Updated November 17, 2023

Difference Between ROIC vs ROCE

Investors rely on two of the most common yet important metrics while evaluating companies: ‘Return on Invested Capital (ROIC)’ and ‘Return on Capital Employed (ROCE)’. ROIC and ROCE are important profitability ratios that help the investor make a well-informed investment decision. Return on Invested Capital(ROIC) gives a more granular view of the business’s profitability. It is a metric that shows the return generated on the capital invested in the business. ROCE is a metric that compares return relative to the capital employed in the business. Therefore, it aims to find the return relative to the capital invested in the business.

Thus, before digging deeper, let us first understand what these terms signify.

Return on Invested Capital (ROIC)

The formula for calculating ROIC is as follows;

The business actively uses invested capital. Therefore, invested capital equals capital employed less than other non-operating assets like cash or cash equivalents.

Although both ROIC and ROCE use Net operating profit in the numerator, the denominator differentiates the outcome. While ROCE is a broader measure, as it considers the total capital employed in the business, ROIC is a more direct approach for analyzing the business’s profitability, as it only considers the capital per se used in the business operations.

Consider the following example to understand the nitty-gritty of both measures.

Suppose there are two companies, A & B, that are both generating 1 crore EBITDA. The revenue for both the companies is 5 crores; however, company A had invested 50 crores in buying the place for manufacturing and equipment required to produce the product, whereas company B had invested only 10 crores for the same by buying the used equipment and leasing out the place for manufacturing.

Now, if we compare the return that both companies generated relative to the capital invested, we can form an opinion on the profitability of both companies.

Company A: 1/50 = 0.02 (2%)

Company B: 1/10 = 0.1 (10%)

Although both companies A & B generated the same EBITDA of 1 crore, Company B generated a higher return of 10% on the invested capital by making a smart decision to invest in a used place & equipment that brought down its overall cost.

Return on Capital Employed (ROCE)

The formula for calculating ROCE is as follows;

‘Net operating profit’ refers to the profit generated from the business’s core operations. Simply put, it is derived by subtracting Revenue from selling & administrative expenses. ‘Capital’ refers to the capital sourced from Equity & debt.

Thus, from the above explanation, it is evident that ROCE measures the return generated on the capital invested in the business.

