Roadmap to a Finance Career: Overview

Starting a career in finance is a life-changing journey that offers many opportunities for growth, learning, and job satisfaction. This article provides a roadmap to a finance career, highlighting essential steps to help you navigate this dynamic field. Finance is one of the most dynamic fields, providing a wide range of roles where individuals can focus on specialties such as investment banking, financial planning, or accounting. However, stepping into finance without preparation can feel overwhelming.

Understanding the Financial Sector

From banking to financial analysis, the diversity in the financial sector allows you to align your career with your interests. Each segment requires distinct skills and knowledge, so take the time to explore what aligns best with your strengths and passions. Some common roles in finance include:

- Investment Banking: This role involves advising clients on investment opportunities, mergers, and acquisitions. It is intense but rewarding for those who enjoy high-stakes deals.

- Financial Analyst: Analysts use data to help companies make informed business decisions. They evaluate past financial data, project future performance and create reports for management.

- Financial Planner: Financial planners help clients manage their money effectively, from budgeting to retirement planning. It is ideal for those who enjoy working one-on-one with people.

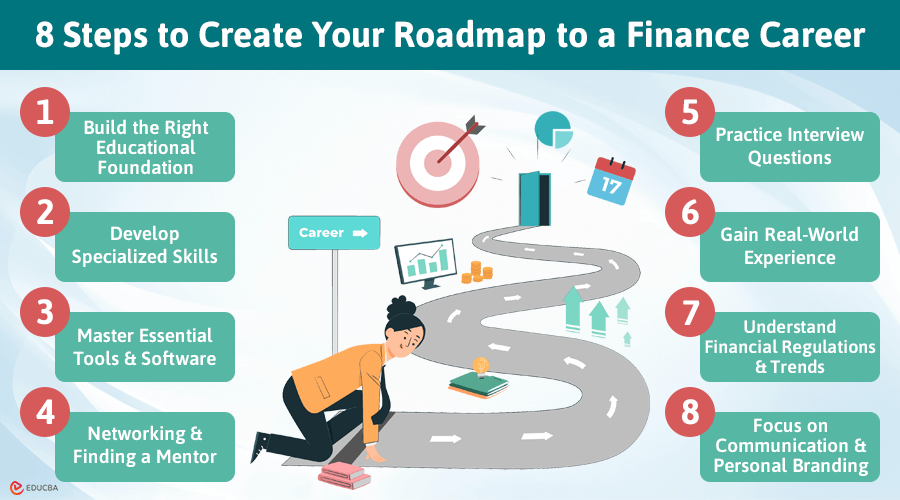

8 Steps to Create Your Roadmap to a Finance Career

Creating a roadmap for a successful finance career involves a strategic approach, combining education, skill development, networking, and practical experience. Here are 8 steps to help you create a roadmap to a finance career:

#1. Build the Right Educational Foundation

Most finance professionals hold a bachelor’s degree in finance, accounting, economics, or a related field. However, going beyond this can set you apart. Advanced certifications like a Chartered Financial Analyst (CFA) or Certified Financial Planner (CFP) are highly respected and can open doors to senior roles.

#2. Develop Specialized Skills

In finance, specialized skills are invaluable. Here are a few examples:

- Financial Modeling and Valuation: These skills are essential for analysts and investment bankers who need to project company performance.

- Data Analysis and Statistical Skills: Data is now critical in finance, so understanding programs like Excel, SQL, and Tableau is highly beneficial.

- Soft Skills: Yes, finance professionals need soft skills, especially if you aim for leadership roles. Skills like critical thinking, communication, and problem-solving are crucial for simplifying and making complex financial concepts easy to understand.

Even if you do not aim to become a CFA or CFP immediately, investing time in courses or certifications in these areas can make a significant difference.

#3. Master Essential Tools and Software

Finance roles often require proficiency in specialized software and tools, some of which can be challenging to learn without a guide. For example, converting financial data to formats compatible with software is a common task. Knowing how to convert PDF to QBO files can save valuable time and make data more accessible. Tools like QuickBooks, Microsoft Excel, and various financial analysis software will become your daily companions.

#4. Networking and Finding a Mentor

Networking can significantly enhance your career in finance. Connect with industry professionals, attend finance-related events, and do not hesitate to ask for advice. LinkedIn is a powerful tool for this. Joining groups, attending virtual webinars, and connecting with finance professionals can help you create a supportive network for your growth.

The Role of Mentorship:

Professional mentors provide insights into the realities of finance, offer guidance on career development, and may even help you avoid common mistakes. Seek out someone with experience in the sector you are interested in, whether it is wealth management, accounting, or financial analysis.

#5. Practice Interview Questions

Finance interviews can be intense, often involving case studies, technical questions, and personality assessments. Practicing these types of questions is key to standing out.

- How do you analyze financial statements?

- Can you discuss when you identified and resolved a financial issue?

- Describe a time when you worked under pressure to meet a financial deadline.

These questions assess your technical skills and ability to handle pressure. To succeed, research the role thoroughly, practice answering questions confidently, and be prepared to discuss your experience with quantitative data.

#6. Gain Real-World Experience

Employers want to see hands-on experience that proves you can apply theoretical knowledge. Internships, entry-level jobs, or apprenticeships provide practical experience and exposure to real financial scenarios. An effectively customized resume can be your ticket to interviews, especially if it is your first role in finance. To make your experience stand out, hire a resume writer who can highlight your strengths and match your qualifications to the expectations of finance recruiters.

A well-polished resume can make you stand out in a crowded job market. Additionally, practice problem-solving skills and enhance your ability to interpret numbers, trends, and data. Tools like Excel and Python can improve your analytical skills, helping you make well-informed decisions and making your resume even more impressive.

#7. Understand Financial Regulations and Trends

Staying informed about the latest financial regulations is essential, especially if you are interested in banking or compliance roles. Familiarize yourself with industry guidelines and policies, as regulatory knowledge is critical for many finance roles. The finance sector is evolving with trends like fintech and blockchain. Understanding these emerging technologies can give you a competitive edge and prepare you for the future of finance.

#8. Focus on Communication and Personal Branding

A finance career often involves explaining complex information to non-finance stakeholders. Gaining written and spoken communication proficiency can be very beneficial, particularly in management or client-facing positions. Present yourself as a finance expert online by sharing insights, attending webinars, or writing about industry trends. This can enhance your credibility and make you more attractive to potential employers.

Final Thoughts

Entering the finance industry is a rewarding yet challenging journey that offers immense growth and learning opportunities. However, success in finance also requires adaptability, as the industry constantly evolves with new technologies, regulations, and trends. Following a roadmap to a finance career involves mastering tools, honing analytical and communication skills, and building a strong professional network—essential steps toward becoming a well-rounded financial expert. As you progress in your career, seek mentorship and advice from experienced professionals, and remember that learning is an ongoing journey in finance. With a focused approach and a commitment to self-improvement, you can build a successful, fulfilling career in the financial sector.

Recommended Articles

We hope this detailed guide to the roadmap to a finance career offers you valuable insights and strategies for successfully navigating your professional journey in the financial industry. Explore the articles below for additional resources and guidance to support your finance journey.