Updated July 24, 2023

Risk Free Rate Formula (Table of Contents)

What is the Risk Free Rate Formula?

As the name suggests, the Risk free rate of return is an investment with zero risks. Basically, the return an investor expects to get when he makes an investment with zero risks. This return is only in theory as all the investments have a certain amount of risks involved with them. It can also be defined as the minimum return an investor expects for any type of risk and that they will not accept anything lower than the risk free rate than if they take an on investment with a certain amount of risk. The risk free rate is generally used in the US 10 year government bond. As the US government has the authority to print money, there is technically no risk to lend money to the government.

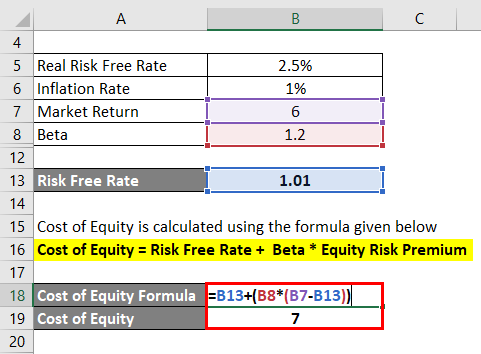

Formula For Risk Free Rate is represented as,

We have a nominal risk free rate in a similar way, and we want to calculate the real risk free rate, then we will just have to reshuffle the formula.

Examples of Risk Free Rate Formula (With Excel Template)

Let’s take an example to understand the calculation of Risk Free Rate in a better manner.

Example #1 – Using the US Treasury Bond

The calculation of risk free return depends on the time period for which the investment has been made. Accordingly, to the tenure, the rate is decided. Suppose the time period is 3 months, then the ninety-day government security, i.e. t-bill, is used. The rate is quoted as.489, then the risk free rate quoted is 0.49%. Treasury bills are usually for a short period of time. For longer tenures, treasury note and treasury bonds are used.

Example #2 – Using CAPM

Consider that you are working as an analyst at a firm where you are looking at a project and are accepted to find out the project’s net present value. The tenure of the project is eight years. For analyzing the net present value, you will first have to determine the weighted average cost of capital. First, we have to calculate the cost of equity using the capital asset pricing model (CAPM).

The firm is based in China. The short term rate of China’s government bills is 2.5%. The ten-year government ball is 3%, and the rate of inflation is 0.8%. On the other hand, US short term and long term rates are 3% and 3.5%, and the rate of inflation is 1%

The market return in China is at 6%, and you have assumed the beta to be 1.2. You decide to calculate the cost of equity using the capital asset pricing model

Since the cash flows are coming in China, you should be using the long term rate on the Chinese government bonds. The long term bond is appropriate since the cash flows are coming in eight years. The cash flows are provided in real term; hence the risk free rate should also be used in real terms –

