Updated July 29, 2023

Difference Between ROE vs ROA

Return of equity is determined as the amount of profit a company earns from the shareholder’s investment into the company or it is a measure of how effectively a company invested in dollar amount and get a better profit from out of it. Return on equity is more important than return on investment to shareholders because it defines, the way your money is reinvested into a company. Return on Asset determines how much profit a company earns for every dollar of its assets. The asset could be anything like cash in the bank, accounts receivables, property, equipment, inventory, and furniture. Return on assets defines the earnings a company is generating from the invested capital(assets). Return on Assets is substantially varying for public companies which highly depend on the industry.

Return on Equity

A company that has higher returns on equity could able to generate more cash internally. So it is always preferable to invest in companies with higher and consistent returns on equity. It is not always advisable to invest in high ROE companies to make better returns. There are certain benchmarks on which a company compares the returns on equity with its industry average. Generally higher the ratio, the better a company to invest in it.

Return on Equity can be calculated on the basis of the below-specified formula:

If we could able to solve the return on equity problem, which is merely a part of the complex problem there are various other circumstances where we can apply the return on equity ratio equation.

Net income is determined by summing up the financial activity of the last full fiscal year, or trailing twelve months, is found on the income statement. And average shareholders’ equity is calculated by adding equity at the beginning of the period and the end of the period and dividing by two. The best practice for investors, they can calculate a more accurate equity average from the quarterly balance sheets.

Let’s take an example, suppose a company with an annual income of $1,800,000 and the average shareholder’s equity of $12,000,000. Then we obtain the company’s ROE 15%

ROE = $1,800,000/$12,000,000 = 15%

Return on Asset(ROA)

If we compare the ROA, it is the best practice to compare it with a similar company’s ROA or against a company’s previous ROA numbers.

As we know that a company’s total asset is the sum of the total liabilities and shareholder’s equity. And the company’s assets are either funded by debt or equity. The outcome of more debt will nullify if we add the cost of borrowing to the net income and average assets in the denominator in a given period. A formula has been defined to calculate the return on assets.

The ROA gives the investors an idea of how much effect the company has and how efficiently the company is converting its investment into net income. The more the ROA number, the more effective the company will earn money on less investment.

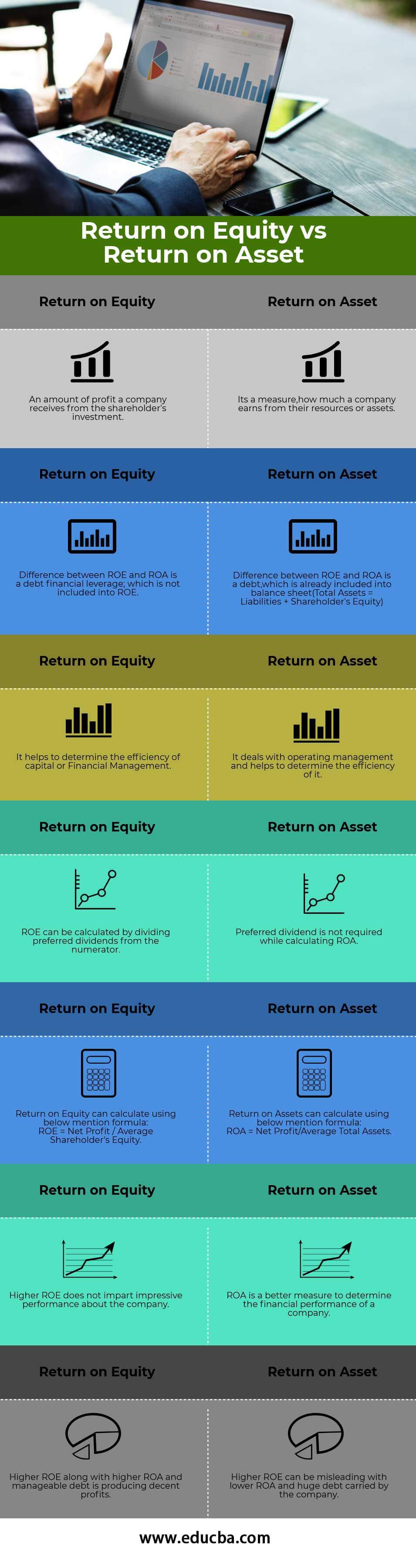

Head To Head Comparison Between ROE vs ROA (Infographics)

Below is the top 7 difference between ROE vs ROA

Key Differences Between ROE vs ROA

Let us discuss some of the major differences between ROE vs ROA:

- Return on equity is determined as the amount of profit that a company receives from the shareholder’s investment in the company. While Return on assets is the amount of profit earns from the assets or resources.

- The difference between the ROE vs ROA is financial leverage, in which ROE does not involve any kind of debt. While in ROA debt part is added into it which is clearly specified into balance sheet (Total Assets = Liabilities + Shareholder’s Equity)

- Return on equity’s concern much more on the capital or financial management. However, Return on Asset deals much more on operating management.

- Investors who wish to see the return on the common equity may do some changes to the formula by subtracting preferred dividends from net income and subtracting preferred equity from shareholder’s equity. While Return on Asset does not involve any sort of preferred dividend in the numerator.

- Return on equity is calculated as annual net profit gain over the span of time divided by average shareholder’s equity while return on assets can be calculated as net profit divided by average total assets.

ROE vs ROA Comparison Table

Let’s look at the top 7 Comparison between ROE vs ROA

| Sr.No. | Return on Equity(ROE) | Return on Asset(ROA) |

| 1 | An amount of profit a company receives from the shareholder’s investment | It’s a measure, how much a company earns from its resources or assets. |

| 2 | The difference between ROE and ROA is a debt financial leverage; which is not included in ROE. | The difference between ROE and ROA is a debt, which is already included in the balance sheet(Total Assets = Liabilities + Shareholder’s Equity) |

| 3 | It helps to determine the efficiency of capital or Financial Management | It deals with operating management and helps to determine its efficiency. |

| 4 | ROE can be calculated by dividing preferred dividends from the numerator. | A preferred dividend is not required while calculating ROA. |

| 5 | Return on Equity can calculate using below mention formula:

ROE = Net Profit / Average Shareholder’s Equity |

Return on Assets can calculate using below mention formula:

ROA = Net Profit/Average Total Assets. |

| 6 | Higher ROE does not impart impressive performance about the company. | ROA is a better measure to determine the financial performance of a company. |

| 7 | Higher ROE along with higher ROA and manageable debt is producing decent profits. | Higher ROE can be misleading with lower ROA and huge debt carried by the company. |

Conclusion

ROE vs ROA is two major terms that are used more frequently to determine the financial performance of a company. Apart from that, there are several other factors that are used to measure the financial health and profitability of the company. But ROE vs ROA is commonly used to measure the performance of the company where Return on equity determines the amount of profit gained on the stakeholder’s investment and Return on asset determines the returns from their assets.

Recommended Articles

This has been a guide to the top difference between ROE vs ROA. Here we also discuss the ROE vs ROA key differences with infographics and comparison table. You may also have a look at the following articles to learn more –