Updated July 25, 2023

Difference Between Revenue vs Turnover

Revenue is the company’s income by selling goods and services to its customers for a price. Turnover describes how many times the company burns using its assets. The words turnover and revenue are often used in each other’s place, and often they even mean the same. In a general scenario, a company earns revenue through sales. However, an organization can even generate revenue without having a turnover. At the same time, it might have turnover, which will not yield any revenue, like in the case of inventory turnover, employee turnover, etc. In this article, we will learn in detail about revenue vs turnover.

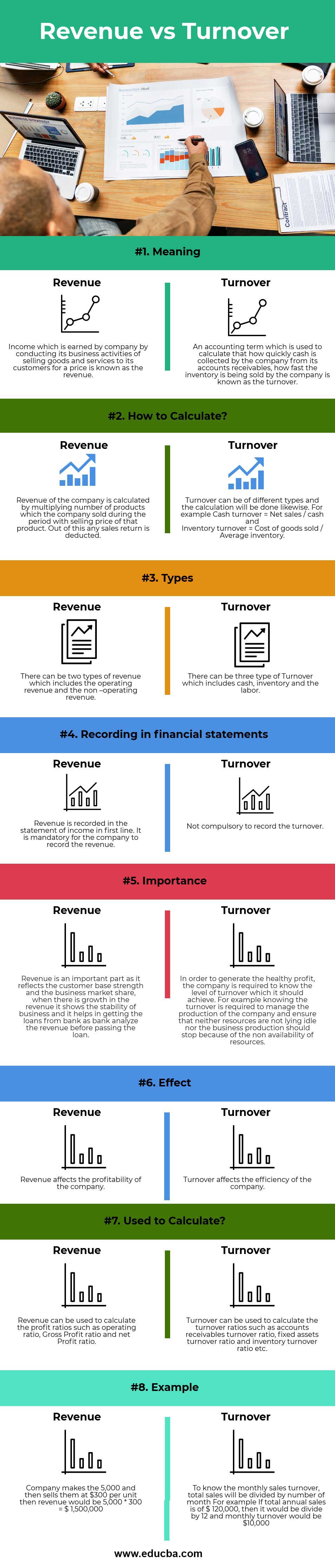

Revenue vs Turnover (Infographics)

Below is the top 8 difference between Revenue vs Turnover.

Key Differences Between Revenue vs Turnover

Let us discuss some of the major differences between Revenue vs Turnover:

- The main difference between Turnover and Revenue is that Turnover affects the efficiency of the company, whereas Revenue affects the profitability of the company

- Turnover can be used to calculate the different types of turnover ratios such as accounts receivables turnover ratio, fixed assets turnover ratio, and inventory turnover ratio, etc., and the Revenue can be used to calculate the different types of profit ratios such as operating ratio, Gross Profit ratio, and net profit ratio.

- The company records revenue in the statement of income as a mandatory requirement. On the other hand, calculating turnover is not mandatory, but it helps the company better understand its financial statements and achieve proper functioning.

- Both revenues and turnover play different and important roles in any organization. The company’s turnover is important because, to generate a healthy profit, the company must know the turnover level it should achieve. For instance, managing the company’s production and ensuring that resources are not idle, as well as preventing production from stopping due to the unavailability of resources, necessitates knowledge of the turnover. On the other hand revenue of the company is an important part as it reflects the customer base strength and the business market share. When there is growth in the revenue, it shows the stability of the business, and it helps in getting the loans from the bank as the bank analyzes the revenue before passing the loan.

- There can be three types of Turnover: cash, inventory, and labor, whereas the revenue is of two types: operating revenue and the non–operating revenue.

Turnover vs Revenue Comparison Table

Below is the topmost comparison between Turnover vs Revenue

| Basis | Turnover | Revenue |

| Meaning | An accounting term used to calculate how quickly the company collects cash from its accounts receivables and how fast the company is selling the inventory is known as the turnover. | The company earns income by selling goods and services to customers at a price, which is referred to as revenue. |

| How to calculate? | Turnover can be different, and the calculation will be done likewise. For example, Cash turnover = Net sales/cash and

Inventory turnover = Cost of goods sold / Average inventory. |

The company’s revenue is calculated by multiplying the number of products sold during the period by the selling price. Out of this, any sales return is deducted |

| Types | There can be three Turnover types: cash, inventory, and labor. | There can be two types of revenue: operating revenue and non–operating revenue. |

| Recording in financial statements | Not compulsory to record the turnover. | Revenue is recorded in the statement of income in the first line. The company must record the revenue. |

| Importance | To generate a healthy profit, the company must know the turnover level that it should achieve. For instance, managing the company’s production and ensuring that resources are not idle, as well as preventing production from stopping due to the unavailability of resources, necessitates knowledge of the turnover. | Revenue is important as it reflects the customer base strength and the business market share. When there is growth in the revenue, it shows the stability of the business, and it helps in getting the loans from the bank as banks analyze the revenue before passing the loan. |

| Effect | Turnover affects the efficiency of the company. | Revenue affects the profitability of the company. |

| Used to calculate? | Turnover can be used to calculate the turnover ratios such as accounts receivables turnover ratio, fixed assets turnover ratio, inventory turnover ratio, etc. | Profit ratios, such as operating, gross, and net profit ratios, can be calculated using revenue. |

| Example | To determine the monthly sales turnover, divide the total sales by the number of months. For instance, if the total annual sales amount to $120,000, the monthly turnover would be $10,000 obtained by dividing the total sales by 12. | The company makes the 5,000 and then sells them at $300 per unit then revenue would be 5,000 * 300 = $ 1,500,000 |

Conclusion

Understanding the differences between revenue and turnover is crucial for every organization to function better and survive. While they are not the same, there is often some correlation between them. For instance, a business that frequently turns over its inventory can generate more revenue. However, it’s important to note that a successful inventory turnover doesn’t always translate to profit.

For example, suppose a company sells its inventory at clearance prices to clear all stock quickly. In that case, it may increase its revenue and turnover rate but still earn low profits due to lower sales than the inventory cost. Therefore, turnover and revenue are distinct yet crucial factors for any business.

Recommended Articles

This has been a guide to Revenue vs Turnover. Here we discuss the Revenue vs Turnover key differences with infographics and a comparison table. You may also have a look at the following articles to learn more