Introduction to Robo-Advisor

Robo-advisors are transforming people’s investments by making smart financial planning accessible to everyone. Whether saving for retirement, planning a vacation, or just looking to grow your wealth, robo-advisors offer an easy, low-cost, and efficient way to manage your investments with minimal effort.

In this article, we will explore robo-advisors, their functions, and why they are becoming the go-to investment tool in 2025. We will also share insider tips, unique features, and hidden benefits that many articles overlook.

What Is a Robo-Advisor?

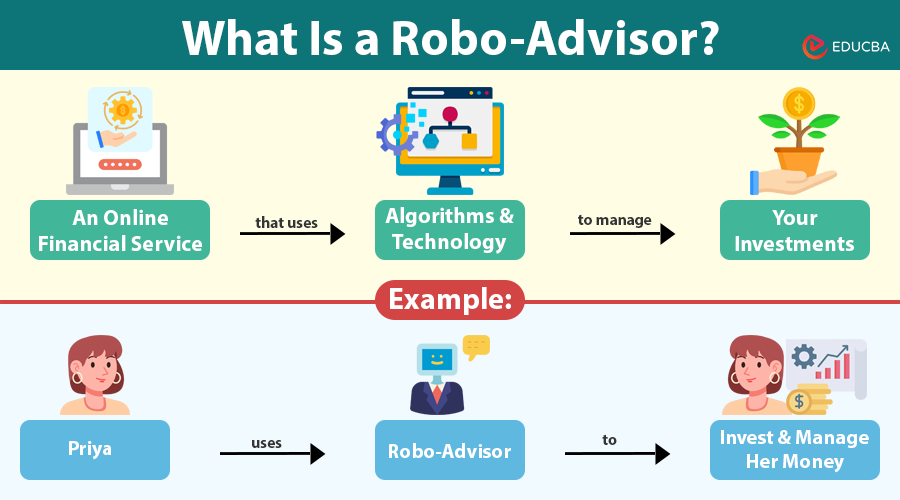

A robo-advisor is an online financial service that uses algorithms and technology to manage your investments. Think of it as a virtual financial planner that builds and maintains an investment portfolio based on your personal goals and risk profile without charging high fees or requiring you to have deep financial knowledge.

Let us say, Priya, a 30-year-old working professional, wants to invest ₹1 lakh in her future but is unsure how to start. She signs up with a robo-advisory platform, fills out a questionnaire, and the system creates a personalized investment plan within minutes. She diversifies her money into mutual funds, government bonds, and ETFs. The platform also rebalances the portfolio regularly—no manual effort is needed.

Key Features and Utilities of Robo-Advisors

Robo-advisors offer a blend of automation, simplicity, and personalization, making them an appealing option for modern investors. Here are their core features:

- Automation and simplicity: Once you set up, you automate everything—from buying and selling assets to rebalancing your portfolio. You do not need to follow market news or spend hours making decisions.

- Low cost, high value: Traditional financial advisors often charge hefty commissions or 1–2% of assets annually. They usually cost much less (0.25–0.50%) while delivering similar returns through optimized asset allocation and passive investment strategies.

- 24/7 accessibility: You can track and manage your investments at any time through our app or website. These platforms also send regular updates, performance reports, and insights.

- Goal-based financial planning: Many robo-advisors enable you to define specific financial goals, such as saving for a wedding, a home loan, or a child’s education, and create tailored plans to achieve them.

- Financial discipline: By automating SIPs (Systematic Investment Plans) and discouraging emotional decision-making, robo-advisors help users stay on track for long-term success.

How Do Robo-Advisors Work?

Understanding how robo-advisors function helps users trust the process and make informed choices. Here is a step-by-step breakdown:

1. User onboarding and profiling: During sign-up, you fill out a questionnaire designed to gauge your:

- Age and income

- Financial goals (e.g., retirement, wealth creation)

- Investment time frame

- Risk tolerance (conservative, moderate, aggressive)

2. Algorithmic portfolio design: Using your data, they recommend an optimal asset allocation. For instance, a younger user may get more equity exposure, while an older investor might lean toward debt instruments for stability.

3. Asset allocation and diversification: They invest your funds in a diversified mix of instruments such as:

- ETFs (Exchange-Traded Funds)

- Index Funds

- Government Bonds

- REITs (Real Estate Investment Trusts). This ensures your portfolio is balanced and less vulnerable to market volatility.

4. Continuous monitoring and rebalancing: Over time, asset performance may skew the original ratio. They automatically rebalance the portfolio to maintain your target allocation, ensuring better risk management.

5. Tax optimization (optional): Some advanced robo-advisors also offer tax-loss harvesting, which involves selling underperforming assets to reduce tax liability and reinvesting the proceeds in similar instruments.

Benefits of Using a Robo-Advisor

- Beginner-friendly interface: You do not need a finance degree to invest smartly. They guide you through straightforward steps, making wealth creation accessible to everyone.

- Affordable minimum investment: Some platforms let you start investing with as little as ₹500 or $10, removing the entry barrier for beginners and students.