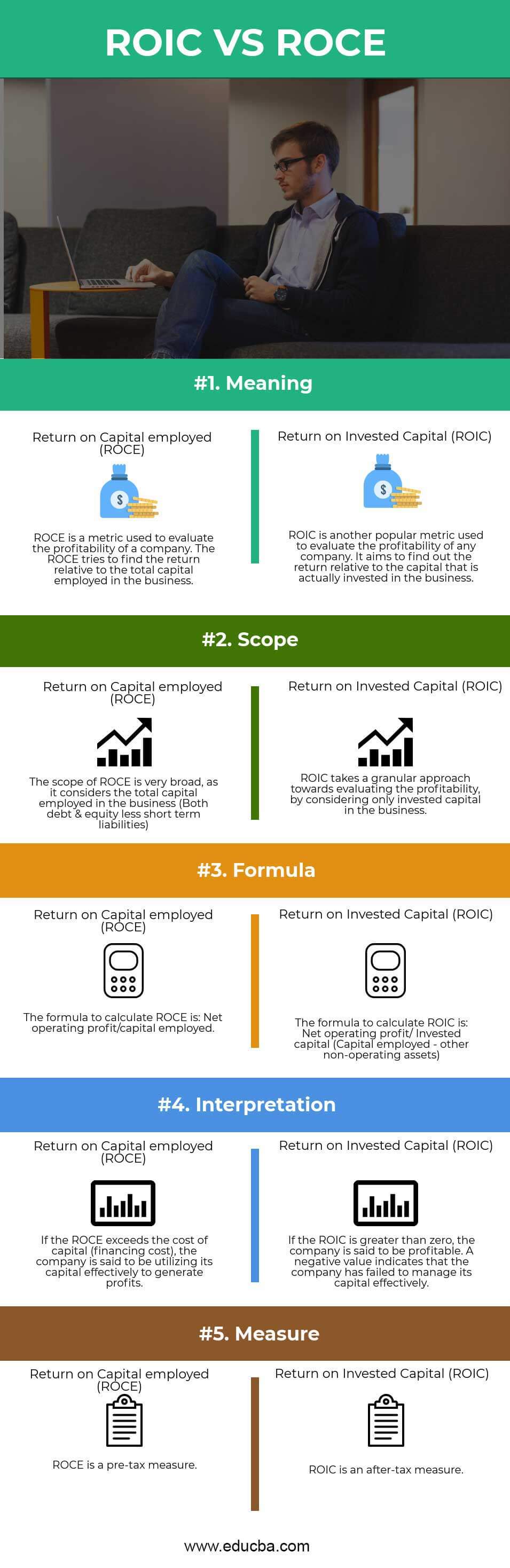

Head To Head Comparison Between ROIC vs ROCE (Infographics)

Below is the top 5 difference between ROIC vs ROCE :

Key Differences Between ROIC vs ROCE

Both ROIC vs ROCE are popular choices in the market; let us discuss some of the major Difference Between ROIC vs ROCE :

- ROCE gives a broader picture of the profitability of any business, whereas ROIC represents a more granular picture of the return the company generated relative to the capital invested.

- ROCE includes the total capital employed in the business (Debt & equity) while calculating the profitability. On the other hand, ROIC only considers the capital that is actively utilized in the business.

- ROCE is a pre-tax measure, whereas ROIC is an after-tax measure.

- When calculating ROCE, a company is said to be profitable if it exceeds the cost of capital. On the other hand, if the ROIC is greater than zero, the company is said to be profitable. A negative number indicates the company is not efficient in capital management.

ROIC vs ROCE Comparison Table

Below is the topmost Comparison between ROIC vs ROCE :

| Basis Of Comparison |

Return on Capital Employed (ROCE) |

Return on Invested Capital (ROIC) |

| Meaning | ROCE is a metric used to evaluate the profitability of a company. The ROCE tries to find the return relative to the total capital employed in the business. | ROIC is another popular metric used to evaluate the profitability of any company. It aims to find the return relative to the capital invested in the business. |

| Scope | The scope of ROCE is very broad, as it considers the total capital employed in the business (Debt & equity less short-term liabilities). | ROIC takes a granular approach to evaluate profitability by considering only invested capital in the business. |

| Formula | The formula to calculate ROCE is Net operating profit/capital employed. | The formula to calculate ROIC is Net operating profit/ Invested capital (Capital employed – other non-operating assets). |

| Interpretation | If the ROCE exceeds the cost of capital (financing cost), the company is said to utilize its capital effectively to generate profits. | If a company’s ROIC exceeds zero, people say that the company is profitable. A negative value indicates that the company has failed to manage its capital effectively. |

| Measure | ROCE is a pre-tax measure. | ROIC is an after-tax measure. |

Conclusion

The uncertainty of stock markets and misleading guidance of the companies expose the investors to a greater risk of loss. Therefore, it is in the investors’ right interest to evaluate the business’s financial statements before making the investment decision.

Looking at the numbers in isolation cannot perfectly evaluate the company’s financial health. Therefore, profitability ratios serve as an effective tool to evaluate financial statements on a relative basis. However, Both ROIC vs ROCE give the outcome by calculating the operating profit relative to how much capital the company invested. Thus, this makes it easier for investors to form an opinion on the management and profitability of the business. Investors can also compare these ratios with those of other companies so that decisions can be taken more effectively. Thus, if the company consistently shows growth in its ROIC vs. ROCE, the business has rightly invested its capital.

Recommended Articles

However, this has guided the top difference between ROIC and ROCE. Therefore, we also discuss the ROIC vs ROCE key differences with infographics and comparison table. You may also have a look at the following articles to learn more.