to pay off short-term and high cost debt.

- It also utilized for meeting any short-term contingencies that was not visualized by the management.

- It help in gaining the confidence of the stakeholders as well. They fortify business at the very core.

Conclusion

The revenue reserves are defined as the reserves that the business tends to retain from the profit earned. The reserves so created are utilized for meeting out contingencies. The contingencies range from payment of unforeseen financial emergencies or payment on short-term debt. It should be noted that the these are created from the actual profits earned by the business and capital reserves, on the other hand, are created from the liquidation of capital or tangible assets or financial instruments.

Recommended Articles

This is a guide to Revenue Reserve. Here we also discuss what is revenue reserve along with respective types and advantages. You may also have a look at the following articles to learn more –