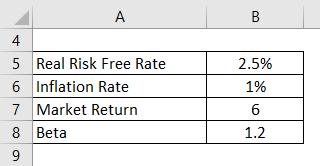

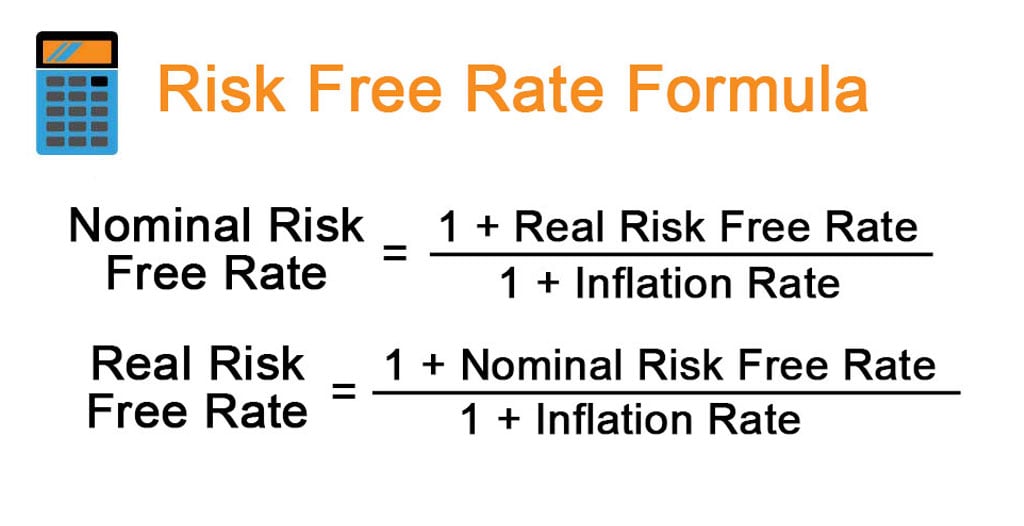

Solution:

Risk Free Rate is calculated using the formula given below

Nominal Risk Free Rate = (1 + Real Risk Free Rate) / (1 + Inflation Rate)

- Risk Free Rate = (1 + 2.5%) / (1 + 1%)

- Risk Free Rate = 1.01%

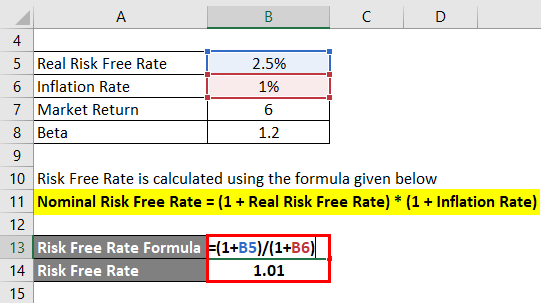

CAPM Method

Cost of Equity is calculated using the formula given below

Cost of Equity = Risk Free Rate + Beta * Equity Risk Premium

- Cost of Equity = 1.01% + 1.2 * (6% – 1.01%)

- Cost of Equity = 7%

Example #3

You are a portfolio manager and are looking to advise your client on his investments. Your client is risk-averse and wants to invest in securities that have less risk. He asks you for your advice and wants to know what is the return over and above the riskless investment.

You look at the return of the S&P 500 for the last year and find out that the return is over 11%. Now to calculate the return risk free rate, you look at the return of a one-year treasury bond. The return is 4%.

You calculate the return as 11% – 4% = 7%

The investor questions of why you are using the rate of the one year Treasury bond. You then explain to the client that these treasury notes have the least amount of risk and are used as the risk free rate to understand the minimum rate of return that is to be expected on any investment.

Explanation

The risk free rate formula has two main factors

- Inflation

- The inflation rate is taken for the tenure for which the investment is made.

- Real rate

- This is the real rate that is earned on an investment. The real rate is calculated as the nominal rate minus the inflation.

There are two risks that cannot be avoided; one is the inflation risk, and the other is interest rate risk, both of which are captured in the formula.

Relevance and Use of Risk Free Rate Formula

It is important to understand the risk free rate as it can be defined as the minimum return that an investor expects on any investment. Also, for any additional risk the investor is willing to take, he will require a return over and above the risk free rate.

Investors must add a premium to the risk free rate for every additional risk they are willing to take. The amount of premium depends on the size of the risk the investor carries. For example, a corporate bond from an old blue-chip company would have a lower risk than a startup bond.

The risk free rate mainly serves as the base and the foundation model for all investment decisions. One of the most important and popular uses of the risk free rare is that it is used in a variety of business valuation models.

It is used in calculating the cost of equity using the capital pricing asset model (CAPM). These are important factors that are used to calculate the weighted average cost of capital (WACC). It is also a fundamentally important factor used for calculation in the Black and Scholes option pricing model and the modern portfolio theory.

Recommended Articles

This is a guide to Risk Free Rate Formula. Here we discuss how to calculate Risk Free Rate along with practical examples. We also provide a downloadable excel template. You may also look at the following articles to learn more –