- Diversification without complexity: The system automatically builds diversified portfolios, spreading your risk across various asset classes and markets.

- Emotion-free investing: Algorithms remain calm during market dips. This detachment from human emotions protects your wealth from impulsive decisions.

- Automatic reinvestment: The system automatically reinvests any dividends or profits generated, helping you compound wealth over time.

- Educational tools and reports: Most platforms include learning resources, market news, and detailed performance reports to keep users informed and engaged.

Limitations of Robo-Advisors

- Lack of deep personalization: If your financial life includes multiple income streams, business revenue, or complex tax issues, robo-advisors may not provide the holistic advice you need.

- No emotional support: A human advisor might reassure you in a market crash and help you make strategic choices. They cannot offer emotional counsel.

- Algorithm bias and limitations: Some platforms rely on outdated models or rigid algorithms that do not adjust quickly to changing economic trends.

- Limited asset classes: They avoid direct stock picking or investing in commodities, startups, or cryptocurrencies.

Top Robo-Advisors in 2025

Global Platforms

- Betterment: Known for its goal-based investing and intuitive interface.

- Wealthfront: Offers tax-loss harvesting and financial planning tools.

- Ellevest: Designed specifically for women investors. For those comparing options, the wealthfront vs betterment debate often comes down to tax optimization (Wealthfront’s strength) versus goal flexibility (Betterment’s edge).

Indian Platforms

- Scripbox: Hybrid model with optional human assistance.

- ET Money Genius: Focuses on smart asset allocation.

- Groww Auto-Invest: Seamless integration with mutual funds and SIPs.

- INDmoney: Tracks and manages global and Indian investments.

- Kuvera: Offers zero-commission investing and family account management.

Hybrid Robo-Advisors: Combining Tech with a Human Touch

In 2025, hybrid robo-advisors are emerging as a powerful alternative. These platforms offer:

- Robo-driven portfolio creation

- Regular rebalancing

- Access to certified human financial advisors when needed.

Why Hybrid Is Growing:

Many investors want automation, but they still appreciate a human voice to help them during crucial life events or economic downturns. Hybrid models, such as Scripbox and WealthUp, provide this flexibility.

Who Should Use a Robo-Advisor?

Ideal for:

- First-time investors

- Busy professionals

- Millennials and Gen Z

- People saving for long-term goals

- Anyone who wants hands-off investing.

Not ideal for:

- Active traders

- People needing detailed tax or estate planning

- Those looking to invest in niche or alternative assets.

How to Choose the Best Robo-Advisor

Here is a handy checklist:

| Criteria | What to Look For |

| Fees | Transparent and below 0.50% |

| Minimum Investment | Low entry point (₹500 to ₹5,000) |

| Investment Options | ETFs, index funds, bonds, and mutual funds |

| Interface | User-friendly mobile app and dashboard |

| Additional Features | SIP automation, family accounts, tax optimization |

| Security | SEBI/RBI regulation, data encryption, 2FA |

Future of Robo-Advisors in 2025 and Beyond

Here is what is next in this fast-growing space:

- AI-powered custom portfolios: Real-time analysis and adaptive risk profiling.

- Voice-controlled financial assistants: Think Alexa for Investing.

- Cross-border investing: Seamless access to international markets.

- Integration with UPI and digital wallets: Easier transactions in India and beyond.

- Socially Responsible Investing (SRI): Portfolios focused on ESG goals and sustainability.

Myths About Robo-Advisors

| Myth | Truth |

| They are only for tech-savvy people | The platforms cater to users of all ages and backgrounds. |

| You can lose all your money | Robo-advisors focus on diversified, long-term investing, not high-risk strategies. |

| They are too rigid | Many offer flexibility in choosing portfolios, investment frequency, and asset classes. |

Final Thoughts

If you are looking for a smart, stress-free way to invest, robo-advisors are worth considering. With low fees, intelligent automation, and growing personalization, they make investing accessible for everyone.

As financial literacy increases and people demand better digital solutions, robo-advisors are no longer the future—they are the now. Whether you are saving ₹1,000 or ₹1 crore, there is a robo-advisor out there that fits your needs.

Frequently Asked Questions (FAQs)

Q1. Can I switch between robo-advisors if I am unsatisfied with one?

Answer: Yes, you can transfer your investments to a different robo-advisor. However, this may involve selling your assets, which, depending on the platform, could trigger taxes or exit fees.

Q2. Is my money safe with a robo-advisor?

Answer: Robo-advisors typically partner with regulated financial institutions. The custodian bank or fund holds your investments in your name, so your assets remain secure even if the platform shuts down.

Q3. Do robo-advisors consider inflation while planning investments?

Answer: Good robo-advisors factor in inflation when building long-term financial plans, helping you achieve real wealth growth.

Q4. Can NRIs use robo-advisors in India?

Answer: Some Indian platforms allow NRIs to invest, subject to FEMA regulations and specific onboarding requirements. Always verify eligibility before signing up.

Recommended Articles

We hope this article helped you understand the features, benefits, and potential of robo-advisors. Check out these recommended articles to learn more about smart investing, digital financial tools, and wealth-building strategies.